Selling life insurance to business owners is a great way to increase your average premium per sale and if you’re lucky enough to have an existing commercial P&C book of business, rounding out your accounts has never been easier!

By the end of this article you will see the massive opportunity selling life insurance to business owners holds for your business, be able to explain the role life insurance plays in funding a buy-sell agreement and, most importantly, show that you are the best insurance agent for buy-sell agreements.

Understanding business succession planning is vital for an insurance agent to make more life insurance sales. If you’re new to selling life insurance, we’ll help you gain the confidence to start having the educated discussions with business clients. If you’re already a seasoned pro and want to help mentor new insurance agents with your infinite knowledge and wisdom, click here and we can chat about joining our expert panel.

Your clients already know and trust you, so you’ve already overcome the toughest part of the insurance sales process. Plus, your clients depend on you to educate and guide them to best protect their business, and that requires dedication to continuing education on your part. Learning how business owners use life insurance is a sure fire way to put you in the position for better conversations, writing bigger deals and earning top life insurance commissions!

How Business Owners Use Life Insurance

Before we dive into the guts of funding a buy-sell agreement, I want you to be aware of how business owners use life insurance in their succession plans. In addition to buy-sell agreements, there are several important ways life insurance is used in business which we will discuss in detail in future posts.

- Buy-sell agreements

- Key man protection

- Executive deferred compensation plans

- Company owned life insurance and premium financing

- Securing refinancing of Small Business Administration (SBA) loans

What is a Life Insurance Buy-Sell Agreement?

Buy-sell agreements facilitate the sale and purchase of a business upon a specified event. Events that often trigger the sale of a business include death, disability or retirement of an owner. Triggering events for Buy-sell agreements execution is the death of the owner or key partner.

A buy-sell will define who gets what share of the business and for how much, and guarantees the buyer a predetermined price based on a company valuation. Another benefit of having a buy-sell agreement is creditors will likely be easier to work with when they see a business has the proper protection in place to make loan decisions easier. Last, and not unimportant, is a buy-sell allows the purchase of the share of the business from the beneficiary of the policy’s surviving estate.

The buy-sell should be drafted by the business owner’s attorney and reviewed by their CPA. Upon approval, your role will be making sure they are properly funding the agreement with life insurance.

There are many compelling reasons to start talking about life insurance with business owners. Whether you have a natural network of business owners or a strong commercial book of business, if you’re not offering life insurance to them, someone else is!

Four Types of buy-sell agreement funding solutions

Below are the four most common ways business owners fund buy-sell agreements:

- Life Insurance: Life insurance payout will be available and distributed exactly the way the co-owners intended to ensure future success of the business. The life insurance company will require details of the buy-sell agreement when your financial professional submits the application.

- Take out a loan: Loans can be used to purchase the business upon death of the owner or partner. This requires borrowing the purchase price while using future business profits to repay the loan and any associated interest.

- Installments: Sometimes installment purchase plans are put in place after the owner’s death, which can create financial strain on the business. Also, payments to the deceased owner’s estate depend solely on the success of the business.

- Cash isn’t always king: The purchasing partner could use cash to purchase the business. This can take many years and isn’t always the best use of cash reserves and not always available if the purchase of the business needs to happen quickly.

Knowing the various funding mechanisms for buy-sells will position you to win the business and get more life insurance referrals. Take the time, do your research and position yourself to educate business owners how they can use life insurance.

Five Reasons Business Owners Should Have a Buy-Sell in Place

- Control the disposition of business: It’s important for an owner to have the peace of mind they have put the right tools in place to ensure the success of their business after they are gone.

- Guarantee a buyer: When planned in advanced the owner knows with certainty the buyer is in place and there won’t be questions on getting the funding secured.

- Predetermined Price: Having a predetermined price eliminates the stress of negotiations that occur when an owner passes away with no succession planning, otherwise it will be based on fair market value.

- Tax relief: If the death benefit is equal to the market value of the decedent’s portion of the business, there is no taxable gain for federal income tax purposes. And, if certain requirements are met, the predetermined price in the buy-sell agreement will fix the value of the business for federal estate tax. You should always seek the advice of a tax advisor to confirm tax implications for any business or estate planning.

- Fairly treat non-business family members: Having the details hammered out ahead of time ensures the family is taken care of and not put in a compromising position.

Using life insurance to address business succession planning can also help with employee retention and provide tax advantages to the business when using cash value from a permanent life insurance policy.

Your financial professional should know how to pivot the discussion based on your needs as a business owner.

Buy-sell considerations for business owners.

In order to really understand the buy-sell discussion, they should be asking themselves the following questions.

- What would you do if you lost a key partner? Do you want to go into business with their spouse? Can you hire a replacement? How quickly can you find a replacement and at what cost?

- Do you have sufficient cash reserves to buy out the deceased owner’s share?

- Does your retirement plan reflect the sale of your business?

- If you died today, what would the consequences be to your business, business partners, subsidiaries, employees, customers, debtors, creditors and most importantly, your family?

These concerns can be solved by using life insurance to fund your buy-sell agreement.

Without a business continuation strategy in place, survivors, including family members, remaining owners and employees, may be left with many issues and problems to deal with after the business owner’s death. Some of these issues include the following:

- Surviving business owners may want to reinvest profits while the deceased owner’s estate wants annuity payments. Stock redemption needs to be clearly laid out.

- Creditors may question the company’s business interest and ability to maintain the level of profitability necessary to service loan obligations.

- There may be no established market for the business and the estate may not be able to secure the fair market price of the business.

- Family is losing income.

- Owners forced to finance the buyout over a term of years with after-tax dollars during a time in which the company has experienced a substantial financial loss of a key person.

Two Ways to Structure Buy-Sell Agreements

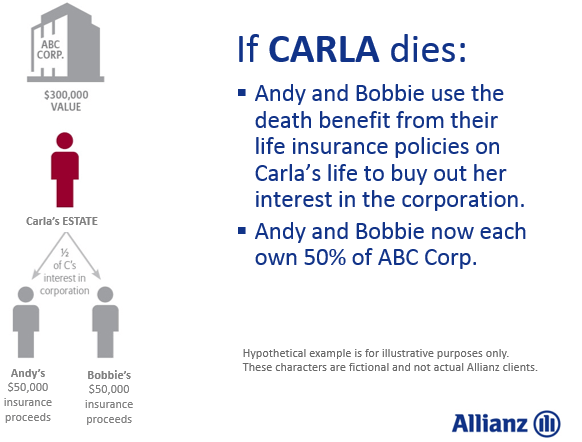

Cross-Purchase Buy-Sell (Personally Owned)

Cross purchase agreements are between the various business owners and address each owner’s interest in the business. For example, if you are working with three business owners with equal ownership, each business owner would own life insurance policies on the other two partners.

Below is an easy way to figure out how many life insurance policies you need to write in order to fund a cross-purchase agreement. As you can see from the example above, there are six life insurance policies needed for this cross-purchase plan scenario.

Below is an easy way to figure out how many life insurance policies you need to write in order to fund a cross-purchase buy-sell agreement. As you can see from the example above, there are six life insurance policies needed for this scenario.

N (Number of Partners) x (N-1)

Example N=3

3 * (3-1) = 6

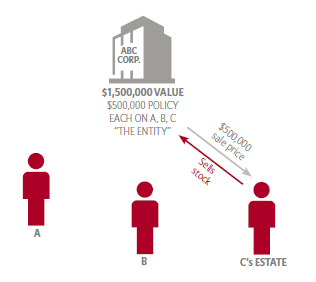

Entity Purchase Buy-Sell (Business Owned)

Entity purchase is the most common and cost effective way business owners fund buy-sell agreements.

In an entity purchase agreement the business (surviving owners) is the owner and beneficiary of the life insurance policy in order to buy out ownership from the deceased owner’s estate.

The example below shows how the company owns life policies on each of the three owners (A, B and C), and uses the life insurance proceeds to purchase back ownership of owner C’s estate upon death.

Fact Finding Questions to Generate More Buy-Sell Sales

Hopefully you’re starting to see how buy-sell agreements should have a place in your agency’s services offered. Below are some key questions to ask business owners to sell more life insurance.

- Type of Business: What type of business entity? Sole proprietor, Partnership, S corporation, etc.

- Ownership: Who owns the business? How many owners and what are their percentages of ownership?

- Management / Key Employees: Who manages the day-to-day operations of the business? Who are the key players that keep the business moving? What are their ages, duties and titles? How much revenue are they responsible for bringing into the business today? What would it cost to replace them?

- Business Continuation: What should happen when the current owner retires or passes away? How many employees would it take to replace the current owners? What is the average replacement salary that would be paid to replacement employees? Do you have a continuation plan in place?

- Business Advisors: Who are the key business advisors? Do you have a strong relationship with your attorney, CPA, etc.

- Business Value: What is the current value of the business and when was the most recent appraisal completed? If you sold today, how much would you ask?

Conclusion

If you want to write more buy-sell agreements, you need to make sure you’re educated and ready to have those discussions.

Study your fact finders, read blogs, scour YouTube, ask your up line, sign up for training, find a mentor, do whatever you can to put yourself in the best position to succeed.

Master the questions to ask when selling life insurance to business owners.

Immerse yourself in knowledge and become the freaking expert!