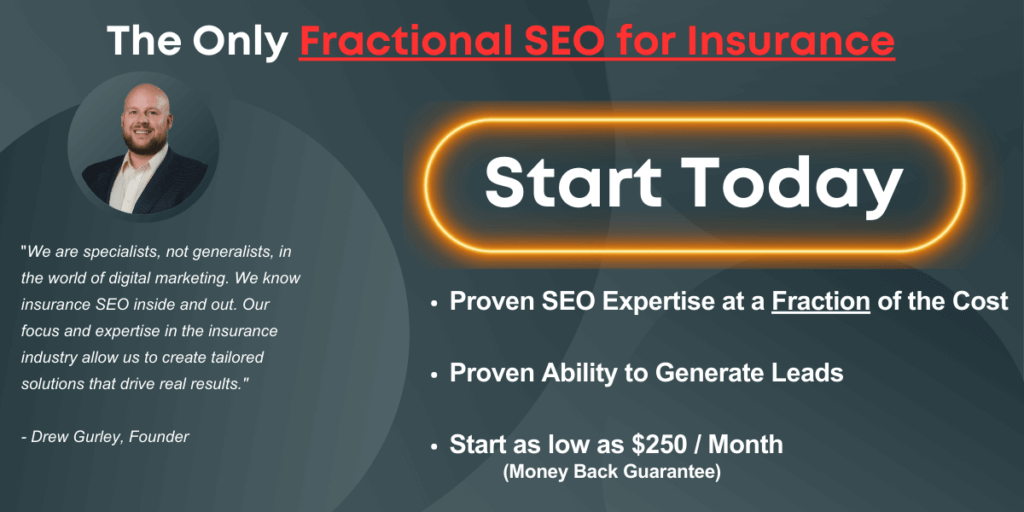

Redbird provides SEO for insurance agencies across all product verticals using a proven playbook that has produced millions in sales.

Insurance Agency SEO Services

- Search engine optimization audits (initial and ongoing).

- Content strategy.

- Content outline creation, copywriting and optimization.

- Backlink architecture and execution.

- Keyword research and editorial calendar development and implementation.

- Title tag and meta description creation, optimization, and monitoring.

- Google My Business optimization creation, optimization, and monitoring.

- Local search optimization.

- Inbound calls, leads, and revenue tracking.

- Competitor SEO and keyword monitoring.

Contact us and let’s get started

Insurance Agency Owners Shouldn’t Be Afraid to Ask for SEO Help!

If you’re an insurance agency owner, you know how important it is to have an online presence. However, you can’t be good at everything, so leave the seo strategy up to us!

The insurance business is already hard enough, don’t let SEO and online lead generation add to your frustration. Let’s be honest, you’re not supposed to know how to optimize your website for the various insurance products you offer, you’re supposed to be a product and sales expert!

That’s where Redbird is supposed to help, and SEO comes in to the discussion! In this article, we’ll discuss why SEO is important for insurance agency owners and what they can do to get the most out of their website.

You’ll be pleasantly surprised how many agencies we meet with that have a great foundation with their website and with a few small tweaks, can start turning a meaningful ROI!

Real Results

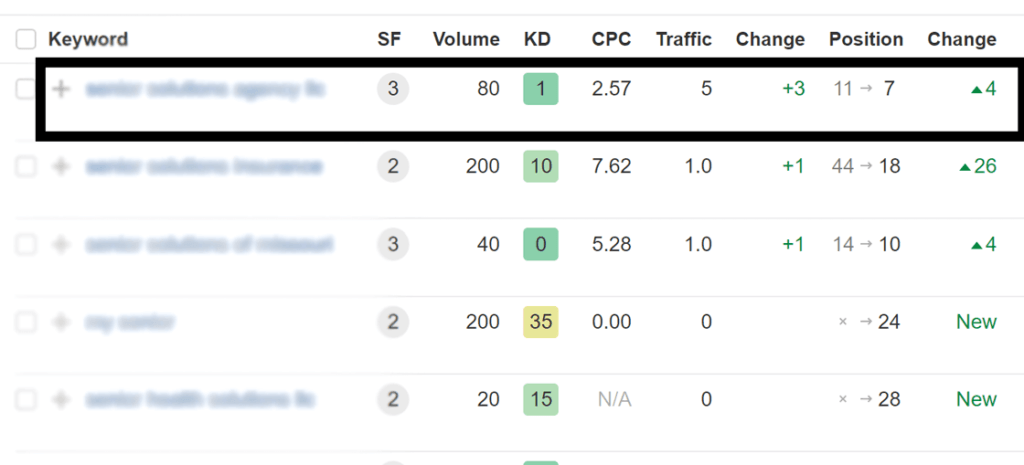

In fact, below is a screen shot from an agency we worked with recently that had an underperforming website in their local market. We did a one hour consultation with their team, made some strategic changes, and within about 4 weeks we had moved them from page 2 to page 1 of google for their local, high converting keyword!

You’ll notice the keyword volume is relatively low, but this is because we went for a local keyword. Trying to optimize nationally as a small to mid size agency is not a productive exercise, however, local search is still a vary big opportunity when paired with a strong google my business profile.

Why You Need SEO for Your Insurance Agency

SEO stands for Search Engine Optimization and it helps you make sure that your website, you, and your insurance agents show up when people search for related terms in their local market.

For example, if a customer searches “life insurance quotes” or “health insurance policy,” your website should show up near the top of the list of search results in your local area. This is because search engines like Google understand that your site has relevant information about those topics.

However, the crawlers can’t understand your site if you’re not setting it up to speak to them. This is the number one problem we find with most agency websites and can bring a lot of clarity to the process in a one-hour consultation.

SEO also helps increase visibility on other platforms like social media, insurance blogs, local directories, and citations. By optimizing your content to include keywords relevant to your insurance products, you can cast a wider net and reach more potential customers who are looking for exactly what you offer.

How You Can Leverage Insurance Agency SEO

There are plenty of resources available that can help guide you through the process of optimizing your website, but we want to share our favorites.

Here are some seo tips for insurance agencies:

- Understand your domain authority score: Document your starting domain authority (DA score) so overtime you can track the performance metrics of your content strategy. There are plenty of free sites you can check domain authority score.

- Have a keyword strategy: Research keywords related to the insurance services offered by your agency and incorporate them into content on your website (blogs posts, landing pages). Make sure these words are used naturally in sentences – don’t overstuff them! Also, pay attention to the intent of the keyword as well as the search volume. Just because a keyword has high search volume doesn’t mean it will convert into an insurance lead for you and your team. This is a key part of your digital marketing strategy.

- Content Updates are King: Update existing content regularly!! I would consider doubling down on industry statistics. This will help keep readers engaged while also boosting rankings on search engine results pages (SERPs). For Example, if you have site that focuses on life insurance reviews, then you can update the rates or underwriting classes on a consistent basis.

- Reviews: Leverage external sources such as reviews or testimonials from customers; this will give potential customers an idea of what they can expect from working with your agency. And, it’s a great way to help with local SEO, especially your google my business profile.

- Links: Create high quality backlinks by linking to and reaching out to high profile websites; this will help boost credibility and improve overall rankings. The algorithms favor sites with high-quality backlinks that help them ensure your site is reader friendly and valuable to your target audience. Backlinks continue to be a factor in search rankings.

- On page optimization: Your website content should also have clearly defined headings, titles, and meta descriptions that not only help crawlers understand your site, but allow you to use sales language to increase you click through rates from searchers which ultimately will boost your website traffic and potential clients. These are good examples of on page seo tactics. There are many other ranking factors besides these, but these are often the most common we see missing when reviewing insurance agency websites. This is extra important considering how competitive lead generation is in the insurance industry is with online search rankings, especially for auto insurance directly from insurance companies. Nearly 10 times out of 10 they will outspend your budget, so you must get scrappy and own your local search market.

- The good ole NAP: Make sure your name, address, and phone number (NAP) on your insurance agency match exactly what you have listed in your business profile on search engines such as google, bing, and even review sites like yelp. Having your NAP match exactly helps with google search rankings and other search engines for local search.

- Analytics: Monitor analytics regularly so that you can track your web pages progress over time and make adjustments as needed, especially in your local market. Finally, don’t be afraid to ask for help from professionals who specialize in digital marketing and SEO! Many agencies offer comprehensive packages that include keyword research, content marketing, link building, google analytics tracking- all tailored specifically for insurance agencies. Working with an experienced partner like Redbird can ensure success by increasing online visibility by driving more traffic to your website through quality content and improving your ROI.

Conclusion:

As an insurance agency owner, it’s important to have a strong online presence so that customers can easily find the services/products that you offer. If you don’t understand this side of the business, hire someone and tie their work to performance to ensure you are getting an ROI. Good firms won’t have an issue with that type of arrangement.

Utilizing SEO strategies such as keyword research, copywriting, and link building can help ensure that your site appears at the top of search engine results pages (SERPs) when customers are searching for related terms or services – thereby increasing visibility among potential customers while boosting ROI in the long run too! Free leads are the outcome of organic traffic, but it takes time, thought, creativity, and subject matter expertise.

If you feel overwhelmed trying to tackle SEO alone, Redbird has plenty of seo services for insurance agencies and insurance marketing resources available to help guide you through the process, so don’t be afraid to reach out! With a little bit of effort on both ends (yours + ours), success is just around the corner!