This article will focus primarily on those looking to sell their Medicare agency or book of business and maximize their agency value. However, a lot of this information is highly related to other types of insurance agencies for sale, so read closely.

Everyone in the financial services and insurance industry lately seems to be selling their insurance agency and a lot of you are asking yourself, “I wonder what my book of business is worth and can I even sell it?”

The short answer is yes, there is an excellent opportunity to sell your insurance agency. It just depends on a number of factors and a detailed due diligence process which we will discuss below. And, you need to find the right buyer.

The overwhelming truth about the insurance industry right now is that the senior healthcare market continues to rapidly grow with the continued expansion of the baby boomers turning 65 and needing Medicare insurance, especially Medicare Advantage. The opportunity for growth has been, and still is, very hot.

But, don’t just take my word for it. See what HealthAffairs.org has to say about it.

After a 9 percent increase from 2021 to 2022, enrollment in the Medicare Advantage (MA) program is expected to surpass 50 percent of the eligible Medicare population within the next year. At its current rate of growth, MA is on track to reach 69 percent of the Medicare population by the end of 2030.

Due to this growth, we continue to see an incredible amount of FMO consolidation for those insurance agencies focused on health insurance, specifically Medicare which includes both Medicare advantage and Medicare supplement.

There has never been a more exciting time for qualifying health insurance agency owners to consider what a potential exit or transfer of equity looks like via full or partial acquisition, both of which will have some type of earn-out scenario. We’re even seeing some independent agents qualify for similar firm valuations.

But what does it take and how does a business owner get started?

Use Our M&A Team to Maximize Your Agency Valuation

Selling Your Medicare Focused Insurance Agency or Book of Business

The first question we get is, “how is a Medicare book of business valued or how do I determine a sale price?”

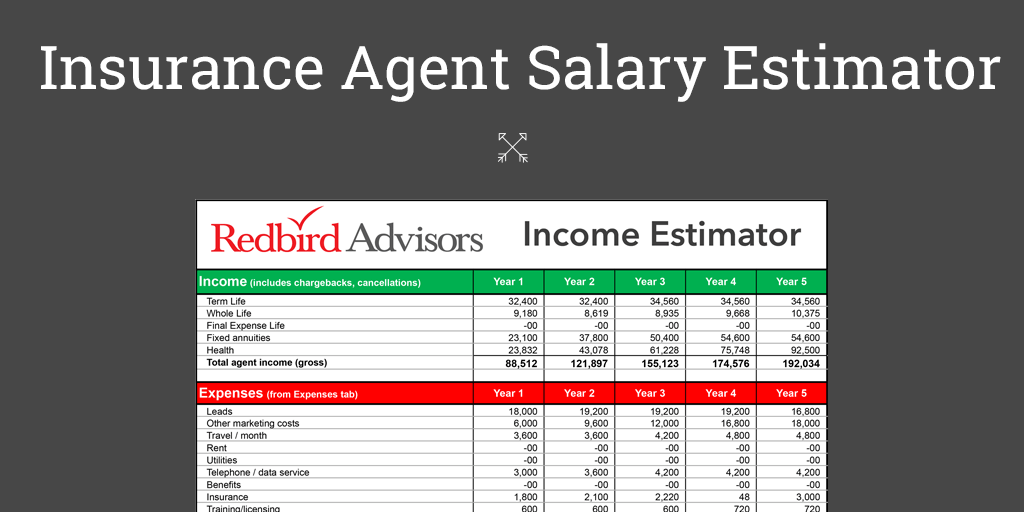

Valuation rule of thumb is most commonly a multiple of adjusted EBITDA which is earnings before interest, depreciation, taxes, and amortization. You can read more about adjusted EBITDA here.

The next item is product mix.

Various insurance products are valued differently based on first year commissions and subsequent residual income. For example, a prospective buyer isn’t going to pay the same multiple on a $1M adjusted EBITDA from term life insurance as they might for $1M in Medicare advantage or Medicare supplement sales.

Health insurance builds a residual book of business overtime with a higher life time value which has a big impact on valuation and final purchase price, especially when paired with a strong and steady growth strategy that the new owner can count on.

Medicare advantage plans and Medicare supplement plans seem to be the hot trend in the acquisition pool, but other insurance brokerage products are also being considered for cross-sell opportunities.

- Life Insurance (final expense, IUL, advanced markets, impaired risk, etc)

- Annuities

- Group health

- Business insurance

- Prescription drug plans

Want to know your agency valuation?

Primary consideration factors for selling your book of business.

Below are the initial items a potential buyer is likely to ask you for after you’ve executed a mutual NDA.

- Your initial asking price.

- Adjusted EBITDA

- Total client base by product type and carrier.

- Total first year commissions by product type

- Enrollment quality such as rapid disenrollment, policy lapse rate, renewals, etc. This is a risk management 101 element you’ll see in all M&A deals.

- Last 3 years of financial statements

- Current YTD financials

The next step of the sales process after the initial discovery is receiving a letter of intent which is typically for a set period of time such as 60-90 days. During that time you will begin the due diligence process with your prospective buyer to work through the final value of your agency and kick off deal underwriting. This is a key element of support you can expect from a business broker and CPA if you planned to take your agency to market ahead of finding a potential buyer or M&A deals.

M&A considerations that affect Insurance agency valuations

Aside from the standard considerations, below are some additional areas that may be considered by a potential buyer. It’s important to have everything organized so a buyer can easily see the value of your book and how it will sustain the current customer base and continue to show profitability post acquisition.

- Cleanliness of financials. This is a big one and one of the main risk factors for agencies trying to sell without being prepared. Your financials need to be clean, balance sheet should be up to date, pro-forma is great if you have one. Cleanliness of financials will be a metric when determining the value of an agency or if it’s even worth considering. This can make or break your ability to sit at the mergers and acquisitions table.

- Total Policies Sold. Total insurance policies sold during AEP compared to OEP and rest of year (Medicare agencies only). Others agency types would need to validate an established book of business and history of low loss or retention rate strategy in order to determine the agency worth. This helps appraiser better understand your income approach and market approach.

- Proprietary technology such as CRM, agency management systems, lead generation technology, or cybersecurity that has a material impact on retention, cost of acquisition, or protection of consumer data. Insurtech continues to boom in financial services.

- Staffing. How many full-time insurance agents on your team and the ratio between experienced and new agents as it relates to sales volume. Do you have all your eggs in one basket or is your production spread through out your distribution with a healthy number of applications per agent per year?

- Referrals. Effectiveness of referral channels. Strong referral channels are a great indicator for a profitable agency if the referral sales volume has a significant impact on controlling acquisition costs.

- Proprietary lead generation such as integrated social media webinar funnels or SEO rankings.

- Unique sales incentives that are key to sales success and employee / sales team culture.

- Insurance lead costs and the average acquisition costs of a new customer for the various insurance plans you’re selling which have a big impact on agency cash flow.

- Loss Ratio. Depending on your geography, loss ratios with specific insurance carriers can play a major role. For example, coastal states such as Colorado, Florida, Louisiana, and Texas (Dallas vs. Houston) are great examples of differentiating factors such as floods, hurricanes and wind risk that can impact the value of a book of business (this applies to property and casualty agencies only)

- Is your agency a turn key operation? Ability to demonstrate your agency is a turn key opportunity for someone.

- Real estate. Location of your agency in proximity to the insurance carriers that are competitive in your area.

- Liabilities. Current liabilities such as debt or real estate.

- Buy-Sell Agreements. Details of your buy-sell agreements with any partners or strategic partnerships to show the agency succession plans.

Every buyer has a different appetite and something you might not consider valuable could be the missing link the buyer has needed and is now willing to pay for it. This is commonly going to occur when you’re working with a much more sophisticated buyer with a well defined M&A strategy as well as most private equity firms.

Here is what McKinsey has to say regarding M&A strategies for insurance.

For companies considering acquisitions, an M&A blueprint should target specific growth themes and boundary conditions that reflect a comprehensive self-assessment of a company’s competitive advantages as well as the compelling strategy requirements for its business model that make it well suited to pursue M&A in a specific area. For example, a personal lines P&C carrier’s corporate strategy included enhancing customer growth through a digital engagement platform. Confident in the company’s ability to rapidly scale new businesses, managers decided that a program of M&A to acquire the various components of an integrated, direct-to-consumer platform would be the best way to accelerate domestic growth and support international expansion.

Moral of the story, make sure you have your value proposition organized so you can tell the most compelling story to your potential buyers who likely know exactly what they are looking to acquire.

Who is buying insurance books of business?

The typical types of groups you can expect to deal with when selling your insurance agency or listing your insurance book of business for sale are as follows:

- Larger FMOs with a focus on Medicare agent and Medicare sales growth.

- Competing insurance agency

- Private equity firms

- Venture capitalists

- Insurance company. For example, Aetna and Humana are two insurance companies that have been known to make M&A transactions over the years.

Next Steps to Learn How to Sell Your Insurance Agency

The Redbird M&A team talks with the following types of independent insurance agents and independent insurance agencies every week about the potential for selling their agency or specific block of business.

- Medicare Advantage and Medicare Supplements.

- Life Insurance

- Commercial Insurance

- Auto Insurance

The most impactful thing you can do is simply raise your hand, ask questions, and make sure you’re visible and part of the discussions when companies are discussing potential new M&A opportunities. Let people know you’re interested in selling so they keep your agency top of mind. We meet with interested buyers all the time!

Minimum qualifications

If you’re considering putting your insurance agency for sale, we’re seeing different categories of buyers in the current market, but they all seem to be based on the following minimum EBITDA amounts.

- $100-$250K

- $500K

- $1M

- Acceptable retention rate and loss ratios.

Clearly, the larger multiples are for those $1M or greater, but there is definitely an appetite for the smaller agencies $500k or less and the valuation methods are very similar.

We are seeing a lot of independent agent’s receive year-over-year acquisition deals for their book of business, which is one of the more interesting models we’ve helped with over the years. It provides upfront funding and ongoing support for growth vs. a typical earn out model which a lot of agent’s can’t qualify for.

If you’re interested in learning what your agency or book of business is worth, we invite you to schedule a time with a consultant on our mergers and acquisitions team to discuss the process and and current acquisition opportunities.