Woman’s Life is one of the best kept secrets for many independent agents, and guess what? It’s not just for women, but they do have an incredible story that will resonate with your clients.

Below is some information to bring you up to speed on their products and why we think Woman’s Life is a product you should be offering your clients.

Woman’s Life at A Glance

- Founded in 1892

- Non-Profit fraternal benefit society 501-(c)8

- Diversified and conservative investment portfolio, consisting primarily of government and corporate bonds

- 3rd highest Solvency Ratio in the industry at 111%

- Zero Debt

- Very strong reserves

Why Agents contract with Woman’s Life Insurance

Getting appointed with Woman’s Life Insurance Society is a no brainer.

- Contracting is lightening fast! 48 hours or less!

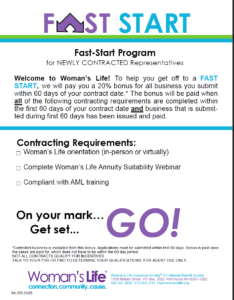

- Fast Start Program – 20% bonus on all new business submitted in first 60 days of contract

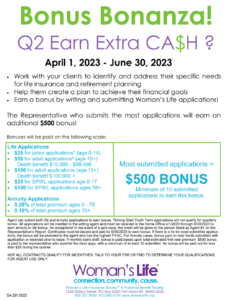

- Quarterly incentive – This changes every quarter (icing on the cake)

- Deferred Compensation – match of 100% up to 5% of deferred commissions during first year

- Field Support – regular product training and webinars, personal field service representatives, internal ordering of underwriting requirements, quality marketing materials

- Incentive trips – one of the lowest trip qualifications in the industry (starting at $12,000 in first year commissions and you and your spouse qualify!)

Agent Fast-Start Program & Quarterly Incentive

Getting started is super easy and they reward you for doing your job.

Agents newly contracted with Woman’s Life will receive a 20% bonus for ALL submitted life business within the first 60 days of their contract effective date, regardless of when the business is issued or paid. For example, if an agent submits an application on the 59th day after becoming appointed with Woman’s Life and the case issues and pays sometime after 60 days, the 20% is still paid to the writing agent.

This is great as many other carriers hold agents hostage to a timeline for cases to be issued and paid.

It’s a great program!

Ready to Get Appointed with Woman’s Life?

Woman’s Life Insurance

Term Life

10-Year Term:

- Auto renewable and convertible

- Competitive rates for ages 18 – 65

- Face amounts of $50,000 to $2,000,000

- Fully underwritten product

20-Year Term:

- Non-Renewable and Convertible

- Competitive rates for people ages 18 – 50

- Face amounts of $50,000 to $2,000,000

- Fully underwritten product

Woman’s Life term products allow for level premiums for up to 20 years which can be attractive to your slightly older client.

Whole Life

Intuitions WL:

- Level premiums and death benefit

- Cash value accumulation

- Guaranteed death benefit and premiums

- Competitive rates for ages 0 – 80

- Face amounts from $10,000 up to $2,000,000

- Various underwriting requirements based on face amount and age

Intuitions whole life is a great product and with face amounts as low as $10,000, it’s a great burial insurance solution.

Intuitions 20-Year Pay WL:

- Cash Value accumulation

- Guaranteed death benefit and level premiums for 20 years

- Paid up insurance after 20 years

- Competitive rates for ages 0 – 80

- Face amounts from $10,000 up to $2,000,000

- Various underwriting requirements based on face amount and age

Intuitions Single Premium WL:

- Cash Value accumulation

- Guaranteed death benefit and premiums

- Competitive rates for ages 0 – 80

- Face amounts from $10,000 up to $2,000,000

- Various underwriting requirements based on face amount and age

Woman’s Life Annuity Products

Product Portfolio Deferred Annuity

- Flexible and single premium options

- Locked Interest rate for one year, renewal at current rate

- 1st year bonus rate of 1.5%

- Issue ages 0 – 85

- Various minimum deposit to maximum of $500,000 deposit

- 10% annual withdrawls without penalty

- Nursing home and terminal illness waiver available

New Money Portfolio Deferred Annuity

Intuitions Five:

- Single Premium option

- Locked Interest rate for first 5 years, annual renewal at current rate

- Competitive with Bank CD market

- Issue ages 0 – 85

- Minimum deposit of $10,000 up to a maximum of $500,000

Intuitions Flex:

- Flexible Premium option

- Locked Interest rate for 1st year

- Issue ages 0 – 85

- Minimum deposit of $500 up to a maximum of $500,000

Woman’s Life for Children

Woman’s Life offers some of the best rates on their whole life products for children. Grandparents will find these policies attractive to gift to new parents or to simply add on to their own whole life policy.

About Woman’s Life

Woman’s Life Insurance Society (WL) was one of the first organizations to offer life insurance to women – thanks to founder Bina West Miller. Miller laid the foundation for the society more than 125 years ago. Although Woman’s Life serves the financial needs of all genders, the name has remained true to the founder’s values and goals.

As a young school teacher, Miller recognized the need for woman to have financial protection. Her leadership and knowledge led the organization to the use of reserve funds and actuarial tables in 1900 – a revolutionary idea for the industry at the time. The conservative investment approach of Woman’s Life shielded it from the blows of the Great Depression and other recessions. The same conservative approach continues to protect the members of Woman’s Life today.

Client Benefits of Membership with WL

- Discount Programs

- Woman’s Leadership Development Programs

- Good Health Benefits:

- Breast Cancer Screening (pays up to $50 annually)

- Colon Cancer Screening (pays up to $50 annually)

- Annual Physical Good Health Benefits (pays up to $50 annually)

- Scholarship Opportunities ($1,000 per year up to four years for under grad programs)

Woman’s Life Agent Login

Contracted agents can access product descriptions, training and support information through the Woman’s Life agent login link listed below.