Selling annuities is not as easy as falling off a log, but it’s not as bad as you think if you dedicate the time and discipline to learn the right way to do it.

Getting a client to understand the role of annuities in their overall plan is just as hard for a fixed agent as it is for the registered rep. An annuity sale takes time to uncover all external factors which impact the client’s decision and this is not a line of business for those who think they are “good at sales”. It’s for those who are exceptional at education and delivering elite customer service.

There is a lot of great information listed in this guide, feel free to reach out to us if you have any questions at all. We’ll continue to update this resource, so we always suggest bookmarking it for future reference.

Table of Contents

Click the section that’s important to you and use the easy “back to top” in each section to browse this guide.

- Current Annuity News

- Getting Licensed to Sell Annuities

- Annuity Commissions

- How to Sell Annuities

- Annuity Basics and Sales Scenarios

- Top Annuity Companies

- Frequently Asked Questions

We work with two types of life insurance agents

- Experienced life insurance agents.

- Life insurance agents that are new to selling annuities.

Experienced Life Insurance Agents: You are an advanced and educated insurance agent / agency owner that consistently pushes the envelope to learn more and utilize our back office as leverage for your time.

We share strategies with you on new and emerging insurance products, allocations, tax strategies, and general case management so you can stay focused in the field with your clients.

Our relationship is strong and we respect each other’s role in the business and work together as a team to better support your client.

Life Insurance Agents new to Annuities: You are likely new to selling annuities or maybe have had some level of success already, but looking to keep up your momentum.

You are looking for someone you can actually talk to and help you understand how annuities work. You’re looking for someone to help mentor you and point you in the right direction for strong training and support.

Sometimes you’re already contracted and your upline just doesn’t feel right and you’re looking for someone who can simply talk to you like a normal person.

You are looking to build a long-term sustainable business relationship with someone you can trust and feel comfortable asking questions.

The common denominator between the two is working with those of you who strongly value RELATIONSHIPS.

Stay Up to Date with Current Annuity Rates for Your Customers!

-

- FIA Accumulation Highlights: Review premium requirements, fixed rates, withdrawals and more!

- Income Rider Highlights: Access up to date issue ages, rider growth rates, rider fees and more!

- MYGA Highlights: Stay up to speed with rate guarantee periods, max issue ages, current rates and more!

- Fixed Annuity Highlights: Inform your customers on current yields, first year bonus rates, minimum premiums and more!

How to sell annuities?

Selling annuities is not for the faint of heart. It’s not for the great salesman. It’s not for those who think they can make the sale and never go back to their client.

This business is about relationships and if you’re not hard-wired to build and maintain relationships, then you shouldn’t consider making annuities a priority in your business.

Five basic steps to learning how to sell annuities:

- Get licensed to sell annuities

- Learn annuity basics

- Learn how to fact find

- Improve your ability to problem solve

- Build relationships

- Service your customers

Understand the mindset

The only area of focus should be the objectives of your clients and prospects, life insurance agents that naturally possess that mind set are always the ones that experience the most success selling annuities. Sounds simple, but you would be surprised.

Below are some considerations we feel compelled to share with you, considerations that you will learn over time to wildly appreciate.

- Appreciate the power of using a fixed indexed annuity (FIA) as an accumulation strategy when the scenario makes sense for your client. Guarantees are certainly the priority for locking in future payments and retirement income, but sometimes accumulation potential is just as important to your clients as they transition from an accumulation mindset to a preservation mindset in retirement. It’s not a one size fits all.

- Utilizing FIA with an immediate income capability vs. assuming it’s only a solution for a SPIA.

- Have an open mind to understand how to leverage capped products vs. uncapped with participation rates.

- FIA with an income rider is not the same as a SPIA!

Clearly there are a lot of scenarios we could discuss, but the point here is that we are looking to help agents that have an open mind to learning new things and offering educational concepts to their clientele.

Selling fixed annuities is not about the product or the money… it’s about your clients and their needs for customized solutions.

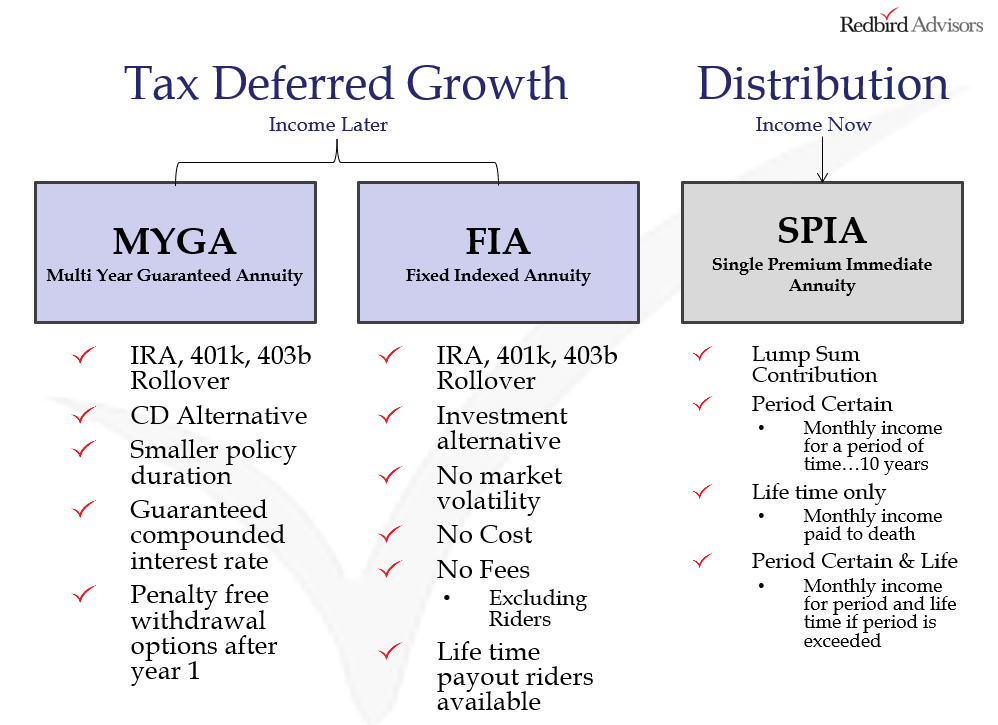

What are the different types of annuities?

There are 3 common types of annuities that life insurance agents sell.

- Fixed Indexed Annuities (FIA)

- Single Premium Immediate Annuities (SPIA)

- Multi Year Guaranteed Annuities (MYGA)

Each type fills it’s own specific solution based on the retirement income needs of your clients and prospects.

Factfinding Tips for Selling Annuities

The fact finding process of selling annuities is one of the toughest parts for new agents to learn. It’s important to understand your client’s objectives and you can’t do that unless you’re a seasoned listener.

As with any type of sales, there is always psychology involved. One of the things I learned when I first started in the business was the psychology of attraction. This was a concept that was hammered into us during training and came directly from the Al Granum book.

The idea is when you’re in a meeting and the fact finding process starts, your main objective is getting to a place of trust as soon as possible. People want to do business with people they like and trust. If I remember right, there were 3 or 4 principles to follow, the most important being listening.

If you’re a good listener, you’ll uncover the true needs of your clients and position yourself to start problem solving for them.

Here are some tips during your fact finding process:

- Make sure you understand how annuities work, current interest rates, how surrender charges work, annuity payment options, and other faqs commonly asked during annuity discussions. Unless you’re securities licensed and registered with FINRA, you cannot market your services as financial planning as fixed and indexed annuities are insurance products. Agent’s falsifying as financial planners is a common problem in the insurance industry, make sure you are working within all your compliance guidelines.

- Be a good listener

- Always set expectations on the first appointment

- Never discuss performance in the first appointment

- Ask questions and listen

- Listen again, and keep listening

- Use a structured fact finder to take notes

- Never leave your first appointment without setting your second appointment

Best questions to ask

Based on what your prospect is telling you, you should develop a list of questions that help keep your discussion specific to them.

- Open ended questions

- Emotional questions

Using these types of questions will connect you deeper to your prospect and build on the trust that you established. And, understanding how to ask good questions is a major differentiating point between good and great annuity agents.

Annuities 101

Here are some critical facts you should know about annuities to help you better educate your clients.

Facts about fixed annuities every consumer should know

- Safe alternatives without market risk compared to mutual funds, stocks, etc.

- Tax deferred growth and/or distribution of retirement savings (not a stock market investment, security or an indexed mutual fund).

- Purchasing “Options” protect funds from loss in market is how customers have downside protection with upside potential. More about this below.

- Minimum interest guarantees and multiple crediting methods for growth.

- Annual ratchet & reset for steady, safe, growth (upside potential with downside protection).

- No loss of initial or future contributions, and bonus options.

- Lifetime income complies with required minimum distribution (RMD) guidelines.

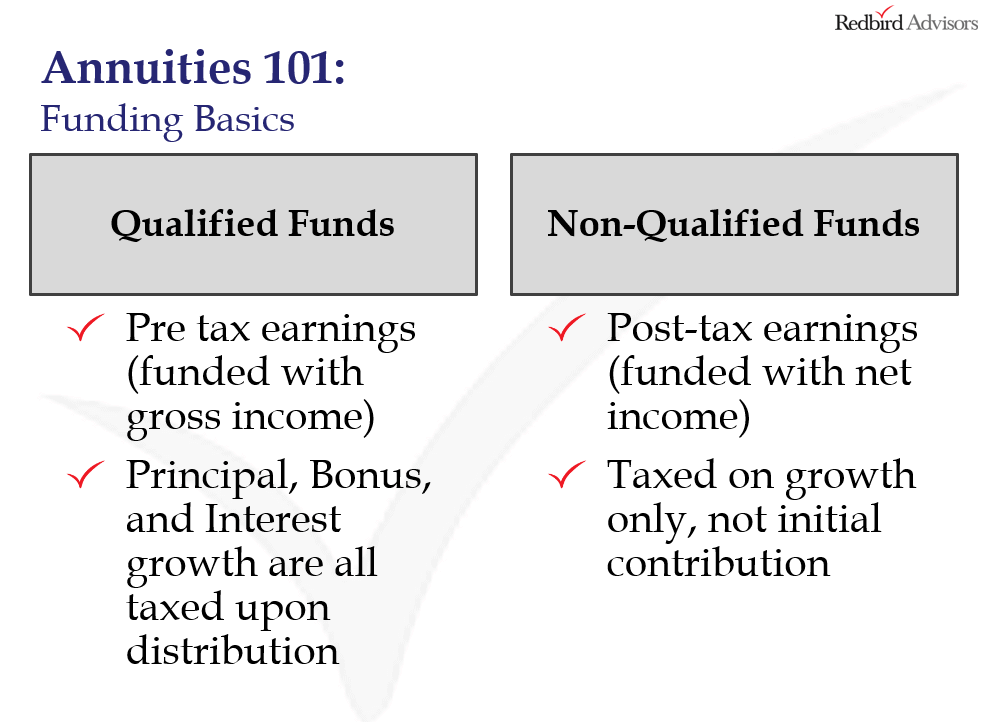

Difference Between Qualified funds vs. Non-Qualified funds

Best question to ask when selling annuities

One of the best ways I have learned to educate clients on annuities is by asking one simple question.

“Mr. and Mrs. Client, what is most important to you, income now or income later?”

The reason this question is so important during the factfinding process is because it gives you a starting point for case design when you are finished with your first annuity sales appointment. And, it will help you understand if illustrating an immediate annuity, deferred annuity, or both makes sense based on your client’s needs.

Understanding your client’s objective of income now or income later is directly correlated to the two common types of annuities.

Income / Immediate Annuities (Income Now)

Annuities designed for distribution are either going to be single premium immediate annuities or fixed indexed annuities with an income rider.

Here’s how the scenario will play out.

You: “What is most important to you, income now or income later?”

Client: “Income now”

You: “Okay, when you say income now, are you referring to income in the next 30-60 days or more along the lines of income in the next year or so?”

Based on how your client answers that question will determine the types of annuities you will want to illustrate for your second appointment.

If they need income in the next 12 months, you’ll likely just work with them on a single premium immediate annuity. It will allow you to take a lump sum and turn it into an income stream virtually immediately.

Growth / Accumulation Annuities (Income Later)

If your client will not need the income for at least one year, consider some type of fixed indexed annuity that offers a lifetime income rider.

Using a lifetime income rider will give your client additional options for taking income vs. having to annuitize like they would with a single premium immediate annuity.

Below is another way to visualize the concept of income now vs. income later.

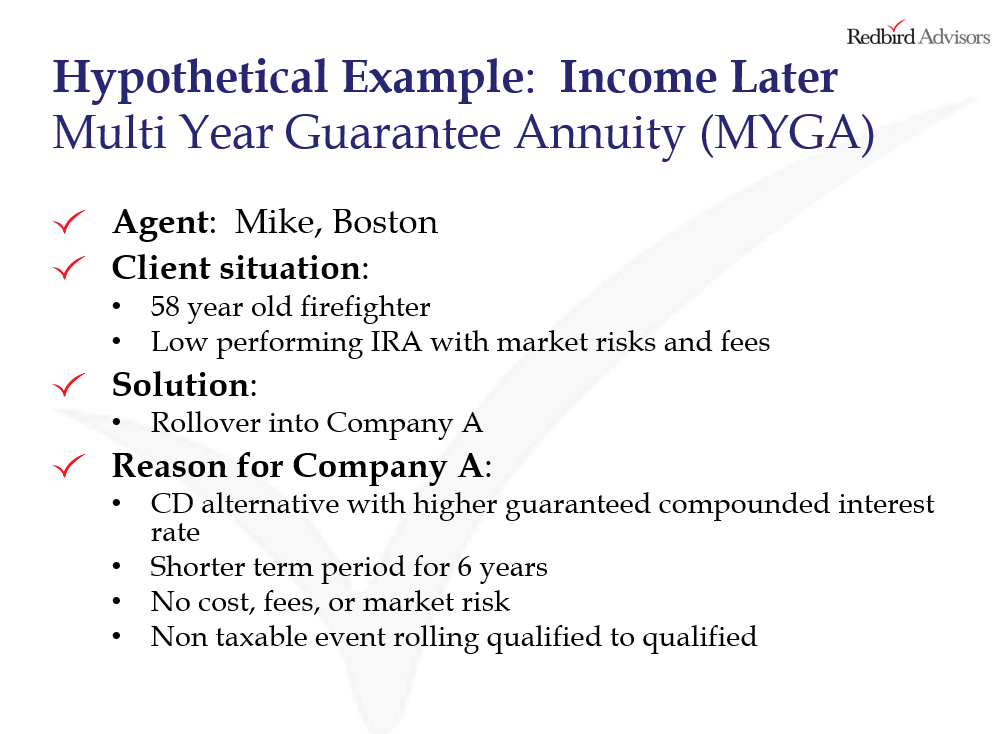

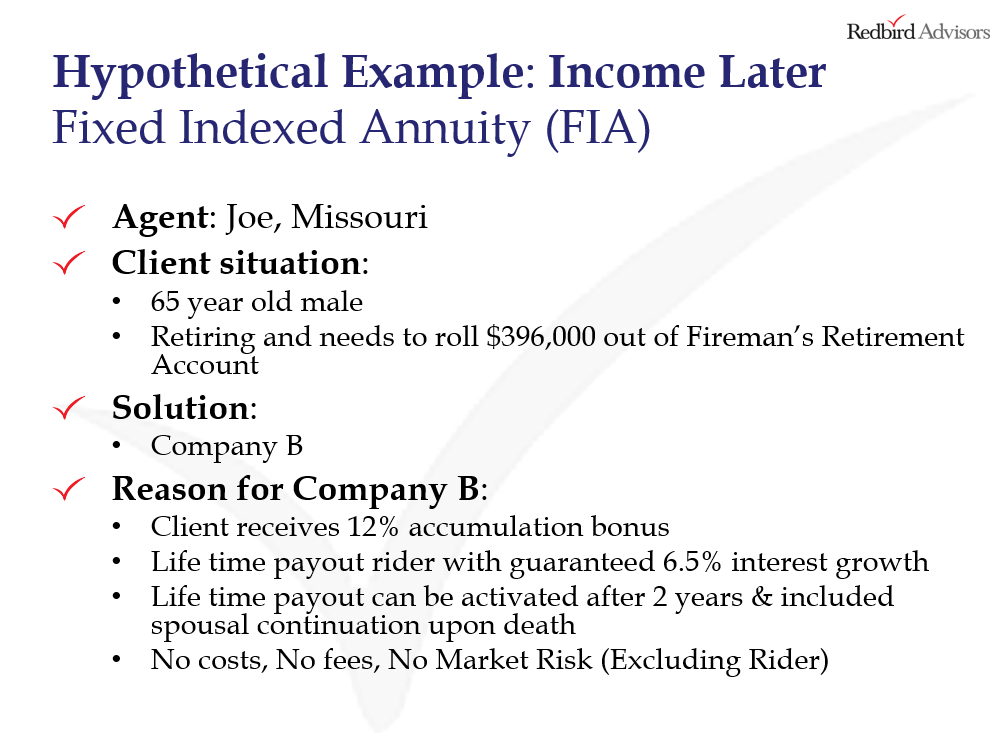

Below are some annuity sales scenarios that illustrate the “income later” annuity sales concepts.

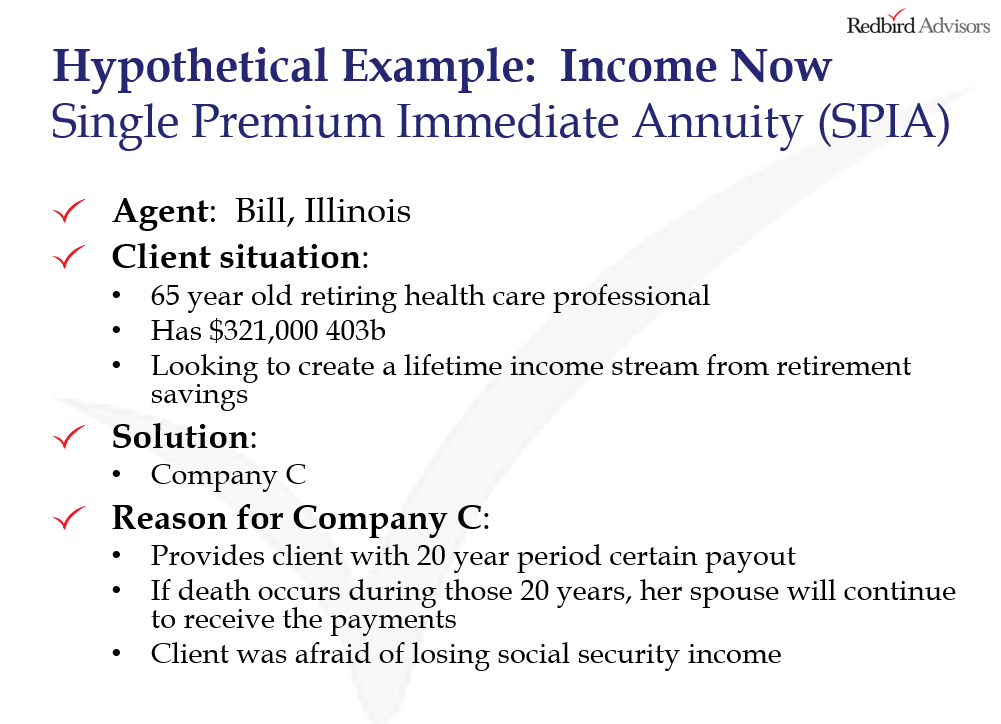

Now, lets take a look at the “income now” annuity scenario.

Now, lets take a look at the “income now” annuity scenario.

We looked at a hypothetical healthcare professional who was retiring soon and needed to turn his savings into an income stream to supplement his social security each month.

Stay Up to Date with Current Annuity Rates for Your Customers!

-

- FIA Accumulation Highlights: Review premium requirements, fixed rates, withdrawals and more!

- Income Rider Highlights: Access up to date issue ages, rider growth rates, rider fees and more!

- MYGA Highlights: Stay up to speed with rate guarantee periods, max issue ages, current rates and more!

- Fixed Annuity Highlights: Inform your customers on current yields, first year bonus rates, minimum premiums and more!

Top Annuity Companies

Below is a list of annuity companies we’re currently seeing strong production from, but these can certainly change.

FIA

- Allianz: 222 and 360

- North American: Benefit Solutions 10

- Athene: Agility 10, Ascend Pro 10, & Performance Elite

- Lincoln: OptiBlend Series

- Global Atlantic: Choice Accumulation

SPIA

- North American

- Nationwide

- Global Atlantic

MYGA

- F&G

MYGA markets aren’t great right now, so we’re suggesting advisors consider looking at 5 year FIA as alternatives.

One you have a better idea of what your client needs, you’ll need to make sure and start pivoting to different annuity companies and products to ensure you’re best serving your client’s needs.

Below is a list of the annuity products we can help you get contracted with.

Annuity Companies |

|

|

|

|---|---|---|---|

| AIG | |||

| AIG Partners Group | |||

| American Equity | |||

| American National | |||

| Assurity Life Insurance Company | |||

| Athene | |||

| Columbus Life | |||

| Fidelity & Guarantee | |||

| Global Atlantic | |||

| Great American | |||

| Life of the Southwest | |||

| Lincoln Financial Group | |||

| Nationwide | |||

| North American | |||

| Oxford Life Insurance Company | |||

| Principal | |||

| Protective | |||

| Prudential | |||

| Royal Neighbors of America | |||

| Sagicor | |||

| Sentinel | |||

| Symmetra | |||

| The Standard |

Get Contracted to Sell Annuities

How do I get a license for annuity sales?

License requirements to sell annuities can vary.

License requirements to sell fixed annuities

You need a life license in any state you plan on selling in.

Once you’re properly life licensed you will then need to complete the product certifications from the annuity companies you represent, and any state-required courses.

Here is a great resource to start the process of getting licensed to sell annuities.

How much do agents make selling annuities?

Annuity commissions vary based on the different types of annuities, so it’s hard to actually pinpoint exactly how much you can make selling annuities unless we know exactly what you’re selling.

Below and some of the common commission levels based on some of the most common annuity products. Also, always make sure and check your contracts for updated compensation details and commissions.

Fixed Indexed Annuity Commissions

Fixed indexed annuity contracts are typically going to pay the highest agent commissions.

It’s important to note that fixed indexed annuity commissions are not paid from the customer’s account. FIA commissions are paid from the insurance company. This is a misconception from many clients that the commissions are deducted from the balance of their annuity. That is not the case.

Street Level FIA Commission

The average street level commission for fixed indexed annuities is 4%-7%.

For example, if you’re client rolls over their $250,000 orphaned 401K from an old employer into a fixed indexed annuity, the commission could be anywhere from $10,000 – $15,000.

Based on the annuity commissions explained above, if you wrote $4 million in fixed indexed annuities this year, you could expect to earn $160,000 – $280,000 in commissions.

That’s only 16 annuity sales for the year, you would be surprised how attainable that is if you’re focusing on asking the right questions during your fact finding sessions.

Multi Year Guaranteed Annuity Commissions

Multi year guaranteed annuities (MYGA) are a great alternative to CD’s. Think about it, “multi year guaranteed annuity”. That means that your clients can put their money into an annuity for multiple years with a guaranteed rate of return.

For example, your client has $100,000 in a CD at the bank earning 2.62%. (national 5 year CD average from Bankrate as of May 2018) They can move it to a multi-year guaranteed annuity (MYGA) which can yield a 25% higher growth compared to the traditional accounts in a banking institution.

Do you think it makes sense to educate your clients on how they can increase their guaranteed returns by 25%?

Street Level MYGA Commissions

Average MYGA annuity commissions are 1.5%-2.5%.

Single Premium Immediate Annuity Commissions

SPIA is the type of annuity that is used when your client wants to take a lump sum of money and immediately turn it into an income stream they will not outlive.

For example, your client has $300,000 in a 403B from a career in education and is ready to retire and turn on a lifetime income stream. They simply roll the money into the SPIA, and the income begins paying out immediately.

Street Level SPIA Commissions

Average SPIA commissions are .5%-3%.

Note that SPIA annuity commissions can vary based on the settlement option selected (annuitization method). For example, life only payout vs. 10 year period certain.

Stay Up to Date with Current Annuity Rates for Your Customers!

-

- FIA Accumulation Highlights: Review premium requirements, fixed rates, withdrawals and more!

- Income Rider Highlights: Access up to date issue ages, rider growth rates, rider fees and more!

- MYGA Highlights: Stay up to speed with rate guarantee periods, max issue ages, current rates and more!

- Fixed Annuity Highlights: Inform your customers on current yields, first year bonus rates, minimum premiums and more!

Frequently Asked Questions: Selling Annuities

How to sell annuities online?

This is a growing trend as more and more consumers are comfortable making purchases online, especially the younger demographics.

Below are the 6 simple steps to selling annuities online.

- Make sure you are well educated before you start selling annuities. As I mentioned earlier in this guide, you need to be an expert. Study the market, new products, how they provide solutions to your clients and be prepared to properly educate your clients. Check out our write up on how to not suck at selling insurance, you might find some great tips.

- Selling annuities takes natural ability to problem solve. Treat you clients scenario as a problem you need to solve. This mindset will help you walk them through the various options which are suitable for their situation. Doing this will strengthen your credibility.

- Know your competition. Whether it’s another annuity company, a bank, or an investment account, you need to understand your competition so you can properly educate on the strengths of the products you are proposing.

- Ask questions. Make sure you are asking thoughtful questions so your clients have the opportunity to begin thinking through all the scenario. Doing this will allow you to listen when your clients tell you exactly what they want or need.

- Propose strong solutions. Once you have completed your factfinding you can then begin pulling together annuity illustrations to present. A great software to use when selling annuities online is Zoom. Zoom is a great cloud based communications platform that doesn’t require any special downloads or accounts. It’s extremely easy for your clients to use.

- Close the annuity sale and service your client. After the sales process is completed, you can process your application and start servicing your new annuity client for years to come.

What is an annuitant?

An annuitant is the individual or entity listed on the annuity policy that will receive the funds.

Can a corporation be an annuitant?

No, the annuitant must be an individual as the benefits are based off a natural person.

What are required minimum distributions?

Required minimum distributions (RMDs) are required withdrawals from qualified retirement accounts that must occur when the account holder reaches the age of 70½.

For example, your client has a $500,000 IRA and they have never withdrawn any money. Once they hit their 70½ birthday they will be required to start pulling out a percentage of those funds and paying taxes at their current tax rate.

How are required minimum distributions calculated?

RMDs are calculated using a divisor of the balance in the account.

For example, your client has a $500,000 annuity when they turn 71. They would check the current RMD distribution period chart and divide their balance as of Dec 31st of the prior year by the distribution period of their current age.

$500,000 / 26.5 = $18,867.92 Taxable RMD

Can you aggregate RMD from multiple retirement accounts?

Yes, this can be a great way to maximize tax liability and growth within annuities.

This is another reason why it’s so important to fact find correctly when you sell an annuity. You need to understand your clients overall portfolio to best help them manage their distributions down the road.

What does “period certain” mean?

Period certain is a guaranteed time frame an annuity will offer an income stream.

For example, if your client purchased a 10-year period certain immediate annuity for $100,000, they would have 10 years of guaranteed income. If they passed away within the 10 years, their estate would continue to get the income stream until the 10 year period, but not beyond.

However, if the account holder lives past 10 years, the income would continue.

What does “life only” mean for single premium immediate annuities?

Life only payout is a payout option available when annuitizing an annuity, and it’s the typically the payout method which produces the highest level of income.

But, there is a caveat.

The additional risk associated with life only payout is that if the annuitant passes away at any time, the insurance company keeps the remaining funds.

For example, your client turns on a life only income stream from their $400,000 annuity. This pays them $5,000 / month for life. If they pass away in month two, the remainder of the 395,000 goes to the insurance company and not the policyholder’s estate.

Why would you choose life only?

Life only payout is a popular option in wealth transfer scenarios where the income is used to fund a life insurance policy. In that instance, it’s okay if the insurance company takes the remaining funds of the annuity because the beneficiaries receive the proceeds of the life insurance policy tax free.

Another reason and sometimes more common reason people choose life only payout would be if they do not have any family or institution to leave money behind. In these scenarios, the highest income is usually the driving factor for choosing this type of payout solution.

Do I need a securities license to sell fixed & indexed annuities?

As of November 2019, you do not need a securities license to sell fixed or indexed annuities at this time.

How long does it take for a company to transfer funds to an annuity company?

This is a loaded question.

Some companies are very quick and will execute a transfer assuming the agent and client have submitted all the correct forms.

Some companies will drag their feet, giving the internal sales reps a chance to retain the funds.

It’s important that you educate your client on the benefits of an annuity so they aren’t caught off guard during the transfer process with their original company.

How do annuities offer upside potential with downside protection?

This is one of the most common questions clients ask. And, they always say it’s too good to be true.

Yes, indexed annuities can take advantage of market gains with protection from downside market losses. The only two products that offer this type of protection are indexed annuities and indexed life insurance.

This is how it works.

Crediting Market Gains

Insurance companies purchase options for a specific index such as the S&P 500, S&P 500 5% Risk Control TR, Morningstar Dividend Yield Focus Target Volatility 5, and many others with various crediting strategies.

If the index has a positive return, the insurance company executes its options and credits the client their gains according to the crediting strategy selected.

The client’s fund are never directly invested in the market.

Market Loss

If index has a negative return , the options expire and the balance remains locked in until the next positive year.

What happens if the primary annuitant passes away during the surrender period of a fixed indexed annuity?

If the primary annuitant passes away during the surrender period of a fixed indexed annuity, the primary beneficiary commonly has the following options.

- Take the lump sum of the accumulation penalty free and roll it into another product.

- Keep the policy intact and continue to let it perform (this can change based on whether the beneficiary is a spouse or non-spouse).

What is the difference between the accumulation side and the income rider side of an annuity illustration?

Accumulation side of an annuity is the amount of funds available to the policyholder through cash surrender or withdrawals.

The income rider side is simply illustrated to show a guaranteed level of growth that can only be used if the policyholder turns on the income rider.

Can the income rider side of an annuity be surrendered for cash?

No, the income rider side of an annuity illustration is only used when the income rider is turned on.

In some scenarios annuity companies will offer enhanced death benefits which allows the option of a lump sum of the current accumulation value upon death or the income rider payable over a period of time.

As a rule of thumb, income rider values are only used to calculate income benefits and are not associated with contract or surrender values. Always check your annuity company specs to verify.

What is a structured settlement?

This is the process where an annuity policy holder sells their annuity payment and works with a judge to determine that the sale of the annuity will protect the financial needs of the policy holder and their family. Upon court approval, this usually results in applying a discount rate and purchasing the entire annuity with a lump sum payment or a series of future annuity payments or periodic payments based on the agreement.

Structured settlement payments are determined by the present value of the annuity contract (value of your annuity) and then translated to the lump sum of cash (amount of money) or monthly payments an annuity owner will receive.

Why do people do structured settlements?

There are a number of reasons annuity owners sell their annuity payments.

- Outstanding medical bills as medical expenses are one of the driving factors for bankruptcy.

- It allows for immediate cash while still maintaining their financial goals.

- They want to use the funds for a down payment for a new home.

- Short term cash needs.

- Credit card debt.

- Additional income due to personal injury.

Do you have strong reasoning skills?

Fixed Annuities force you to consider a great many more issues than life insurance. It’s like the difference between checkers and chess. Sometimes with annuities the obvious answers are the worst answers. You have to guard against jumping to conclusions. Every case requires a high attention to detail and strong reasoning skills, especially to ensure you’re offering a suitable solution. This means, does the product make sense for your client’s situation? You absolutely have to nail the details!

Prospecting for annuity clients takes knowing how to be a problem solver.

**I followed a mental toughness training platform that transformed the way I think. The book is free and the course is nominal, you should definitely check it out here!

Are you skilled at asking the right fact finding questions?

“Of course I am” most agents will tell you. So many agents—and I mean SO many—ask leading questions.

They already have an answer in mind and their questions reflect that bias. Our industry has herded agents toward this product-first mentality that is harmful to clients no matter what product is up for discussion.

Learning how to market annuities is more than just a marketing plan, it’s a mentality.

Which of the following two questions would you choose to ask in a retirement planning discussion with a client?

a. “Would you be interested in a product with no cost, no fees and no market risk?”, or

b. “Which type of product would you choose: one with higher risk and a higher return, or one with lower risk and a lower return?”

Which one gives you the best chance of learning what’s really important to a client?

The more you can engage your prospect with thoughtful questions focused on their needs instead of your sales goals, the better chance you have of developing strong rapport and relationships.

And, the better chance you have to sell fixed annuities.

Are you a talker or a listener?

Annuity specialists and financial advisors are master detectives… they know the right questions (see #2 above) and they listen, not just for the answer but how the answer was given.

They read the room. Is the person nervous? Are they unsure? Are they scared? Are they not on the same page with their spouse? Are they telling the truth?

They listen.

You have two ears and one mouth… you should listen twice as much as you speak.

What is your style and, more importantly, what style do you enjoy?

We have an agent who prefers selling final expense because he says he doesn’t have the patience for the longer sales cycle which many annuities require. And, he’s a talker… make it quick and get on to the next prospect. He has made a wise decision to start selling fixed annuities.

Before you jump into selling fixed annuities do some serious self-analysis to ensure it is the chase for you.

Do you have a solid work life balance in your insurance agency?

This has nothing to do with annuities, but everything to do with running a successful insurance agency and being organized in your life. Is this you (I found this in a great post on Lifehack)?

- Your mail sits unopened for a week and you pay your bills late

- You think the more plates you have spinning the more you will have it all

- You keep declining invitations from friends

- You forget appointments and blow off commitments (like working out, eating healthy)

- You don’t care if you’re on track with your plan

- You can’t remember what’s in your plan

- You don’t answer your phone or you’re always on the phone

- You’re on a hamster wheel and can’t get off. If you don’t get this fixed it ultimately won’t matter what you choose to sell.

Are you willing to put in the time?

Being great at selling annuities won’t happen because you aced the annuity section on your life insurance exam. Compliance is always changing and it’s vital you commit to the ongoing continuing education associated with annuities. Moreover, new products and options pop up all the time and clients are being bombarded with so many options.

You have to stay current on annuity product training and suitability training.

You can use sources like WebCE and others to sign up for the most current annuity courses as well as access from all the carriers. Remember what I said up front: selling annuities IS NOT as easy as falling off a log.

Are you right for fixed annuities?

This story isn’t about whether selling fixed annuities are right for you… it’s whether you’re right to begin marketing and selling fixed annuities.

Do you get irritated on a life case when you’re having the third conversation (“why can’t they make up their mind… this is a no brainer”)? Selling fixed annuities is a marathon compared to the sprint that can sometimes be life insurance.

An annuity isn’t an expense for the client, it’s a major financial decision. It’s real money they are putting away and, short of a disaster, agreeing to not touch for a long time.

Fixed annuities demand a very broad understanding of a client’s financial situation. While they aren’t registered securities, the questions you must ask to get to the right answer for the client will be eerily similar to those asked by your registered rep friends.

Most of all, selling annuities requires patience.

Now that we have done our best to help you think through if annuity sales are for you, it’s time to dive into what you should know when learning how to sell annuities.

Conclusion

Just when you think you can’t take any more waffling by the client, there’s more to take.

One of our agents uses seminars for selling annuities and went more than four months before one of her leads finally converted.

She practiced patience and ended the year with just over $2M in annuity sales. Not bad for a beginner!

Then the flood gates opened and she was prepared like a seasoned vet. She asked herself these questions , studied annuity case studies, and put herself in the best possible position to serve her clients.

Every new line of business has a learning curve, some are just a little more detailed than others. Make training and education a priority. Make sure it’s right for you.

We have a great team of insurance and financial producers who are ready to guide you in your journey to selling fixed annuities.

Stay Up to Date with Current Annuity Rates for Your Customers!

-

- FIA Accumulation Highlights: Review premium requirements, fixed rates, withdrawals and more!

- Income Rider Highlights: Access up to date issue ages, rider growth rates, rider fees and more!

- MYGA Highlights: Stay up to speed with rate guarantee periods, max issue ages, current rates and more!

- Fixed Annuity Highlights: Inform your customers on current yields, first year bonus rates, minimum premiums and more!

Discloser: Redbird Advisors is not a securities licensed entity and does not provide investment advice or solicit financial products such as variable annuities. Redbird does not sell variable annuities. Investment advice or questions should be directed to a securities licensed investment advisor.