If you’re looking for help with your insurance website, you have come to the right place.

Why Redbird vs. other insurance website builders?

Because we’re experts in the insurance industry (practice what we preach), we know what it takes to rank, and can show you exactly how to generate leads online for the insurance products your agency is selling. Its not just about creating beautiful websites, it’s about driving performance and ease of use.

Two simple options to start working with us, choose one.

- Your current site is under performing or out of date: Complete the audit request form below.

- Need a new website for your agency: Click Here

Auditing your existing insurance website is the first step we take to help you understand how to rank on google and generate leads online.

For a limited time, we’re giving away a FREE insurance website audit and FREE consultation (retail value over $300)!

Request an Audit ($300 value for $0)

Let’s get started!

"*" indicates required fields

How this FREE audit thing works…

- You complete the short form above.

- Redbird will generate your audit report, email you a copy, and schedule your FREE consultation.

- Review your results, conduct a live Q&A, and learn how to start generating leads online.

Three things you will learn from the FREE consultation…

- How to increase your website traffic without writing any new content.

- How to improve your search rankings without paying Google.

- What it takes to outrank your local competitors.

Insurance Websites Should Generate Leads

Most independent insurance agencies tell us their website is somewhere between “life support” and “flat lining” when it comes to generating leads. The homepage looks great but isn’t doing the job.

And, they don’t know where to start to make improvements.

There are many resources online that can build insurance websites (you’ve probably already searched), but which one is right for you? Who can you trust to technically do it right? And, who can you trust to develop the content?

Some will even do all this for free but, you guessed it, there’s a catch (well, there are two):

1. They probably understand what’s under the Internet’s “hood,” but they speak a language you’ve never heard (and generally don’t need to learn).

2. They know nothing about insurance.

Would you hire a Ford mechanic to fix your Ferrari?

Four years ago, Redbird began a journey to become digitally relevant… to use the Internet as a competitive differentiator. Today, not only does our website generate all the leads we can use, our lead numbers increase every single month (check us out at redbirdagents.com)!

And, after four years of building our lead generation capabilities bit by bit, we now help other insurance agencies do the same. This article gives you a look under the Redbird hood, and what you’ll find are capabilities in one place to help you turn your “Ford” into a Ferrari.

And, if you don’t like our “Ferrari”, then we’ll help you find a model that works for you.

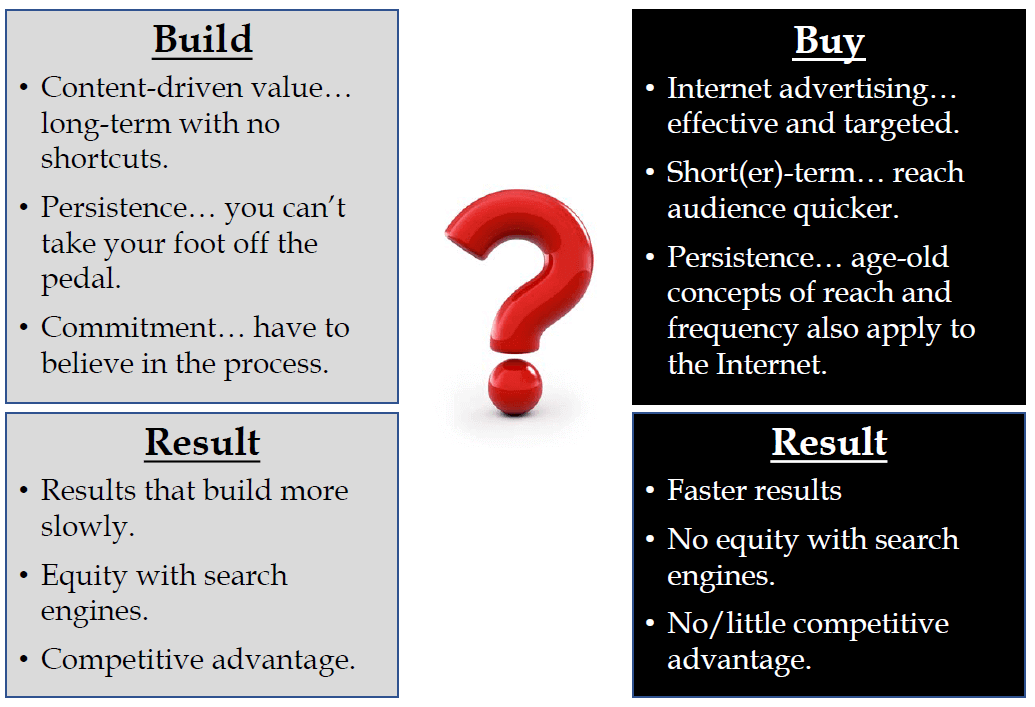

You have two options when it comes to generating leads online: build or buy?

Redbird chose not to pick one: we chose both. But, at the heart of our strategy is a “build” mentality. We believe—and it’s what we tell every client—competitive advantage comes from building content-focused capabilities. It’s hard, but the rewards are great because the vast majority of your competitors will choose not to take that approach.

They will pick “buy”. Why? Because it’s easier.

We have nothing against easy, but buying leads by itself builds no foundation. You have no control of your environment. If someone comes out with a better mousetrap—a better ad or a better program—there’s nothing you can do, but keep spending more and hope your message and your program can compete.

We chose the harder, longer-term strategy because, four years ago, we envisioned we would be in a competitive position like we are today. We didn’t know how long it would take, but we knew it was the right approach.

Today, we continue to invest in building our content-driven capabilities, and we augment our valuable content with highly-targeted Internet ads.

One of my favorite quotes about marketing and advertising is from John Wanamaker back in the early 1900s:

“Half the money I spend on advertising is wasted; the trouble is I don’t know which half.”

Redbird knows exactly what we get from our Internet investment today. You can, too.

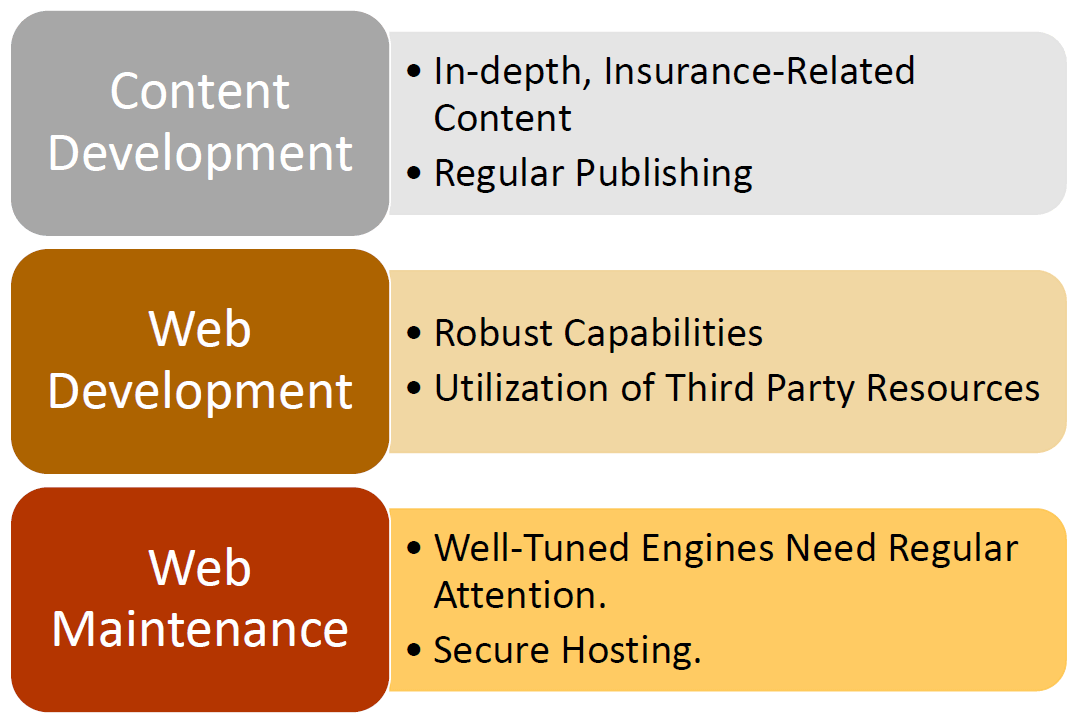

Three Pillars of Great Insurance Website Designs

There is nothing fancy nor particularly mysterious about building successful insurance websites, the secret is the lead generation capability.

Some insurance services are really hard to rank for.

We didn’t say it was easy. Our approach starts with a sound foundation—your website—and is topped off with a robust content-driven program that, over time, can establish you and your business as insurance experts in the eyes of Google and other search engines.

And, when Google decides you know what you’re talking about, now you’re on to something competitors can’t match. Here’s how it’s done:

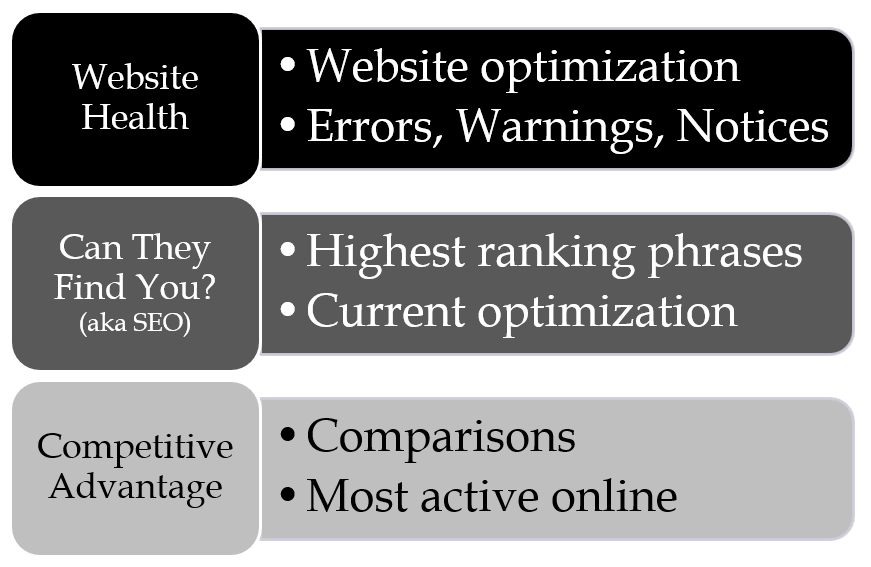

Website Audit is Where You Start

This assumes you already have a website for your insurance agency. If you do, perfect! If not, contact us and we can help you figure it out.

Like a car, your website needs a well-tuned, reliable engine. If one cylinder is off, the car performs poorly.

Our audit addresses three key components to give you a high-level view of how close—or how far—away you are from being ready to build your capabilities.

Two of our more recent audits of insurance agencies provide quite a contrast into the range of capabilities across the market:

| Website Audit Comparison (Property and Casualty Agencies) | Client 1 | Client 2 |

| Errors and Warnings | 127 | 6,749 |

| Mobile-Friendly Platform | Partial | Non-Existent |

| Clicks/Month in Top 25 Search Categories (in Their Markets) | 51,000 | 180,000 |

| Number of Page 1 rankings in Top 25 Search Categories | 0 | 0 |

| Customer Reviews 2017 | 0 | 0 |

We were lucky that, in both cases, the clients knew going in that their reports wouldn’t be pretty. Client 1 was clearly superior from the standpoint of website maintenance. Client 2’s website was, well, a disaster. In both cases, the clients needed significant work on their websites.

Bottom line, however: neither client was within a country mile of being relevant to Google for insurance related search terms. The only terms in which either client ranked were those where the client’s name was in the search.

Said another way: our clients only appeared in searches by people looking specifically for these clients. Otherwise, they don’t exist to the rest of the population who is shopping for insurance quotes online.

I’ll say it again: these clients don’t exist when it comes to searching on the Internet.

Sobering.

It was for them, too.

Our website audits don’t take much time, but provide a meaningful look at how close or far away you are from ranking and generating leads.

The next section is a semi deep-dive into the types of insurance websites. This is important because you will need to decide what you want to be before you can build/re-build your website.

Guide to Insurance Websites

Insurance websites are like anything else, complex if they aren’t something you spend time with. Think about it, if you’re focused on selling insurance, you don’t have time to be well versed in website design and development, or SEO marketing and plugins.

You leave that to the experts, right?

Unfortunately, the “expert” web developers that most insurance agencies use can do little more than clean up your current site and make sure it is secure and won’t crash. No doubt, a secure website is critical, but that’s just the ante to the game you want to play.

You want a website that attracts new customers (and, doesn’t crash).

Here’s some good news: most insurance agencies do exactly what we just described and then a year later wonder why their website isn’t generating leads.

The reason is simple: It’s because their expert “Internet guy” doesn’t know the first thing about insurance.

We Understand SEO and We Know Insurance Inside and Out as it stands today, and continue to evolve with the daily changes.

Redbird understands websites and we understand insurance. No, let’s be more specific: we know how to generate insurance leads with insurance websites, which makes us the best resource to build your insurance website.

This guide is going to walk you through the important elements of great insurance websites.

- Types of insurance websites

- Must-have elements of an effective insurance agency website

- Definitions (it’s critical you understand the building blocks to generate insurance leads, no matter what kind of agency you own)

These are the most common types of insurance websites we work with:

- Life Insurance Websites

- Health Insurance Websites

- Home and Auto Websites

- Commercial Insurance Websites

Let’s start with the basics.

Types of Insurance Websites

Depending on what type of insurance policy you are selling, there are two common types of insurance websites:

Traditional Insurance Agency Websites

Insurance agency websites are most often for independent agencies and offer basic information about the agency and bios of the agents. They are typically simple and light on content; built more for credibility than for anything else (we used to call them “brochures on the web”. Unfortunately, credibility is the last thing they accomplish with these flimsy sites.

Most are built from templates not designed for lead generation. But, they are what the experts (who know nothing about insurance) use because it’s what they know. What the unsuspecting agency owner is left with is a car with a new engine, but no steering wheel.

When we run across these types of websites they often have been neglected, whether it is poor maintenance and security or lack of content development. We recently conducted a website for a large property and casualty agency and found more than 3,000 errors.

Yes, that’s a lot.

In this scenario it’s almost always better to scrap what they have and build a new website from scratch that is designed specifically to do what they want: generate insurance leads. Nine times out of 10 it’s much easier to build a new website than to have a developer make adjustments to an existing template that likely wasn’t created for lead generation.

Insurance Comparison Websites

Insurance comparison websites capture consumer data and generate leads for agents. For example, a consumer searches for “life insurance quotes” and ends up on a website with content related to life insurance. Within that page the consumer will have an opportunity to request a life insurance quote from various insurers.

At that point, they will see a variety of life insurance companies to choose from. Upon their choice, the data (often filtered by zip code) is sent to the agent who is purchasing that lead.

There are many great insurance websites that can generate various types of insurance leads such as life insurance, auto insurance, homeowner’s insurance, health insurance, Medicare supplements, etc. Websites to check car insurance rates are currently among the most competitive insurance websites.

We always encourage our clients to look at the insurance websites that rank at the top of Google and document the elements of their site, as they are clearly doing something to rank in such a highly competitive category.

Elements of the Best Insurance Agency Websites

Creating insurance websites for agencies takes planning, structure and a strong knowledge of the insurance business. Off the shelf is great, but personalized is always best.

Below are the basic pages you need to make sure your website includes if you want to generate leads online.

About Us

An About Us page tells your reader who you are, and it’s often the website page that is given the least amount of attention. Remember, you never get a second chance to make a great first impression. When someone lands on your website, they almost always review the About Us section, so you want to make sure and take advantage of that to communicate why you’re the best agent for them to work with.

Services

This is your opportunity to tell your website visitor the areas of insurance in which you are an expert. Unfortunately, this is where so many insurance agency websites fall short. Your goal should be to figuratively punch your visitors in the nose with the list of services, both those which are your bread and butter and those that you are capable of writing. It’s important that you always list your core services at the top of the list and use benefit-oriented content that resonates with your readers.

There is nothing worse than going to an insurance agency website and seeing it flooded with industry terms. They might as well be speaking Chinese to the average insurance client.

Insurance Quotes

Do you have an insurance quote widget on your website? No. Big mistake. What do I mean by widget? A simple form that allows a consumer to choose the product they need and run a quote directly from your website.

There are plenty of insurance quote software programs you can plug into your website with very little technical experience. If you plan on doing this, you’ll need to make sure you have the application program interface (API) feeds from the data vendor that is providing the quotes. Using API will make life insurance lead generation so much easier!

Insurance Blog

“Blog” is one of the most misunderstood and abused internet terms.

Think of a blog as your opportunity to shout your point of view to potential customers. It’s an opportunity to educate prospects on the things that worry them.

For example, if you live in Florida and coastal insurance is your specialty, you could write a blog post about the top 10 ways to save money on coastal insurance. The topics are endless.

Learn more about our tips on running a successful insurance blog here.

Not only do you have full control of the content topics, but you can repurpose the content to share on your various social media accounts.

If your website contains these four elements then you’ve taken a big step toward having an effective lead generation program.

Phone Number

Seems simple, but you would be surprised how many agencies are really hard to reach because their phone number isn’t front and center.

SSL Certificate

If you want your customers to trust you and google to give you attention, then your url needs to be secured with an SSL certificate. Any good website builder will suggest this and build it into your pricing.

Best Insurance Website Builder

This is something we hear a lot.

What is the best insurance agent website creator?

There are multiple ways to get started using an insurance agent website creator, and it all comes down to how comfortable you are using website creator software.

3 insurance agent website creator programs

- WordPress

- Wix

- Square Space

We’re convinced there are ways for you to build your own insurance agent website to generate online leads and the three options we gave above can all help you accomplish that. Personally I think wordpress is the best way to go as it provides you ultimate flexibility in creating exactly what you want.

With that said, wordpress isn’t as easy and straight forward as they make it out to be. If you’re looking for an insurance agent website creator that can turn around results fast, I would suggest contacting our team to help you get it built quickly.

Insurance Websites that Generate Leads

Learning how to generate insurance leads on your website is definitely easier said than done.

But…

It’s very doable as long as you are willing to dedicate your time to learning the process.

Learning how is simple when you follow these steps.

- Step 1: Get an insurance website with a memorable domain name.

- Step 2: Start a blog and begin writing every week to build your email marketing list. Also, offer your readers push notifications to keep engagement high.

- Step 3: Don’t stop, keep doing it, it will take time.

- Step 4: Make sure you have a high-quality lead capture form in your blog posts.

- Step 5: Offer something for your prospects to download in exchange for their contact information.

- Step 6: Follow up with your customers after they find your website online, fill out your form, and request information.

- Step 7: Make sure it’s compatible with all mobile devices.

If you want your website to help you find customers , then you have to put in the time and work. As we mentioned above, there are two ways to learn how to generate insurance leads online, buy it or build it.

The process I just mentioned is related to building it. This means content marketing, SEO, and a lot of patience. If you want to generate leads online without waiting, then you should certainly consider using a paid traffic.

What does paid traffic mean?

Paid traffic is when you go to google or any social media site and use their paid advertising platforms. You can choose the keywords you want to target, and then you’ll pay a fee for every person that clicks your advertisement.

Using Paid Traffic

Using paid traffic to generate insurance leads online is a much fast process, but you need the money to do it.

Below is a high level look at what you need to do to generate leads online.

- Step 1: Build a Landing Page

- Step 2: Do your keyword research (google keyword planner works well)

- Step 3: Determine your budget. Many people will start out with something like $100 per day for 10 days to ensure they are sticking to their budget.

- Step 4: Choose your start and end date.

- Step 5: Run your campaign

- Step 6: Get exclusive leads that you generate online.

Yes, it’s that straight forward as long as you have the resources to do it. Life insurance lead generation is one of the most competitive topics online, so you can expect to spend a good amount of money to get to generate leads online using a paid strategy.

Website Definitions Insurance Agents Should Understand

The faqs below will help you understand some common terms if you are going to get involved in the web design process with your insurance website builder.

Search Engine Optimization:

Tools and techniques that allow companies to affect the visibility of their website and its content in a web search engine’s unpaid results

Integration:

This is how your website talks to your CRM. For example, a prospect completes a lead form and the data transfers directly from your website form to your agency CRM. Make sure you let your web developer know the CRM you are using to ensure your site is equipped to integrate.

Hosting:

Websites require hosting, just like houses require lots in real estate. And the age-old term in real estate applies to websites: location, location, location. This is one element of your Internet program in which you should not try to save money. Just like there are good and bad parts of town in real estate, there are good and bad providers of hosting services. May the buyer beware.

Analytics:

This is basically your doctor telling you how healthy you are. You should periodically check in with Google Analytics for an assessment of your website’s health. Below are the critical items you can track through Google Analytics:

- How many people are visiting your insurance website

- The pages your website visitors like most

- The insurance quote forms perform the best

- The keywords (subjects) your website is ranking for and at what position (Page 1, 2, etc).

- The number of people your website is being put in front of for specific search terms (e.g. if I search “life insurance agent near me”, your site shows on the page as a choice for me to click).

Page Speed:

How quickly your page loads when a prospect opens it on a computer, phone or tablet. You’re probably just as annoyed as anyone else when you visit a website and it doesn’t load immediately. That is page speed, and the faster your page loads, the better.

Content:

The words on your pages. Pretty simple.

Conclusion

Insurance websites should be considered as big a priority as your other lead generation strategies. If you’re not taking the time now to build your foundation online, you’ll be miles behind your competition.

Remember the basics of a great insurance websites:

- About Us: Tell your story and take the time to let your clients learn about who you are as a person and an agent. This is your chance to make a great virtual first impression.

- Services Offered: Highlight your core services first, your bread and butter. Other services can follow, but make sure you’re letting your clients know exactly what you’re an expert in such as life insurance, auto insurance, etc.

- Insurance Quotes: There is nothing worse than a website that doesn’t easily give you the ability to get quotes in real time. Technology has advanced and there are many third-party companies that can provide the capabilities to allow someone to run insurance quotes directly from your website.

- Insurance Blog: This is your best shot at consistently creating valuable content for your prospects and clients. You have complete control and can repurpose your blog content to share on your various social media accounts.

Make sure your website has these elements and you’ll continue to build a strong foundation to attract new customers.

Other Services

Get Your Free Audit Now!

Let’s get started!

"*" indicates required fields