Welcome to the first in our series of becoming a six-figure senior market advisor with guest author, Brandon Clay, CEO of Senior Market Advisors (SMA is an FMO out of Nashville). Brandon is a sales leader, author, and business strategist with more than 30 years experience as a senior market advisor. Over his career, Brandon has trained more than 30,000 agents on his six-figure senior market advisor curriculum. You can Brandon on Linkedin here.

Senior Market Advisor’s Core Products

A senior market advisor is an insurance agent who’s niche focus is working in the senior health insurance market, typically characterized as clients aged 65 or older.

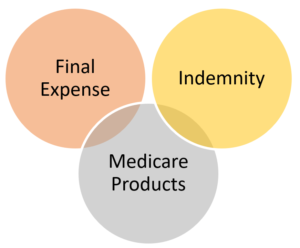

There are the three core products that will help Senior Market Advisors build a sustainable career: Final Expense life insurance, Medicare products including Medicare Advantage and Medicare Supplemental, and Hospital indemnity.

While there are other products that can help meet the needs of the senior population, these are the foundation.

Health insurance products, such as critical illness plans, provide coverage in the event of diseases like cancer, heart attack and stroke.

There is long-term care to help provide assistance in the event someone needs a nursing home.

Annuities and other financial products are also part of the complete financial strategy for many seniors.

Many new Senior Market Advisors stumble out of the gate when they start their insurance agency because they try to be “all things to all people” when it comes to offering healthcare as a service. As your business progresses and your client base grows, narrowing your focus on these core products would be natural additions to your portfolio. They will set the stage for you to become a trusted advisor, build a structured business that is scalable, and create a firm foundation to generate and sustain a six-figure income consistent new business and long-term renewals!

Final Expense, Medicare Products and Hospital Indemnity are the foundation of the Senior Market Advisor portfolio.

Building a Six-Figure Residual Income Isn’t as Complicated as it Sounds!

Advantages of Portfolio Cross Selling

From the perspective of the beneficiary which would you rather deal with?

Three different agents coming to show you one product each, or one agent who is qualified to guide them to the best fit solution with multiple products?

Make no mistake, if you are selling Final Expense insurance only, according to statistics, 33% of your clients are buying Medicare Advantage and 24% are buying Medicare Supplements. Enrollment is happening, just not with you.

That works in reverse if you are selling Medicare Advantage and not the other products.

While many agents are engaging a “one product” mentality” the carriers are marketing the additional products to the clients you bring to them.

Maybe another agent is coming into the home to market another product but replacing your business in the process. Here’s the real issue you face:

Is someone else finishing the work you started?

Consumers prefer to work with one professional agent…someone who knows their situation and can advise them on an annual basis or whenever they need. There are also many benefits to you, the trusted Senior Market Advisor:

It allows you to work smarter not harder.

It allows you to work smarter not harder.

The number one challenge facing most senior market advisors is lead generation. You either need to produce more leads, or get more out your current leads and opportunities you have.

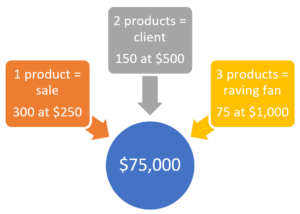

To create a 6-figure income, you need a steady stream of new clients – which takes time, energy and money. The portfolio approach leverages your current client base and maximizes it allowing you to make more money with fewer clients.

More products sold to a client means higher persistency.

Have you ever sold a product to a client, had another agent replace that product, and the client never reached out to you?

We’re all shaking our heads yes.

That’s because you had not established yourself as their one-stop resource… their trusted advisor.

When someone purchases the first product from you all you have is a sale.

When you add an additional product, now you have a client. But when you add that third product, which creates a comprehensive solution to their problems and needs, now you have a raving fan.

Raving fans call you if their circumstances change or if someone approaches them about an alternative solution or product, even if it is a product you don’t represent.

That is the power of portfolio!

Portfolio selling generates more referrals.

The natural byproduct of creating raving fans is that they tell everyone about you. You have built a relationship and asking for referrals no longer feels uncomfortable because you have earned the right to gain access to their network of friends and family. The portfolio approach creates several opportunities for the Senior Market Advisor to interact with key people in their clients’ lives.

Here’s an insider tip, provider offices are great places to build relationships and referral channels.

Cross selling generates a higher close rate

Which lead would you rather have: a cold call lead, or repeat business and referral?

The “holy grail” of exclusive insurance leads is repeat business and referrals.

Certainly, the first product sold to a new client would be the toughest, but when you call them back, having already set the stage for the additional products, the close is almost assured.

They already know and trust you, you need to leverage the hard work you put in.

Portfolio selling creates a standardized sales cycle

As mentioned, lead generation is the challenge for most agents, and there is always an “effort phase”, particularly for new salespeople. As you build the base of clients, you should be able to transition into the “skill phase” where business is meeting you at your desk every day versus you going out and finding it.

With a solid base of clients you work systematically and consistent marketing, you now have a system. You have created a predictable lead generation model based on the science of selling. Rather than having seasonal peaks, valleys and “dead zones” where you have no leads, the power of the portfolio is that it provides year-round stability and sustainability of income.

The advantages of taking the portfolio approach will afford the Senior Market Advisor several benefits that make their business more stable, scalable and sustainable.

Earn more money cross selling senior market products like Medicare and Final Expense

Certainly, there are people that take the one product approach and do quite well with a consistent lead generation and a referral process. They invest in their business and instead of being individual producers, they are running a system.

The thought of adding more products is not attractive as it would detract from their core business. However, for the majority who do not have the benefit of a system, portfolio selling is the fastest way to achieve a six-figure income.

Combined as a portfolio, these three core products will provide the Senior Market Advisor a tremendous six-figure income opportunity.

- Medicare

- Final Expense

- Hospital Indemnity

How to Become a Senior Market Advisor

Getting started is simple, you just have to take the plunge and connect with the right marketing organization (Medicare FMO). I created a detailed guide that will walk you through the exact steps needed to become a Senior Market Advisor in the insurance space. Check it out here!

As I always say, as you serve…you deserve!

Want to Learn The Specific Playbook to Building a Six Figure Residual in the Medicare Business?