The “1,2,3,4,5 method” of presenting hospital indemnity insurance will change your life, I promise! If it doesn’t, it’s because you don’t want to cross sell and make more money! 🙂

First, I need to rant a little bit to help provide with some perspective from my personal experience on this topic.

Presenting hospital indemnity with every Medical insurance sale is a choice every agent has and most choose not to.

Hospital confinement and the associated unexpected expenses is one of the largest financial risks to individuals and their family members utilizing Medicare health benefits such as Medicare Advantage plans, plans through the affordable care act, limited benefit and short term plans, and any other miscellaneous medical insurance plans providing essential coverage.

What does this mean? It means everyone with health insurance has the right to know that solutions exist to help them save money on medical costs.

My personal opinion (take it for what it’s worth) is that health insurance sales should have a compliance requirement to provide education on how indemnity plans work. It’s a massive disservice to the customer and these plans need to be presented together so they know the path to reduce the financial burden of medical bills such as deductibles, coinsurance, emergency room expenses, and many other medical costs that come along with hospital admission.

Do you have to sell it to everyone?

Of course not, because eligibility hurdles exist with hospital indemnity insurance plans. However, that doesn’t mean someone shouldn’t have the right to understand how healthcare works. You need to first educate and help them understand how to mentally navigate the best solutions to keep their healthcare costs to a minimum, then you can determine if they are qualified due to pre-existing conditions or state subsidized benefits such as Medicaid.

“How can you not give 100% when it’s 100% your choice” – Jerry Rice

Table of Contents

- Why agents fall short and 1,2,3,4,5 spoiler alert.

- What is a hospital indemnity plan?

- Why hospital indemnity?

- How to make hospital indemnity easy.

- MAPD copay data findings.

- Top hospital indemnity carriers.

- The 1,2,3,4,5 Method of selling hospital indemnity.

Why do agents fall short cross selling hospital indemnity?

It’s simple.

- You self-sabotage.

- You focus on the wrong things, i.e., thinking you need to know the complete details of every pre-existing condition, every available rider and lastly, convincing yourself your clients can’t afford it, etc.

The truth is, we don’t know what we don’t know, and it haunts us. And frankly, nobody has told you it’s okay to not know everything. Guess what, it’s okay!

Sometimes we just need someone to show us a path to follow. So after a data deep dive, the result was the birth of the “1,2,3,4,5 Method”, the easiest way to present and sell hospital indemnity with every Medicare sale.

Spoiler Alert!!

The “1,2,3,4,5 Method” is a methodology that strips away all complexity for insurance agents to remember how simple hospital indemnity is to pair with Medicare Advantage plans. In a nut shell, you need ONE insurance company that offers a TWO hundred, THREE hundred, and FOUR hundred daily benefit for a total of FIVE days.

Get it? It’s as easy as counting 1,2,3,4,5!

This method will work with 80+% of the plans on the market and now you don’t have to think what to present to your customers.

Let’s take a deeper look and how we figured it out.

Ready to get contracted and use the “1,2,3,4,5 Method” for selling hospital indemnity plans?

How Hospital Indemnity Insurance Works

A hospital indemnity plan (HIP) is a supplemental health insurance plan offered by an insurance company that pays a daily cash benefit when a policy holder is admitted as inpatient to the hospital. And, it’s one of the most common supplemental coverage options for those with Medicare Advantage plans.

For example, if you go to the hospital and your copay is $300 per day for the first 7 days and you spend 4 days in the hospital, you’ll have a bill for $1200. Your hospital indemnity coverage will reimburse you for those hospital bills based on how your plan is structured. This is why supplemental insurance is so important.

HIP plans live in the ancillary category along with cancer and accident insurance.

These supplemental health insurance plans are specifically designed to correlate with the daily out-of-pocket costs on Medicare Advantage plans and according to CSG, hospital indemnity sales are projected to more than double between now and 2028.

Why is hospital indemnity insurance important to your agency?

There are three main reasons hospital indemnity is important.

Customer Experience

Everyone with health insurance deserves to know that supplemental plans exist to help them mitigate the expenses that come with hospital confinement. Most agents are scared to offer this and when you educate your prospects, you will instantly differentiate yourself and strengthen the customer experience.

Enrollment isn’t required, but education should be and your prospects will appreciate it.

Increased Retention

If you have been paying attention to the biggest players in the Medicare market, you’ll know there has recently been a 27% reduction in the lifetime value of a Medicare Advantage sale, and retention is to blame.

If we’re on the subject of using statistics and data to our advantage, remember the time-tested industry basics around more policies in a household can nearly double your retention rate.

Moral of the story here is intentional retention!

HIP plans are hand in glove with MAPD and it will always make sense to the customer when you are showing them the features and benefits.

Happy customers stay on the books longer, that’s a fact!

Increased Income

This is simple math.

If you write 200 MAPD policies per year and sell 40% of those a hospital indemnity plan, you can expect to earn an additional $20,000 per year without having any additional, travel, meetings, and most importantly, customer acquisition costs.

How to Make Cross Selling Hospital Indemnity Insurance Easy

First, let’s highlight a few key statements that everyone needs to hear so we’re all on the same page and starting from the same place as we discuss this easy way to present and cross sell hospital indemnity.

- Cross selling can and is confusing to most insurance agents, you’re not alone.

- Learning to add various product riders just adds to the confusion.

- Standardizing the presentation process is what everyone wants and is the key to sales success.

We’re going to focus on number 3 and turn this into the easiest way you can increase your revenue immediately and provide an even strong customer experience. Below is the process for how I consider adding new insurance products to my sales portfolio.

5 Step approach to cross selling various insurance products

- Understand the market

- Understand the niche

- Leverage data and statistics

- Pick a core carrier

- Standardize the sales process

The good news, I have done this work for you already and will show you exactly what I found.

Understanding this process will help you reframe and realize you don’t need to know every detail in a product brochure. Your confidence of your customers needs will outweigh your insecurity of knowing which rider to choose or which daily benefit amount that you believe someone can afford.

This is a perfect example of the power of the process, a concept that so many people in sales have talked about for so long. Let’s not reinvent the wheel! 🙂

Understand the market and niche

According to CSG, “Senior HIP products are specifically designed to fill in the gaps of Medicare Advantage products and so the target market for Senior HIP products is the Medicare Advantage market.”

Senior market targeting Medicare Advantage customers is where we focus.

If you’re a new agent, open enrollment is the perfect time to implement this as you’ll have a consistent number of prospects to speak with every week regarding their upcoming health insurance coverage changes.

Leverage Statistics

First, reviewed every single Medicare Advantage plan across the country by plan type and county. This data is publicly available on the CMS website, just search for the plan landscape file.

This is what we found.

MAPD Hospital Daily Copays

- 35% of all MAPD plans have hospital copays between $200 and $300.

- 30% have hospital copays between $300 and $350

- 19% have hospital copays between $355 and $400

- Grand Total – 84% of all MAPD plans have hospital copays between $200 and $400 per day!

Wow, we just validated our niche.

84% of all Medicare Advantage plans have a significant gap that poses a real and meaningful financial risk to policy holders should they become hospitalized.

There is a high likelihood the majority of your clients fall into this 84%.

Hospitalization Data

The most important thing we looked for was the average length of stay in a hospital.

According to the Agency for Healthcare Research and Quality, the average hospital stay is 4.5 days.

Now we’re getting closer to standardizing our presentation process. We can officially help project our customers average cost for an average hospital stay based on statistics.

Daily Hospital Copay x Average Length of Hospital Stay

However, we now need plans and pricing information to create a simple and standardized sales process that is scalable and easily implemented.

So, we relied on the CSG hospital indemnity market study.

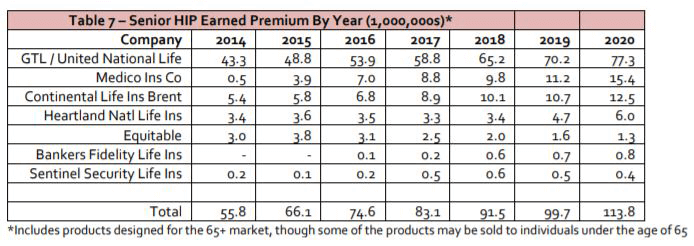

Who are the top Hospital Indemnity Insurance carriers?

- GTL – Winner Winner Chicken Dinner!

- UHC Advantage Guard – This is great plan with really strong benefits and eligibility requirements.

- Continental Life (Aetna) – I’m also a very big Aetna fan.

- Medico

- Heartland National Life

- Equitable

- Bankers Fidelity

- Sentinel Security Life

According to the CSG Hospital Indemnity Market Study, GTL is the leading carrier by more than 6.5X the second and third place contenders.

Make it easy on yourself and go with the top carrier in the market to get started, you can always choose another option down the road once you’re confident and successful with your sales process.

My first choice is GTL and that is who I would recommend you use too if you want to get off to a fast start with a financially sound company for your customers.

Would you like more training on cross selling hospital indemnity?

What is the average premium for hospital indemnity?

$474 per year is the average annual premium across the seven carriers listed above.

In staying true to the data, we are going to make our presentation model based on $474 as the benchmark.

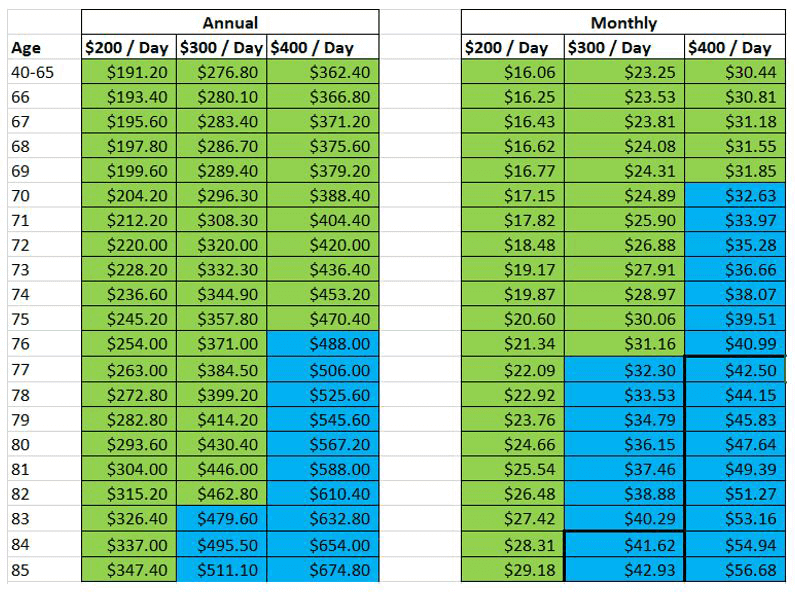

GTL Hospital Indemnity Rates

This is the last step of leveraging data and statistics before launching your sales process.

Let’s first recap the most important stats we’ve found know so far.

- 84% of all MA plans have hospital copays between $200 and $400

- 65% of all MA plans have hospital copays between $200-$350

- Average hospital stay is 4.5 days

- Average annual premium is $474

Now let’s get to what everyone is wondering, will this be affordable to your customers?

We reviewed the base benefit rates for GTL Advantage Plus Elite.

- $200, $300, and $400 daily hospital benefits (this solves for 84% of all available MAPD plans).

- 5-day benefit period (remember the average stay is 4.5 days).

- Compared each segment to the $474 national average as identified by CSG.

- Compared each segment to the common sales language of “you can spend $1 per day or less”.

GTL Rate Review

Here is what we found:

$200 daily hospital copay / 5 day hospital stay

- Annual premium is under the national average of $474 for ages 40-85 100% of the time.

- Monthly premium is less than $1 per day for ages 40-85 100% of the time.

$300 daily hospital copay / 5 day hospital stay

- Annual premium is under the national average of $474 for ages 40-85 86% of the time.

- Monthly premium is less than $1 per day for ages 40-85 57% of the time

- Monthly premium is less than $1 per day for ages 40-76 100% of the time

$400 daily hospital copay / 5 day hospital stay

- Annual premium is under the national average of $474 for ages 40-85 52% of the time.

- Monthly premium is less than $1 per day for ages 40-85 29% of the time.

- Monthly premium is less than $1 per day for ages 40-69 100% of the time

As you can see, the data is very clear and allows you to drastically simplify the process of implementing hospital indemnity into your Medicare sales process.

What is the 1,2,3,4,5 Method of Selling Hospital Indemnity?

The moment of truth!

It’s easy, just look at your hand and count to five.

1, 2, 3, 4, 5!

That’s it and here is what it means.

- Choose one of your favorite hospital indemnity companies. Yes, you really only need one carrier and show a comparison chart with the following options.

- $200 per day

- $300 per day

- $400 per day

- 5 day benefit.

Based on the data, using this one standardized offer will work with 84% of all plans in the country, drastically simplifying your life and making implementation of hospital indemnity into your sales process incredibly simple.

Why? Statistics don’t lie, use them to your advantage.

Knowing that 84% of all MAPD plans have hospital copays between $200, $300 and $400 and the average hospital stay is 4.5 days, you no longer have an excuse to not do this because it eliminates your need to have to “figure” out what to present when you’re at the kitchen table.

Ready to transform your sales by using the 1,2,3,4,5 Method for selling hospital indemnity?

Conclusion

Cross selling hospital indemnity isn’t trendy, it’s a vital component to delivering an exceptional customer experience.

- 84% of all MAPD plans in 2022 have hospital copays between $200 and $400.

- The average hospital stay is 4.5 days.

- The average cost for hospital indemnity plan is $474.

Using the data to drive your discussions not only simplifies your process but also helps you build credibility with your customers. When you know the data, and more importantly, know how to communicate the data to your customers, you help strengthen their confidence in choosing you as their agent.

Keep things simple.

Use one default offer as your starting point to present hospital indemnity and you can add the bells and whistles once you’re comfortable with the process and have made it a habit in your presentations.

Give this a try and let us know how it works for you!