We recently had a great guest speaker from one of our favorite insurers, Illinois Mutual on hand to discuss how to sell disability income insurance in a way. Not only is it easier for your clients to understand, but it’s proven to help boost your sales and income.

She focused on how to get started, but more importantly, strategies and concepts to generate more leads and make disability coverage a more meaningful part of your business.

Remember, an effective client conversation puts the client in control by affirming their decision to protect their income, leads them through a positive conversation focused on the benefits of DI and ultimately powers them to make their own decision.

This article will teach you exactly how to do that!

Disability Income insurance has one major purpose:

It provides income protection which offers an income stream when you are unable to work.

Many times insurance producers ask us about DI and seem to think there is some level of complexity. The hardest part of selling DI is getting clients to believe they have a realistic chance of becoming disabled before retirement.

Did you know that one in four of today’s 20 year-olds will experience a disabling event before they retire?

So ask yourself this, are you properly communicating the risk of disability to your clients?

68% of the private sector workforce has no long-term disability insurance.

25% of today’s 20 year-olds will experience a disabling event before retirement.

This screams opportunity, especially when you consider that 51% of the population has openly admitted their concern about their ability to support themselves if they were to become disabled. We as insurance producers should be communicating the need and offering realistic options.

YES, Teach Me the M.U.G. Disability Income Sales Strategy

We reviewed a sales tactic in our training this week that really makes selling Disability Insurance simple.

The M.U.G. plan is a great selling tactic to simplify DI for your clients and increase your sales.

M.U.G. Disability Sales Plan Covers Essential Expenses

- Mortgage (M)

- Utilities (U)

- Groceries (G).

When you think of it in this simple way, it makes the discussion with clients much easier.

If you traditionally sell life insurance or property and casualty, you can easily start generating Disability insurance leads immediately by introducing the MUG concept to your existing clients.

Language to Generate Disability Insurance Leads

Let’s walk through an example of how you can use the MUG plan at the conclusion of every single sale. You have just delivered a life or P&C proposal or policy and at the conclusion of the appointment you simply ASK the following.

Agent: “By the way, who takes care of your income protection?

Client: “I don’t know what you mean”

Agent: “If you became totally disabled and couldn’t work, which of your insurance plans kicks in to pay your mortgage, utilities and groceries?

Client: “I don’t think I have anyone that would pay me”

Agent: “Ok, I need to show you the M.U.G. plan. The M.U.G. plan is a very affordable disability insurance policy that will provide income to pay your mortgage, utilities, and groceries if you become totally disabled and are unable to work. All I would need to know is how much you spend each month on these three expenses and I can get you some rates to review while we’re getting your other policies set up.”

This simple approach language starts the discussion about the monthly expenses people worry about most.

Best Way to Communicate Disability Income Insurance

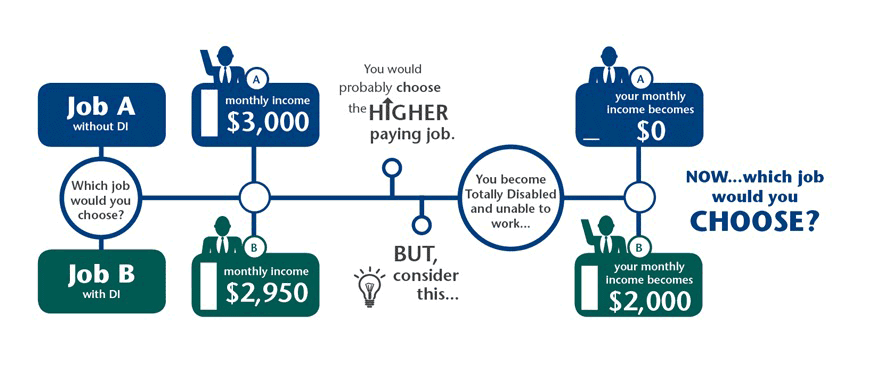

Take a look at the example below and simply ask your clients if they would take job A or job B?

So, would you be willing to take less than a 2% reduction in your pay to protect your income if you became disabled?

I think the answer is wildly obvious. On top of being an easy decision, putting the plan in place is just as easy.

Selling Disability Insurance with No Medical Exam

A myth of selling a disability insurance plan is that it requires a medical exam for eligibility, which is a big speed bump for many clients.

The M.U.G. plan covers the essential expenses and in most cases requires no medical testing assuming the monthly benefit doesn’t exceed the maximum benefit of $3,000.

That’s right, submit the application directly to the insurance company without a medical exam or financial underwriting.

The underwriters will review their medical history and issue the policy assuming all underwriting questions were accurate and eligibility is confirmed. Here’s one of the most popular no-medical M.U.G. plans.

- $2,500 / Month payout in Benefits

- Two-Year Benefit Period

- 30-Day elimination period

Disability Stats to Share with Your Clients

Disability from Sickness

- 1 in 2 men will be diagnosed with Cancer in their lifetime

- 1 in 3 women will be diagnosed with Cancer in their lifetime

- Every 34 seconds someone in America experiences a heart attack

- Stroke is the leading cause of disability

Disability from an Accident

- Roughly 54% of accidents occur at home

- 13% of accidents happen at work

- 9% of accidents happen while driving

Losing the ability to earn an income is absolutely devastating to a family.

Quoting Disability Insurance

Quoting a disability insurance plan requires collecting some critical information about your client.

- Date of birth

- Tobacco use?

- Pre-existing conditions

- Occupation

- Job duties: You need to be specific. For example, a St. Louis exterminator could be someone running the business from an office vs. an owner operator that’s onsite completing the work. The scope of work makes a difference to the underwriters.

- Length of employment (very important for 1099 contractors)

- Annual income

- Qualified benefit amount: This is typically 60% of your clients income. For example, someone earning 100,000 per year could qualify for $60,000 in disability income.

- Existing disability coverage: If yes, is it employer paid or not?

- Additional disability coverage needed: Only if they have some coverage and need more.

- Waiting period: The period of time a client must wait from the point of filing a claim to when the benefits begin paying.

- Known medical condition: Any known medical conditions.

We are now seeing agents offer M.U.G. disability quotes policy with every policy delivery or proposal and driving significantly more cross selling opportunities for their agency.

If you are new to DI or just haven’t taken the plunge, I challenge you to simply start asking the golden question at the end of every sale:

Who takes care of your income protection?

You will increase your DI insurance sales by asking this simple question and explaining that an income protection policy exists to cover mortgage, utilities, and groceries.

Start Using The M.U.G. Sales Strategy

Why Sell Disability Insurance?

If you’re not selling disability to your clients, somebody else is.

DI should be a staple in your practice as it protects the most important asset your clients have, their ability to earn an income and support their loved ones.

FAQs

Learning to sell disability takes time, below are some common questions you may have to help you gain a better understanding.

What is the definition of disability?

According to the ADA, “The ADA defines a person with a disability as a person who has a physical or mental impairment that substantially limits one or more major life activity. This includes people who have a record of such an impairment, even if they do not currently have a disability. It also includes individuals who do not have a disability but are regarded as having a disability.”

This is from a medical perspective and the definition can vary from a financial perspective when applying for SSDI income from the social security administration or collecting disability income benefits from a DI policy.

What is total disability?

Total disability classifies your client as unable to work in their current or most recent job which was impacted by the disability claim.

What is partial disability?

It’s exactly what it sounds like.

Partial disability is when your client experiences an injury or condition that doesn’t 100% reduce their ability to perform their job. Different insurance companies have different definitions which can impact the claims, so it’s important to understand the disability definitions on the policies you are presenting to your clients.

What is own-occupation disability insurance?

Own-occupation or own-occ as the industry people call it is a disability policy that will pay out a disability benefit and still allow your client to work and earn an income. For example, if your client is an industrial paint contractor, and became disabled and lost their ability to operate a specific machine, they could receive disability income and still go get another job with other duties.

Own-occ is a great benefit when selling disability insurance.

How does short-term disability insurance work?

Short-term disability benefits are usually sold through voluntary benefit packages through an employer, however, there are some companies that sell short term DI to individuals.

Short-term policies do not usually require medical exams to qualify and are designed for a short benefit duration to replace a portion of your income. They can cover up to 80% of your client’s gross income assuming they do not have other disability policies inforce.

What is a disability elimination period?

This is the time frame it takes from the start of the claim for your client to begin receiving their benefits. Said another way, it’s how long your client can go with out an income until the disability benefits kick in.

30, 60, 90 days are the common elimination periods.

How much does Disability Insurance cost?

Rule of thumb on cost for disability insurance is 1-3% of your clients annual salary. For example, someone earning $100,000 per year should expect to spend $1,000 to $3,000 per year in disability premiums.