Why is the US national debt clock important to insurance agents and financial advisors?

In any insurance sales jobs, the secret is to identify your target market accurately and to use effective marketing communications channels and tactics to reach it.

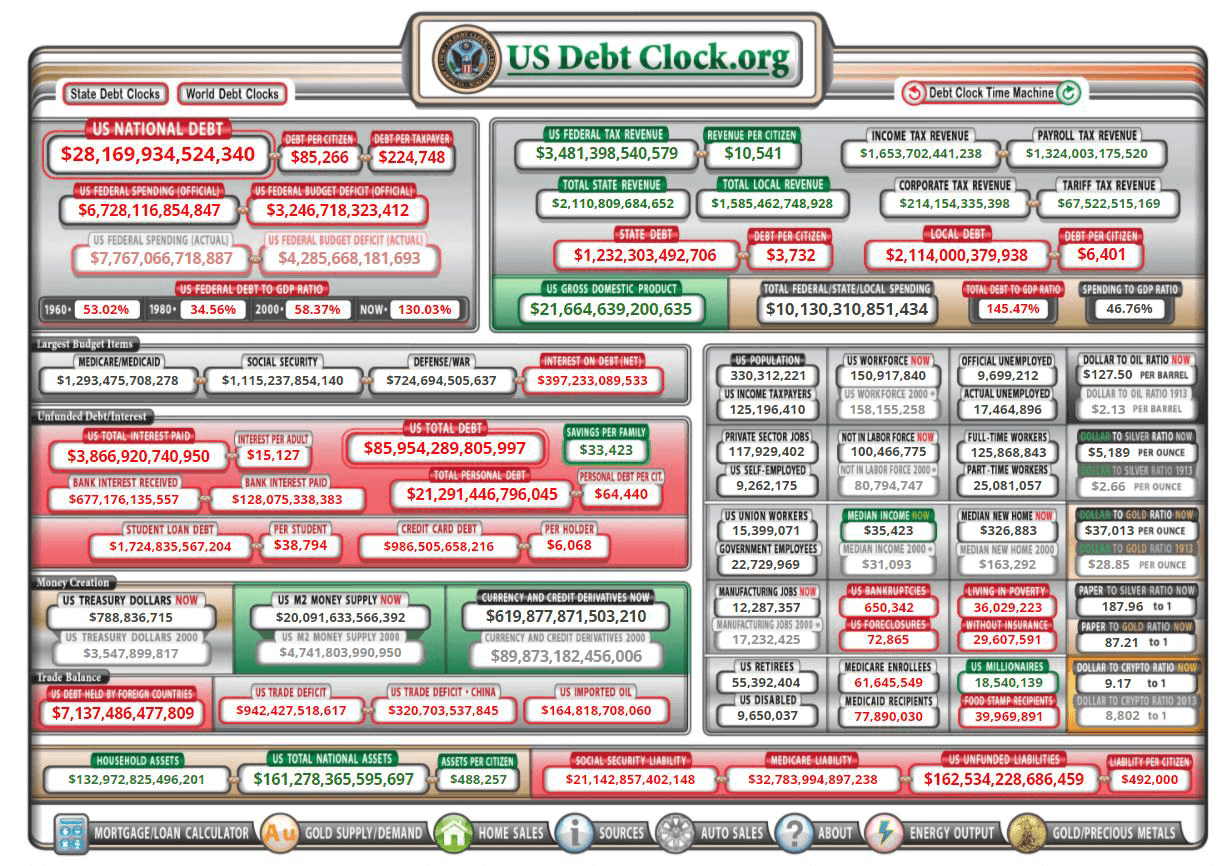

Seymour Durst invented the US National Debt Clock in 1989. Since then, the debt clocked has served many insurance agents and financial advisors as an important sales tool to provide important insights to the the performance of the US economy.

The debt clock can serve you as an important tool to have deeper discussions with your clients.

How financial advisors use the US national debt clock

As a financial advisor, you can reference the clock to arm yourself with the projected information such as the federal governments under funded liabilities such as Medicare and social security liability, and unemployment. These are all great points to talk to your clients about the risk of increasing taxes to transition to tax efficiency discussions.

Another way is to compare the economic impacts from the white house changes of power such as the transition from Obama to Trump and Trump to Biden.

If you’re paying attention, you can begin to tell a more compelling story that will better resonate with your prospects and customers.

Whether you’re selling life insurance or annuities, the debt clock will arm you with value information to share with your clients.

How to use US debt clock in your client presentations

Understanding economics and the moving parts of the US economy are an important part of being a well rounded and educated insurance agent or financial advisor.

Some of the areas you’ll gain insight are as follows.

- Largest budget items such as Medicare, Medicaid, Social Security, and War and Defense.

- Current US population and corresponding unemployment

- Student loans and average debt per student

- Credit card debt and average per person

- Total US unfunded liabilities

As you can see, there are a lot of great elements you can reference to provide you more ammunition when talking to your clients about health care, real time federal government actions to the taxpayer, and total debt.

You should really be referencing this tool consistently to stay fresh on the current numbers.

What is the US National debt clock?

The national debt clock was invented by Seymour Durst in the late 80’s has since been a great tool used by many including those in the white house to address the issues with national debt.

This is updated in real time to show the alarming increase of our country’s national spending, allowing for predictive modeling for numerous industries.

The national debt clock is an incredible resource that will keep you equipped with the knowledge to have meaningful discussions in your personal and professional networks.

Elements included in the US debt clock

Some of the more compelling stats included the in the US debt clock are as follows:

- Medicare and Medicaid liabilities

- Social security liability

- Impacts on federal budget.

- Debt to GDP ratio

Reducing the U.S. national debt

According to the balance.com, “the only way to reduce the debt is to either raise taxes or cut spending and impact the federal budget.

“Either of those can slow economic growth. They are two of the tools of contractionary fiscal policy.

“Cutting spending has pitfalls. Government spending is a component of GDP. If the government cuts spending too much, economic growth will slow. That leads to lower revenues and a larger deficit. The best solution is to cut spending on areas that do not create many jobs.”

What is interesting about this is that if you increase the debt to boost the economy too much, you’ll have an adverse reaction.

As you can see, there are some delicate roads to pave when trying to forge a path to reducing the national debt. What may seem like a simple solution can have catastrophic impacts.

So when you’re talking to your clients about the state of the economy and how the US Debt impacts decisions, you can better navigate by explaining some of the micro details around how the debt needle is moved while maintaining a productive interest rate environment.

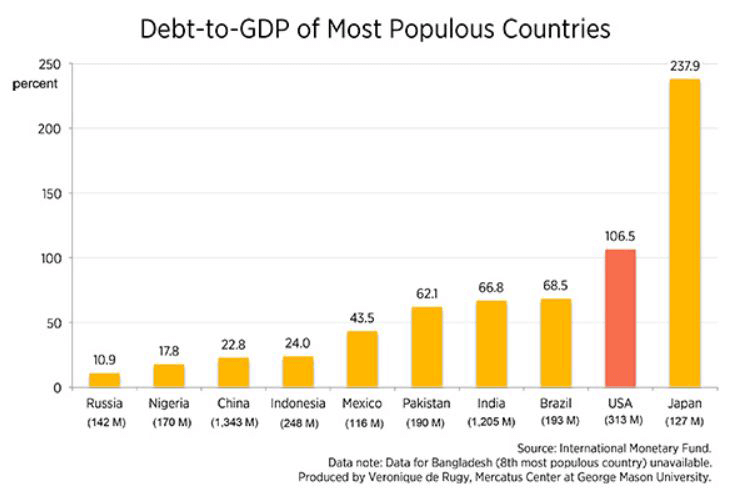

How does the national debt in the US compare to the rest of the world?

includes: us treasury treasury bills,

Simply looking at the number of debt a specific country has is not the best way to compare.

What you should be looking at is the ratio between total debt and GDP to give yourself the most accurate picture when comparing countries. The United States will clearly have higher debt than other countries simply as a result of population being one of the factors.

Below is a breakdown of debt by country from 2018 compare to our country’s debt.

How does Medicare impact the US National Debt?

The biggest contributors are the aging baby boomers and the associated healthcare costs for that demographic.

This directly impacts Medicare at the federal level, Medicaid at the state level, and the amount of people aging into and drawing from the social security trust fund. All of which are liabilities found on the debt clock.

As our spend increases in these three areas and exceeds our budget, it directly impacts the amount of interest owed to our lenders which adds additional burden.

We can either reduce our spending in strategic areas, or increase taxes from the taxpayers in a consolidated effort to reduce the total debt in u.s. dollars. Lastly, we can address the debt ceiling which is the limit on the amount of national debt that can be incurred by the U.S. Treasury which impacts how much money the federal government may borrow.

Conclusion

As you continue to immerse yourself in education around the insurance and financial industry, you’ll find the debt clock a great tool to keep you current. It’s free and readily available to all insurance agents and financial advisors, my advice would be to start paying attention to the stats and begin implementing them in your discussions.

Check out the US debt clock here.