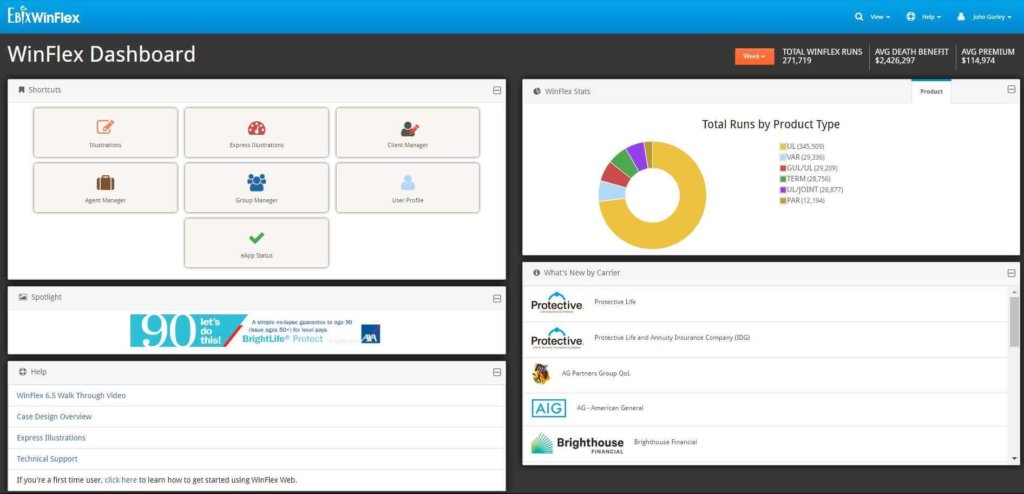

Below is a review of Winflex and Winflex Web which is a common life insurance quoting software tool that life insurance agents and financial advisors use to run illustrations and quote comparisons for their clients.

For those of you selling IULs, this is often the software your upline uses when running illustrations for you. If they aren’t using it, then they are using the internal carrier software which is often powered by Winflex.

There is a good chance Winflex has been a big part of your business as they are a leader in the insurance quote technology field.

My personal opinion is you should always lean on your marketing organization to run your illustrations until you have developed a strong understanding of how to design a permanent life insurance illustration. However, once you’ve hit that comfort zone, you’ll be amazed how creative you can get using Winflex for advance life insurance case design.

Do You Want Free Access to Winflex Web?

What is Winflex?

Winflex is one of the most widely used software programs that allows for comparing multiple insurance company quotes. It’s often used by insurance companies as their default insurance quote software and can be downloaded directly from their sites. For example, Winflex is the platform used by Mutual of Omaha.

You can use Winflex to run various types of insurance quotes. For this example, I’m going to focus on how to use Winflex to run life insurance quotes.

What types of products does Winflex support?

- Indexed Universal Life

- Universal Life

- Whole Life

- Term Life

- Health Insurance

- Annuities

- Employee Benefits

What companies participate with Winflex and Winflex Web?

There are many companies that work with Winflex, and the list continually gets updated. As of 12/29/2020 the following companies can be quoted using Winflex or Winflex Web.

- Accordia Life and Annuity Company

- AIG American General – Independent Agency Group

- AIG Life Brokerage

- Allianz Life

- American National Insurance Company

- Axa-Equitable

- Ameritas Life Insurance Corp.

- Assurity Life Insurance Company

- Cincinnati Life Insurance Company

- Columbus Life Insur. Company

- Columbus Life Insurance Company CL

- Columbus Life Insurance Company CLI

- Columbus Life Insurance Company CLIC

- John Hancock Merrill Lynch

- Lincoln Financial Group

- MassMutual – Merrill Lynch

- Mutual of Omaha – Health Advisor

- Mutual of Omaha – United of Omaha Advisor

- National Western Life

- NACOLAH

- Nationwide

- Pacific Life

- Pacific Life – PL Promise

- Penn Mutual / Penn Insurance and Annuity

- Principal Life

- Principal National Life

- Protective Life & Annuity Insurance Company

- Symetra Life Insurance Company

- Symetra Life Insurance Company – Merrill Lynch

- Transamerica

- United of Omaha

- Zurich American Life Insurance Company

You can also request to add other carriers that are not currently participating. Doing this helps Winflex build the need with non-participating insurance companies to begin using Winflex.

What does Winflex cost?

It’s FREE for agents, but you need to find a participating agency that will give you access.

How is Winflex free?

The insurance companies pay Ebix to subscribe to Winflex and the cost is passed through to the agent users at no cost. This is why Winflex is a common default quote software for many of the big insurance companies.

How do I get access to Winflex?

Winflex Web is traditionally accessed through an FMO, BGA, or insurance companies directly.

If you sign up directly through an insurance company, you’re going to only have their products to quote which sort of defeats the purpose of an insurance quote comparison tool.

If you sign up through your FMO or BGA, you’ll have access to all the carriers they support, which is usually much more effective. If there is a carrier missing, you can request the carrier to be added if they are on the list of insurance companies that integrate with Winflex.

There are more than 2,000 agencies that are Winflex subscribers, if your FMO or BGA is on that list, you should request access from them. You can request access to these agencies directly within your dashboard.

We would be happy to give you access to Winflex to begin running life insurance quotes for your clients immediately.

All you need to do is ask and we’ll add you as a user in our system and you’ll receive your Winflex login directly to your email.

Once you receive your free login to Winflex, you can begin using the quote tool to compare life insurance options for your clients.

Do You Want Access to Winflex Web?

How to Use Winflex to run IUL Quotes

As I mentioned, WinFlex has two versions:

- Desktop

- Online

I always suggest the online version to avoid missing an update which would make your illustrations out of date and potentially out of compliance.

Below is a quick look at how to login to winflex and begin running your first IUL or term life quotes.

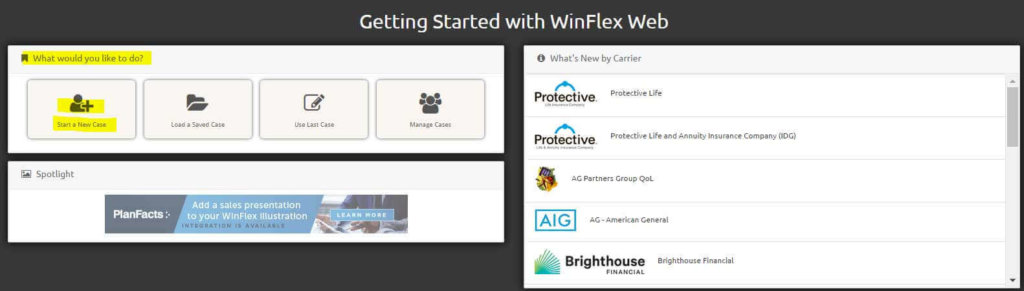

Step 1: Login to WinFlex Web

Step 2: Choose illustrations and then click Start a New Case

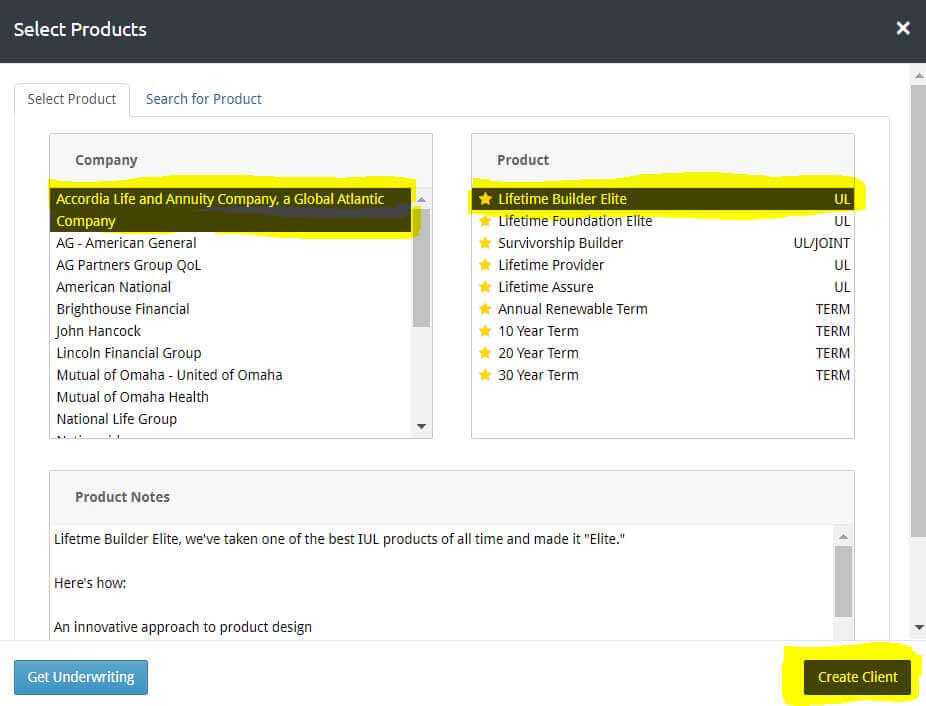

Step 3: Select a Company and Product

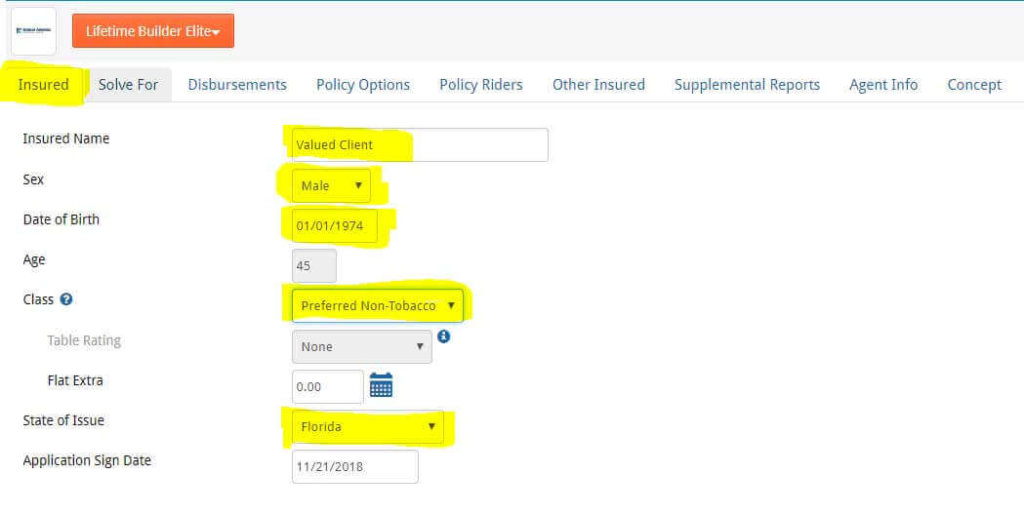

Step 4: Enter your client’s information

If you can’t tell yet, this is extremely easy!

However, you need to understand the elements to design an IUL illustration. If you’re not comfortable with this, I would suggest contacting your upline to get some help.

Below are the categories in Winflex you will need to complete in order to get through the illustration process.

![]()

Once you have entered your client’s information into WinFlex, you can continue creating the IUL illustration to meet your client’s needs.

Quick tip, always prepare the following:

- Face amount or desired premium.

- The length of time your client wants to pay for their life insurance.

- Cash Value or tax-free income goals.

Once you have the basic info, you can proceed to the IUL case design.

The first step is understanding how to “solve.” You’ll need to pick an option, so it’s important to understand what each option offers your client.

IUL Premium Solve Options:

Solve to Endow

This option will allow you to illustrate to a specified period of time at which the premiums paid into the policy equal the cash value, typically age 120.

Target

This calculates the amount of death benefit based on the target premium. Target premium is a great middle-of-the-road way to run an IUL illustration, as it always provides the client more flexible premium options.

7-Pay TAMRA

This calculates the minimum non-modified endowment contract (MEC) death benefit based on planned premium. For example, if your client has agreed on a $300/month budget you could back into your death benefit amount using this option.

Maximum Non-MEC (max funded iul)

This option will produce the maximum amount of premium a client can pay into a policy without creating a MEC. This is called a “max funded IUL”.

Minimum

This is the floor option, which is the lowest available premium the client can pay to keep the policy in force and cover the insurance company’s charges and expenses during the 5-10 year no lapse period for any permanent product.

Guideline Premium

This is a test to make sure that a product still qualifies as a life insurance policy under the IRS code.

The next step is to determine if you’re going to show distributions (taking income/distributions from the policy).

If so, you can simply choose the age it will start and for how many years it will continue. If you have the numbers incorrect, the system will alert and show you that the policy can’t perform as illustrated.

Lastly, you can save your IUL illustration for your client, customize the contact information and send a customer-friendly version to keep the sales process moving.

Winflex Demo

I found a great video that was put together by the team at Winflex and is a great demo on how to use the software.

Who is Ebix?

Ebix is the company that owns Winflex.

According to ebix.com, Ebix “is a leading international supplier of on-demand infrastructure exchanges to the insurance, financial, and healthcare industries. In the Insurance sector, the Company’s main focus is to develop and deploy a wide variety of insurance and reinsurance exchanges on an on-demand basis, while also, providing Software-as-a-Service (“SaaS”) enterprise solutions in the area of CRM, front-end & back-end systems, outsourced administrative and risk compliance.”

Ebix provides solutions for the following categories in the insurance and financial services industry.

- Life Insurance quotes

- Health Insurance quotes

- Employee Benefits

- Annuity quotes

- Claims adjudication

- Commissions processing

- Policy administration

- Workers compensation reporting

- and many more.

Click here for a full list of services provided by Ebix.

Winflex Web is Free for Agents

Other Helpful Articles