Need a Decreasing Term Product for Mortgage Protection Sales?

- Approval Rates: 92% of applicants get an instant approval

- Policy Limits: Up to $1M in coverage with no medical exam.

- Life Insurance Company: One of the strongest historical names in the insurance industry.

Mortgage protection insurance is not just another job.

It’s one of the great insurance sales jobs for a life insurance agent.

Here’s how it works.

It guarantees your clients’ children will continue going to the same school and growing up as normal as possible after the death of either of their parents. It’s about keeping a family in their home without ever having to worry about making their mortgage payment. It’s a policy you can feel good about selling, regardless of the premiums, as the coverage provides amazing survivor benefits.

Selling mortgage protection insurance (MPI) allows you to offer peace of mind to your client while also collecting a nice paycheck. It’s a great combination.

And the truth is, it generates more secondary life insurance leads than other sales models like final expense, home, social security seminars or auto Insurance.

No matter what sales model you’re currently working, you can get started selling MPI Insurance very easily.

Getting Started

My name is Drew Gurley and I’m going to show you step-by-step how to be successful selling mortgage protection life insurance.

We’ll cover the traits of the most successful agents, the pros and cons of being captive versus independent, different types of leads, and even how to make six figures selling a policy that has premiums as low as $10 per month.

And after you’re through, you’ll see why MPI Insurance should be in your portfolio or maybe even your core selling model.

Let’s get started.

Table of Contents

What is mortgage protection insurance?

Mortgage protection life insurance is coverage sold with the purpose of paying off the mortgage balance for the surviving family in the event of death or disability of the primary wage earner. This effectively eliminates the mortgage payment from the surviving families living expenses moving forward.

For example, you (new independent life insurance agent) receive a lead from a client who currently has a loan of $250,000 with their mortgage lender. You could sell them a 30-year term life insurance policy with a $250,000 death benefit to match the existing mortgage balance. Once inforce, this becomes the mortgage protection policy to store with their lender information.

The policy will not only pay a death benefit to the survivors but also living benefits should the proposed insured become disabled or sick.

This is what the insurance company calls “living benefits”, which add to the value of the policy and not necessarily the premiums.

This coverage is most commonly offered by independent agents and not the mortgage lender.

What Are Living Benefit Riders and Why Does an MPI Insurance Policy Need Them

Diseases that used to kill people are now just disabling them, which is one of the driving reasons life insurance companies continue to develop products with more living benefits. This is a new trend in coverage and certainly opening doors for additional opportunity.

Examples of living benefit riders are disability, nursing confinement, chronic or critical illness and even terminal illness diagnosis. Should any of those happen to your clients, they have various options to accelerate their policy’s death benefit while they are still living to continue paying or completely payoff their mortgage balance.

It’s this evolution of living benefits that has consumers welcoming new options from their agents to upgrade their existing life policies to get more bang for their buck. When you can offer identical coverage with enhanced riders and benefits, people will listen.

Most MPI policies are written with life insurance companies that do not require medical exams. Using a non-med insurance company is the best way to place more cases and get paid faster, all while providing an excellent service to your client.

Coverage amounts range up to 500k before medical exams are required.

Removing the medical exam from the sales process allows clients to get coverage without having to disrupt their life, which is a huge selling point to many people and makes buying life insurance easy.

As you can see it’s a relatively simple product with a defined purpose of paying off a mortgage balance.

Need a Decreasing Term Product for Mortgage Protection Sales?

- Approval Rates: 92% of applicants get an instant approval

- Policy Limits: Up to $1M in coverage with no medical exam.

- Life Insurance Company: One of the strongest historical names in the insurance industry.

What’s the Difference Between PMI and Mortgage Protection Insurance (MPI)?

PMI is an acronym for private mortgage insurance. This type of insurance policy is designed to protect a lender from the risk of the loan holder defaulting on their loan. Private mortgage insurance is required when the loan-to-value ratio exceeds 80%.

This is a common question that comes up when selling mortgage protection life insurance. People often believe they are already protected due to the PMI built into the cost of their mortgage.

So, when you are speaking to a client about a mortgage protection policy, make sure you are educating them on the differences between PMI and MPI.

By doing this, you will realize many people believe they have protection through their lender should they become sick, disabled or pass away. It’s misconception that we as agents need to make sure and explain.

What is the opportunity for Mortgage Protection?

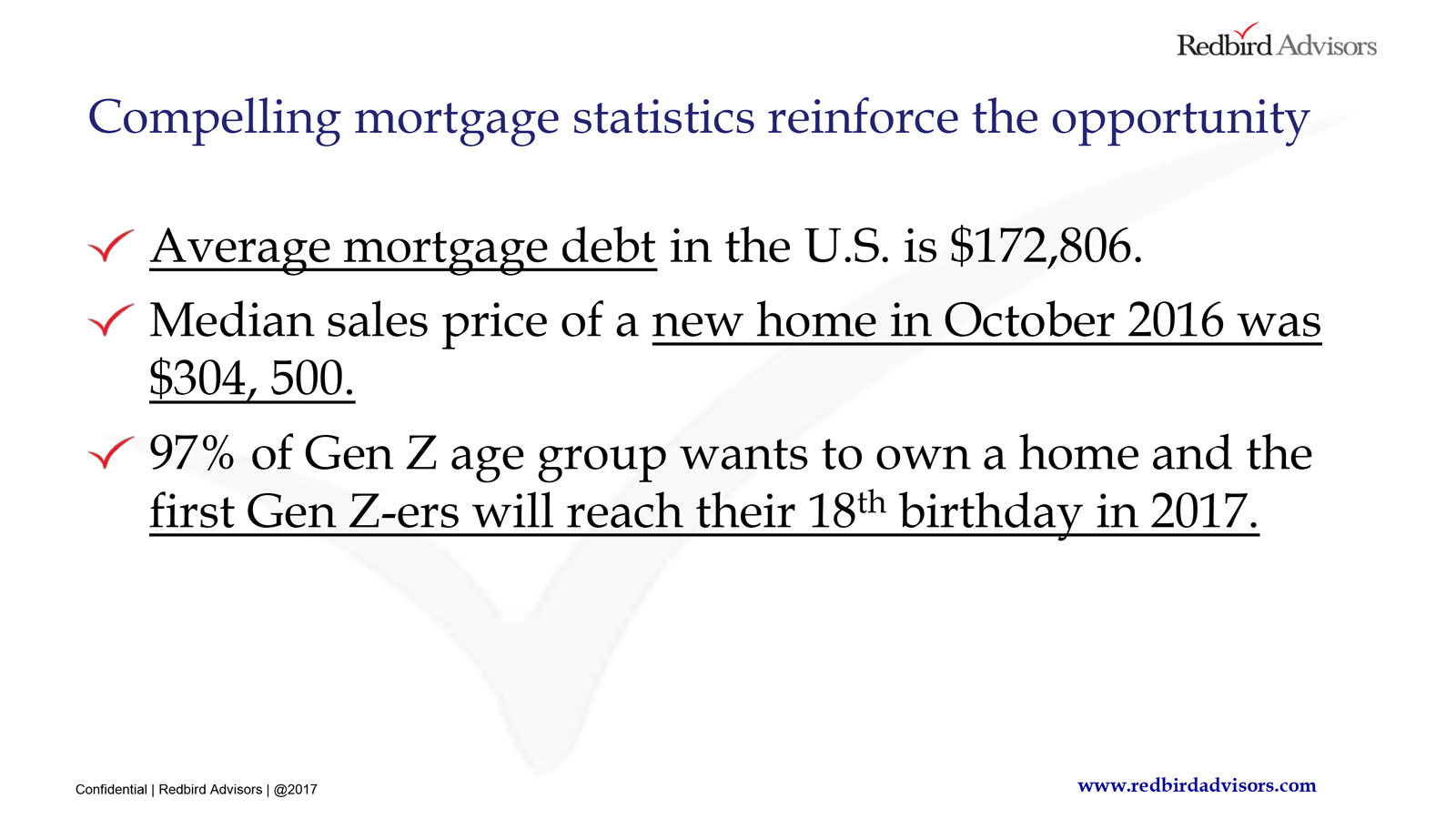

Mortgage protection sales are sky rocketing in part because new life insurance products include living benefits that protect from disability, and chronic, critical and terminal illnesses.

Consumers are beginning to realize they can buy a new kind of life insurance policy which opens the doors to reviewing and modifying what they currently have. One of the reasons this happens so much is due the insurance company updating their mortality tables which keeps premiums down.

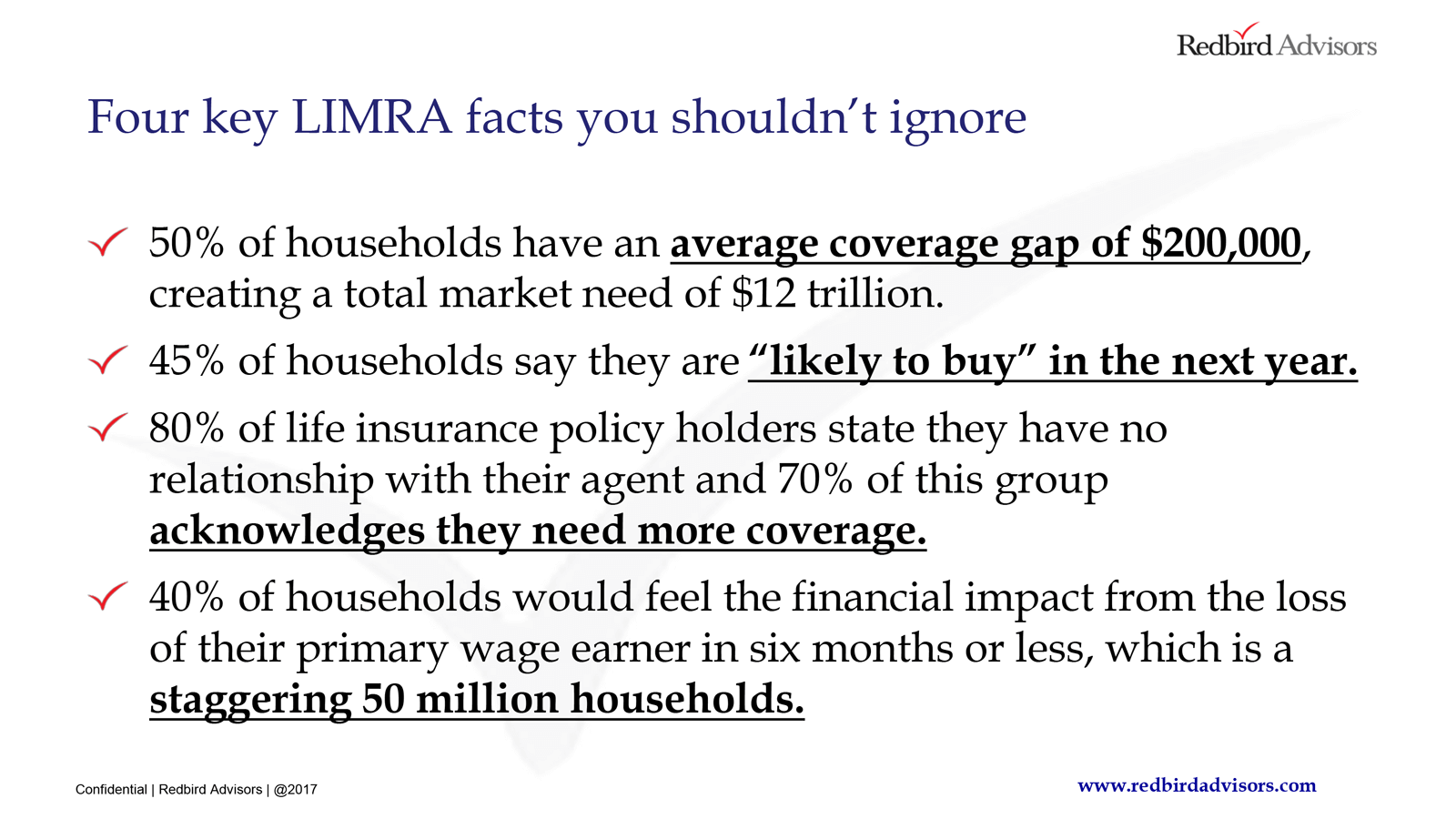

I pulled some industry facts from a recent training webinar which further reinforces the importance to educate your clients on the new types of coverage.

What do these facts tell us?

The market is busting at the seams with customers who need protection for real problems. And, the needs for a mortgage protection policy fall well within the limits for life insurance without medical exams.

Coupled with the explosion of e-apps and voice signatures, you are sitting on a gold mine of opportunity.

If you’re paying attention to the market and planning your business around the facts, you will make a lot of money, plain and simple. And, your premiums per household will undoubtedly increase.

Added bonus, the typical lender doesn’t offer mortgage protection life insurance.

Discover Your Earning Potential

How much money can an insurance agent make selling mortgage protection insurance?

At the current pace, agents working the MPI market in our network wrote nearly $30,000,000 in paid annual policy premiums in 2018. We’re hoping to see a massive growth once we finish up 2019 and move into 2020.

Whether you’re at a 25%, 50%, 100%, or 130% (yeah, these high contracts DO exist!), that’s a huge opportunity! Marketing this type of coverage certainly has its advantages.

Snap shot below summarizes the top agents from the last week of August 2019.

Yes, these are weekly production numbers which means these agents are all earning well into the six figures. Something to note, average premiums per policy are higher with mortgage protection versus final expense or other lines of life insurance.

| Charles | $24,315 |

| Marya | $18,234 |

| Anthony | $17.476 |

| Venita | $14,402 |

| Dan | $13,044 |

| Joe | $11,466 |

| Kim | $11,234 |

| Edward | $10,248 |

| Yasmira | $10,132 |

| Elsa | $9,993 |

Sure, every agent isn’t going to perform at this level, but the opportunity is right in front of you.

Think about this, the average insurance agent salary is less than $50,000 per year.

Would you be upset if you changed that to $80,000 or even $100,000?

It’s a lot easier to make six figures in this business when you take the time and study the details inside and out.

Can you imagine what selling MPI would do for your agency?

FREE TOOL! Discover Your Earning Potential Using Our Mortgage Protection Income Estimator

How to Get Started Selling MPI

The simplest answer is to align yourself with someone successful and replicate what they do. I can’t emphasize this enough!

Doing this will give you track to run on and more importantly save a lot of time and energy trying to learn it all on your own. The process is relatively simple:

- Ask yourself if you want to do this alone or join a team.

- Decide if you want to be a captive or independent agent. (Tip…you can work for an agency and still be independent).

- Find a mentor (contact us if you want help with this, we’ll happily connect you with someone)

- Create your marketing plan.

- Get contracted with the best mortgage protection insurance companies.

- Buy leads and start selling.

- Make money

Need a Decreasing Term Product for Mortgage Protection Sales?

- Approval Rates: 92% of applicants get an instant approval

- Policy Limits: Up to $1M in coverage with no medical exam.

- Life Insurance Company: One of the strongest historical names in the insurance industry.

What license do you need to sell mortgage insurance?

Getting licensed to sell mortgage insurance is the same as getting licensed to sell life insurance.

So, if you want to get licensed to sell mortgage insurance, you need to take your life insurance test.

Best Mortgage Protection Insurance Companies

| Royal Neighbors of America | Sagicor |

| Lincoln Financial Group | Transamerica |

| American National | Illinois Mutual |

| National Life | Banner Life |

| AIG | Assurity |

| North American | Americo |

We can introduce you to several great agencies in the Redbird network that specialize in this market.

Our main goal is to connect you with the absolute best resource that puts you in the best position to succeed, and connects you to the best mortgage protection insurance companies.

Know Who You are and What You Do

Now that you have a basic understanding of the MPI business, it’s time to get real.

This is the most critical step and likely what most recruiters will never address with you.

If you’re new to the business, you’ve probably encountered some resistance from prospective clients. Sometimes it’s simply their discomfort with the idea of life insurance. More often, they have had bad experiences with agents trying to sell them something they probably didn’t need.

Just try selling life insurance to your friends and family and you’ll see exactly what I mean.

To put yourself in the best position to succeed, you must do three things:

- Put the client’s needs first

- Believe in the product you’re selling (sold correctly, life insurance is a great product)

- Believe in yourself (MOST IMPORTANT)

All three of these came together for me when I processed my first death claim; a real eye opener which solidified my belief in what I was selling and my belief in myself as a licensed agent.

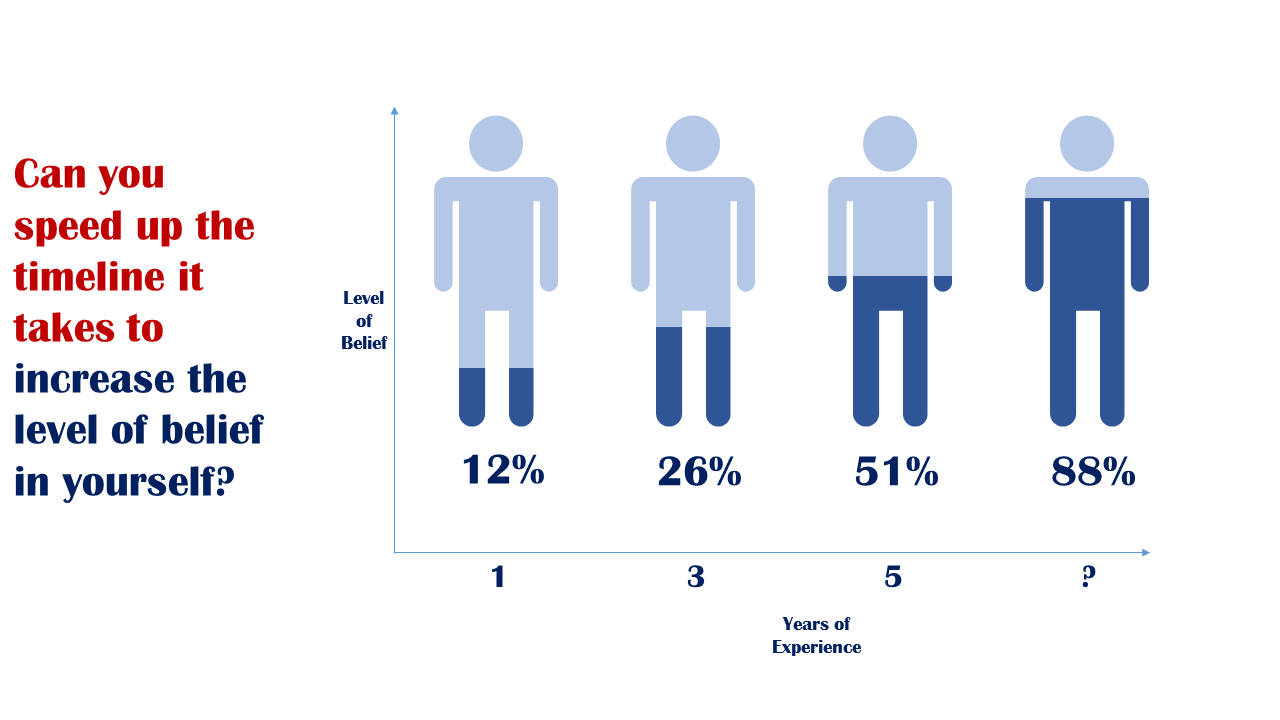

Knowing who you are and what’s important to you is key to succeeding in sales. Are you going through the motions day-to-day or are you wildly confident in your abilities?

Unfortunately, this takes time.

You’re either naturally confident in yourself or you need to start making some life changes to help build the required self-confidence.

Top producers are unapologetically passionate about who they are and what they do because they have changed the way they think about their business and believe in the coverage they are selling. The ones who can naturally do this amaze me, but they are few and far between.

Most of you will need a lot of help in this area.

Here’s my suggestion.

I’m about to share with you one of the best kept secrets in our business that is at your finger tips; Mental Toughness Training, a system to absolutely turbo charge the way you think about your life and business.

I can personally attest to this because it’s exactly what I did and continue to do on a daily basis.

If you follow the steps in this course and implement the Mental Toughness Playbook every single day for the next year, I promise you will make over $100,000 selling mortgage protection insurance.

“Success is not just about changing your habits, it’s about changing the way you think.”

– Ben Newman

Ben is a “performance coach” who has mentored more than 150 financial professionals who became MDRT qualifiers and more than 20 who achieved the prestigious Top of the Table award.

Last year in 2020 he worked with 25 individual life insurance agents who’s personal life production exceeded $25 million.

Ben is a performance coach for many of the top MDRT insurance producers, athletes playing in the NFL, MLB and PGA as well as a New York Times best-selling author.

Click Here to Start Your Mental Toughness Training – Completely FREE

One of my personal favorites from his playbook (which you’ll learn) is learning how to write your “I am Statement” which leads to my next point.

Gain selling confidence by changing how you tell people “who you are and what you do”.

For example, when you’re sitting at a restaurant and someone asks what you do, what do you tell them?

I am a Life Insurance Agent

OR

I am a Mortgage Protection Specialist

I know this may seem cliché but you must have an identity that you believe in! Clearly you can see which “I am” statement is more appealing.

If you don’t, you’re toast.

Now you need to memorize the “what you do” script.

I am a Mortgage Protection Specialist and I show people how to protect their greatest asset, their home.

As I mentioned earlier, not everyone thinks life insurance agents walk on water. It’s crucial to have a meaningful identity before you dive into this career.

The more mentally prepared with who you are (or, who you want to be) and what you do, the more success you will have.

You need to be unapologetically passionate about what you do!

Download Your FREE Mortgage Protection Income Estimator

Captive Agent vs Independent Agent

This decision doesn’t need to be tough, you just need to be honest with yourself.

Here’s my opinion…

Are you truly a self-starter? If so, I would suggest going the independent agent route.

Do you need a cheerleader or someone to hold you accountable to get out of bed on time? Then you need to go captive.

Don’t fool yourself into thinking you’re a self-starter when you’re not, otherwise this business will chew you up and spit you out…fast.

Let’s dive deeper on this to get a glimpse of what you can expect from either scenario.

Captive Mortgage Protection Agent

Captive agents work for an agency and do not own their book of business. That means if you work for someone, sell a policy and then leave in two years, you are likely leaving your clients and renewal commissions with your former employer.

Which is why you always want to ask about a vesting schedule in your interview.

As a captive agent, you should receive extensive support such as sales tracking, life leads, training, hand holding, mentoring and maybe a nice Christmas party. The captive sales model allows you to focus on selling and never having to worry about how to get life insurance leads again.

Independent Mortgage Protection Agent

As an independent agent, you will be a 1099 contractor to an insurance marketing organization (FMO, IMO, MGA, BGA, or GA). You will be provided access to the best mortgage protection insurance companies and a variety of lead sources.

You’ll notice I said lead sources and not just life leads. This means you are responsible for paying for your own leads, all other operating costs and managing the day to day business operations. When you’re independent, you’re a business owner which is why I said going independent is great for self-starters!

Because you are taking on much more responsibility as an independent agent, you will earn significantly higher commissions than a captive agent.

Think of it this way: If you’re an independent agent you’ve started your own business and you should be ready to act like a business owner. The other part of this is when you sell a policy, you are paid directly by the insurance company based on a percentage of the premiums.

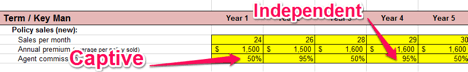

For those of your who are analytical, below is a link to our most popular tool to estimate your insurance salary as a captive or independent agent. Once you’ve downloaded the mortgage protection salary estimator we’ll send you periodic updates as we improve it throughout the year.

Don’t forget to adjust the commission levels and expenses in the calculator to get an accurate look. I used examples in the screen shot below; use your specific numbers when using the calculator. For example, if policy A pays out at 85%, then make sure and put 85% in the correct cell in the calculator as well as the corresponding average premiums.

Download Our Mortgage Protection Income Estimator

Mortgage Protection Insurance Sales Training

Training is a must.

Training continually allows you to critique and refine your pitch, which increases closing percentages. The best agents build training into their weekly routine regardless of how many years they have been in the business.

One of the reasons why I see agents fail is lack of consistent training. It’s not because they don’t believe in training, it’s because they choose not to make it a priority. This results in constantly jumping from one sales model to another and never having any real success.

Think about the amount of time baseball’s Albert Pujols put into mastering his swing (Sales Model). He constantly works with his batting coach (Sales Trainer) to constantly tweak his stance to avoid or get out of a slump: forward, backward, side to side and choking up or down on the bat.

The constant tweaking, adjusting and learning has allowed him to maintain a high level of performance throughout his career.

In our business, you must dedicate yourself to ongoing training so you can have the confidence to focus on changing your stance when times get tough versus changing your proverbial swing (sales model). By doing this, you will keep your policy count and average premiums high!

Below are 10 critical training topics you should continually refine, regardless of your experience level.

- Mortgage Protection Industry 101

- Target Market

- Types of Mortgage Protection Leads

- How to Prospect and Set Appointments

- Mortgage Protection Sales Presentation

- Submitting and Placing New Business

- Mortgage Protection Insurance Companies and Product Knowledge

- Overcoming and Preventing Sales Objections

- Consumer Purchase Behavior

- Sales Psychology and Mental Toughness

Here’s an interesting fact when we reviewed our team’s sales stats: Agents participating in weekly training are making on average $2,592 per week compared to non-participating agents making $959 per week.

Would you agree it’s worth 60 minutes of weekly training to more than double your salary?

Download Your FREE Mortgage Protection Income Estimator

Mortgage Protection Leads: Use Multiple Channels

If you’d like to skip through this and learn more about the mortgage protection leads for sale, click here.

The more prospecting channels you have, the more money you will make. But, you have to start somewhere. You have to get your hands on a consistent source of mortgage protection leads.

The key in the beginning is building a foundation that allows you at a minimum to have someone to call every day. Then you can eventually work towards expanding your prospecting channels and lowering your new client cost of acquisition.

This means you need leads, and leads cost money, which is exactly why you need to decide whether to go captive (agency provides free life leads) or independent (you pay for life leads).

Good Leads vs. Bad Leads

I’m going to ruffle some feathers here, but it’s something you need to hear.

There is no such thing as a bad lead.

Yes I said it, yes some of you are shaking your head at me. But, it’s true.

Working leads (any type of lead) takes patience and consistency.

I wish I could take credit for this, but it’s a great phrase I heard once from Don Runge.

There are 365 days in a year, 24 hours in a day, 60 minutes in an hour, 60 seconds in a minute…for you to catch your prospect at the right 30 seconds to set an appointment or let you in the door to give a presentation.

Leads are all about timing and I would be doing you a disservice if I didn’t emphasize that point.

Now, certain lead types can be easier to set than others.

Below is a breakdown of the common types of mortgage protection leads. But always remember that catching a prospect is all about the right timing, keep that in mind whenever you’re working any type of mortgage protection lead.

Common types of mortgage protection leads and prospecting methods.

Direct Mail Mortgage Protection Leads

These are the most common type of life insurance leads used for mortgage protection.

The recipient completes a postage paid return card which in turn lands in your mail box and on your call list.

Many agents will say these are the best leads to work, but the problem is you aren’t guaranteed a response rate.

For example, you send out 1,000 direct mail letters and have no idea how many will get returned. The average response is 1% and that’s just an average. Make sure you have these costs built into your plan if you’re solely relying on direct mail.

Direct mail lead campaigns retail for anywhere between $450 and $600 per 1,000 mailers.

Some companies that offer a cost per lead option which is roughly $40-$50 per lead with a 10-20 lead order minimum. We have used many different direct mail sources and continually rotate vendors as marketing updates occur regularly.

Below is a promotion we’re running for a limited time. This is a great opportunity to access an exclusive direct mail program we have been working on for quite some time. The best thing we have found so far is that we are getting agents to the kitchen table for an appointment much faster than the competition. If you haven’t tried these leads, it’s worth a shot!

Discover Your Earning Potential

Door Knocking

My absolute favorite! The Covid impacts are still not crushing those who have built their career on door knocking.

I have made thousands of dollars simply knocking doors of leads I couldn’t reach over the phone. You’ll find over time you have a stack of leads on your desk that you just can’t reach. Next time you’re out simply pop in unannounced, introduce yourself, show them the lead card they returned, and tell them exactly why you are there. This is arguably the easiest way to make an extra $1,000 / week.

You already paid for these so you might as well work them to get the best bang for your buck.

Tele-marketed Mortgage Protection Leads

Telemarketed mortgage protection leads are generated through a call center, but certainly aren’t leading the charge in regards to conversion…but it’s improving.

They record the call and upload the lead to a database where you can access and begin calling to set your appointments. Tele-marketed mortgage protection leads are cheaper than direct mail mortgage protection leads but have a much shorter shelf life which means your window to convert them to an appointment is much shorter.

The shelf life problem with tele-marketed leads comes from the fact that consumers are less committed when they say “yes” over the phone versus when they fill out a piece of direct mail and send it back. The key for the agent is acting quickly on these leads.

Tele-marketed leads are usually in the $20-$25 per lead range but can certainly go lower if you commit to ordering specific volume. Ask the lead company if they will give you any breaks on high volume orders.

Learn more about our telemarketed leads.

Testing Different Types of Telemarketed Mortgage Protection Leads

We have tested and continue to test new vendors for telemarketed mortgage protection leads and we’re having a mix of success. The first set of leads we purchased was outsourced to Philippines and the success was pretty good. Out of the first 1000 leads we ordered, we were seeing closing percentages around 18% which is okay, but not super exciting.

What we found was that the quality of the data really impacted the success rate of the agent who was setting the appointment. So, what we learned from that exercise was to get very specific about the data sources we were purchasing to use with the phone team.

If you’re going to work telemarketed mortgage protection leads, you really need to make sure and track them extremely closely to ensure the best ROI.

My suggestion on how to use telemarketed leads is to use them in conjunction with direct mail leads or public data. Try buying 10 a week and pair it with 10 direct mail and a hand full or data or aged leads. It’s a great lead recipe to keep consistent activity.

Aged mortgage protection leads

These are cheap life insurance leads because they are old (aged). Old telemarketed, old internet, and old direct mail. Don’t think it’s anything different than just that.

This is a very cost effective way to expand your prospecting methods as costs can be as low as a few dollars per lead.

Aged leads usually cost around $5-$8 per lead. Many marketing organizations have these types of leads available at no cost to help keep you busy when you’re first starting. Definitely ask about this option and press to get them free!

My suggestion on working aged mortgage protection leads would be to buy 15-20 of these weekly to supplement your order of fresh leads each week. This allows you to have more people to call each week.

Remember, it’s all about your activity that drives results.

If purchasing an extra 20-30 aged mortgage protection leads weekly can increase your activity, then you are setting yourself up for success.

Public Mortgage Data

Many agents will access public records to see who has purchased a home in the last 30, 60 or 90 days. You must make sure they aren’t on the do not call list, but this is a great way to constantly get new home buyer leads.

Each municipality will vary on what it charges. Many times, you can access public mortgage records for around $5.

Using public data mortgage protection leads can be another great way to stay in front of new prospects weekly.

Prospecting Friends and Family

Good old fashion insurance marketing at its best: Ask the people who know you best. This has and remains one of the strongest methods of prospecting for life insurance.

These babies are FREE!

Delivering policies is a great way to generate more leads and referrals.

By delivering your mortgage protection policy, you now have the chance to revisit discussions from your first appointment. Policy delivery will result in additional life and annuity sales.

Policy delivery leads are the best kind, FREE!

We have a great tool we use for this that will skyrocket your sales.

Mortgage Lender Relationships

Strategic relationships are one of best way to generate mortgage protection life insurance leads. You can partner with a small regional mortgage lender to funnel you each closed loan. This works out great as it drastically lowers your cost of acquisition, but can be tougher to put in place.

It takes strong relationship skills, but certainly pays off once you’re in the blood stream of the lender.

As you can see, there are many ways to prospect and generate mortgage protection leads.

When you first begin, you’ll likely rely on direct mail as it’s the most common lead generation tactic and provides stable foundation for you to learn how to sell. But, don’t be imprisoned by what most agents are doing. Believe in yourself… give some of these other methods a try.

This will help you gain confidence and you’ll soon realize the value of integrating additional prospecting methods. It’s also important you don’t forget to track your average premiums so you can consistently monitor your costs of acquisition of a new client.

Can you see yourself selling mortgage protection life insurance if you knew it could generate a six-figure income?

Do The Math and Learn How to Make $5,000 Per Week Using Our MPI Income Estimator Tool! [CLICK HERE]

Mortgage Insurance Salary: How to make $5,000 a week.

Most agents set appointments with 50% of their leads and average agents will convert 50% of those appointments to sales. In this example, let’s set a realistic production goal of eight sales per week. Assuming a 50% close rate, you will need roughly 30 leads each week.

Let’s walk through this backwards so you can see exactly how to hit the $5,000 weekly income goal.

Weekly Income = $5,130

$6,480 ($960 Average Sale x 90% Blended Average Commission) – $1,350 ($45 Lead Cost x 30 leads)

30 Leads = 15 Appointments = 7.5 New Sales / Week

Ask yourself the following questions…

What would that weekly number look like if you added one or two closed referrals?

What if you knocked on the door of five leads from the week before?

What if you had a relationship with a local mortgage broker and he/she sent you one new lead each week?

What impact would these additional prospecting channels have on your income and how much could they lower your out of pocket lead costs?

It works.

Make a Sales Plan and Stick to it

Buy leads, set appointments, analyze coverage qualification, make sales, service the policies and repeat.

Below are some additional considerations when creating your plan.

- Identify your target market.

- Know the numbers. Create a proforma for your business and a plan for profitability.

- Make sure you have enough working capital (whatever you think you’ll need… you’ll need more).

- Identify primary and secondary lead sources (this will be one of your largest expenses).

- Make sure you have capabilities to scrub applications before submitting them to carriers (mistakes by the agent are the number one reason an insurance policy is delayed).

- Become a student of your carriers by closely reviewing their underwriting policies.

- Have you organized all your case management information when business starts picking up?

- Consider whether you’re going to expand your business beyond mortgage protection.

These are all things you need to consider as a business owner and it takes time to get them ironed out.

Selling mortgage protection is easy once you have mastered the steps required to be successful. In order to master anything, you need to put in the work.

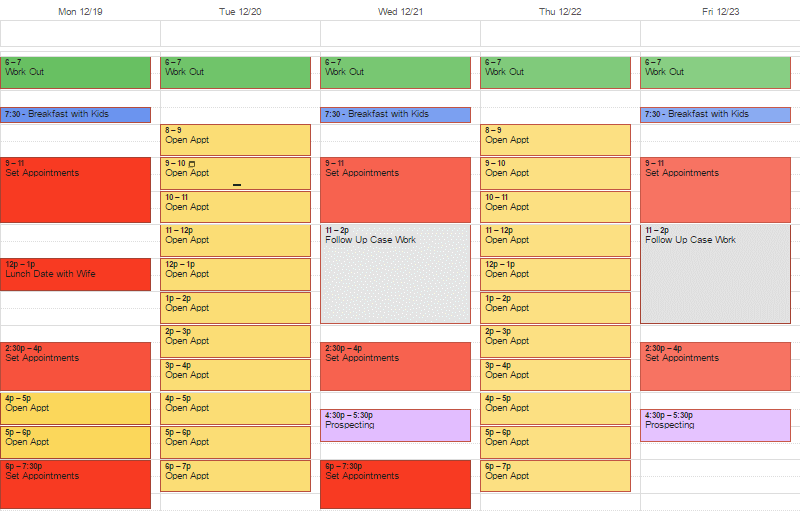

Below is a quick look at how some agents use their calendar to plan their week. The calendar allows them to schedule not only work but also family time to ensure a strong balance.

You’ll notice time is blocked off each week for setting appointments and open sales appointments. This is a great way to stay organized and ensure your daily disciplines aren’t falling through the cracks.

For me, each day starts with exercise to keep the mind fresh. Also, notice I’ve scheduled breakfast with the kids and lunch with my wife. It’s extremely important to have balance in this business, so why not just include it as a priority on your calendar?

Does your current job allow you to build time with your family into your work day?

Cross Selling Drives More Commissions

Have you ever taken an insurance training course? For example, do you know how to pivot from mortgage protection to selling annuities or index universal life (IUL)?

This is where the business gets exciting! It’s also where so many agents fail.

Cross selling insurance is always hard when you aren’t equipped with a plan. It may sound as simple as falling off a log, but I can promise you that’s not the case. I’m sure you can imagine how much valuable it can be to have more than one insurance policy in each household. By doing this, you drastically increase your chances of making another sale down the road, which is a much cheaper than trying to acquire a new client.

Check out what the White House had to say about the cost of acquiring a new customer. If this doesn’t scream cross selling, I’m not sure what does.

It is 6-7 times more expensive to acquire a new customer than it is to keep a current one.

– White House Office of Consumer Affairs

Simple Cross Selling Tactic

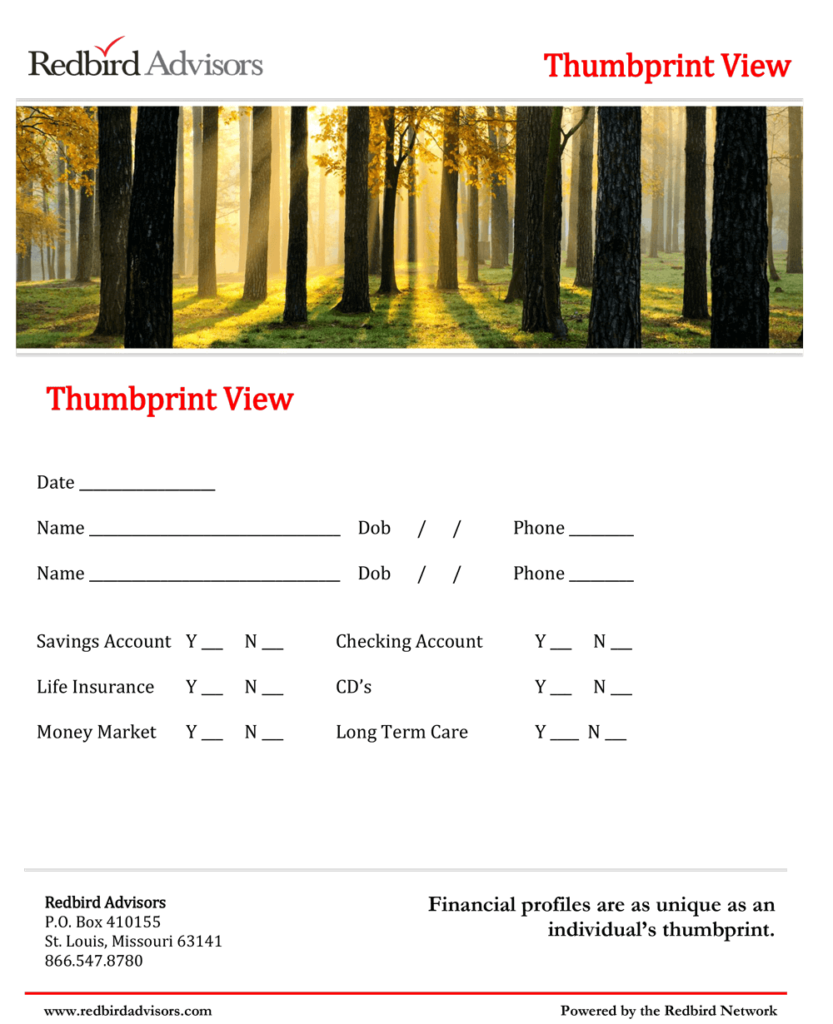

Cross selling is about understanding client needs. One of our agents’ most used tools is what we call the “Thumbprint”. Its sole purpose is to collect a small amount of information that will open doors to future meetings. See below.

Using the Thumbprint or a resource like it will help you collect key information from your clients that will prove useful down the road.

Let’s walk through an example of how easy this tool is to use.

Assume you’re selling $2,000 per week of life insurance premium. There’s nothing wrong with $2,000 per week, but, you are beginning to get the itch about leaving money behind at the kitchen table.

Time to make a change.

When you’re done completing your client’s life insurance application, simply bring out the Thumbprint and ask the following yes or no questions. (Yes or No only, no need to ask for details at this point)

- Do you have a 401k and are you contributing beyond your employer’s match?

- Do you have a plan at the local funeral home covering your burial expenses?

- Do you currently have any long-term care plans in place?

- Are you currently contributing to an IRA or any qualified retirement accounts?

- Do you have any non-qualified savings such as Roth IRA or CDs?

- Have you examined the amount of current coverage you have in place to determine if it’s accurate?

Make sure and breeze through this (two minutes’ tops!) and continue focusing on your original purpose of the meeting, selling mortgage protection.

Focus on making the sale that is in front of you and set yourself up for success in the next meeting. Don’t forget what I said about patience!

Collecting this data allows you to easily open new discussions at your second appointment (policy delivery).

Use policy delivery to start expanding your discussions.

“Mrs. Baker, you mentioned in our last meeting that you have a 401k with an old employer. How did you feel when the news broke in 2008 that millions of people had lost a significant portion of their 401k? Are you satisfied with your current level of coverage?

This instantly sets the stage to introduce the safety of an alternative retirement solution such as a fixed annuity or opening an IUL account. You’ll notice I didn’t ask Yes or No questions. This meeting is about understanding needs.

The key to training is not just learning what to say, but why you are saying it.

What if you discovered annuity sales opportunities in 15% of all your appointments and IULs in 25%?

Based on the 15 appointments / week example we reviewed earlier, that’s six new appointments and three new sales for no additional cash outlay. Not bad! Especially when the coverage amounts sold are much higher with mortgage protection life insurance.

How much impact would three new sales per week have on your income?

Remember, patience is one of the major reasons agents fail in this business. Having a plan from start to finish that includes cross selling will make all the difference of whether you are successful or not.

You have already broken down the barrier (made your core sale) and proved your ability to provide value and gain trust.

You now have a much higher likelihood of increasing your policy per household and income.

Conclusion: Get Started Selling Mortgage Protection

Selling mortgage protection is one of the great insurance jobs and one many agents overlook.

There are a lot of smart people who truly care about your success and are willing to take the time to teach you. You just need to reach out and ask. (Remember, find a mentor!)

Coupled with a cross selling strategy and rock solid plan, you will quickly earn your place on the Mortgage Protection leader board!

Need a Decreasing Term Product for Mortgage Protection Sales?

- Approval Rates: 92% of applicants get an instant approval.

- Policy Limits: Up to $1M in coverage with no medical exam.

- Life Insurance Company: One of the strongest historical names in the insurance industry.

We have immediate mortgage protection insurance jobs in Los Angeles, St. Louis, Kansas City, Chicago, San Francisco, Las Vegas, Reno, Charlotte, Dallas, Atlanta, Denver, Fort Worth, Philadelphia, Austin, San Diego, New York, Connecticut, Houston, San Jose, Charlotte, Tampa, Miami, Jacksonville, Virginia Beach, Nashville, Memphis, Birmingham, Clayton, Sarasota, Fort Meyers, Naples, Ft. Lauderdale, Joplin, Springfield, Baltimore, Louisville, Tucson, Sacramento, Mesa, Colorado Springs, Raleigh, Oakland, Minneapolis, Tulsa, Wichita, Aurora, Santa Ana, Anaheim, Lexington, Pittsburg, Cincinnati, Greensboro, Columbia, Plano, Newark, Lincoln, Jersey City, Fort Wayne, Gary, St. Petersburg, Irvine, Norfolk, Winston-Salem, Glendale, Scottsdale, North Las Vegas, Fremont, Baton Rouge, Spokane, Portland, Fayetteville, Montgomery, Little Rock, Shreveport, Augusta, Tallahassee, Overland Park, Knoxville, Providence, Chattanooga, Tempe, Sioux Falls, Jackson, Salem, Pasadena, Sunnyvale, Hollywood, Joliet, Bridgeport, McAllen, Cedar Rapids, Topeka, Hartford, Norman, Tuscaloosa, Fargo, Ann Arbor, Peoria, Clearwater, Richmond, College Station, Boulder, Burbank, Davenport, Wichita Falls, South Bend, Greeley and Cleveland. If you live in a city not listed, let us know and we’ll see if that territory is currently open. Get in touch if you’re interested.