We all have clients who want us to tell them when the bull market is out of steam. Many have money in places that make them nervous.

A recent article in Market Watch by writer Howard Gold identified four headwinds he believes will slow down the markets.

He made sure to point out that they are headwinds, not typhoons. A combination of slowly rising interest rates, a strong dollar, unimpressive corporate earnings for the rest of this year and the U.S. government’s annual inability to manage its own house combine to set us up for the correction “experts” have been talking about for 18 months. That’s a vote for the bears.

Mergers and acquisition activity is on fire according to the Wall Street Journal. At its current pace, 2015 will end as the second-biggest year in history after, you guessed it, 2007. Fifteen deals proposed or announced this year are valued at more than $10 billion, the highest such number on record, according to Dealogic. This is one for the bulls.

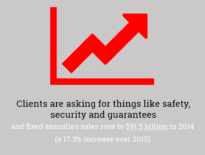

While we’re by no means investment advisors, we are investors and the memories from 2007-2008 aren’t that far back in our rear view mirror. Many clients are looking for safe places to land and fixed annuities are my pick.

Get Your Updated Copy of Annuity Rates

Here are three compelling reasons:

Release the Stress of the Markets

A fixed annuity guarantees the client will get all their principal investment back at the end of the term plus a minimal amount of growth.

As long as they follow the rules they will never lose their investment.

With a variable annuity there’s the risk of losing the principal because the base product performance is predicated on market-based accounts that will move up and down. And, a variable annuity is also going to be a more expensive product because of the fees.

Alternative to Pension Plans

Many agents overlook the fact that annuities can serve as an alternative to traditional pension planning.

Almost half of all pension plans today are underfunded, so there’s the real risk a pension plan might not be able to meet its obligations to the client.

Find out how much money is going to be guaranteed from the client’s pension plan and then compare that to the guarantee with a fixed annuity.

You’ll be surprised how often annuities are a sound choice.

Pick the Best Annuity Companies

Know the insurance company you’re dealing with and how they invest their money.

Annuity companies make money just like the rest of us by finding investments that fit their strategy. Make sure the annuity carrier you pick is the right fit for your client’s strategy.

We focus on three options that provide safety, security and guarantees not provided with market-based products:

- Fixed Indexed Annuities (FIA)

- Multi-Year Guaranteed Annuities (MYGA)

- Single Premium Immediate Annuities (SPIA)

The magic with selling annuities is not the product… it’s the questions that drive the discussion to that end. Ask the hard questions about needs and experiences. It will be a paradigm shift for many clients, but one that will be eye opening for most.

Related Articles

- Ultimate Guide to Selling Fixed Annuities

- Q&A: Digging Under the Hood of Fixed Annuities

- 3 Common Annuity Sales Scenarios

Get Your Updated Copy of Annuity Rates