Obama care continues to shake up the health insurance market and more agents are looking for other ways to recover their lost health insurance commissions and support their clients suffering from “high deductible” syndrome!

If you’ve spent any time on this site, you’ll know how passionate I am about cross selling.

Whether it’s cross selling life insurance or cross selling accident insurance, cross selling is what separates the good agents from the top producers.

And, one of the easiest products to cross sell is accident insurance, especially if you already have relationships with your existing customers.

What is Accident Insurance?

Accident insurance is an affordable insurance policy that pays a pre-determined amount of benefit to your client when they suffer an accident.

For example, a child breaks their leg at the playground. Their accident insurance policy kicks in and pays cash benefits at nearly every step of the treatment process. This could include ambulance ride, x-rays, surgery, follow up visits, etc.

Accident Insurance at a Glance

- Accident Insurance benefits paid directly to you regardless if you have health insurance or not.

- Benefits never paid to the insurance company or medical facility

- No lifetime limitations

- Accident insurance claims do not cause rate increases

- No health questions for accident insurance

- Everyone qualifies

- Accident insurance is cheap!

How Does Accident Insurance Work?

Check out the 4 scenarios below and learn how accident insurance works.

These examples review accident insurance case studies, underwriting, commission potential, and exclusive Redbird Cash Bonus program for selling accident insurance.

- Mom Saves Family $3,710

- Firefighter Recovers $9,175 Using Accident Plan

- Florida Farmer Get’s $2,100 Back

- Dad and Son Recover $6,500

Accidents Happen Every Second of Every Day

Did you know more than 40 million people in the United States suffer from nonfatal injuries every year?

With the spike in high deductible health insurance plans, there are a lot of people needlessly spending money out of pocket for their accidents.

This article will teach you everything you need to know about accident insurance and how you can start helping your clients get enrolled immediately.

Let’s get started.

Who Buys Accident Insurance?

Accident plans are good for anyone with high deductible health insurance plans or those without health insurance at all.

Why?

Because accident plans will put cash back in their pocket at a time when their health plan isn’t covering or covering at a very low level.

However, anyone can purchase an accident plan, whether they have health insurance or not.

Are you ready to get started selling accident insurance?

Accident Insurance vs. Health Insurance

Accident insurance is a supplementary plan for individuals and families. Health insurance is NOT required to qualify for accident insurance.

Most people buy accident insurance to protect their financial liabilities of either 1) not having health insurance or 2) having a high deductible plan.

Do you need health insurance in order to buy accident insurance? Absolutely not.

Does accident insurance help offset your out of pocket expenses? Yes.

How Does Accident Insurance Pay Out?

Accident insurance plans are a type of indemnity plan which pays out directly to the insured.

For example, if you own an accident plan and take an ambulance ride, the insurance company will write you a check directly versus paying the hospital or medical facility.

This gives your client complete control of how to use the proceeds from the insurance company.

Below are some examples of the types of services and injuries many accident plans will cover and the associated payments your clients can expect to receive.

| Hospital Stay | $200-$600 per day |

| Intensive Care (ICU) | $500-$1,000 per day |

| Ambulance | $100-$300 lump sum per trip |

| Helicopter (Air Ambulance) | $1000-$2,000 lump sum per trip |

| Emergency Room | $300-$600 per occurrence |

| Transportation (traveling to and from facility) | $400-$600 |

| Lodging for Family | $100-$200 per day |

| Doctor’s Visit | $30-$50 per visit |

| Physical Therapy | $30-$50 per visit |

| Medical Imaging (MRI, CT, EEG) | $150-$250 |

| Blood & Plasma | $100-$200 |

| Fractures | $200-$3,200 |

| Dislocations | $200-$3,000 |

| Lacerations | $75-$400 |

| Injuries Requiring Surgery | $200-$1,200 |

| Paralysis | $5,000-$12,500 |

| Burns | $900-$1,200 |

| Dismemberment | $500-$40,000 |

| Accidental Death / Final Expense | $25,000-$150,000 |

How much does Accident Insurance Cost?

Accident insurance is cheap!

Yes, I said it. It’s cheap and everyone should buy it.

Some plans are as low as $15 / month for an individual and $40 / month for a family (make sure and review your plan designs).

Think about accident insurance as low cost “out of pocket” insurance.

How Does Accident Insurance Work?

If someone get’s in an accident, the accident insurance company will pay a predetermined amount of money to the policy owner for the type of accident that occurred.

Below are four case studies of how accident insurance works.

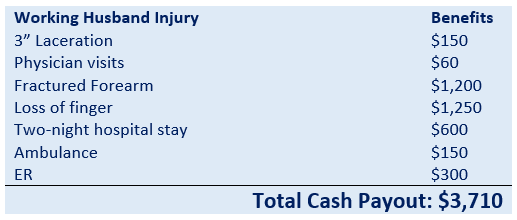

Accident Insurance Scenario 1: Mom Saves Family $3,710

One of your existing clients stays at home with her four children while her husband works. Due to their high deductible health insurance plan, she’s constantly worried about what would happen if they get hit with a bunch of medical bills. Could they still pay their mortgage?

Her husband was involved in an accident at work that resulted in losing a finger and multiple nights in a hospital. While they have employer sponsored benefits, they were still stuck with a large out-of-pocket expense. An expense that will certainly impact her ability to pay for the commitments they have for their four children each month.

After the claims process was complete, their accident insurance plan reimbursed them for more than half of their health insurance deductible. Between the coverage he had at work and their family accident insurance plan, they were able to fully recover their out-of-pocket costs.

Below is an overview of the total cash payout they received from the accident insurance plan.

Underwriting: None, accident insurance is guaranteed issue!

Application Type: E-app or paper (e-application is extremely easy!)

Monthly Premium: $52.30 / month total for dad, mom and all four kids

Agent Commission: $257.31 for the first year and 4% renewals for life. Commissions are paid weekly.

Do you currently work with families on their home and auto coverage?

Don’t you think they could benefit from a product that protects their entire family from the high out-of-pocket costs related to their current health insurance?

Contact Us Today to Get Started Selling Accident

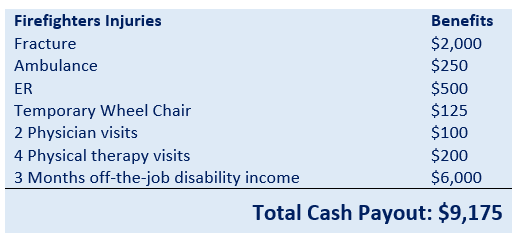

Accident Insurance Scenario 2: Firefighter Recovers $9,175

One of your clients is a veteran firefighter with your community fire department and absolutely loves his job, despite the inherent risks. After nearly 10 years of no accidents, he recently suffered an injury while climbing on a two-story roof of a fire scene and was transported to the hospital for treatment.

You helped him coordinate his accident insurance claim and after the claims were paid, he was more than fully reimbursed for his medical expenses while not interfering in his workers comp claims.

One of the items to note is that his waiver of premium rider kicked in during his three-month disability and covered his ongoing policy premiums.

Below is an overview of the total cash payout he received from the accident insurance plan.

Underwriting: None, accident insurance is guaranteed issue!

Riders: Waiver of Premium & Public Safety (exclusively available for firefighters, police and first responders)

Application Type: E-app or paper (e-application is extremely easy!)

Monthly Premium: $36.50, which also kept him from losing his workers comp benefits.

Agent Commission: $179.58 for the first year and 4% renewals for life. Commissions are paid weekly.

Do you have a natural connection to first responders, police or firefighters?

If so, do you think they would benefit from a policy that pays above and beyond department provided insurance?

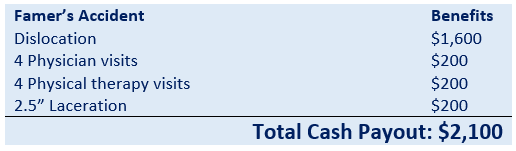

Accident Insurance Scenario 3: Farmer Gets $2,100 Cash Back from Accident Insurance Plan

One of your clients has been farming for nearly 15 years. Recently while working on a piece of farming equipment, his hydraulic lift shifted and pinned his shoulder to the ground, resulting in sever dislocation and laceration. Upon helping him with his claim, you were able to get him reimbursed for nearly the full cost of his deductible.

Below is an overview of the total cash payout he received from the accident insurance plan.

Underwriting: None, accident insurance is guaranteed issue!

Application Type: E-app or paper (e-application is extremely easy!)

Monthly Premium: $38.20 for the farmer and his spouse.

Agent Commission: $187.94 for the first year and 4% renewals for life. Commissions are paid weekly.

Are you currently working in or near a rural market?

Do you believe your clients who match the description above would appreciate you providing them the option to access this type of affordable accident insurance?

Accident Insurance Scenario 4: Dad and Son Get $6,500 to Cover Deductible

Your hypothetical client and one of his sons were driving back from a weekend lacrosse tournament and suffered a rollover car accident resulting in multiple injuries and more than $5,000 in out-of-pocket medical expenses. After using their accident insurance, they were fully reimbursed for their medical expenses and have $1,500 left over for future medical bills.

Below is an overview of the total cash payout they received from the accident insurance plan.

Underwriting: None, accident insurance is guaranteed issue!

Application Type: E-app or paper (e-application is extremely easy!)

Monthly Premium: $52.30 for entire family.

Agent Commission: $257.31 for the first year and 4% renewals for life. Commissions are paid weekly.

Would it be worth adding accident quotes with every home and auto policy if you knew you could potentially earn an additional $2,500 / month in commission?

Earn Cash Bonus Selling Accident Insurance: Up To $650 / Month

We believe in this product so much that we have negotiated a special cash bonus for you from one of our best accident insurance companies.

It’s not uncommon for P&C agencies to sell more than 40 new policies per month. Considering the price of accident insurance and the impact it has to help people save money, this is a no brainer.

Here’s how your cash bonus works.

- $20 bonus per application up to 10 applications per month.

- $30 bonus per application for applications 11-25 per month.

Get Started Selling Accident Insurance is simple!

-

- Make the commitment (remember, cross selling is easy when you start with an easy product that provides nearly instant value for your clients)

- Get contracted with an accident insurance company (Redbird can help you with that!)

- Study your products to fully understand how the benefits pay out

- Start prospecting your natural network

- Set appointments

- Print off these four examples to show your clients

- Enroll using a simple online accident insurance application