A common roadblock an independent insurance producer faces is how to complete Anti-Money Laundering Training (AML) in order to get contracted to sell life insurance or annuities.

You’re here because someone told you that you need to complete your AML training program refresher course, or, you’re new to the business and need to get your AML training completed for the first time in order to get contracted to sell life insurance.

There are two very quick and simple ways to complete your AML training so you can keep selling life insurance with various insurance carriers.

FINRA states:

“The purpose of the AML rules is to help detect and report suspicious activity, including the predicate offenses to money laundering and terrorist financing, such as securities fraud and market manipulation.”

In other words, this is not optional.

If you plan on starting or continuing your career as an independent insurance agent, you need to complete your anti-money laundering training every 2 years as well as stay up to speed with the updates.

You first need to take the core AML test and then there are periodic updates you will need to complete on an ongoing basis. The updates are super quick and easy.

Below are two ways to complete AML training for insurance agents:

WebCE Anti-Money Laundering Training

Web CE is the easiest way for new insurance agents to complete the required AML training. However, there is a cost associated with buying the AML course.

LIMRA Anti-Money Laundering Training

LIMRA.com is the most common way to complete and maintain your AML training after you are already appointed with various insurance companies. LIMRA AML works a bit different than Web CE and can be easily explained by clicking here. If you are already an agent and need to renew or take an updated course for AML, LIMRA is a great solution.

Take a look at the instructions below on how to complete AML training using either Web CE or LIMRA. We have included screen shots of each step to make this quick and simple. Good luck and happy selling!

Carrier Specific AML

Most carriers rely on LIMRA and will also accept other forms of AML from companies like Webce. However, some companies have their own internal AML training that is available upon request.

Method #1: WebCE Anti-Money Laundering Training Program

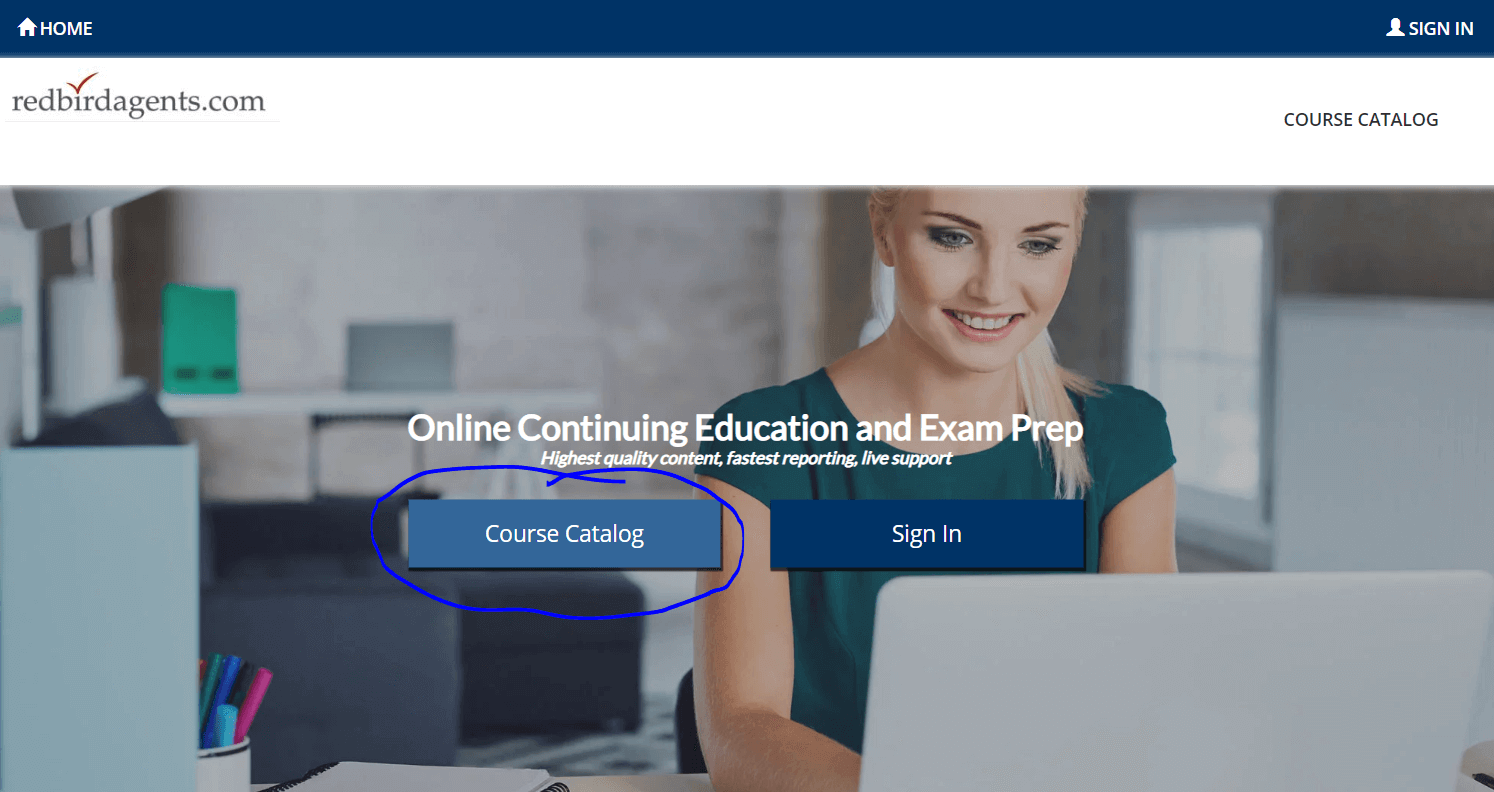

Click Web CE and click on “Course Catalog”.

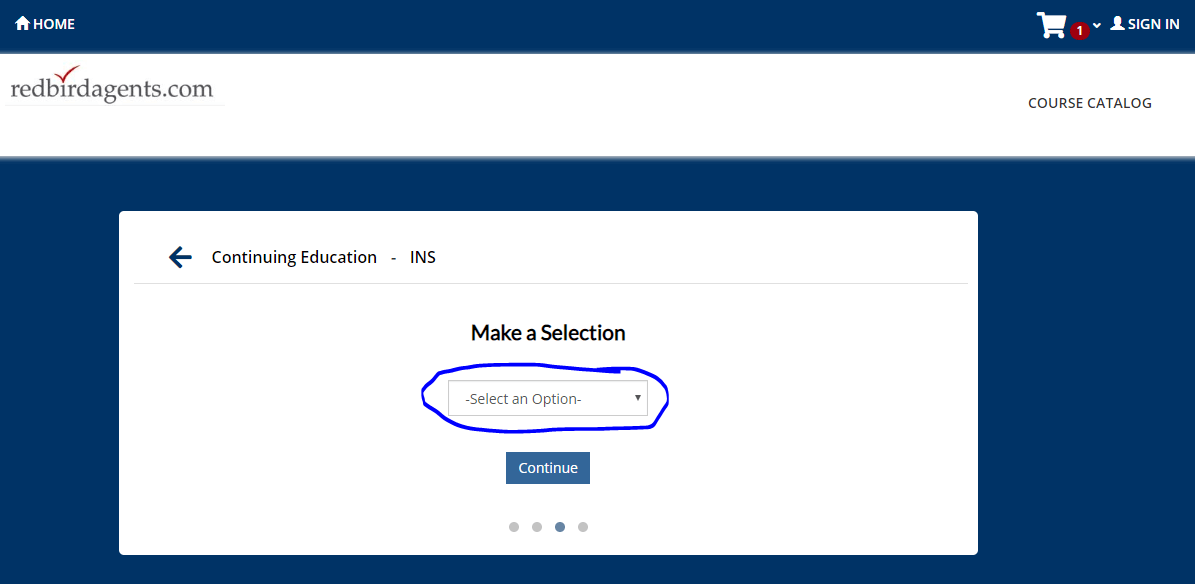

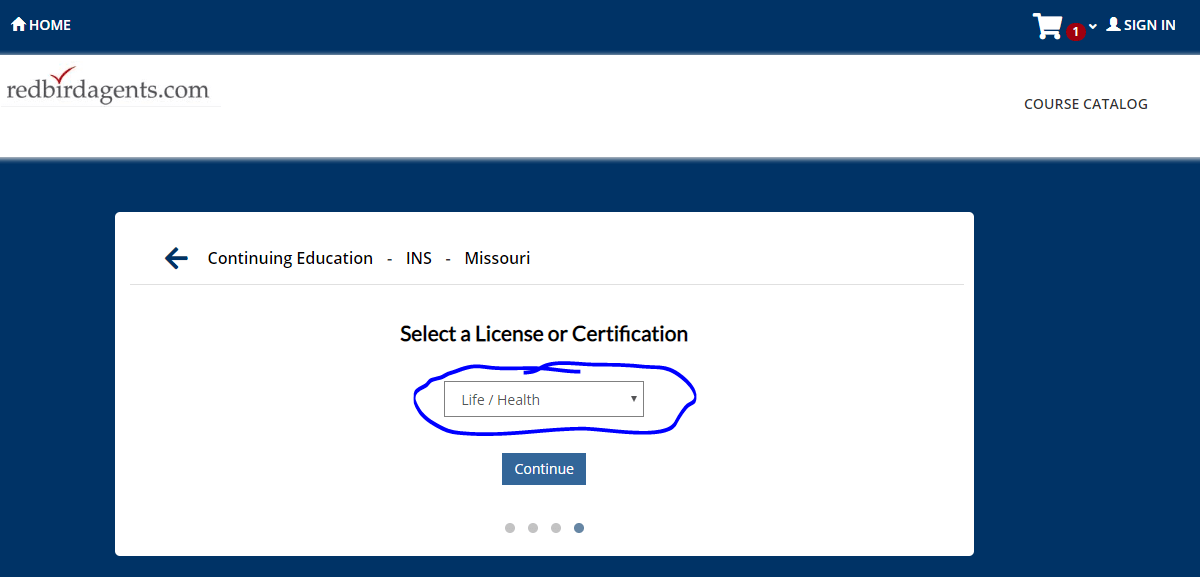

Select your “Resident State”

Choose “Select a License or Certification”

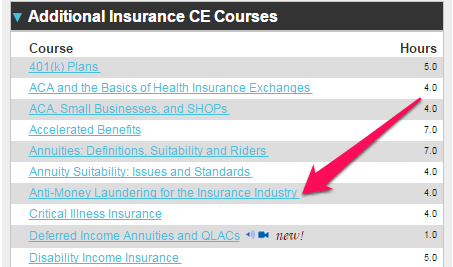

Scroll down screen to “Additional Insurance CE Courses” and choose “Anti Money Laundering for the Insurance Industry”

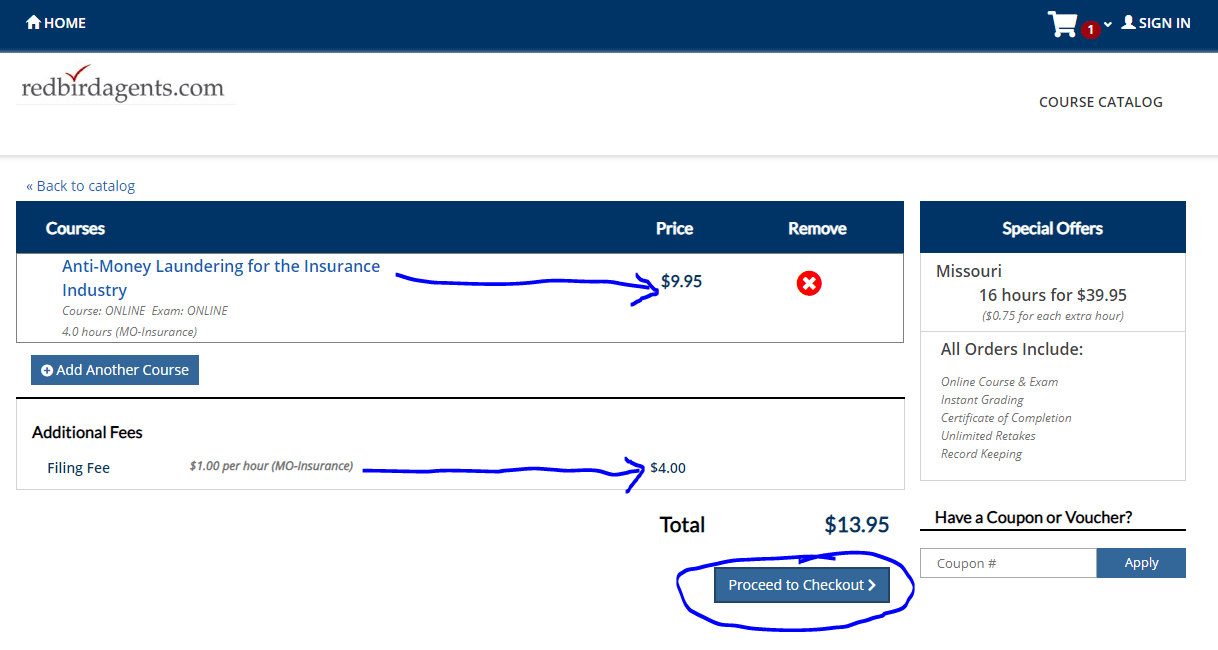

Click Add to Cart – Length 4 Hours, $9.95 + State Specific Filing Fee

Now you just need to purchase your AML training, complete and pass it, save for your records, and send it to your upline or directly to the carriers that are requesting it from you.

Method #2: How to take Anti-Money Laundering Training with LIMRA

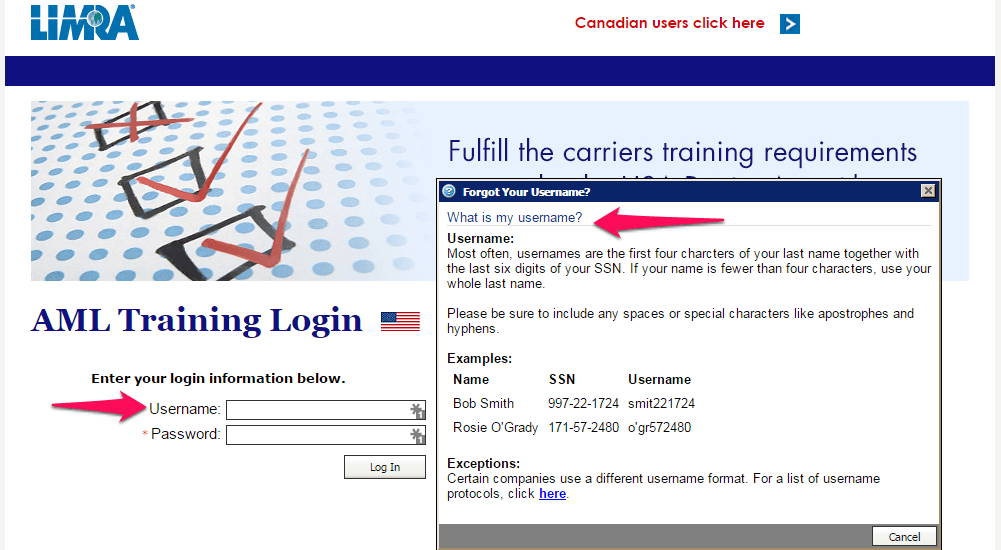

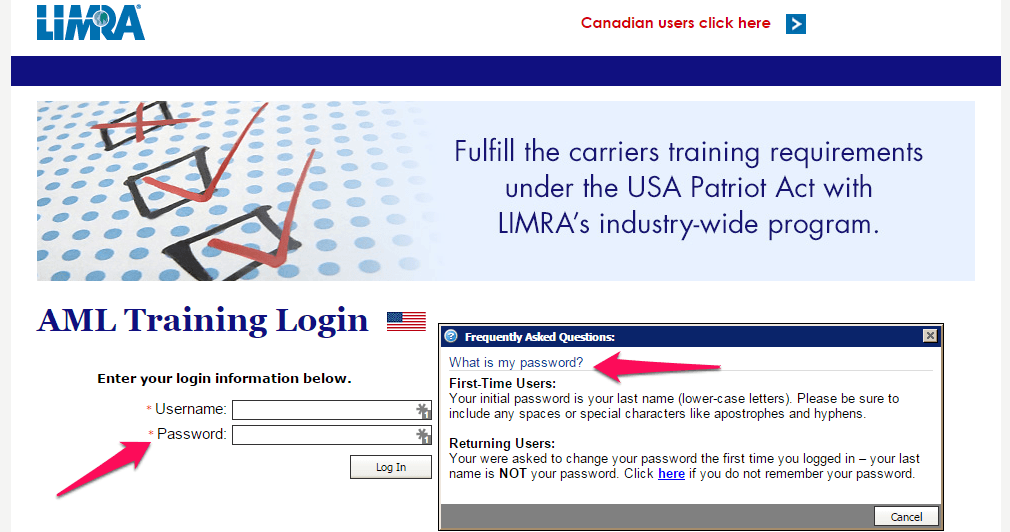

Click LIMRA and click on “AML Training Login” on the right side

Enter your Username

Enter your Limra AML Password

Once logged in to LIMRA, complete the LIMRA AML training as well as any carriers who have registered you to complete their specific AML requirements.

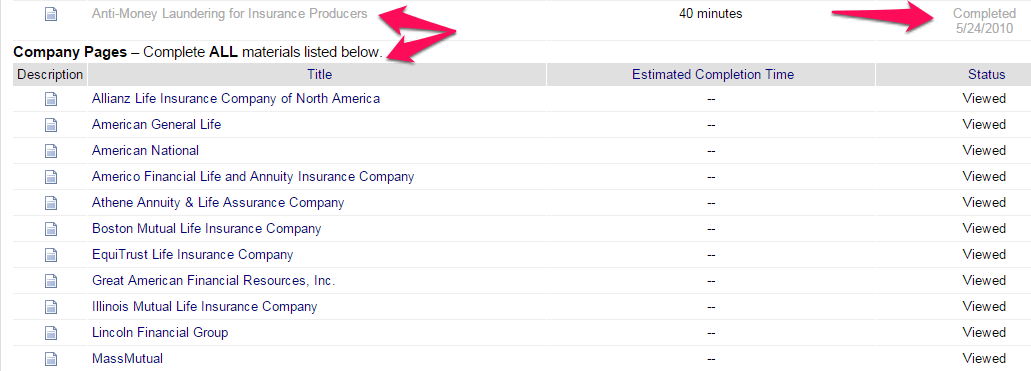

LIMRA will NOT provide you a printed certificate so you will need to record your completion date as listed below.

I suggest taking a a screen shot because some times the insurance companies ask for it. Make sure your screen shot includes the completion date within 2 years.

If you cannot log in to LIMRA AML, that means a carrier has not yet submitted a request to LIMRA for AML training. Sometimes it can take up to a week after your contract has been submitted before showing up in the LIMRA AML system.

If that is the case and you’re in a hurry, you should proceed to using Web CE or ask the carrier if they have specific AML training you can take to speed the process up.

Method #3: Carrier Specific AML Training

The last method for completing AML training is to use a carrier specific course. This is not always the most widely used method, but it definitely works and here’s how you do it.

If you cannot get access to LIMRA and you don’t want to buy a course from Webce, you can ask your carrier rep or upline for a carrier specific AML course. If they have one available then it’s relatively simple, but not all carrier have it.

The process is simple.

- Ask your upline or carrier to send you the aml training

- Review the course information

- Sign the document stating you have reviewed and completed the required training.

- Send it back to be processed.

Conclusion

There are three ways to complete AML training for insurance agents.

- Buy an AML training course through WebCE

- Take AML training base course for free through LIMRA

- Complete carrier specific AML training

Each source will provide training instructions and may require you to enter your national producer number (NPN) or social security number.

Now that you have figured out how and where to take your required aml training, complete and maintain your AML certifications and continue selling and contracting.