There’s good news and better news to share regarding opportunities in the retirement market.

Good news first. A decade ago we were all riding the Baby Boomer wave, knowing that this largest-ever generation was beginning to receive the “greatest transfer of wealth in history” from their parents. What was then $8 trillion is today, despite a crippling recession, expected to be more than $12 trillion.

Now the better news. What is being called the “greater transfer of wealth” is starting to happen now, with an estimated $30 trillion to be passed from Boomers to their Generation X children. Get this: from today through 2045, 10 percent of the total wealth in the United States will be changing hands every FIVE YEARS, according to a recent study by Accenture. That’s mind boggling.

Numbers don’t lie… this is an opportunity for those willing to dig, but where to start? If you’re thinking about attacking both segments be prepared to multi-task. The Accenture study revealed stark differences between Boomers and their children regarding money and investing, for example:

- Boomers often followed in the footsteps of their parents, using the same advisor and/or firm. Their GenX children demand more transparency and control and are likely not to use their parents’ advisor.

- Boomers are not “social” regarding their finances, typically working singularly with one person. Their children readily share information through social networks and they are not tied to traditional sources of investment advice.

Unlike the big investment firms that reach across broad market segments, often with shotgun tactics, we as independents must be snipers with high powered rifles hunting for specific types of clients. At Redbird, we focus on clients who recognize the need to be balanced, who view risk as something to be distributed, not concentrated. That may mean helping a retired Boomer with guaranteed income or a GenXer with protecting a portion of their investments from unpredictable markets.

We prefer to play defense in a world full of agents and advisors playing offense.

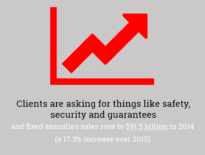

For example, for the middle 60% of Boomers—those with money but not wealth—there is a fear of outliving their money. Their fear is well founded: Boomers are likely the healthiest generation in history and will be pushing up the averages on life expectancy. They need a defensive product—like a Fixed Annuity or a Fixed Indexed annuity funded with a lump sum—that will give them a guaranteed income stream. They can’t afford to be in the market when the next correction rolls around… there’s no time for recovery.

Gen Xers have similar needs but are typically in a different financial position than their parents. Defense for them is a product that guarantees the principal but also provides a death benefit, like a tax-free retirement life insurance policy or a long-term annuity product, whichever best fits their needs. At the end of the policy term they can convert it to another policy at no cost based on their needs at the time.

There are many other options and scenarios. The key point is to focus on client needs, ask the tough questions that no one likes asking and play the role of defensive specialist to help Boomers and their kids protect what they both have worked so hard to earn.

Thanks for reading and give me a call or drop an email.

Redbird Chirps

- Do the “evil rich” like annuities? Market Watch wondered if the top 1% of earners like annuities. The answer was a resounding “yes”. They call them transfer-of-risk strategies and they aren’t just for themselves.

- Selling your business: plan the work, work the plan. Our friend Andy Kaiser spends a lot of time helping clients sell their businesses. And, like many other things, clients tend to focus on the end game: the number they are going to get. What many don’t do is put the building blocks in place early to ensure they get the number they want. Some good stuff here.

- Crafting your product to make it stand out. So often in insurance we sell the “what” of a product, not the “how”. Here are some great examples of how a product’s craftsmanship became a key part of its story… moments where it was actually good to tell clients how to build the watch, not just what time it is. Great read and one that has a clear connection to what we do.

- Can’t say it enough: lead with your strengths. Jon Gordon provides some solid reminders. The more time you spend developing and leading with your strengths the more you will become known for them. Practice, practice, practice.