Reading time… 7 minutes

Nobody thinks their baby is ugly. So, understandably, we’re pretty proud of our twice-weekly training sessions. But, we’re really proud and excited about today’s announcement.

Here’s the situation: we believe equity markets are overdue for a “correction” (as the industry lovingly refers to sudden drops in the markets). While we’re by no means investment advisors, we are investors and the memories from 2007-2008 are forever tattooed in our minds. Will the correction be big or small… we don’t know. Is this over-reacting… we don’t think so.

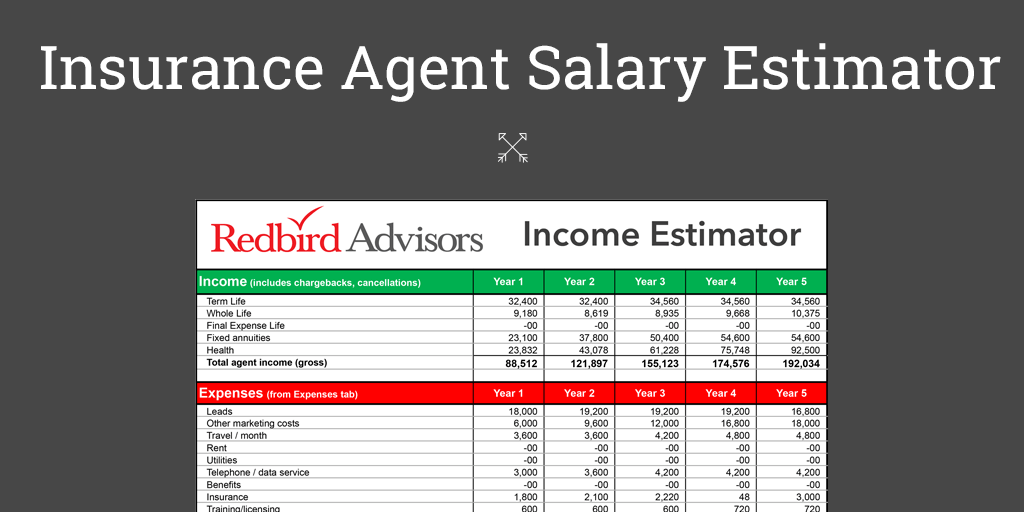

On Thursday, March 13, we will introduce the latest addition to our training and education curriculum: Moving Money, Protecting Clients. It will be the most important content we’ve produced to date, both in depth and timing. It will allow agents in one session to see the safe, low risk solutions they can offer, including:

- Fixed Indexed Annuities (FIA)

- Multi-Year Guaranteed Annuities (MYGA)

- Single Premium Immediate Annuities (SPIA)

In short, it will be about helping Redbird agents help clients lower risk by moving money to a safer place.

“This training is about moving clients’ money out of harm’s way,” said Redbird’s Vice President of Training and Development. “We’re going to help agents start a discussion to understand clients’ needs. What do you intend to do with your retirement? Where will your income stream come from? Do you want to pass it on? Is safety and security important?”

That’s only half the story for agents. Another key element of the training will be coaching patience.

“In most cases this will be about getting to a second meeting for the agent. Even if you instinctively know what product may suit the client you run the risk of moving too quickly. Most clients will be very deliberate in the decision to move money. They will press you on how you came to that conclusion. They’ll want to know what research supports your conclusion.

Suffice it to say, this is a considered decision for clients.

“This kind of sale is about value added service. If we ask quality questions the client will tell us what they want and that will create an opening for a second meeting. We (at Redbird) can help the agent with the needs assessment and case design. If possible we’ll go with them. We’ll work on overcoming objections. And, if the agent needs help when they are with the client they can call us on the spot. That builds credibility with the client.

“This is also all new for the client who is moving their hard earned money out of market—which is all they’ve known—into, for example, an FIA. It will be a paradigm shift for many clients and agents will have to be very sensitive to this.

“It’s going to be exciting working with the agents that want to expand their capabilities.”

Take a look below at the sessions scheduled in March. And, with baseball just around the corner, we have scheduled a doubleheader for March 20: Tax-Free Retirement in the first half hour and Moving Money, Protecting Clients in the second.

Redbird Chirps

- Transamerica offers new Trendsetter® Living Benefits (LB) product. The rising incidence of illnesses like strokes, heart attacks, cancer and other chronic diseases is putting increased financial pressure on families. This new Transamerica product is another in a growing list of important products that provide access to cash while clients are still alive. Check out the excellent (PDF) brochure from Transamerica.