If you have contemplated learning how to sell final expense insurance or how to become an insurance agent, there is no better time than now to get into the insurance business.

My name is Drew Gurley and what you’ll find in this guide is a lot of information I have learned from my personal experience selling final expense out in the field as well as what I’ve learned from other mentors along the way.

Some of the most successful final expense agents came from completely unrelated industries, so don’t be afraid to change careers and learn about selling final expense insurance.

This is your opportunity to transition within the industry, change careers or add a new service line to your agency.

Have you ever wondered what sales language top Final Expense Agents use?

FREE Top Producer Presentation

(FREE Download)

What’s in this guide to selling final expense insurance and who is it for?

This guide will uncover the not-so-mysterious business of selling final expense insurance, and how successful agencies are driving millions of dollars in sales each year.

There’s something for everyone:

- If you’re new to final expense, you’ll walk away equipped to negotiate your first contract.

- If you’re a seasoned vet, you’ll walk away with new ways to close more deals and lower your costs of acquisition.

- If you’re just getting started selling insurance, you’ll know quickly if final expense insurance is for you.

There are a lot of elements you need to consider before taking the plunge, and I’m going to show you exactly how to do it, step-by-step.

Let’s get started.

Table of Contents

-

-

- What is final expense insurance?

- Different types of final expense plans

- Final expense companies

- How to get started selling final expense

- Final expense leads

- How to work your leads

- The sales presentation

- Underwriting tips & Medications

- Understanding commission levels

- Final expense telesales

- Captive vs. Independent

- Frequently asked questions

-

What is Final Expense Insurance?

Final expense insurance is life insurance with the sole intent of covering the costs of a funeral and other final expenses. It will help ensure your prospects loved ones aren’t burdened with out-of-pocket funeral costs.

Some smart guy coined the term “Final Expense” to describe low face amount life insurance which is sold seniors or retirees to address funeral planning.

What a genius. I wish it was my idea!

Final expense insurance is typically a low face amount whole life insurance policy anywhere from $5,000 to $50,000.

Here’s a quick look at the final expense sales process:

- Get your life insurance license (you can order your life license study materials here)

- Get contracted to sell final expense

- Start a lead campaign.

- You (new final expense agent) receive a lead card in the mail from a client interested in a $10,000-$15,000 policy to cover the cost of their funeral. Your goal is to sell them a $10,000 – $15,000 whole life insurance policy (final expense policy) to cover the final expenses the family will face upon their passing.

- You’ll likely set the client up on an automatic electronic funds transfer (EFT) from their bank account for their roughly $40-$60 per month premium, which is paid directly to the insurance company.

- The entire sale will take less than 90 minutes and you’ll walk out the door with a pending commission to hit your account in as little as 24 hours.

And, there are no medical exams whatsoever!

Sounds easy, right?

It can be. If you dedicate yourself to the growing senior market, final expense life insurance can be a great way to make money selling insurance.

What are the Different Types of Final Expense Insurance Plans?

There are four types policies you will sell out in the field or over the phone, all of which are based on the health of your prospect, which ultimately dictates how the death benefit is paid out.

It’s important to clearly understand the difference so you are always giving your client the best options.

Level Final Expense Plans

Level plans will pay the full amount of the life insurance benefit starting immediately upon approval.

For example, if you sell a level benefit policy for $12,000, the policy beneficiary will receive the full policy amount upon death of the insured, even if they die within the first week of the policy being active.

Other types of final expense policies—detailed following this—have various waiting periods and alternative payment methods before the full amount of the policy is paid in the event of the death of the insured.

Level plans are the most cost-effective type of final expense plans your clients can qualify for and, in most cases, pay the highest commissions.

Graded Final Expense Plans

Graded plans are good options for clients with certain pre-existing health conditions, which you’ll uncover during your fact-finding process or in the medical questions part of the application.

Graded plans pay out the death benefit plan on a graded scale during the first two years of the policy, not all at once. For example, a $10,000 graded policy could pay out in the following structure depending on the company:

- Death in year 1 of owning the insurance policy: 30% of the $10,000, or $3,000 is paid to the beneficiary.

- Death in year 2: 70% of the $10,000, or $7,000 is paid to the beneficiary.

- Death in year 3 or after: 100% of the $10,000 payout is paid to the beneficiary.

- Accidental death in any year pays 100% of the death benefit.

Different companies have different payout schedules, so it’s important to fully understand before explaining to your clients.

Modified Final Expense Plans

Modified burial insurance plans are nearly identical to graded plans, except for the type of payout. Modified plans are used for pre-existing conditions that pose a higher risk for the insurance company, which results in a reduced payout schedule (using a $10,000 policy as the example):

- Year 1: Return of your premiums paid to date + 10% interest

- Year 2: Return of your premiums paid to date + 12% interest

- Year 3: 100% of the $10,000 payout

- Accidental death in any year pays 100% of the death benefit.

The important thing to remember about modified burial insurance plans is that it is worth shopping other insurance companies because you might be able to qualify for a graded plan, which would increase the payout to your client’s family and lower their costs.

Guaranteed Issue Final Expense Plans

The last type of final expense plan is called guaranteed issue. This means there are no health questions and all of your clients will be approved.

Guaranteed issue is for those with pre-existing conditions that deem them uninsurable in many cases.

Guaranteed issue payout schedule:

- Death in year 1: Return of premiums paid to date + 5% interest

- Death in year 2: Return of premiums paid to date + 7% interest

- Death in year 3: Return of premiums paid to date + 10% interest

- Death in year 4: 100% of the $10,000 payout.

- Accidental death in any year pays 100% of the death benefit.

This is why it is so important to have multiple companies as a final expense agent. You need to be prepared to handle the various underwriting scenarios you will face in the field.

Here are some common health conditions that can sometimes result in guaranteed issue final expense sales.

- Cancer

- Oxygen use

- Kidney failure / dialysis

- Recent heart attack

- uncontrolled diabetes with additional complications

- Recent organ transplant

It’s important to always fact find effectively as you’ll find many times that a prospect may appear to be a good candidate for guaranteed issue when in fact you may be able to place them on a graded benefit with another carrier.

Also, it’s important to note that benefits vary from carrier to carrier and the numbers listed above are common examples.

Below are some guarantee issue final expense companies.

Guaranteed Issue Final Expense Companies

- AIG

- Gerber

- Columbian

- Kemper

- Mutual of Omaha (accidental death up to 500k)

- Great Western

- United Home Life

- Nationwide

- Americo

- Gleaner Life

Have you ever wondered what sales language top Final Expense Agents use?

FREE Top Producer Presentation

(FREE Download)

Understanding the Funeral Market

Another thing you need to do is stay updated on the industry as a whole.

Understanding the consumer trends will drastically help you when you’re out in the field meeting with your prospects.

For example, we are seeing average policy face amounts decrease as a whole in the industry and this makes sense based on the statistics.

According to the NFDA, cremations have been trending up consistently for the last 10 years and are projected to continue for the next 2 decades.

The more you know about your industry and can communicate to your prospects during your conversations, the more they will see you as an expert in your field.

Best Final Expense Insurance Companies to Sell

Final expense life insurance products are somewhat of commodity, especially when you consider the total number of final expense companies in the market today. We get asked this question all the time and the response is almost always the same.

Sell what is best for your customer.

With as many final expense companies that are available, you should be able to pick any combination of 4 companies that will help you build a strong book of business while also doing what is best for your clients.

Best Final Expense Insurance Companies

We prefer the companies in bold.

| Company Name | ||||

|---|---|---|---|---|

| (Recommended) Mutual of Omaha | ||||

| (Recommended) Prosperity Life | ||||

| (Recommended) Royal Neighbors of America | ||||

| (Recommended) Transamerica | ||||

| (Recommended) American Continental | ||||

| (Recommended) Gerber Life | ||||

| (Recommended) Columbian Mutual Life | ||||

| AIG | ||||

| American Amicable Life Insurance Company of Texas | ||||

| American Home Life Insurance Company | ||||

| Americo Financial Life and Annuity Insurance Company | ||||

| Assurity Life Insurance Company | ||||

| Baltimore Life Insurance Company | ||||

| Equitable Life Insurance | ||||

| The Independent Order or Foresters | ||||

| Gleaner Life Insurance Company | ||||

| Great Western Insurance Company | ||||

| Kemper | ||||

| Liberty Final Expense | ||||

| Medico Insurance Company | ||||

| Nationwide | ||||

| New York Life Insurance Company | ||||

| Oxford Life Insurance Company | ||||

| Sentinel Security Final Expense Insurance | ||||

| Security National Final Expense Insurance | ||||

| Senior Life Insurance Company | ||||

| S. USA Life Insurance Company (Prosperity) | ||||

| Trinity Life Insurance Company | ||||

| United American insurance Company | ||||

| United Home Life | ||||

| United of Omaha Life Insurance Company |

How to Get Started as a Final Expense Insurance Agent

Getting started doesn’t need to be difficult, but you do need to do your homework and dedicate yourself to becoming an expert.

Get a Life Insurance License

The first thing you need to do is get licensed to sell life insurance.

In order to get a life insurance license, you need to follow the state required guidelines. Some states require passing a moderated test and some require taking an in-person course.

Here is a link you can use to start the process of getting your life insurance license. Once you’re licensed, you can follow the remaining steps in this detailed guide on how to sell final expense.

Get Your Life Insurance License Here

Don’t try to recruit

One of the ways agents make a lot of money selling final expense is by recruiting agents to their hierarchy. Most of the time they try recruiting too soon.

You should learn the entire business on your own before you start trying to pitch the opportunity to other agents.

If you start recruiting too early, you’ll get stuck with a bunch of bad agents who write and place bad business that ends up charging back. When it charges back and they can’t afford to pay it back, it will roll up to you.

Are you prepared to cut a check for $1,000, $10,000, or $20,000?

Become an expert on the business before you start trying to take financial responsibility for someone else.

Follow a System or a Proven Producer

The number 1 growing franchise in the U.S. in 2019 is Taco Bell. If you bought into a Taco Bell franchise, would you change its proven processes for running a profitable store?

Probably not.

You would likely take their franchise guide and follow the step-by-step instructions to turning a profit. After all, you just paid a lot of upfront money to buy into a successful business model.

Think about final expense the same way: There is a proven approach to selling final expense that works. Find someone or an FMO (more details below) who is crushing it and see if they will be your mentor, you don’t get what you don’t ask for.

Don’t try to reinvent the wheel.

Invest in Yourself

The biggest difference between a final expense insurance agency and a franchise like Taco Bell (besides selling final expense life insurance or tacos), is final expense insurance doesn’t require large upfront fees to get started.

Taco Bell startup costs can be as low as $500,000 and as high as $2.6 million. The average store owner makes roughly $124,000 annually.

Your costs to start a final expense insurance agency can be as little as $2,500, and first year income can be $109,000 after your marketing costs for leads, which for direct mail are a whopping $460 / week at the going postage rates. Some people make a lot more, but this is a good average.

Would you rather pay $500,000 upfront to make $124,000 and work seven days a week, or $2,500 up front, work four days a week and bring home $109,000, with unlimited room to grow?

Enough said.

Investing in yourself is the difference maker and that is where a lot of agents fail. Take the time to invest

in your business on a weekly basis.

Also, take some time to learn about the various products on the market your client will be exposed to.

Become familiar with various Colonial Penn life insurance products, AARP, Globe Life and all the

insurance offers they receive through the mail.

This way you can speak intelligently about these products when a client brings them up.

Have you ever wondered what sales language top producers use?

FREE Top Producer Presentation

(FREE Download)

Final Expense Leads 101

You are only as good as your leads in the final expense business.

If you don’t have a consistent source of leads, you will fail.

A good rule of thumb is to make sure you have at least 15-20 new final expense leads to work each week and 30-50 follow ups. This should conservatively yield you roughly $2,500-$5,000 in new commissions each week (assuming street level commissions).

I personally had the most success working direct mail, but like anything, marketing initiatives are always evolving. We’re now having really great luck with facebook leads.

There are 4 common types of final expense leads.

Facebook Final Expense Leads

Facebook continues to grow as a popular lead source for final expense leads for agents. Here is what you should know.

Not all leads are created equal and here’s why.

Facebook is a different animal than google and running lead campaigns is constantly a moving target. Below are some considerations when getting Facebook final expense leads.

- What is the final expense target market? Does your lead provider give you any details?

- Are the leads TCPA compliant? What does TCPA even mean?

- Are the leads generated using Facebook default forms or directly traffic to a landing page to convert?

- What geography are you targeting

- What time are the ads running and what is the average time your respondents are filling out the forms?

- Are the leads delivered in real time or are you waiting for someone to download the leads and send them to you?

All of these elements can impact the quality and volume of leads you receive. Not many vendors will tell you everything because they fear you’ll leave them as a customer, which is a legitimate fear.

Here’s my take on Facebook final expense leads…

Use a vendor that knows what they are doing and let them continue to do it well. You are a final expense agent, not a lead generation guru. Business is all about surrounding yourself with those smarter than you.

Let the lead generation experts do their job while you stay focused on how quickly you’re dialing your leads, following up, asking for referrals, door knocking, etc.

How much do Facebook final expense leads cost?

I have seen prices as low as $8 per lead and as high as $30, it all depends on the elements I discussed above and the volume you’re ordering. A good average price I’ve found from various sources is $15-$19 per lead with a 20 order minimum.

Direct Mail Final Expense Leads

Direct mail final expense leads are generated through a letter with a postage-paid reply card completed by the prospect requesting more information on burial insurance or alternatives to the $255 social security pays upon death. The client must physically fill out the card and return it to the sender via mail.

By physically completing the reply card, the client is much more likely to remember completing the form, greatly increasing your chances of setting an appointment.

Average return rates for direct mail final expense leads are 1% (2,000 weekly mailers x 1% response = 20 leads), so you need to really make sure you’re working them well to ensure you have a solid ROI.

Expect to pay $40-50 for each direct mail final expense lead.

Direct mail leads are often considered the best final expense leads as that is what the industry heavily relies on. We have been testing other types of final expense leads and can’t quite say which is best, but we’re starting to see some compelling trends that indicate you should diversify the types of final expense leads you are buying each week.

Best Direct Mail Companies

We have used numerous direct mail companies so it’s hard to determine who deserves the award for best. Below are the best direct mail companies we have directly used or our agent network has given us great reviews.

My good friend Glen Shelton created a great review of the best final expense direct mail companies, you can check it out here.

Telemarketed Final Expense Leads

Telemarketed final expense leads are generated through cold calling your target demographic and typically offering to provide information on new state approved burial plans. Some agents thrive on cold calling, but if this isn’t you, there are many third-party telemarketing firms both in the U.S. and internationally.

The prospect commits to the lead over the phone with a promise an insurance agent will contact them within 24 hours. This is a much faster turn-around and about half the price as direct mail, but these leads have a much shorter shelf life to convert the lead to a sales appointment.

So, it’s critical you follow up with telemarketed leads quickly; preferably the same day.

Telemarketed final expense leads cost around $15-$25.

Our agents currently use a blend of telemarketed leads and direct mail, you can learn more about that here.

Door Knocking Final Expense Leads

Door knocking final expense leads are not as intimidating as you might think. Frankly, they are highly effective if you can get over your fear of getting punched in the nose! 😉

All jokes aside, door knocking is highly effective for final expense sales.

The difference between door knocking and setting final expense appointments over the phone is you don’t have a phone. Door knocking final expense is all about diversifying your prospecting efforts.

If you have a stack of leads from previous weeks that you can’t reach by phone, go knock on their door when you’re in their area.

It’s simple, you just have to step out of your comfort zone and do it.

Plus, you’ll be addicted once you do it and see how effective it is in generating new sales. Door knocking final expense leads feel like they’re free, because you’re simply following up on direct mail leads you already purchased but couldn’t reach over the phone.

It’s a great use of your free time in between other appointments. The agents that are consistently door knocking each week are absolutely out producing those that aren’t.

Door knocking script

Here is language and process I use when knocking doors.

- Organize all my leads in a stack.

- Enter them into a mapping software

- Go knock the route that takes me to all my leads in a circle from home to all my appointments and back home again.

When I’m at the door, I use simple language.

“Hello, Mrs. James? Hi, sorry to catch you off guard but my name is Drew Gurley and you had sent me this card a couple days / weeks ago. (show them the card)

“I was in your neighborhood meeting with some other clients and wanted to stop by and introduce myself so you could put a face with a name. Do you have 15 minutes for me to walk you through the information you requested?”

If they say no….

“I’m sorry, I wasn’t clear. I didn’t mean today as I’m fully booked. I will be here the rest of the week before I move to a new city. Are you available Tuesday or Thursday at 11:00 or 2:00?”

I have used this approach many times with great success. If you consistently integrate door knocking into your weekly sales activity, you’ll 100% see an increase in your numbers.

Don’t be afraid of door knocking!

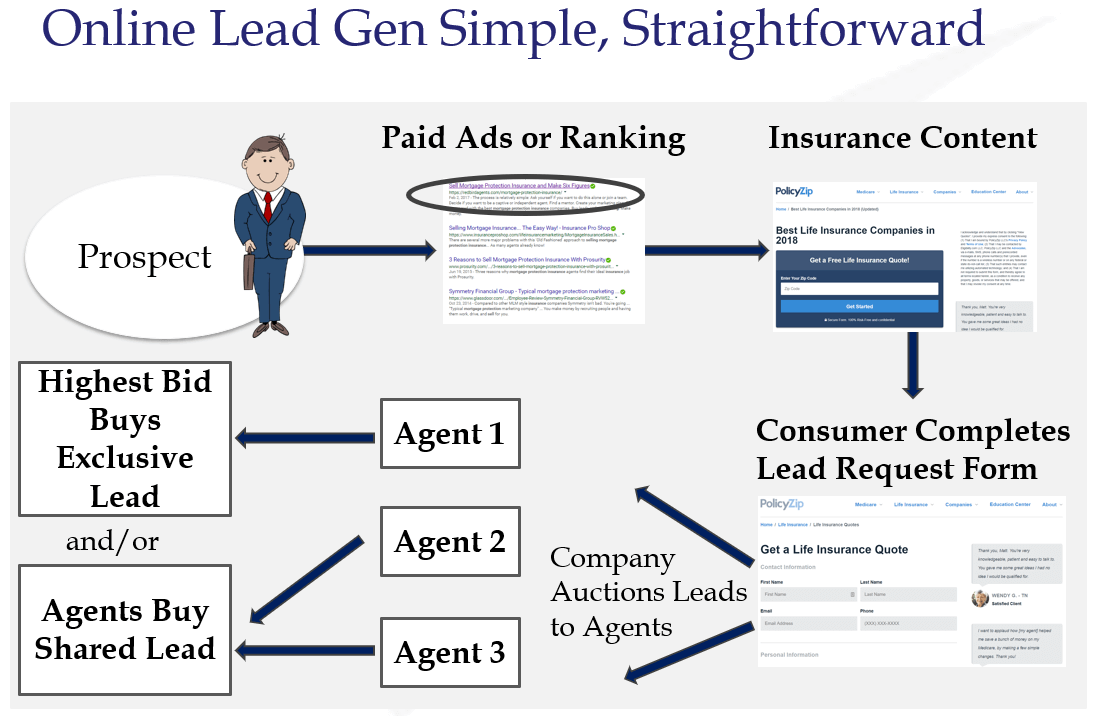

Organic Internet Final Expense Leads – Google

I hear this from agents just about every day: “The final expense market isn’t online.”

Just because the typical final expense prospect is older than 50, don’t make the mistake of assuming they are not users of the internet.

Millions of people buy insurance online, final expense included. They simply search for a website regarding burial insurance or funeral insurance. Usually those sites will offer free final expense quotes, which are then sold and distributed to independent agents for anywhere from $12-$40 per lead.

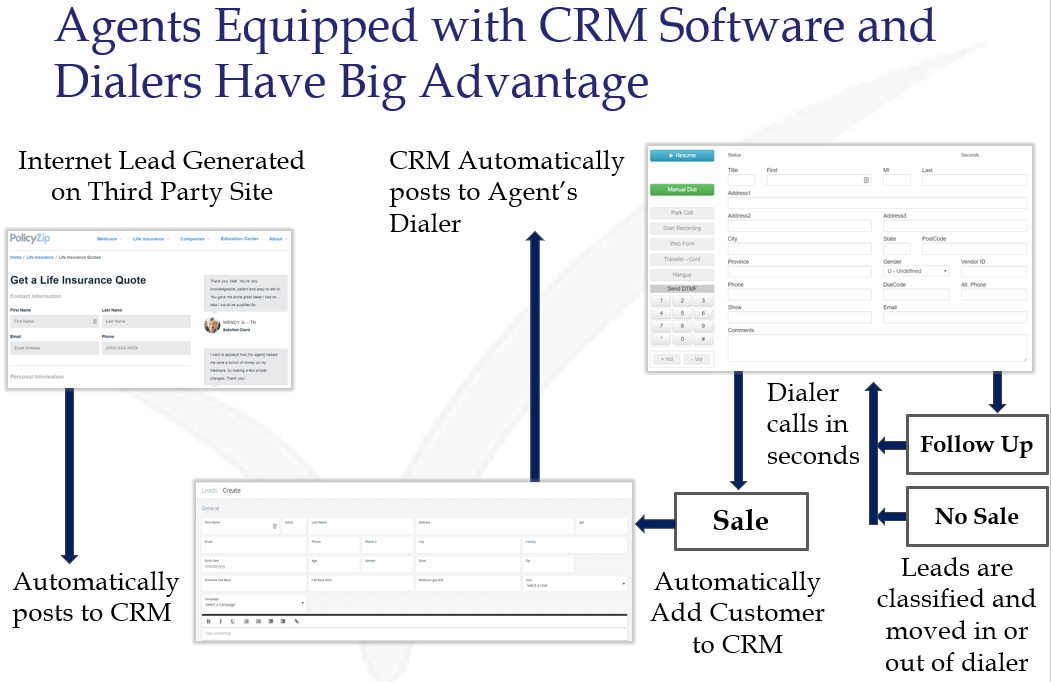

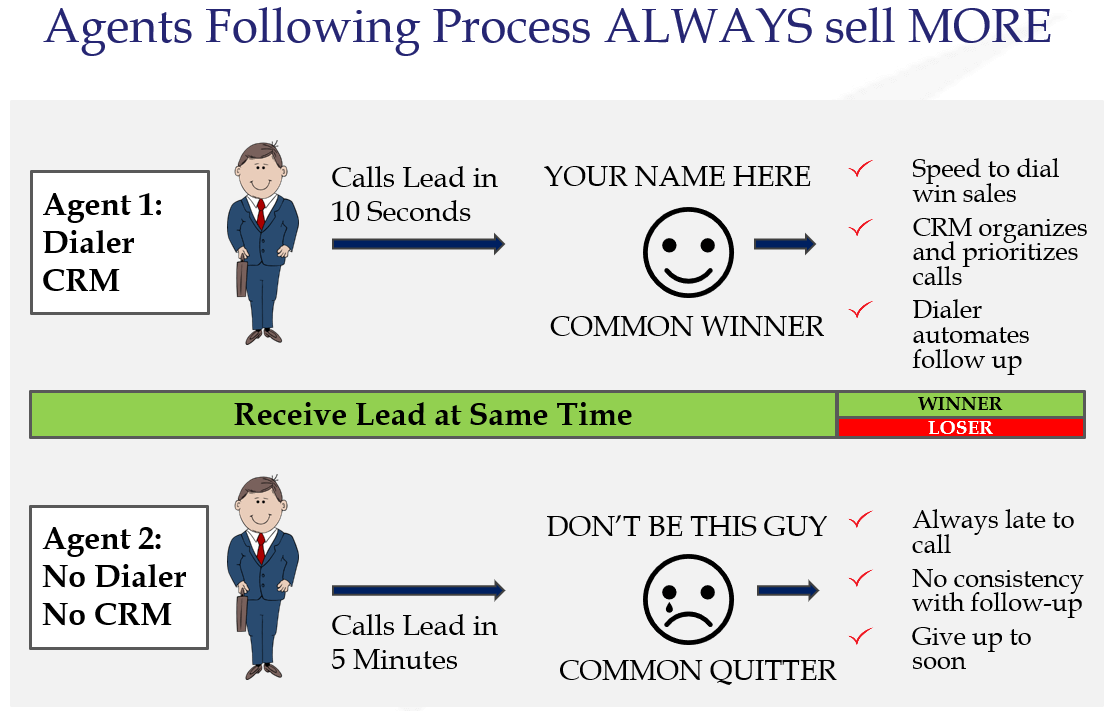

Internet leads are all about timing. These leads have an extremely short shelf life, so you have to strike while the iron is hot!

Many agents working internet leads have an automated dialer that will call leads within 10 seconds of the consumer filling out the lead form online. The really good news here is these leads are often generated via SEO which is two parts great content and one part great links. You can do this yourself if you hire a good insurance copywriter.

Below is a quick look how the process works from how internet final expense leads are generated to the best way to work them.

Process to sell final expense over the phone using internet leads.

Hopefully now you can better understand why it can be so difficult to sell internet leads over the phone.

How Many Leads Do I Need Each Week?

This is a loaded question, I’ll try my best to answer objectively.

A good rule of thumb for a full time life insurance agent is to have 20 presentations per week. If you’re consistently doing that, then you are going to crush it in this business.

Have you ever wondered what sales language top producers use?

FREE Top Producer Presentation

(FREE Download)

How many leads does it take to get 20 appointments per week?

That answer varies whether you’re doing field sales or final expense telesales.

Field Sales

This depends on the type of leads you’re working, below are some estimated lead counts based on lead type.

- Direct Mail Leads: 20 new leads

- Telemarked: 50

- Internet: 100+

What these numbers don’t represent is how many over flow leads you have from the previous weeks order. For example, you have 20 new direct mail leads this week to work plus the 8 from last week that you couldn’t reach or connect with. This same principal applies to telemarketed and internet leads.

The key here is over time you will develop a robust database of leads to work each week that will help you have enough conversation to book 20 appointments. This is a perfect example of the compound effect over time.

The more consistent you are with your weekly lead orders, the bigger you database will be and the more leads you will have weekly to call and set appointments.

Telesales

Final expense telesales is a different animal from a full time business perspective. You can still sell final expense over the phone using the same amount of leads as it takes for the field, however you’re conversations will likely be lower. If you’re going to go down the path of telesales, you can’t be afraid of phone calls.

There are different programs for telesales but the rule of thumb is as follows:

- 20 leads per day

- 15-20 conversations per day

- 4-6 sales per day

Final expense telesales metrics are very different than field sales.

Final Expense Data – Make sure you buy good data.

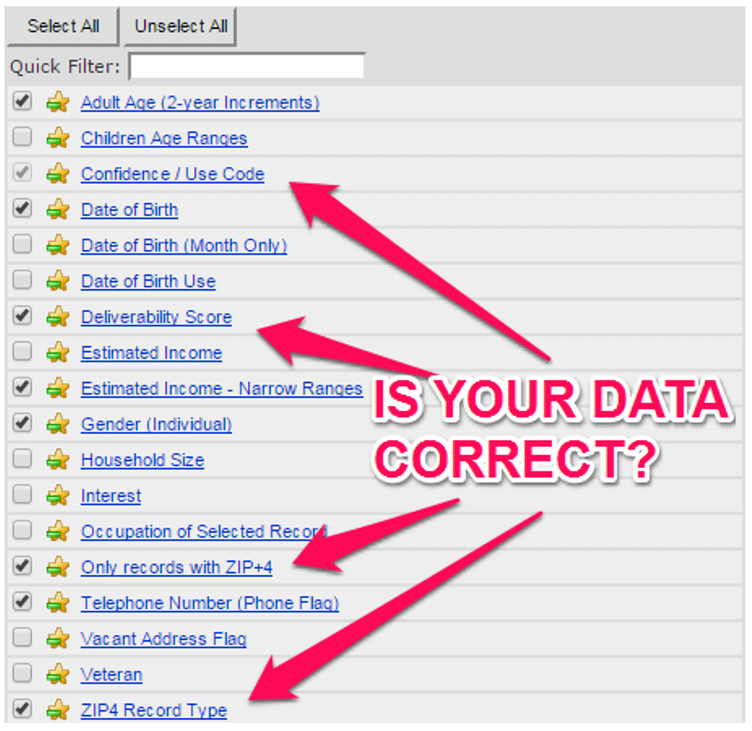

Another component of leads you need to understand is data.

You need to make sure the final expense data lists you are buying are strong and fit each of your lead types.

For example, how do you know the data you just purchased is current? How does the lead company filter the data? Do they include phone numbers? What types of guarantees are there and have they verified the address with the USPS? If there are multiple prospects in one house, are you sending one lead card or two?

You need to make sure the vendors you are using are helping you succeed. If you aren’t sure how they are pulling your data together, pick up the phone and call the data company. Make sure they walk you through the best filters to capture the strongest data possible regarding your target market.

The last corner you want to cut when creating your final expense marketing plan is data. You are going to encounter a lot of offers for FREE data. Buyer beware! Bad data is bad data, whether it’s free or not. Press the vendor on where the data came from and what filters were used.

My suggestion is you call two or three data companies and tell them what you are trying to accomplish. They will not only have input on how to filter the data, but they’ll also help you understand the true costs of final expense insurance lead generation.

What is the Best Final Expense Lead?

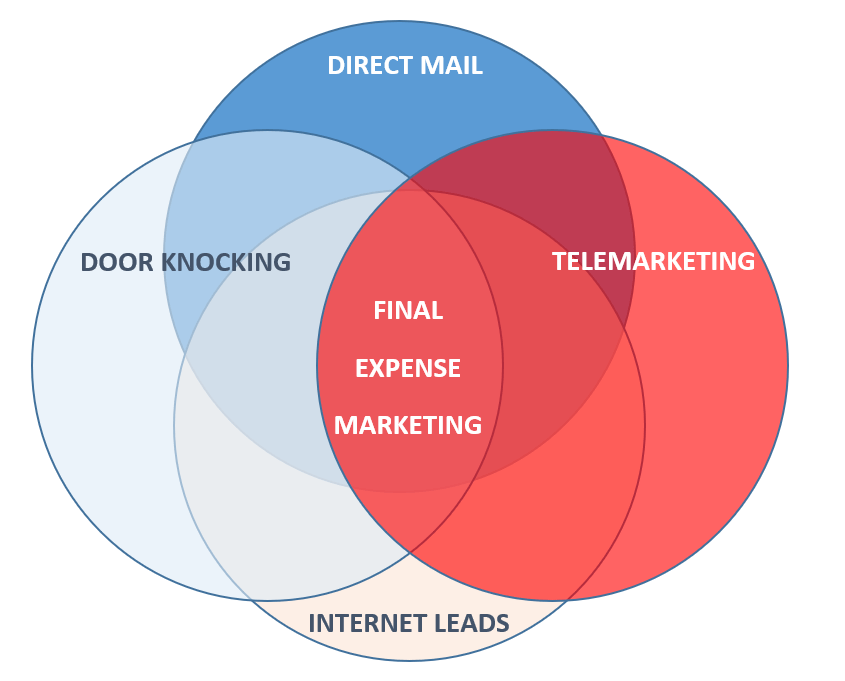

Simple answer: Multiple lead types working in unison is your magic bullet to selling final expense. The golden ticket is consistent activity and one great way to consistently stay busy prospecting is by using multiple types of leads.

Good news for you: Most agents won’t have the tenacity to do what we know works and are going to walk you through in this next section.

Again, tenacity wins when selling final expense.

Open your shiny new data list from the previous step and do the following:

- Step 1: Identify everyone on the DO NOT CALL list and send them a direct mail card.

- Step 2: Identify everyone not on the DO NOT CALL list and start tele-marketing.

By doing this you are staying compliant by following the do not call (DNC) rules and you are maximizing your costs of the data list by marketing to every single person in your data list to get a response.

For example, if you bought a list of 2,000 prospects in a specific zip code and only sent direct mail, you would only get 12-20 lead cards returned, which would cost you $45-$60 per lead (remember, 1% is the average return rate for final expense direct mail leads).

What about the other 1,980 prospects who didn’t respond to your mailing?

Put all contacts not on the DNC into a telemarketing database and call each one, maximizing your investment on the data list.

You will end up with a percentage of telemarketed final expense leads, a handful of direct mail leads and more folks to knock and follow up with each week.

If you follow this strategy each week, I promise this will increase your activity and drive more sales. If you’re not making sales, then you’re cheating and skipping steps.

How much does this extra marketing cost?

You’re already spending money on direct mail and that’s coming out to about $45-$60 / lead. If you send out 2,000 letters, your average cost is roughly $900 per mailing.

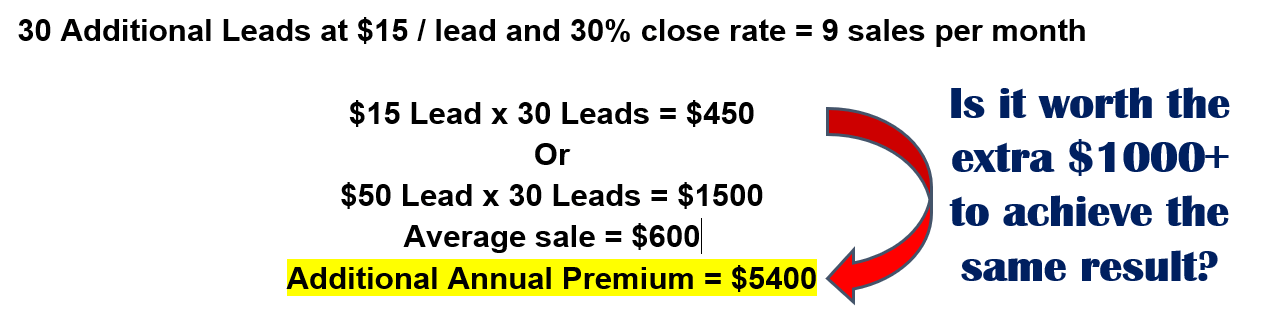

By using a telemarketing company, you can send them your list and they can generate additional leads anywhere from $8-$22 per lead. This is in many cases less than half the cost of direct mail.

Let’s assume each month you could generate an additional 30 telemarketing leads. Assuming a 30% close rate, that is 9 new sales per month. You could be adding an additional $5,400 in annual premium per month.

Are you willing to spend $450 to bring an additional $5,400 in premium to your business on a monthly basis?

Final Expense Sales Training

I don’t care what you’re selling, you need a strong insurance sales training foundation to get your business to the proverbial “Next Level”.

Many new agents fast forward through final expense training because they believe it is easy to sell a small policy to pay for a funeral.

Nothing could be further from the truth.

While the premiums for the typical final expense policy are less than $60 per month, this is a significant sum for many target customers and, consequently, is an important decision for them.

Below are some of the core components you need to learn during your final expense training:

- Overcoming rejection and failure

- Appointment Setting: How to set your final expense sales appointments.

- Sales Presentation: What to say when you’re sitting at the kitchen table.

- Phone Script: How to set your appointments over the phone.

- Objections: How to structure your presentation so you can prevent objections from occurring.

- Closing: How to help your client make the purchase decision with you.

- Sales Psychology: it’s not just what to say, but why and when to say it.

- Leads: How to properly work your final expense leads

Learn How to Work Final Expense Leads

If you want to be a successful final expense agent, you need to know how to work your leads.

In the past, you could get away with just using direct mail. But, times have changed.

Imagine having the opportunity to create a kick-ass final expense lead strategy and use it over and over again to maximize your dollars spent and drive more production.

You can easily double or triple your income when you learn how to work the final expense leads together. Too many times agents try and create new lead designs, new content, new demographics and it simply isn’t necessary.

What are the common reasons you can’t connect with your final expense leads?

- They don’t answer the phone.

- They’re on the Do Not Call (DNC) list.

- You are number 157 to send them a direct mail letter.

- They aren’t home.

- They didn’t pay their phone bill.

All of these reasons are exactly why you need to create a sales plan. The key word here is PLAN, and you must stick with it all year long. Here’s my plan, pay attention.

- Step 1: Buy a final expense data list.

- Step 2: Identify everyone on the DO NOT CALL list and send them a direct mail card.

- Step 3: Identify everyone not on the DO NOT CALL list and start telemarketing.

- Step 4: Use internet leads as filler for when you have exhausted your direct mail and telemarketed lead calls.

- Step 5: Knock the doors of every lead you can’t reach, introduce yourself, and set an appointment.

Knowing how to work your leads is half the battle; the other half is getting out of bed and showing up every day. If you do both of those activities religiously, you’ll make a lot of money selling final expense.

“I worked in retail for 10 years prior to this and never had a chance to save for retirement or take vacations with my children. My first month I made $8,000.”

-John

Final Expense Presentation Outline

What you’ll learn is everyone has a similar approach to selling final expense, and along the way you’ll learn words that work with your style.

Below is a basic outline of your presentation in the home.

Build Rapport

This starts from when you’re calling to set the appointment to the moment you’re knocking at their door. Always be on time, dress appropriately, and make sure you’re confident in your abilities.

You don’t need to spend the first 30 minutes on a warm up. Build rapport quickly and get them into the presentation.

You can do this easily by finding common interests.

“Hello Mrs. James, I’m Drew Gurley, I called you last night about the card I received from you about the final expense program available to seniors. How are you today? Great, hey what’s you’re dog’s name?”

By doing this you’re able to then pull from your personal experiences and respond accordingly. For example, “I’ve grown up with dogs and coming home to a happy furry friend is about as good as it gets, wouldn’t you agree?

Seems simple and it is, just make sure you’re genuine about it. Find something that triggers your mind to connect, and talk to them about it.

Getting into rapport should take 10 minutes or less and from that point you can transition into your sales presentation.

Build the Need

The easiest way to kick this off is by reading the card or ad they responded to. This is something they recently completed and it will trigger their memory as well as start the process of identifying the problem, discovering opportunity, and qualifying for coverage.

Try not to use Yes or No questions, and instead go for a more open ended approach.

“How did the death of your loved one impact your family?”

“What was the hardest part about the funeral planning process?”

Set the Expectation

It’s always important to tell them what you intend to do.

“Here is how our program works, Mrs. James. Our program is designed to help you take a few dollars each month and set them aside to have the entire funeral expense covered before it ever happens.”

It’s important during this phase to make sure you’re consistently explaining the facts and benefits of the program. And, being extremely courteous along the way.

Here are some examples I learned from Jim Mall, one of the greatest final expense sales trainers.

Fact Statements:

We provide benefits starting at $2500 dollars, going as high as $25,000. These benefits are immediate, 100%, guaranteed, cash benefits.

Here is the full breakdown.

Fact: Immediate Benefit

Benefit: If you pass away, the insurance company pays your family.

Fact: How are you going to die? It can only happen 3 ways: Natural Accidental, or Suicide

Benefit: No matter what happens, we can design a solution that will pay your family.

Fact: 100% guaranteed

Benefit: Your family gets all the money to use as needed, it’s not in the control of the funeral home

Fact: Cash Benefits

Benefit: Your family receives the money, not the funeral home. We don’t cut checks to the cemetary, the hospital, nursing home, or even your utility companies. We pay the benefits directly to you.

Fact: Guaranteed Benefits

Benefit: One thing in life that we know is guaranteed is that we’re all going to pass away, something we already covered. When you die, you family will get paid.

Fact: Tax-Free

Benefit: Your family gets the full amount of the policy and does not have to pay taxes.

Explaining these facts and benefit is a great way to recap your discussion about final expense. The next step is giving them your three guarantees.

Fact: Your payments will never increase as your age or health changes

Benefit: You’re not surprised on any given month when your premiums are collected. It’s always the same, predictable amount.

Fact: You benefits will never decrease.

Benefit: Your family know exactly how much they will receive to properly plan your burial.

Fact: Your policy cannot be cancelled, no matter how old or sick you get. As long as you make your payments on time each month, you’re policy will remain active. The best way to do this is to have your bank send the premiums to the insurance company every month for you.

Benefit: We cannot take it away, especially during critical times like illness or accidents. The plan is there when you need it.

Closing the Sale

Once I have made it through my presentation and confirmed the facts and benefits above, I pull an application out and state the following.

“How long would it take you to save $10,000 at one or two dollars per day?

“Our program gives you the $10,000 in the snap of a finger when you pass away, simply through transferring $2 per day to an immediate balance of $10,000.

“Let me get some additional information from you, then we’ll decide which program you will be comfortable with”

From here I ask the health questions on the application and I prepare 3 options starting with the death benefit amount they requested on their card.

If you have covered your facts and benefits correctly, used open ended questions, and built adequate trust, your closing should go very smooth.

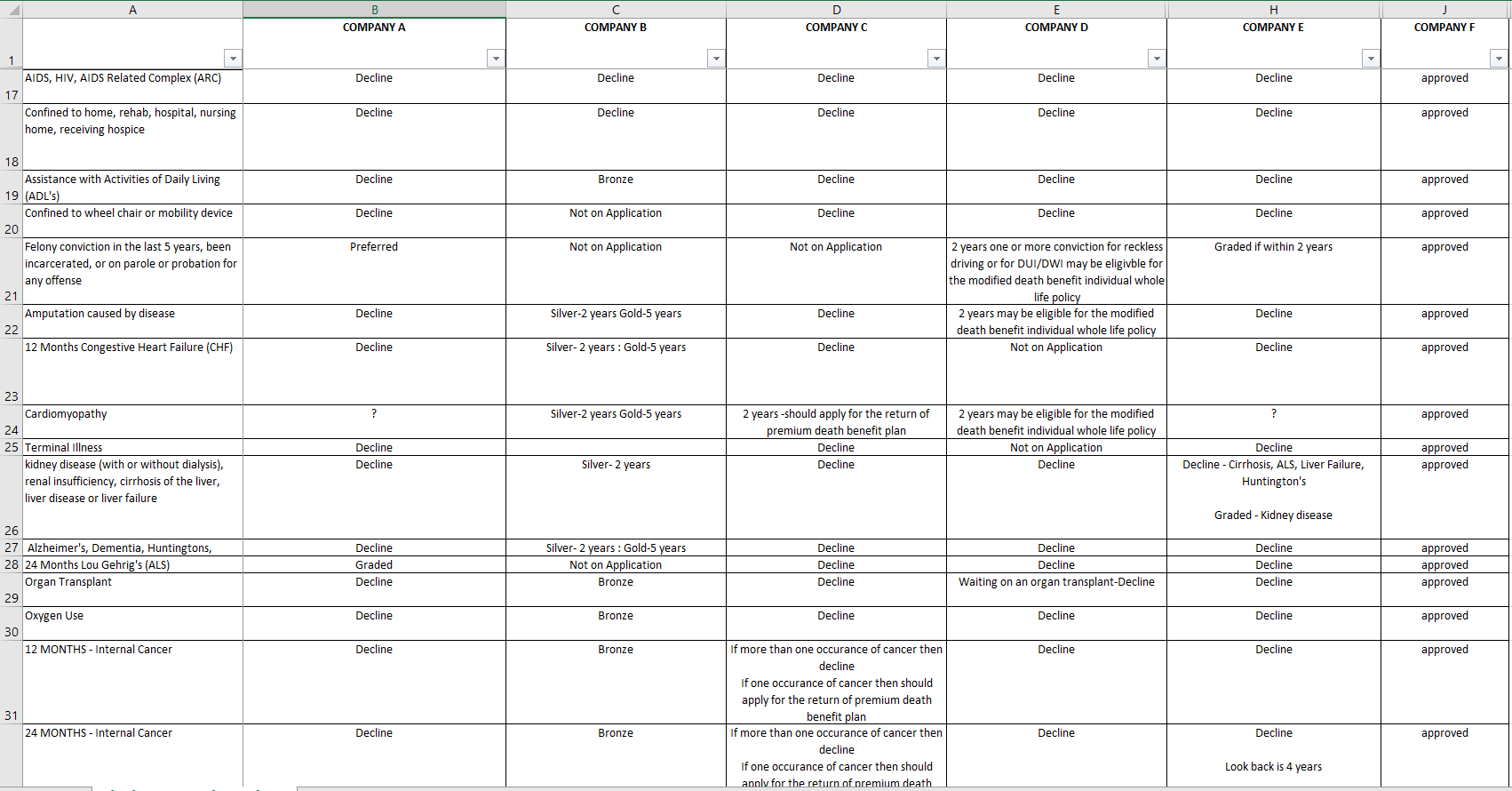

Final Expense Underwriting

If there’s any magic in selling final expense I believe it is here. Knowing how your carriers deal with various health conditions doesn’t happen overnight, but those who master it are much more equipped to write large amounts of new business.

If you’re brand new, here’s a link to an article we did regarding common medical conditions you’ll come across in the field. This will help you get a baseline understanding.

If your client is an insulin-dependent diabetic, you should know which company to choose. If they were diagnosed with cancer four years ago, you need to know where to turn. Knowing how to navigate the carrier underwriting separates the good final expense agents from the great!

Here’s how to create a final expense underwriting cheat sheet:

Step 1: Get copies of each of your core final expense carrier health questions.

Step 2: Create a spreadsheet:

- List you core final expense carriers across the top so each company has its own column (starting in column B). List them from left to right in order of importance (e.g. your top choice carrier goes in column B, etc.).

- Starting with the first row the names of carriers, list the final expense health questions and associated time frames in each row of Column A. You should now have chart that has companies on the top, conditions down the side and a bunch of blanks cells to fill in.

Step 3: Complete one carrier at a time and enter the following choices in each cell based on the underwriting question listed on the application.

- Level

- Graded

- Modified

- Declined

Step 4: Once completed, go to your primary final expense carrier column:

- Highlight every cell labeled “Level” in column B in bright green. This makes it easy to instantly know which company you should use first in every scenario, especially when your cheat sheet has a ton of carriers listed.

- Highlight all “graded” cells yellow

- Highlight “modified” cells blue

- Highlight “decline” cells red

Now that you have all your companies and health questions organized, you can easily find which company to use in every possible scenario.

Why don’t I offer a free final expense cheat sheet for you to download?

Because you need to have skin in the game and put the work in. If you’re not willing to create this on your own, then you’ll likely cut corners again on another important part of your business.

Cutting corners leads to failure, so don’t do it.

Creating a final expense underwriting cheat sheet is a great exercise as you’ll learn a lot about the final expense companies you are carrying around in your sales bag.

Below is a screen shot of what a hypothetical final expense cheat sheet looks like.

Common Final Expense Underwriting Questions

What carriers will take clients taking insulin for diabetes?

This is an extremely common question.

Many final expense companies will take clients who are using insulin to treat their diabetes. Below are a few examples.

- Aetna

- Americo Eagle

- Mutual of Omaha

- United Home Life

Other information you’ll need to know for placing final expense for clients with diabetes

- Age your client was diagnosed with diabetes

- Are they using insulin or oral medication

- Do they have any complications with their diabetes

- What are health conditions do they have on top of diabetes

There are plenty of final expense companies that can write for people with diabetes, you just need to make sure you collect all the details to give you clients the best shot at getting a level death benefit plan.

Final Expense for someone with COPD

COPD is a common condition you will face in the field and there are a few core companies we have found that will take these cases.

- Transamerica (previously Stonebridge and Monumental)

- Assurant

- Americo

What you need to make sure is whether or not the client is also using oxygen as that will drastically impact your options to get the case placed.

Final Expense for someone with Cancer

If you didn’t know, 1 in 2 men and 1 in 3 women will be diagnosed with some type of cancer in their lifetime. This means you will likely come across cancer when you are qualifying your clients.

Here are some companies that have been known to help clients with a history of cancer.

- Americo Eagle

- Sentinel

- Transamerica

- Mutual of Omaha

- Liberty Bankers

- AIG – guaranteed issue

- Gerber – guaranteed issue

I could keep the list going, but the point here is that you have options. What you need to make sure you’re looking at with each company is how the cancer question is worded and what is the look back period.

Some companies have a 2 year look back and some have 4 or 5 years. Make sure you’re referencing your field underwriting guides available from each carrier to understand the rules of getting someone with cancer a final expense policy.

Final Expense for someone over 85

This is extremely common and the companies that will write final expense insurance for seniors over 85 is limited. Below is a snap shot of the companies we have found that work well for this age group.

- Aetna

- Security National Life

Final expense for people without Social Security numbers

Every now and then depending on the parts of the country you are working you will come across instances where your final expense clients have an ITIN number instead of a SS number.

What is an ITIN number?

An ITIN in an individual tax identification number designed for tax payers who do not have a social security number to file their tax returns. Most commonly you’ll find US resident aliens that fall into this category. Below are some of the final expense companies you can use for clients with ITIN numbers instead of social security.

- American Amicable

- Transamerica

- Liberty Bankers

- Columbian Financial Group

Medications You Should Know When Selling Final Expense

One of the things you’ll learn on your journey of final expense sales is common medications.

Below are some of the common medications you will come across in the field.

- Lisinopril: Used to treat high blood pressure and heart failure.

- Carvedilol: This is a beta blocker which is used to treat high blood pressure as well as congestive heart failure (CHF).

- Simvastatin: Common cholesterol medication used to reduce the risk of heart attack, stroke and other conditions.

- Metformin: Oral medication for diabetes treatment.

- Losartan: Commonly treats high blood pressure.

- Metoprolol: Commonly used to treat chest pains (angina), heart failure, and high blood pressure.

- Atorvastatin: Treats high blood pressure and reduces risks of heart related issues.

- Gabapentin: Commonly used to treat seizures and relieve nerve pain.

- Glipizide: Used for treatment of diabetes.

- Novolog: Used for treatment of diabetes.

- Hydrochlorothiazide: Treats high blood pressure.

- Lantus: Treats diabetes.

- Lasix: Congestive heart failure.

- Furosemide: Congestive heart failure.

- Depakote: Treats seizure disorders.

- Warfarin: Brand name for coumadin which is a blood thinner.

This is just a glance at the many drugs you will come across in the field. It’s always important to remember to ask what other conditions someone might have in conjunction with their current pre-existing conditions.

Medications also often have a dual purpose so it’s important to ask your prospect what they are using each medication for so you’re not surprised when you try to get the policy approved.

**SALES TIP** This is a great moment to show your clients your high attention to detail and build confidence that you are the agent they should be working with.

Captive Agent vs. Independent Agent

I know you’re wondering: “How much can I make selling final expense”?

Aside from your work ethic, it’s going to come down to how you choose to get into the business. There are two main ways you need to consider.

First, ask yourself this question and answer HONESTLY: Are you instinctively a self-starter or do you need a cheerleader on a daily basis to get you fired up for the day? If you answered self-starter, then going independent would be a great place for you to start.

If you need the cheerleader then I would highly consider going captive, at least until you get your feet wet and build some experience and success.

Fooling yourself during this part of the process is just setting you up for failure. Don’t do it.

Let’s make this a little more real and look at both scenarios.

Captive Final Expense Agent

When you’re a captive agent, you work for an agency and do not own your book of business. This means that every customer you write is owned by your agency and not by you.

Why does this matter?

When you decide to move on, your book of business does not go with you and neither will your renewal commissions.

The other part about being captive is understanding you are going to get paid less.

You’re probably thinking, “why would someone ever agree to getting paid less?” Part of being captive is that the agency has typically invested heavily in infrastructure to support you, whether it’s training, marketing, or IT.

You should expect to get paid less when you are getting a high level of support from your agency. Below are some examples of the level of support you can expect in a captive agency:

- Extensive hands on training and mentorship.

- Consistent ride-along sales support.

- Leads, preset appointments, or both provided at a significant discount or no cost.

- Other benefits such as base salary, health insurance, and travel allowances.

The captive sales model allows you to focus on selling and never having to worry about how to get life insurance leads again.

As mentioned above, in exchange for this level of support you will receive a much lower compensation.

Remember, there is always a cost to doing business.

You can either pay for it out of your pocket and be your own boss, or you can trade your ability to sell and have a captive agency provide those services for you.

Being a captive final expense agent certainly has its perks; it’s up to you to decide if it’s the type of environment you need in order to become a top final expense producer.

Independent Final Expense Agent

Independent agents are 1099 contractors to the various final expense companies. In most cases, your commissions are paid to you directly from the insurance companies and not the agency/FMO you’re working under.

As an independent agent, you will be provided access to the best final expense insurance companies and a variety of final expense lead sources.

Pay close attention to my words, “sources”.

This means you are responsible for your own expenses and your upline will not be covering those costs for you.

You’ll also be responsible for all of your business expenses and operating costs.

When you’re independent, you’re a business owner, which is why I said going independent is great for self-starters!

Independent agents carry more responsibility as well as earn significantly higher commissions than a captive agent; typically, at or near street level.

What does street level commissions mean?

Street level commissions vary by carrier, but the income potential always remains strong.

Generally, they are in the 100%-115% of annual premium range and are typically the highest level a carrier will pay an individual agent without requiring proof of production (previous insurance sales success).

For example, if you sell a policy that costs a client $50 per month or $600 per year and you’re at a 110% commission level, you can expect to receive 110% of the full $600 premium for a total payout of $660.

Payout modes

There are two common ways commissions pay out.

As Earned

As earned means you are paid each month as the client pays their monthly premium. This is the least common method agents typically want to get paid because it’s hard to cash flow your business.

For example, if the client is paying $50 per month and you’re at a 110% contract, you would receive $55 per month for that policy for the first 12 months.

Advanced Commission

Advancing is the most common way agents, and it’s the most risky due to clients cancelling which results in charge backs. Charge backs require you to pay back your advances. There are two common advance commission scenarios.

Six Month Advance (50%)

Six month advance means that you are paid 6 months of commissions up front and the remaining six month pay as earned.

Nine Month Advance (75%)

Nine month advance means that you are paid 9 months of commissions up front and the remaining three months pay as earned.

My suggestion is to set your primary company up on a 9 month advance and your other companies up on as earned. If your primary company is on a 9 month advance you should be able to generate plenty of cash flow to cover your expenses and pay yourself.

Setting up your commissions this way will help you manage your charge back risks.

Final Expense Telesales

Telesales (selling final expense over the phone) is a hot topic!

More and more agents reach out to us with questions regarding how to get started in final expense telesales because they hear direct mail responses are smaller and prices are higher. Plus, they see the potential for generating leads on Facebook and the appeal for remote selling over the phone get’s even bigger. And, the market is growing for prospects willing to buy final expense over the phone.

In fact, there is so much detail that goes into selling final expense over the phone, we could probably write an entire how to guide on this topic alone.

Here’s what you need to know at a glance.

Final Expense Telesales: How to Sell Final Expense Over the Phone

Find a Mentor

Selling final expense over the phone is NOT the same as selling in the field.

Telesales can be hard to get used to which is why a mentor is SO important.

You need to align yourself with someone who has proven success with final expense telesales so they can teach you exactly what to say, why to say it, and how to master the one call close.

There are a couple great places to learn the ins and outs of final expense telesales.

If you are interested in selling final expense over the phone, shoot me an email and I can get you introduced to the two companies I trust the most. One of my closest contact’s agency wrote over $20 Million of final expense over the phone last and is set to crush that record this year.

Not only did they write huge annual premiums, their persistence was north of 85% which is unimaginable in most instances. This is because they have an amazing process in place.

Want to Get Started in Final Expense Telesales?

Contract with Final Expense Companies that Accept Voice Signatures

This is critical for scaling your telesales operation.

Most final expense companies have an e-app, but not all have voice signatures for telesales.

The vast majority of the traditional final expense market is not computer saavy which makes using e-apps sort of difficult. It’s not impossible, it’s just a road block that you shouldn’t have to face.

That is why you need final expense company with a voice signature. Voice signature completely eliminates paper, emails, etc…you simply follow the approved script on a recorded line and upload the voice signature file to the company portal. Below are some of the companies that have voice signatures.

- American Amicable (specific products only)

- Americo

- American Home Life

- Foresters

- GPM

- Prosperity Life

- Senior Life Insurance Company

Telesales Compliance

The first rule of selling final expense over the phone is that you need to make sure you’re in compliance.

Telephone Consumer Protection Act (TCPA) “regulates telemarketing calls, auto-dialed calls, prerecorded calls, text messages, and unsolicited faxes”.

This is EXTREMELY important for you to follow and any credible lead company will already have TCPA compliance in place. One of the things you should always ask to review from any lead vendor is their TCPA disclosure as this is your first line of defense. Always have your attorney make sure you’re in compliance.

This is another reason why it’s easier to work under an agency already succeeding in selling final expense over the phone. They should have all of these items already addressed so you can simply focus on selling.

Customer Relationship Management System (CRM)

Telesales requires extreme organization!

You have to stay organized so you know how many times you have attempted to call your clients or prospects. You should also make sure the CRM you choose can integrate with your dialer, it will make your life much easier.

My suggestion would be review the dialers first and then find out which CRM companies they are already integrated with.

Sales Dialer

Having a sales dialer to sell final expense over the phone will drastically increase your efficiency. Check your state laws before using and the capacity in which you plan on using the dialer before you pull the trigger. Make sure you aren’t violating any laws.

Also make sure you’re HIPPA compliant and the dialer has a BAA agreement in place.

Confidence

Selling final expense insurance over the phone takes confidence and is something you absolutely need to practice building. Some say you have as little as 30 seconds to make your first impression with lead on the other end of the phone. I recently read a comment online from Jeff Root where he shared some excellent words.

“In telesales, you have 30 seconds to make an impact. If you open your call with a low or monotone voice, no engagement or awkward pauses, you’ll have a hard time engaging with your prospect.

Open your call with an overly positive and confident tonality – conveying that you are going to facilitate a streamlined process.

It’s less about what you say and more about how you say it.

The key is starting the call off right.”

Below is a list of some of the more popular dialers to use for final expense telesales.

- VanillaSoft

- Five9

- Sales Dialers

- Velocify

- Leadsrain

**SALES TIP** The magic of this is getting a system that allows you to consolidate your leads in one place and build in a process of automation to keep your communication consistent. For example, you should always be texting your leads as a means of touch point.

Want to Get Started Selling Final Expense Insurance Over the Phone?

Final Expense Sales Incentives

We love sales incentives, and there are lots of opportunities to earn them selling final expense. If you’re a top producer these companies will literally allow you to travel all over the world. Below are some of the various incentives you can expect to receive in the final expense market:

- Trips around the world

- Gas cards

- Monthly cash awards for top final expense producers

- Fast start FREE LEAD PROGRAMS

- Rewards trips (IMO and Carrier sponsored)

- Monthly lead credits

Managing Your Book of Business

Arguably the easiest way to keep your renewal income each year is to stay in touch with your customers by paying close attention to your book of business.

We preach customer experience in all of the sales models at Redbird, and final expense is no different.

Depending on the sales model you choose, holiday cards, thank you cards and client review cards should be sent to your clients annually. This makes it easy for you to maintain touch points with your clients while staying focused on working your final expense leads each week.

Some agents will say they don’t see an impact in their business. It’s our belief that you should always provide a premium customer experience, so sending cards should be less about you and more about making your customers feel appreciated.

Also, here’s a trick that always works…

Hand address and use stamps. This will increase your open rates and further solidify your relationships with your customers.

Frequently Asked Questions (FAQ)

Is it hard to sell final expense?

It’s not necessarily hard, but it takes mental determination to do really well. You need to fully understand that this is a process business and if you’re not starting out learning a defined sales process, then you’re likely in the wrong place. Selling final expense is “easy”, learning how to sell it at a scale that is profitable and provides you the financial freedom you are seeking is the part that takes the blood, sweat, and tears!

Can you get final expense insurance training online?

Absolutely. I would suggest working with Jim Mall’s program, 1 and Done. Jim Mall is a final expense pioneer and his selling method is exactly what I learned and still use to this day when I’m out selling. It’s a methodical process that will give you every piece of information you need to take a stack of leads and start earning a living. If you memorize his stuff and put it to practice in the field, your results will amaze you.

What does “advanced” commissions mean?

This means the insurance company will pay you in advance for future premiums your client will pay. For example, if you sell a $1200 per year policy and are set up to receive a 9 month advance (75%), you will be paid $100 / month for nine months upfront for a total of $900. Upon the 10th month, you’ll begin getting $100 for the remaining of the first policy year.

What are “as earned” commissions?

As earned commissions are the safest way to go, but take the longest to build sustainable cash flow.

Using the example above of a policy that costs $100 per month, you are paid your commission each month your customer pays their insurance premium bill.

My suggestion is to take your contracts using a blend of advanced and as earned commissions to balance out your cancellation risk.

What is a chargeback?

If you’re client cancels before those 9 months of premium have been paid, you’re 9 month advanced commissions will become a chargeback that you will need to pay back to the insurance company. Each company has different chargeback rules, so make sure you’re paying attention to the fine print in your contract with the final expense company.

What is a release?

A release is a written authorization from another upline organization allowing a contracted agent to move their contract to another wholesaler or agency.

This is why I always urge agents to do their homework before choosing an agency or FMO to work under. You should have a clear understanding of any potential restrictions you might experience.

Some places have an open release policy which makes a lot of agents feel good and some don’t. Those that do not usually have some type of proprietary process that takes time and money to activate a new producer. In that case, getting a release is tough because they want to recoup their time and money for training and support.

How do I switch to a new FMO?

First, you need to determine if you need a release. Most of the time the rule is that you don’t need a release if you haven’t written business with a specific final expense company for 6 months. In those instances, you can likely recontract with any upline or FMO or your choice.

If you have written business within 6 months, you’ll need to get a signed release from your previous FMO.

Can I switch FMOs to get higher commissions?

In short, yes, but it’s extremely frowned upon and many final expense companies do their best to keep that from happening. What you’ll find when you trying to switch is the insurance companies can make you wait anywhere from 6 to 12 months before your new FMO can increase your commission level.

Make sure you understand the rules before you decide to jump ship over a few bucks…another reason you need to shop around before making your decision.

Don’t say I didn’t warn you! 🙂

Do agents really door knock?

Heck yeah we do!

Door knocking is an integral part of your sales prospecting process and a core element in nearly every top field agent selling in the final expense market.

Don’t let anyone fool you, door knocking is still a very effective part of the prospecting process, especially in final expense field sales.

What does LOA mean?

LOA means licensed only agent.

If you are on an LOA contract, that means all of your commissions and future commissions are paid to your agency who then pays you.

This is the typical setup in a captive setting. Most of the time independent agents will be paid directly by the insurance company and not from their agency or upline.

If you’re considering a captive arrangement that requires LOA contracts, you should closely understand your vesting schedule for your future renewals.

Final Expense Sales Process At a Glance

Don’t let an easy sales process make you think it’s an easy business.

Final expense sales can and is often mentally exhausting when you don’t stay focused. Here is a condensed version of everything we discussed in this article

- Get contracted

- Buy leads EVERY WEEK. You ultimately should expect to be spending around $1,000 per week on your expenses and the majority of that cost will be leads.

- Master a consistent final expense sales presentation for face-to-face sales and telesales.

- Set a goal of having 15-20 sit down presentations every week

- Be courteous and patient

- Exercise caution when writing direct express or credit card business (it rarely sticks on the books and will cost you a lot of money in charge backs)

- Understand your insurance company point of sale interview process

- Track your commissions to ensure the carriers are paying you correctly

Conclusion

Learning to sell final expense insurance is not that hard, you just need to dedicate the time to become an expert.

Final expense insurance sales is one of the fastest growing sales models available and the market continues to grow. Below is a recap of what our team believes are the keys to learning how to be successful selling final expense insurance:

- Stay focused and don’t get distracted.

- Don’t reinvent the wheel; there are too many people willing to help you replicate their system.

- Interview and find a final expense FMO that fits your needs… be selfish and patient.

- Understand the various final expense leads available.

- Create a sales and marketing plan to work your leads.

- Commit to training and become an expert. Remember to use your script to not only know what you say, but why you’re saying it.

- Don’t get greedy. If you take your time and plan out this business, you should never have any issues getting the commission levels you deserve.

Get comfortable with a sales model, find a mentor and absorb everything you can. If you’re not happy, change it.

If you’re fired up, keep attacking!

Put yourself in the best position to succeed and lean on those that are willing to help you.

We would love the opportunity to partner with you, contact us today to learn more.

Want to sell your final expense agency?