In the midst of a housing boom we’re finding that life insurance isn’t keeping up.

Truth is, well before the housing market started consuming high octane fuel in early 2017, the life insurance industry was happily stumbling along at its own pace, both ignorant of the seismic societal change around us, and of the growing gap of people who know they need life insurance but can’t seem to find someone they trust.

That’s a mouthful. If you’re interested in a quick read on what we see around the corner, check out my point of view on the coming life insurance disruption.

So, what about this housing boom and selling mortgage protection insurance (MPI)?

Don’t Forget To Check Out Our Ultimate Guide to Selling Mortgage Protection Insurance! [CLICK HERE]

There are some both alarming and amazing facts to consider about this insurance sales opportunity.

This is a really good story, and a really good opportunity if you’re looking to either get into life insurance, or looking to expand into new markets such as mortgage protection insurance.

Life Insurance Sales Stats Drive Action

The Market is Screaming for Help and No One’s Listening

Let’s start at the beginning. Mortgage protection insurance is term insurance coverage to pay off a mortgage in the event of death or disability of the primary wage earner.

The scenario is simple: your client has a 30-year, $325,000 home loan, with an outstanding balance of $315,000. They have 28 years left before it is paid off. You sell them a 30-year term life insurance policy with a $315,000 death benefit to match the current mortgage balance. In the event of a disability or death of the policyholder, the policy pays off the outstanding balance.

Here’s what we think and the stats that should get you excited.

How Much Can I Really Make Selling Mortgage Protection? Use This Simple Estimator and Find Out!

LIMRA Life Insurance Fact 1

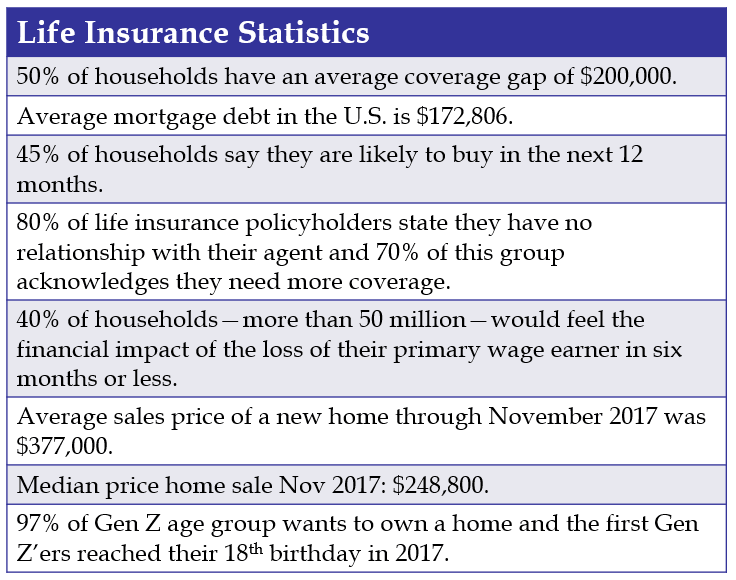

50% of households have an average life insurance coverage gap of $200,000.

Our Thoughts: LIMRA’s data does not conclude why there is such a significant gap, but the following data certainly begins to help us draw some conclusions (and set up the opportunity for those looking for an opening).

LIMRA Life Insurance Fact 2

Average mortgage debt in the U.S. is $172,806.

Our Thoughts: Other than covering lost income from the primary wage earner, there is no greater risk to a surviving family than mortgage debt. Losing a home can send a family in a spiral it can’t recover from.

LIMRA Life Insurance Fact 3

40% of U.S. households would feel the financial impact of the loss of their primary wage earner in six months or less.

Our Thoughts: While economic times for many have improved since the debacle of 2008, there are still millions of households living month to month, one misstep or two away from disaster.

There’s Gold in Them Thar Trees with Mortgage Protection Insurance

Here’s where the rubber meets the road, and where our industry appears to have lost touch with the market.

LIMRA Life Insurance Fact 4

80% of life insurance policyholders state they have no relationship with their agent and 70% of this group acknowledges they need more coverage.

Hello! Buehler?!

We see two broad causes for this:

- Insurance agents are lazy. That doesn’t mean there aren’t many capable and qualified agents, because there are. But, the data screams that we need more, better agents to meet demand.

- Agents chase the forest rather than the trees. There are millions of shiny objects in the forest, and from our experience that’s where most agents flock. It’s simply easier, but not better. We think the gold is in the trees.

And, that gold is selling mortgage protection insurance.

Not long ago we published a highly-detailed guide on every aspect a career in mortgage protection, and we’ve received amazing feedback and response (obviously not all of you are ignorant of what’s going on around you).

So what’s my suggestion after all of this?

Get off your tail and go to work…and of course read through the selling guide first!

If you want to talk with someone about more ways to help you improve your insurance sales, feel free to email us your questions, we would love to connect.

Independent Agent? Want To Learn About Our Limited Time Direct Mail Leads as Low as $9 Per Lead?