Featured Book Recommendation!

Dear Medicare Agent, you’re making a huge mistake if you don’t have a copy of Brandon Clay’s 6 Hours to 6 Figures book.

Welcome to the 2024 edition of the Ultimate Guide to Selling Medicare! My name is Drew Gurley and I’ll be your host for today. 🙂 Get prepared, this is a long article that you can either read in full, or skip to the areas that are most important to you.

Introduction

Selling Medicare insurance (Med Supps or Medicare Advantage plans) is one of the great insurance sales jobs, even in the pandemic, and most importantly post pandemic. Times have changed, consumers habits have changed, technology has adapted, and agents are faced with evolving. The good news is, consumers needs to be served has not changed, so your success in this business sits firmly on the foundation of delivering an exceptional customer experience.

I say this with confidence because I have done it myself and continue to offer this type of health coverage in my agency.

In fact, I started in the senior market selling Medicare products and transitioned to cross selling other lines of business such as Medicare Advantage plans and ancillary health coverage such as dental, vision, cancer, and hospital indemnity products.

The main reason I wrote this guide is to show you our team is dedicated to going above and beyond to ensure we always provide you with deep details that will help you move forward.

We love to work with experienced agencies as well as entry level sales agents who believe in being part of a great team, but we can’t do that if we don’t have a way to get connected. If you’re reading this, you’ve found us because you’re searching for something related to sales support around Medicare.

Consider this our first introduction to each other. It’s nice to virtually meet you! 🙂

If you’re happy with what’s we’ve written for you, and interested in learning more about building your agency, we would love for you to schedule a time to connect with us.

If you haven’t completed your insurance license yet and looking for detailed information on how to get started, please start here first.

Do You Want to Learn The Specific Steps to Building a Six-Figure Residual in the Medicare Business?

Why sell Medicare?

I strongly believe every insurance agent needs a base of residual income in order to create long term sustainability. In this instance we’ll talk about Medicare insurance sales as that residual income source for you.

Selling Medicare can steadily help you build a six-figure residual income in as little as 3-4 years. At that point, you’ll have a great six-figure salary. In rare instances, we have seen first year insurance agents working full-time meet the goal of nearly 400 new clients to kickstart their residual income.

Having a residual income gives you the flexibility to stretch your capabilities and begin learning how to cross sell other lines and strategically round out your book of business over time. This is hard to do if you don’t have a steady monthly income allowing you to spend the time learning.

Baby Boomers are aging at rapid rates, creating a bubble of opportunity for an agent to start selling med supps (Medigap, as CMS calls them).

Most companies pay the same commission for seven years and some even pay for life. Plus, Medicare sales are at an all-time high because of the aging population. The U.S. Census says that by 2040 there will be about 82.3 million senior citizens. MedicareGuide.com surveyed how well U.S. adults 65+ use and trust eight sources of information and shared some interesting data that found Medicare beneficiaries in support of their Agents.

Let’s dive in and see what all the hype is about!

Table of Contents

Use this as a resource reference and click the section below that is most important to you.

- Medicare Training

- Selling Medicare over the phone

- Medicare Sales tips

- Getting prepared

- Residual income opportunity selling Medicare

- Defining your target market

- Leads and how to work them

- Get Contracted to Sell Medicare

- Medicare Basics

- Summary

Medicare Sales Training

Before you take the plunge of selling Medicare Supplements, you’ve got to be a student of the details of basic Medicare. There is nothing worse than independent agents who think they can wing it.

You can’t!

Regardless of how many Medicare supplement leads you have coming in each week, you’ll get swallowed up if you’re not prepared to serve your clients.

You must take the time to become an expert, become the customer’s advocate. Your customers will appreciate the difference between talking to a well-informed agent and one who’s just there to make a sale. And, trust me, they will smoke you out if you’re just there for an easy sale.

If you do it this way, you’ll help a lot of people and make a lot of money at the same time.

Where’s the best place to get Medicare sales training?

You start to learn how to sell Medicare Supplements through the government handbook: the Medicare and You 2024 Handbook. The Centers for Medicare and Medicaid Services (CMS) releases this book every year with the new updates.

I always tell anyone looking for Medicare supplement training to first read the Medicare and You Handbook cover to cover, and then read it again. It’s a great Medicare supplement training resource.

Medicare and You Booklet

I read this Medicare guide cover-to-cover every year to make sure I’m up to date with the CMS changes. You should do the same.

Following are the basic elements of Medicare (you will need to dig into the booklet to really understand how it works):

Do You Want to Learn The Specific Playbook to Building a Six-Figure Residual in the Medicare Business?

What is Original Medicare?

Selling Medicare supplement plans takes an enormous understanding of Medicare, so make sure and pay attention to the next few paragraphs as well as getting your copy of the Medicare and You handbook.

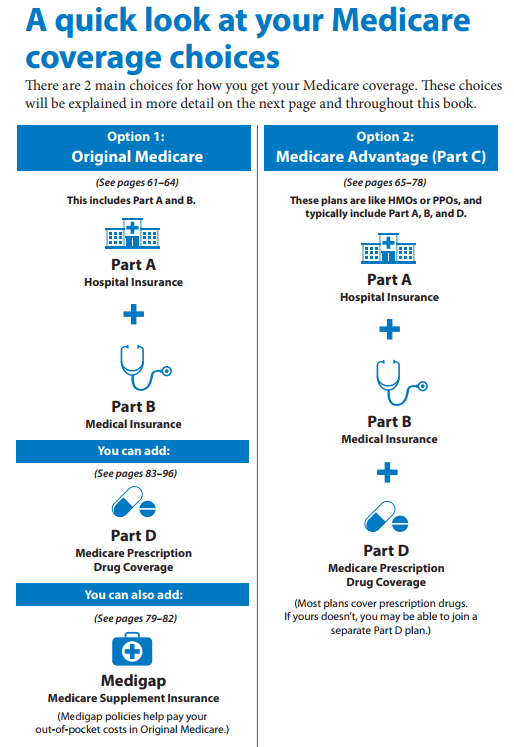

Original Medicare includes parts A and / or B. The coverage is provided directly from Medicare and provides 80% after deductibles and coinsurance. The remaining 20% liability is why there is a need for supplemental coverage.

This isn’t going to cover everything about selling Medicare plans, but it will give you a great starting point. You can start reading about this on page 9 of the Medicare book.

What is Medicare Part A?

Part A is Medicare coverage responsible for hospital-related expenses. In most cases, Medicare Part A doesn’t require a monthly premium as it was funded through you paying a minimum of 10 years of Social Security taxes through payroll.

Consequently, most people earn Medicare Part A.

In the event someone didn’t earn Medicare Part A, it can be purchased. For those who need to purchase Medicare Part A they will spend up to $413 per month in 2021.

Below are some examples of Medicare Part A covered services:

- Blood

- Home health services

- Hospice care

- Inpatient hospital care

- Skilled nursing facility care

Gaps in coverage with Medicare Part A can result in some of the highest financial risks for your clients which is why many agents often cross sell ancillary insurance.

What is Medicare Part B?

Part B is Medicare coverage responsible for medical-related expenses. When your clients are first eligible for Medicare, they have a 7-month initial enrollment period (IEP).

Your clients IEP begins 3 months before the month they turn 65, their birth month and ends 3 months after.

Below are some common examples of Medicare Part B covered services:

- Doctor’s visits

- Ambulance services

- Ambulatory surgical centers

- Blood

- Bone density tests

- Breast cancer screening

- Cardiac rehabilitation

- Cardiovascular disease

- Cervical screenings

- Diabetes screening

- Chronic care management

- Colorectal cancer screenings

- CPAP

Check Pages 29-55 of the 2024 Medicare and You Handbook for the complete list of Medicare Part B-covered services.

Part B also has a monthly premium which is, in most cases, deducted from your client’s Social Security check each month. Part B premiums can be as low as $164.50 or as high as $428.60.

The range in price is directly correlated to your client’s income.

If for some reason your client doesn’t elect Part B on time, they will be subject to a late enrollment penalty of 10% for every full 12 months they delay enrollment.

The Medicare Part B enrollment penalty can be waived in instances where the proposed insured has credible coverage, for example, they have existing coverage through an employer.

Lastly, Medicare Part B has an annual deductible of $226 This deductible must be met before Medicare will begin paying. At the point of meeting the deductible, your client will be on the hook for 20% of the Medicare-approved amount.

As an independent agent, it’s important for you to understand the Medicare basics in order to have valuable discussions with your clients. Remember, the more your client’s trust you, the more referrals you’ll receive over time. And, referrals are the best Medicare Supplement lead you can get your hands on!

What Services Aren’t Covered by Original Medicare?

This is very important. Your Medicare Supplement sales will suffer if you can’t answer this very common question.

Original Medicare is not an all inclusive health insurance plan, so you need to make sure and understand the services that will result in gaps or out of pocket expenses for your clients. Below is a list of the services Medicare doesn’t cover.

- Dentures

- Acupuncture

- Hearing aids

- Cosmetic surgery

- Eye glasses or vision screenings other than after cataract surgery

- Long Term Care

- Preventative dental

- Silver Sneakers (health & wellness benefit offered through Medicare Advantage)

It’s important to share this information with your client so they aren’t surprised at the time the need these services. Most of these services are covered through additional supplement insurance products. Make sure you understand the cross selling rules to ensure you are compliant.

What is Medicare Part D?

Medicare Part D is what covers prescription drugs and carries a monthly premium. If your client doesn’t enroll in Part D on time, a penalty will be added to their premium moving forward. Penalties are waived in instances that your client has existing credible coverage.

Part D plans follow the annual election period (AEP) schedule and can be changed every year between October 15th and December 7th. It’s very important to review these plans annually because the tiers and copays can change.

An easy way to find your client’s available Part D plans, and basic copays and deductibles is by looking in the back of their 2023 Medicare and You Handbook.

Below is a chart to help you understand the differences between Medicare Advantage and Medicare Supplements. Remember, your clients have two choices.

Do You Want to Learn The Specific Playbook to Building a Six-Figure Residual in the Medicare Business?

What is Medicare Advantage?

Medicare Part C is commonly known as Medicare Advantage (MA plans), and is offered in the common forms of an HMO or PPO plan from private insurance companies approved by Medicare. This means that those who choose a Medicare Advantage plan are subject to using the doctors listed in the associated HMO (requires referral) or PPO (referrals NOT required) networks.

These are the plans that everyone sells during the annual enrollment period from October 15th through December 7th and some during the open enrollment period from January 1st to March 31st of each year.

There are other scenarios that allow you to sell outside of that time frame and you can find those on page 66 of the 2024 Medicare and You Handbook. Pay special attention to the open enrollment period as well as the annual election period when you’re reading those sections, there is a lot of important detail.

Top Medicare Advantage Companies You Might Recognize

- Aetna

- Anthem / Elevance

- Amerigroup

- United Health Care

- Humana

- Cigna

- Cigna HealthSpring

- Essence

- Cox Health

- Banner

The confusing part about Medicare Advantage is that client’s often think if they have a Medicare Advantage plan, that they no longer have Medicare.

That is false!

Parts A and B are required to enroll in Medicare Advantage.

The difference is that once your client is enrolled in Medicare Advantage, the private insurance company becomes the primary payor instead of the Medicare program and assumes the liability of paying the Part A and Part B covered services. This was a way for Medicare to cut spending and transfer the patient liability to the private insurance companies. This transfer of liability is why you see some plans offering additional benefits such as dental, vision, hearing and wellness. It’s the private insurance companies best interest to keep their policy holders healthy in order maintain acceptable loss ratios.

Why do people choose Medicare Advantage?

- Covers Part A and Part B deductibles

- Carries little to no premiums

- Offers additional services such as hearing aids, wellness discounts and limited dental work.

- Some plans include prescription drug coverage, reducing the out of pocket monthly premium costs.

Using Part C is one way your clients can limit their risk of the 20% liability of original Medicare.

Make sure and check out the Medicare Part C section of the Medicare and You 2024 handbook starting on page 61.

Medicare Advantage Commissions

According to CMA, the agent level Medicare Advantage commissions in 2024 are as follows. According to the new rule from CMS, agents will be getting a $100 increase on new and a $50 increase on replacements starting in 2025.

- New to Medicare commission: $603

- Replacement commission: $301

- Renewal: $301

- Max Referral Fee: $100

Some states pay differently which can impact your business if you’re selling over the phone and have the ability to market multiple states.

New to Medicare – $715

- California

New to Medicare – $626

- Connecticut

- DC

- Pennsylvania

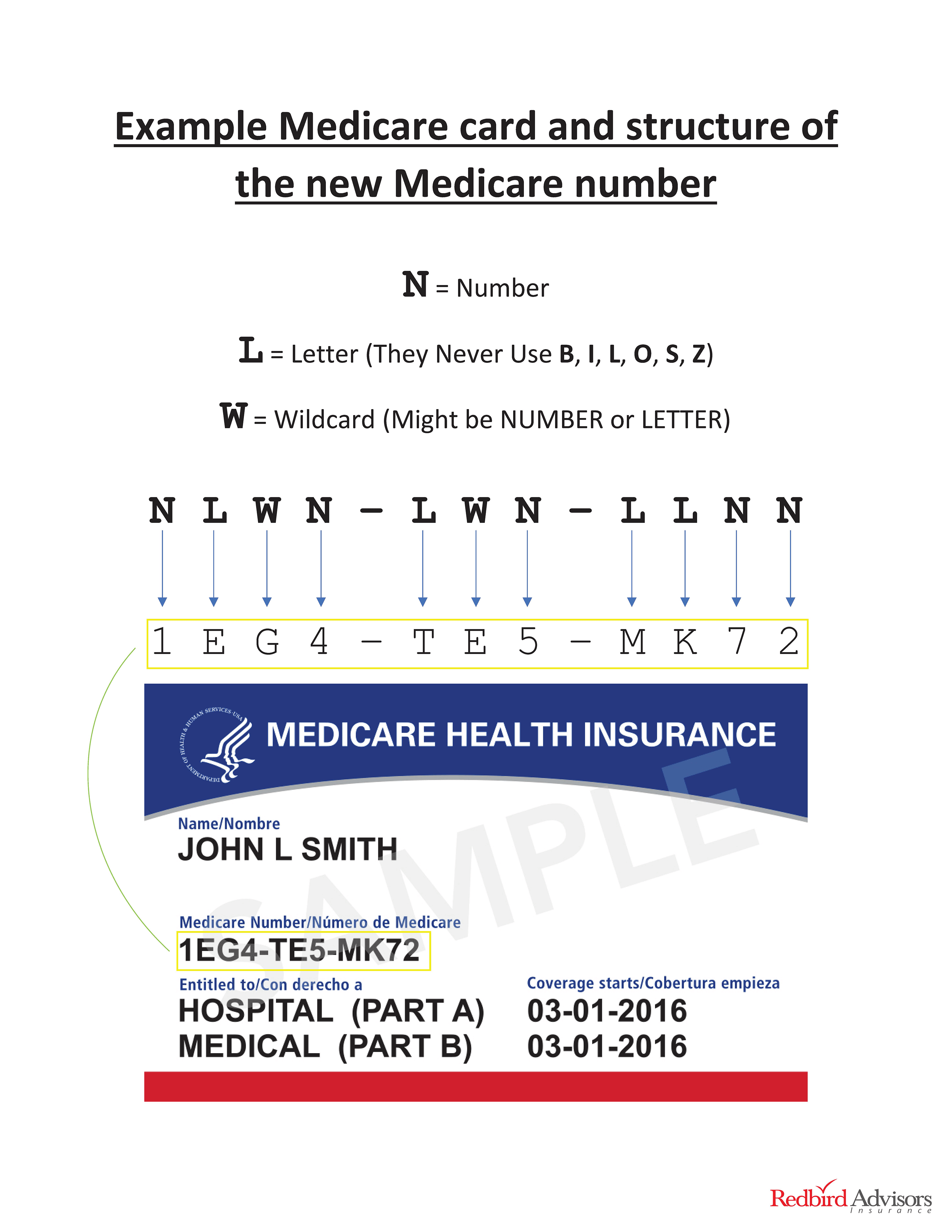

What does the new Medicare card look like?

Medicare recently made two significant changes to the red, white, and blue Medicare card, so Medicare beneficiaries will all be receiving new cards. Oh, and for those who don’t know, the Medicare card is often referred to as the red, white, and blue card.

- They created a new design

- They began assigning every beneficiary a new Medicare number.

The reason why they changed the number was because previously the number for the Medicare beneficiary was often their social security number. With the wide spread risk of identity theft, they have phased out the old number and began issuing new numbers to all Medicare beneficiaries. Below is a snap shot of what the new Medicare card looks like and how the new Medicare numbers are structured.

It’s actually quite interesting how they structure the new medicare numbers.

How does Medicare work with other insurance policies?

Many times, clients will have existing health insurance and believe Medicare is secondary or vice versa. Regardless of which coverage is primary, you need to be prepared to have that discussion with them.

Below are some of the example scenarios when Medicare is the primary coverage.

- When your client is using a retirement health plan.

- Over the age of 65, still employed, on a group health plan and the current employer has less than 20 employees.

- Disabled and under the age of 65, still working and on an employer health plan with an employer with less than 100 employees.

When you are having that discussion need to remember to ask the following questions”

- How old are you?

- Are you currently working or retired? If you’re working, are you on a group plan or Cobra? Cobra is NOT creditable coverage and can trigger a late enrollment penalty.

- If currently working, how many employees does your company have?

Knowing the answers to those three questions will help you determine if Medicare is primary coverage in most scenarios.

Now that you have a base level understanding how Medicare works, let’s dig into the required AHIP Medicare training.

Do You Want to Learn The Specific Playbook to Building a Six-Figure Residual in the Medicare Business?

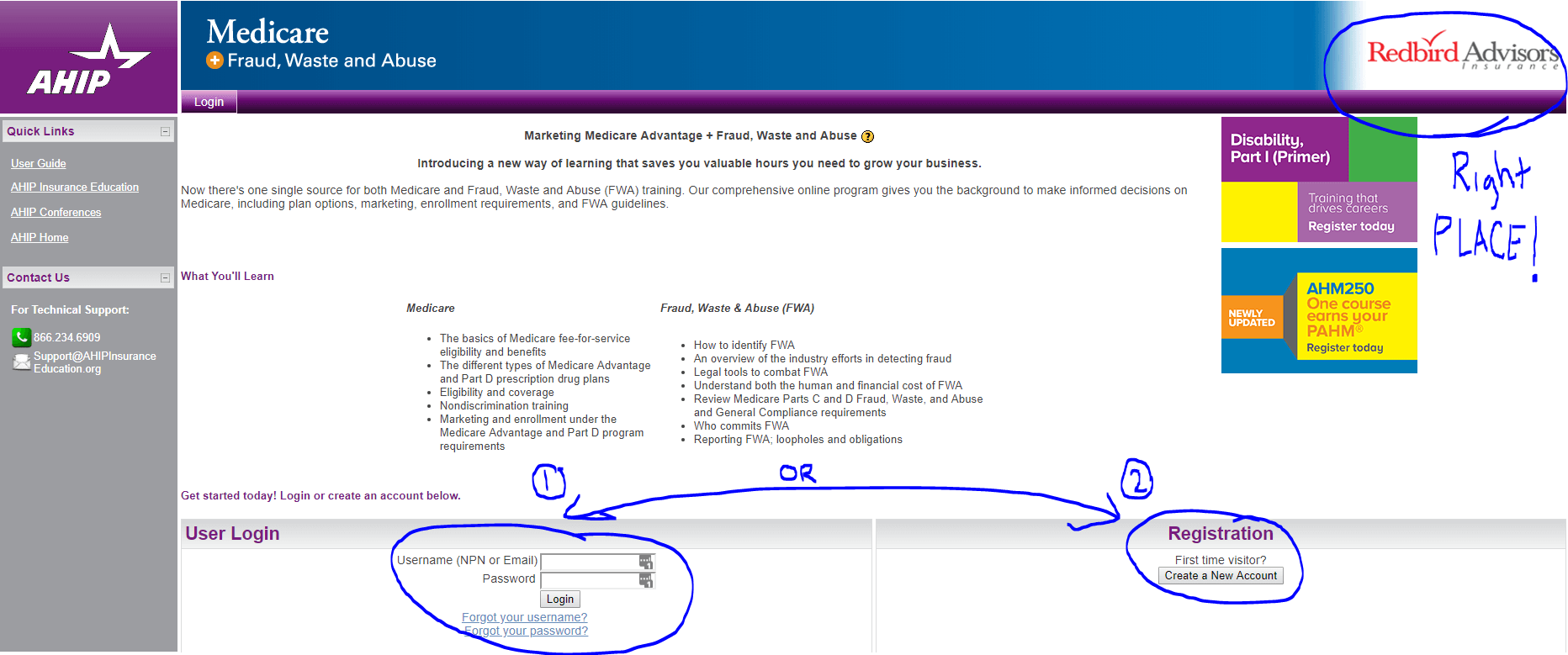

AHIP Medicare Training (America’s Health Insurance Plans)

AHIP Medicare training is required when selling Medicare Advantage and Medicare Part D plans.

The reason you need AHIP Medicare training is so you can enroll your clients in their Medicare part D plan. If you’re also learning how to sell Medicare Advantage plans, then you’ll need to complete AHIP prior to getting approved to sell.

You’ll notice I didn’t say Medicare Supplements because AHIP is not required to sell Medicare Supplement insurance.

Aside from AHIP Medicare training being required for Part D sales, it’s a great resource to help you gain a strong understanding of the Medicare market. Here’s an overview of the topics it covers:

- Medicare basics

- Different types of Medicare Part D prescription drug plans

- Part D enrollment requirements

- Understanding fraud waste and abuse

- Eligibility and coverage details

Completing AHIP Medicare training can be done directly through our AHIP discount code. You can usually get an AHIP discount code if you complete it through a carrier. Below are some of the Medicare Advantage companies that offer discount codes for AHIP Medicare training.

- United Health Care

- Essence

- Coventry

- Anthem

- Cigna

Getting started with AHIP Medicare training is simple.

- Use our AHIP discount link

- Register by clicking on the button that says, “Create a New Account”.

- Complete the registration by entering your last name, date of birth (DOB), and last four of your Social.

- Enter your national producer number (if you don’t know your NPN, you can search it here).

- Enter the remaining personal information such as full address, email address, create a password, and preferred language.

- Click “Register”.

First, make sure you’re on the correct page to ensure you’ll get a discount. If you see the Redbird logo at the top of the screen, you’ll know you’re in the right spot.

Once you are registered you will see a tab labeled, “Medicare Course Home”. At the bottom of that page you’ll need to click on a link labeled, “2024 AHIP Medicare Training”.

You’ll be prompted to enter your payment information which will then unlock the course. At that point, you can decide if you want to take the course with or without CE credits.

If you don’t need CE at that time, take it without. If you need CE, take it with. It’s that simple.

Once you have completed the modules and passed the AHIP Medicare training exam, you’ll be ready to start getting setup with the various Part D plans.

**Tip: Don’t forget to find the companies that offer AHIP discount codes in your area, it will save you some money.

Learn how Medicare Supplements work.

Medicare benefits such as Medicare Supplement insurance plans are sold by private insurance companies to cover the liability of the 20% and deductibles associated with Original Medicare. The typical Med Supp client coverage scenario looks like this:

Original Medicare Part A & B + Medicare Supplement + Part D

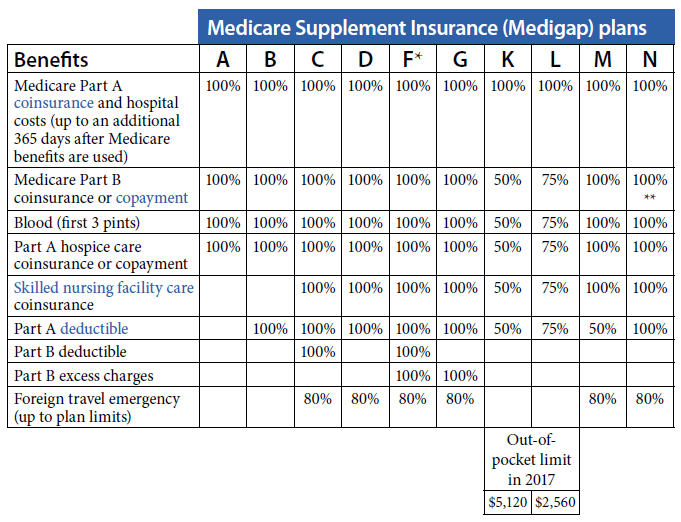

Medicare Supplement insurance is also referred to as a Medigap policy by CMS. These names are interchangeable.

Your client should expect to pay monthly premiums for Original Medicare Part B, their Supplement and their Part D drug plan. It’s a triple whammy!

Medicare Supplements are accepted by any doctor that accepts Medicare, so there are few restrictions for the doctors and specialist your clients can see.

This is especially helpful for clients who travel frequently. Medicare Supplements are not restricted like HMO or PPO plans, so clients won’t have problems using their coverage out of network.

Another great thing about Medicare Supplements is the plans are standardized across all the carriers.

As you’ll notice below, all plans of the same letter offer the same Medicare benefits.

For example, your client is moving from a United Health Care Plan G to a Mutual of Omaha Plan G, the only difference is the monthly premium. This makes selling Medicare Supplements simple, especially because you can find this information on page 69 of the 2024 Medicare and You Handbook. Many clients are surprised when you explain this to them.

The most common Medicare Supplement plans you will likely sell are Plan G and Plan N.

Do You Want to Learn The Specific Playbook to Building a Six-Figure Residual in the Medicare Business?

Medicare Supplement Plans: Quick Look at Plan G, and N

Medicare Supplement Plan G

Plan G has the most robust benefits of all Med Supp plans currently available.

Medicare Supplement Plan N

Plan N is a Medigap plan that covers the same major benefits as Plan G with the addition of a $20 primary care doctor copay and $50 emergency room copay.

This means that each time your client goes to see their primary doctor they will pay a $20 copay and $50 if they go to the ER and are not admitted. If they are admitted to the ER, the $50 copay will not be charged.

How to qualify for Medicare Supplement insurance?

Just like there are qualifications for original Medicare, your clients must qualify for a Medicare Supplement:

- Your clients must first have Original Medicare (parts A and B).

- Cannot currently have a Medicare Medical Savings Account (MSA) Plan.

- If a client has a Medicare Advantage plan, they can apply for a Medigap policy but must leave the Medicare Advantage plan prior to the Medigap policy becoming effective.

- The client’s Medigap policy is guaranteed renewable even if there are health problems. The insurance company cannot cancel the Medigap policy if premiums are paid.

Services Medicare Supplement insurance does not cover?

Below are common examples of services not covered by Medicare or Medicare Supplements, which clients are often confused about:

- Long-term care

- Private-duty nursing

- Vision

- Dental

- Hearing

You will be amazed how many people think long term care is covered by Medicare Supplements. Also, having this discussion is a great way to plant a seed for future cross selling opportunities. As we mentioned previously, always double check you are in compliance before starting any cross selling or marketing campaign.

What type of insurance isn’t considered a Medicare Supplement plan?

Medicare Supplements (aka Medigap policies) are the only policies which directly impact the 20% liability of original Medicare.

Below are the common types of insurance that clients mistake for Medicare Supplements:

- Medicare Advantage Plans (HMO, PPO, RPO, PFFS)

- Medicare Prescription Drug Plans (Part D plans)

- Medicaid (State level financial and medical assistance plans)

- Employer or union plans (good examples of credible coverage)

- Veterans’ benefits (VA plans)

- Long-term care insurance policies (LTC)

- Tri-Care

You’ll find that using the word “Supplement” is what causes a lot of client confusion. This is probably why Medicare Supplements are referred to as Medigap policies by CMS.

Make sure you and your clients are clear on the correct verbiage.

How do your clients start using their Medicare Supplement insurance?

One of the common questions your clients will ask you is, “how do I use my card once I receive it?”

This is the great part about Medicare Supplements: Your client will go to their doctor, complete a procedure, and go home. In the case of a Plan G, they won’t even have a copayment.

A few weeks later they will receive their explanation of benefits (EOB) and it will outline the services rendered by the doctor or medical facility and then show the amount due of zero.

Medicare Supplements are extremely efficient and allow seniors on a fixed income to confidently know they will not be billed in excess of their monthly premiums for medical or hospital services.

This is true peace of mind for your policy holders.

Medicare Supplement Sales Training Tips

A mentor once told me, “repetition is the mother of learning.”

This is so true when learning how to sell Medicare Supplements.

You need to read the Medicare and You Handbook every year… it’s the bible. Below is a list of Medicare Supplement sales training tips you should review every year like clockwork.

- Review the Medicare changes outlined in the 2024 Medicare and You Handbook.

- Review the demographics of your target market in your territory:

- How many people are turning 65 in the next three, six, and 12 months?

- What is the average household income? (knowing this will help you better target prospects for Medicare supplements vs. Medicare Advantage)

- How many married households vs. single? (maximize your efforts to get two sales from one household)

- What percent of home ownership vs. renting? (Homeowners will likely be better suited to afford the premiums that come along with Medicare supplements)

- Have “Do Not Call” requirements changed?

- Make sure the standardized plans have not changed.

- Has any new competition moved into your area?

- Should you be focusing on Medicare telesales or face-to-face?

This may seem like a lot, but it’s the agent that pays attention to the details that will earn six figures selling Medicare Supplement insurance.

Do You Want to Learn The Specific Playbook to Building a Six-Figure Residual in the Medicare Business?

How to Get Started Selling Medicare Supplements

Learning how to sell Medicare Supplements all starts with finding a sales system to replicate.

There is no reason to try to reinvent the wheel!

It’s a simple process:

- Determine if you want to do this all on your own or with a team.

- Decide whether to be captive or independent.

- Determine if you want to get started with telesales or face-to-face.

- Find a mentor.

- Develop a marketing plan (important step that results in a lot of agents failing if not done).

- Contract with the best Medicare Supplement companies.

- Lock down your leads (make sure you’re buying Medicare Supplement leads and not Medicare Advantage… two completely different types of leads and demographics).

- Set appointments, start selling and make money!

Determining the Best Medicare Supplement plans

Choosing the best Medicare Supplement plans should be based on many facts beyond just commission percentages.

Below shows you how to review the financial strength of the Medicare Supplement plans before choosing which one to sell:

- Do they offer a household discount?

- What is their AM Best Rating?

- How many years have they been in the market?

- What has their average rate increase looked like over the past three years? (I always suggest picking a Medigap policy that averages single digit increases)

- What are the loss ratios nationally and by state? (average loss ratio for Medigap plans is 80%; anything higher than that would indicate a higher than average claims year which could result in premium increases)

Higher than average loss ratio = unhealthy risk pool = increased chance of rate increases

With this information, you can review and compare which companies will be a good fit for your clients.

Take a look at the Plan F case studies below which I ran for a 65-year-old female in the state of Missouri.

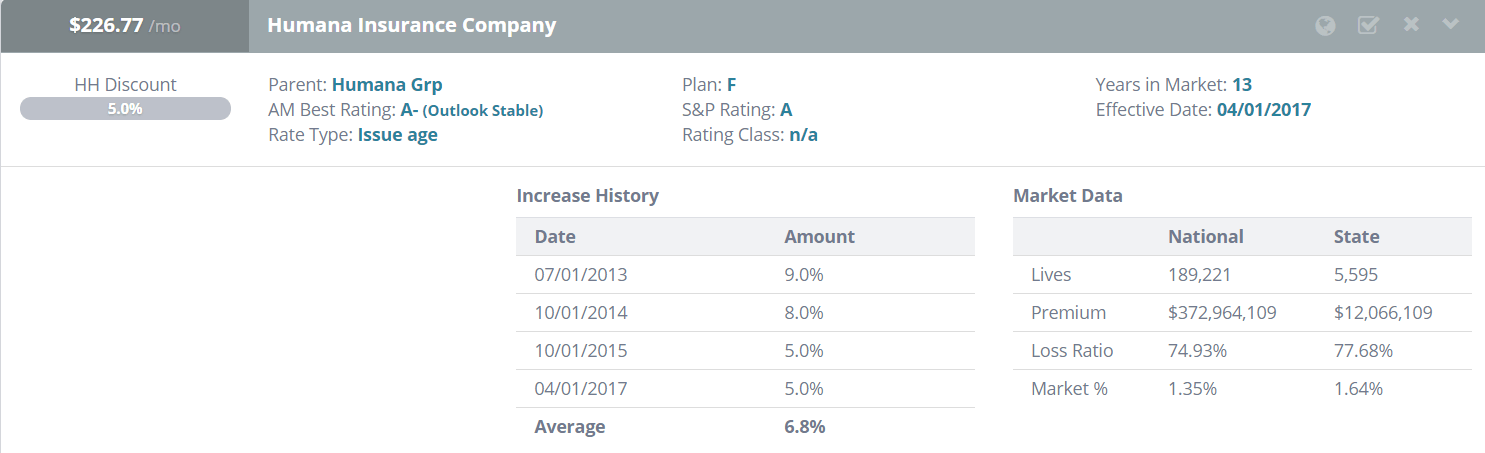

Humana Plan F Medicare Supplement Example

You’ll notice you can pull the relevant information for a specific company.

In this example, Humana Medicare Supplement Plan F in the state of Missouri is $226.77 per month and offers a 5% household discount if you have a husband and wife applying.

This plan has an average 6.8% rate increase over the last four years and a 74% loss ratio (lower than the 80% average that most insurance companies strive for). This means Humana is paying less in claims then the competition and has a healthier risk pool.

Lower loss ratio = healthier risk pool = better chances of stable rates

Based on this example, Humana appears to be a good Medicare supplement option. But, let’s keep shopping to make sure.

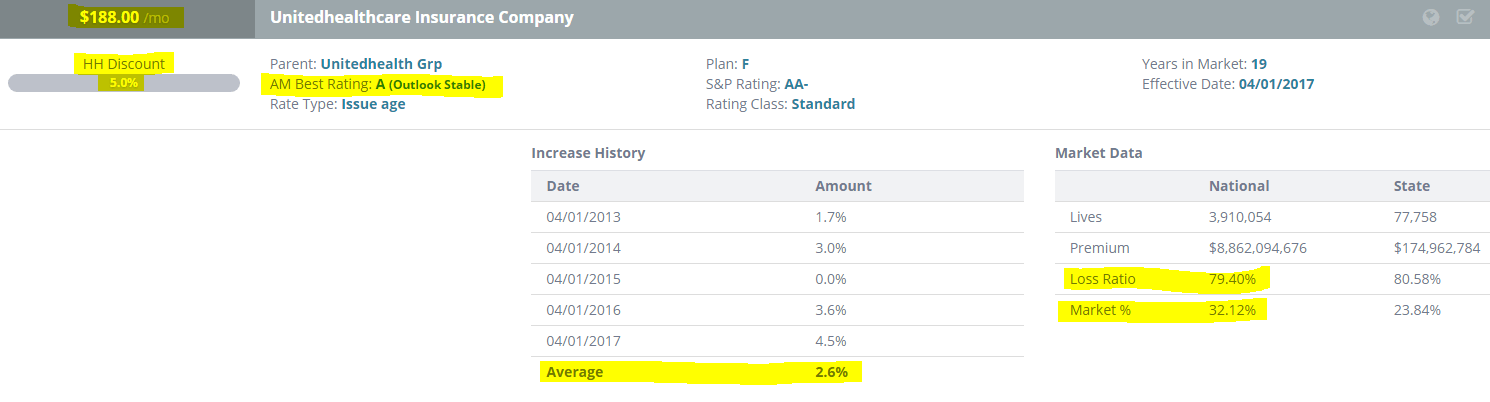

United Health Care Plan F Medicare Supplement Example

UHC offers a Medicare supplement insurance Plan F for the same 65-year-old female in Missouri for $188 ($38 less than Humana for the same coverage) per month as well as the 5% household discount.

UHC’s loss ratio of 79% is still in the normal range for individual health insurance products and it has a much larger market share of 32%. Not only does UHC have financial strength, it has a larger client base, lowers the risk of having a bad claims year.

On top of that, the average rate increase over the last five years is averaging 2.6% as of June 22, 2017.

This is a great example of a solid Medicare Supplement plan. Plus, it’s a great example of how important being an independent agent is to your clients. If you only worked for Humana in the first, your clients wouldn’t have the choice to save $38 per month while going to the same doctors and hospitals.

Clearly, offering multiple Medicare supplement companies is a no-brainer!

Best Medicare Supplement Insurance Companies

Selling Medicare supplements is easy when you partner with great household brands, especially those listed below.

- Americo

- Combined Insurance Company (A+)

- United Health Care Medicare Supplement (A)

- Aetna – American Continental Medicare Supplement(A)

- Transamerica Medicare Supplement (A+)

- Cigna Medicare Supplement (A-)

- State Farm Medicare Supplement (A++)

- USAA Medicare Supplement (A++)

- United American Medicare Supplement(A+)

- Mutual of Omaha Medicare Supplement (A+)

- AARP Medicare Supplement

Only independent agents can access the above companies, so you’ll need to make that decision up front. Also, this list represents the A rated or better Medicare Supplement companies.

Decide on Captive or Independent?

This decision is all about personal accountability: are you ready to run your own business, because that’s what you’ll face when you become an independent agent.

If not, that’s okay. What’s important is you fully understand the pros and cons of each. Your answers to the following questions will help determine which direction you should go.

- Are you truly a self-starter (answer honestly!)?

- Do you need a cheerleader or someone to hold you accountable to get out of bed on time (you know if this is you or not, so don’t lie to yourself)?

If you’re not a self-starter, or you need help waking up and getting to work on time, then go captive.

Otherwise, you’re a prime candidate to become an independent Medicare Supplement agent.

It’s that simple, don’t over think it.

Below is a bit more detail on the differences.

What is a captive Medicare sales agent?

A captive agent works for someone and does not own their book of business. This isn’t a bad thing, it’s just how it works. So make sure you understand what selling medicare supplements in a captive environment means to your business.

As a captive agent, you should expect to receive extensive support such as sales tracking, Medicare leads, sales training, hand holding, mentoring from your sales team, and a variety of incentives. This model allows you to focus on selling vs. worrying about all the other aspects of running an insurance agency, like buying leads or case management.

Captive agencies are great places to learn how to sell Medicare Supplements without being distracted.

Important: captive agent commissions will certainly be lower due to the amount of support you should receive from your agency.

This type of arrangement is great for new agents looking to become a Medicare sales representative.

Are You Ready to Learn The Specific Playbook to Building a Six-Figure Residual in the Medicare Business?

What is an independent Medicare sales agent?

An independent insurance agent represents many insurance companies. However, there are some captive agencies that broker multiple products, so it’s important to shop around before making a decision.

Independent Medicare Supplement contracts are accessed through various insurance marketing organizations:

- Insurance Marketing Organization (IMO)

- Field Marketing Organization (FMO)

- Brokerage General Agency (BGA)

- Managing General Agent (MGA)

- General Agent (GA)

These organizations will not only provide you access to represent the best Medicare Supplement plans, but they’ll also connect you with the best Medicare Supplement lead companies.

As an independent Medicare agent, you are responsible for paying for your own leads as well as all other operating costs and managing the day-to-day operations of your business.

Important: More responsibility means more commissions.

I started as a captive agent and transitioned to the independent side. Yes, I gave up renewals, but I saw it as a training cost to move my career forward.

Looking back, I wouldn’t change a thing.

What is a Medicare FMO?

A Medicare FMO is a field marketing organization that serves the senior market, specifically the Medicare market. Commonly confused with IMO, an FMO typically sits at the top of hierarchy for insurance carriers that independent agents are contracted to sell.

In most cases, Medicare agents must use an insurance FMO as most insurance companies will not allow independent agents to contract directly. This is largely due to insurance carriers not being suited to provide the agent support that is needed for medicare agents.

FMO will help with things like top contacts for agencies and agents, lead programs, sales training, and other ways to attract customers such as digital marketing, webinars, and miscellaneous marketing materials.

FMO faqs:

- Do you have an open release policy?

- What type of quoting tool do you use?

- What types of lead programs do you offer? No-cost or fully paid programs?

- What type of carrier co-op programs can my agency access?

Read our full write up on Medicare FMOs here as well as access some FMO recommendations.

Choose the Best States to Sell Medicare Supplement Insurance

Now that you have a good idea of the types of leads that work, you need to figure out where to start working them.

It’s always better to laser target your markets.

The video below shows how I filter data by zip code to determine how many Medicare eligible prospects are in my target territory.

The tool used in the video is provided by Alesco Data, a company we consistently use to purchase T-65 lists and other Medicare supplement lead data.

Choosing the Best Medicare Supplement Leads

Generally, if you have more leads, you’ll make more sales. No big shock, right? But, it all starts with the first lead that turns into the first sale.

Below is a quick look at the various types of Medicare supplement leads available.

Direct Mail Medicare Supplement Leads

Direct mail is the most common lead source and some of the best Medicare Supplement leads for agents. Here’s how to generate Medicare Supplement insurance leads using direct mail:

- Find a lead vendor. (This is the direct lead vendor we use, and you can get a discount.)

- Pick your territory and buy your list from a T-65 Lead database.

- Choose a format, typically a tri-fold self-mailer or lead cards.

- Determine how many T-65 mailers you want to send out (at minimum you should be sending out 1,000 per week; we’ll get to the math on this a little later)

- Choose first or third-class mail (this will impact your price per thousand, but potentially also impact the effectiveness of your mail campaigns)

- Make sure your data includes phone numbers scrubbed to the do not call list.

- Get a copy of your turning 65 Medicare leads list once the order has been processed.

You should expect a 1.5%-3% response rate on direct mail for Medicare Supplements. The recipient completes a postage paid return card. Some say 1% is average, but I’ve found that direct mail response rates are always higher for Medicare than, say for whole life insurance.

If you sent out 1,000 direct mail cards, you should expect to get 15-30 Medicare Supplement leads in return.

Direct mail lead campaigns cost anywhere from $420-$500 per 1,000 mailers.

There are also companies that will offer a fixed cost Medicare Supplement lead in the $40-$50 range. These are usually tied to a minimum order of 15-20.

If you purchase direct mail leads, make sure and do it through our program with Target leads. We’re not paid anything by Target leads, but you’ll get some additional perks as a friend of Redbird.

Door Knocking Medicare Supplement Leads

This used to be my favorite before the pandemic!

I have made tons of new sales by knocking doors of T-65 leads that didn’t respond to a preset appointment request, or send a lead card back but I was unable to reach them to set an appointment.

These are the ones you go knock.

Simply show up, knock on the door with a positive attitude and introduce yourself. You’ll be amazed how many people don’t chase you off the porch.

I love doing it, and it always seemed to generate an extra $500 or so every week in commissions. However, it’s not for everyone, but I suggest every agent give it a shot.

Turning 65 Medicare Supplement Leads (T-65 Lists)

What are T-65 Medicare Supplement leads?

T-65 leads are lists of people who are turning 65 in the next three to six months. It’s a great way to constantly have someone to call.

You can order T-65 leads from virtually any good Medicare lead provider and have a list produced the same day.

Yes, it might seem boring or antiquated, but it works. Pick up the phone, smile and start setting Medicare Supplement sales appointments.

You’ll never get what you don’t ask for!

Tele-Marketed Medicare Supplement Leads

Generated by a call center, these leads typically come from a T-65 list.

You need to make sure the data you are purchasing is clean and in compliance with the do not call list. Any reputable data company has this capability.

Calls are made to your target demographic and interest is generated by letting the prospect know that someone is available in their area to educate them on the choices they have for Medicare Supplements as they get closer to turning 65.

If you’re just learning how to sell Medicare Supplements over the phone, then the approach would be more directed to qualifying the prospect for a new plan for a lower premium.

Either way, each call is recorded and uploaded to a database for you to access and begin following up to set your sales appointments. You should also ask if the telemarketing company offers live transfer Medicare Supplement leads.

Tele-marketed Medicare Supplement leads are cheaper than direct mail, but they have a much shorter life span because with a phone call, the prospect hasn’t invested the time in the process the way they do with direct mail by filling out the card and getting it mailed. They are much more likely to forget a quick phone call from someone they don’t know.

When you work telemarketed leads, you have to work them quickly!

You can expect to spend in the neighborhood of $15-$24 per lead, but ask the lead company for a bulk order discount.

Here is a full write up on insurance leads.

Below is a quick look at how lead quality can vary from vendor to vendor. This can be due to language barrier, script language, or many other factors. You’ll noticed we compared 2 third party lead vendors to our own internal telemarketers following an identical script.

Sample Size: 2520 Telemarketed leads from 3 separate lead sources.

- Vendor 1: 1,287 leads and set 628 appointments (48% appointments set) which resulted in 288 sales (45% closing).

- Vendor 2: 350 leads and set 112 appointments (32% appointments set) which resulted in 51 sales (45% closing).

- Internally Controlled: 883 leads and set 463 appointments (52% appointments set) which resulted in 201 sales (43% closing).

What’s the take away here?

We were able to bring our lead generation capability in house and nearly replicate the results of Vendor 1 and cut our cost by nearly 70%. We couldn’t do this if we didn’t have a team to help manage the process, but the point here is you can certainly help contain your costs by controlling your own lead source.

Selling Medicare Supplements to Friends and Family

Don’t forget to constantly remind your friends and family you sell Medicare Supplements.

If you aren’t constantly telling people who you are and what you do, they’ll never remember to think of you when the opportunity presents itself.

Don’t be afraid to embrace that you’re a Medicare agent and take every chance to remind people of that.

These are the best free Medicare Supplement leads you can buy.

Policy Delivery

Delivering Medicare Supplement policies allows you the chance to reiterate the benefits of the Medicare Supplement plan as well as ask for a referral.

There is absolutely nothing wrong with asking your clients for a referral after you have just returned to their home to deliver and further educate them on the plan they are going to depend on for supplemental insurance.

They are happy and they trust you… this is the best time to get a referral.

While direct mail lead generation remains the most common source of Medicare Supplement leads, it’s important to always keep your eyes out for additional lead sources.

Here’s a great story about a successful Medicare agent.

You’ve Made it This Far, Are You Ready to Learn The Specific Playbook to Building a Six-Figure Residual in the Medicare Business? 🙂

How to work Medicare supplement insurance leads

What does “work your Medicare supplement leads” mean? It’s the strategy and tactics required to maximize your ability to get in front of your prospects and make weekly sales.

What keeps you from reaching your Medicare Supplement insurance prospects?

- They don’t answer the phone

- They’re on the Do Not Call (DNC) list

- You are number 157 to send them a direct mail letter

This is exactly why you need a strong marketing strategy when working your leads.

You must commit to an ongoing campaign if you want to be successful selling Medicare Supplements.

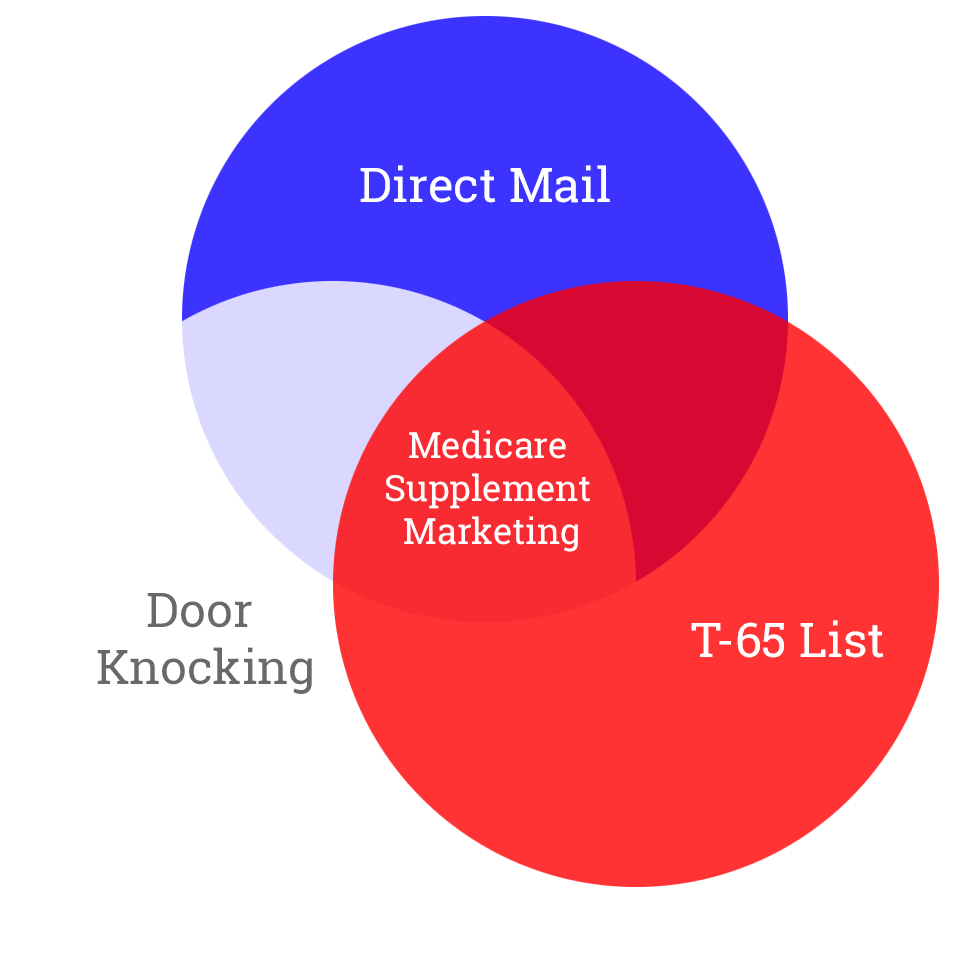

Below is an example of how to work each T-65 list using telemarketing, direct mail and door knocking to maximize your results.

Step 1: Buy a Medicare T-65 lead list that is scrubbed against the do not call list (this means every listing that includes a phone number is safe for you to call)

Step 2: If a phone number is listed, give them a call, introduce yourself and attempt to set an appointment. Repeat until you have exhausted your list and hit your goals.

Step 3: If a phone number isn’t listed (this means they are on the do not call list), add them to your direct mail list.

Step 4: Send direct mail cards to all the listings on your T65 list that don’t have a phone number.

Step 5: If you receive a completed direct mail card with consent to call, then make the call and set the appointment. Repeat until you have made contact.

Step 6: If you receive a direct mail card but cannot reach them by phone, swing by, introduce yourself, and give them a Medicare buyers guide. (Make sure you take the direct mail card you received so they can connect the dots that you’re the one they sent it to.)

Selling Medicare Supplement takes tenacity. Working your T65 leads is the most critical step when you first learn to sell Medicare Supplements, don’t cut corners!

Telesales: How to Sell Medicare Supplements Over the Phone

Selling Medicare supplements from home or over the phone is a growing trend. We are seeing more agents trying to get out of the field and transition to selling Medicare over the phone.

Can it be done?

Absolutely. In fact, we have an agent who consistently sells 10+ Medicare supplements over the phone each week utilizing the exact process listed below. There isn’t a magic bullet, it’s just about staying focused on efficiency.

And, most recently we launched a telesales team that placed more than 3,000 policies in their first 7 weeks.

Six-Figure Residual Means You Are Earning a Minimum of $8,000 Per Month From Your Existing Customer Base.

Requirements for Selling Medicare Over the phone

- Leads. The first key is that you really need a steady flow of Medicare leads every day to work. My suggestion would be allocating a budget for 20 new Medicare leads per day. As your weeks and month progress, you’ll build a strong list of prospects to call which will translate to 10-15 sales per week. Utilize a mix of the various types of Medicare leads to get yourself up to 20 per day.

- Digital Medicare leads. The highest intent leads are usually the ones generated from SEO. Learn more about insurance SEO here.

- TV Medicare Leads

- Direct Mail Medicare leads.

The secret to selling Medicare over the phone is…speed to dial!

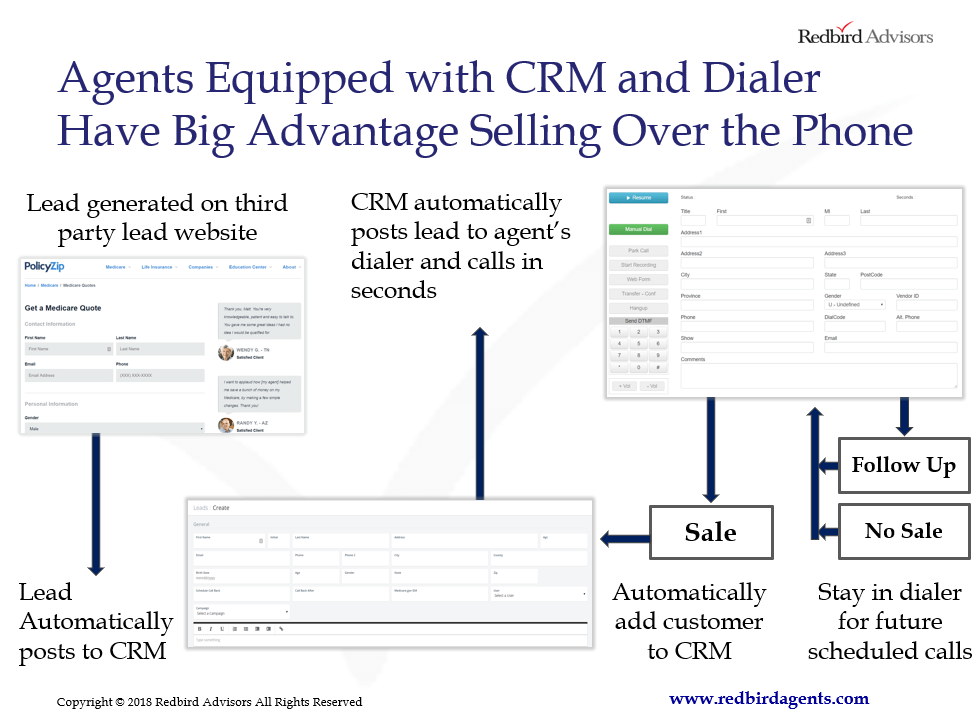

If a Medicare lead is generated online, you need to be calling the lead within seconds of it being generated. Same with telemarketed and direct mail. This allows you to take advantage of maximizing the shelf life of your lead. In order to maximize your speed to dial you need to have your CRM posting specs in a format you can easily provide to your lead vendors. From there, the vendor will post a lead to your CRM in real time as soon as a prospect clicks submit on their lead form. Once you have tested that your receiving the leads, you need to get your CRM to post that lead to your dialer so it instantaneously creates a lead in your CRM and starts dialing the lead with in seconds…this is your crystal ball.

Your ability to get in front of the prospect first will drastically improve your close rate. If you’re not prepared for this, you really shouldn’t try to get started with Medicare telesales.

- Telemarketer. There are a few sales models I’ve seen that really push hiring your own off shore telemarketer to dial T65 data to generate leads. I can’t argue with that logic at all. It’s important to diversify your leads, and having a consistent flow of inbound leads of people turning 65 is a great way to do so. My suggestion would be to check out Upwork and find a freelancer that has experience with lead generation. And, if you’re going to do it, make sure you follow any of the compliance guidelines set forth by the carriers you’re contracted with.

- CRM. You need to stay organized and a CRM is a great way to do that. There are tons of choices, but below are some of the well known options for HIPPA compliant CRM for telesales.

- SalesForce

- Active Campaign

- Velocify

- HubSpot

- Zoho

- VanillaSoft (Dialer and CRM)

- LionDesk

- Dialer. Using a dialer will increase your efficiency. What I mean by dialer is simply an auto dialer, not a predictive dialer. This means the dialer is simply calling for you vs. sending out a prerecorded message. You need to check your state compliance rules around using dialers.

- VanillaSoft

- Five9

- LeadsRain

- ProspectBoss (previously Salesdialer)

- Velocify

Speed to dial is accomplished with a dialer, but you need to make sure you’re setting aside time every day to work it. A dialer is only as good as your discipline to put in the time to work it.

Voice Signature vs. E-Apps

There are 2 common ways to sell Medicare over the Phone, and you’ll need access to both.

Voice Signature Application

Utilizing a voice signature means there is no paper application or e signature required. This is a true phone sales process as it allows anyone on the phone to choose their plan and sign their application using a voice signature.

Once you have completed the sales process, you’ll then read your client an approved script from insurance company verbatim. This is followed by the voice authorization from the client to proceed with the policy. Upon completion, you then upload any documents the insurance requires of you along with a copy of the recorded voice signature.

Voice signature is a very simple process when you have all the elements such as a CRM and dialer to support you documents.

Medicare Supplement Electronic Application (E-App)

The other way many agents sell Medicare supplements over the phone is by using a standard electronic Medicare supplement application, or E-APP.

E-Apps are very simple assuming your client has an email or knows how to use a computer. Stats show the senior market is definitely online, but there are certain scenarios you’ll com across where using an e-app is not an option. If an e-app is not an option, then you’ll need to make sure you have a voice signature product or go face-to-face to make the sale.

Want to Learn The Specific Playbook to Building a Six-Figure Residual in the Medicare Business?

Medicare Phone Sales Process

Here is a look at how all of the elements work together to help you maximize your ability to sell Medicare supplements over the phone.

Remember, the secret to selling any type of insurance over the phone is your speed to dial. You need to call the leads as soon as possible from when they are first generated.

Residual income selling Medicare Supplement Insurance

Selling Medicare Supplements is one of the best ways to earn residual income in the insurance business.

Here are the two most important things you need to know about Medicare Supplement commissions.

- Medicare Supplements pay the same commission for seven years.

- Some Medicare Supplements pay the same commission for life.

What does this mean?

Your sales compound each year, creating a residual income with no additional working hours. The chart below shows how this works assuming you’re making $30,000 in new commissions each year.

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | |

| First Year Comp | $30,720 | $30,720 | $30,720 | $30,720 | $30,720 | $30,720 | $30,720 |

| Year 1 Renewals | $30,720 | $30,720 | $30,720 | $30,720 | $30,720 | $30,720 | |

| Year 2 Renewals | $30,720 | $30,720 | $30,720 | $30,720 | $30,720 | ||

| Year 3 Renewals | $30,720 | $30,720 | $30,720 | $30,720 | |||

| Year 4 Renewals | $30,720 | $30,720 | $30,720 | ||||

| Year 5 Renewals | $30,720 | $30,720 | |||||

| Year 6 Renewals | $30,720 | ||||||

| TOTAL INCOME | $30,720 | $61,440 | $92,160 | $122,880 | $153,600 | $184,320 | $215,040 |

To illustrate the point, I didn’t include placement or persistency in those numbers.

Now let’s look at what your activity level needs to be to hit those numbers listed above.

What does it take to earn $30,720 per year selling Medicare Supplement Insurance Plans?

Direct Mail Scenario:

-

- Mail 2,000 direct mail cards monthly with an average 1.5% response, you have 30 exclusive Medicare Supplement leads each month.

- Conservatively, you should be converting 25% of those leads to new customers.

- That is 7.5 new sales, we’ll round up to 8 for simple math.

$30,720 Annual Income

8 sales x $1,600 (average premium) x 20% (average street commission)

Do you think you can sell two Medicare Supplements per week?

Do you have the patience to work the system to allow yourself the opportunity to earn a residual income?

It all sounds easy, but most agents just aren’t patient enough to work the system.

Conclusion

Selling Medicare Supplement insurance can be a great insurance job.

It takes time and patience, but as you can see from above, it pays off in a big way when you see how quickly your residuals can add up.

Below are the big takeaways of learning how to sell Medicare Supplement insurance:

- Always carry a copy of the 2024 Medicare and You Handbook on your appointments.

- Medicare Supplement plans are standardized from carrier-to-carrier, the only difference is price.

- CMS refers to Medicare supplements as Medigap policies and agents refer to them as Med Supps. Perfect example of 3 ways to describe the same thing.

- Follow my process video using Alesco Leads to start analyzing your territories and buying T-65 Medicare lead lists and direct mail data.

- Medicare Supplements have higher than average direct mail response rates.

- Strong renewal commissions.

- Job Security due to more Baby Boomers turning 65.

- If you’re going to sell Medicare supplements over the phone, make sure you your dialer and CRM integrated to take advantage of speed to dial.

Hopefully this has been helpful as you continue your journey of learning how to sell Medicare Supplement insurance.

If you have any questions, please contact us and we’ll do our best to help you.

Want to Learn The Specific Playbook to Building a Six-Figure Residual in the Medicare Business?

Other Trending Topics