A commonly overlooked element of insurance sales training is learning how to write a life insurance cover letter to an underwriter.

This is something I learned from a mentor of mine who was a top 1% advisor in the country.

Using a life insurance cover letter when submitting life insurance applications is one of the easiest and quickest ways to increase your placement. And, earn more commissions.

Yes, this is something top insurance agents have learned to do because they know it increases their productivity!

You have a strategy for your life insurance sale pitch right? Why not have one for your underwriters?

Why Write a Life Insurance Cover Letter

The purpose of the life insurance cover letter is simple: provide case-specific details that help get your client the most competitive offer from the life insurance company and likely expedite the approval process.

Here’s the scenario.

You just submitted a life insurance application and after a few days the emails begin pouring in about outstanding requirements holding the case from moving forward. A life insurance cover letter submitted with the original application will help avoid these interruptions.

The more information you provide an underwriter on the front end, the better off you’ll be. Plus, you’ll begin to build great relationships with the underwriting team. Tip…life insurance underwriters love cover letters because it makes their job easier!

Save yourself the time and headache and include a life insurance cover letter with every application you submit. One of the easiest ways to get a request for letter of explanation is by not including the information ahead of time in your cover letter.

The most recent example of a cover letter working to our advantage was an impaired risk case we ended up placing for a target premium of $43,000. The underwriter loved our detail and it avoided a bunch of wasted time communicating back and forth.

General Life Insurance Cover Letter Information:

Each life insurance cover letter should include the basic information that an underwriter will want to review. Below are the items you should include in your life insurance cover letter at a minimum.

- Employment and community involvement

- Your relationship with the client (Example, new, longstanding, center of influence, etc.)

- The offer you are looking for and the timeline you are trying to work within

- Any other pending applications or life insurance offers

- Explanation why any requirement is not available or attainable

Purpose of Insurance, Sales Strategy, and Financial Information:

- Family Protection:

- Is the applicant married, divorced, widowed?

- Do they have children or other dependents?

- Buy-Sell:

- Is there a formal buy-sell agreement or business appraisal in place?

- How was the value of the business determined?

- Are all partners applying?

- Key Person:

- What are the proposed insured’s job duties?

- How experienced is this person in the industry?

- How was the loss to the company determined?

- How long has this business been in operation?

- How many employees?

- Is this the only key person?

- Loan collateral:

- What is the purpose of the loan?

- Is this an SBA loan?

- What is the duration and value of the loan?

- Estate planning

- Was an estate planning attorney or CPA involved?

- How was the face amount determined?

- Will the policy be owned by a trust?

- Premium financing:

- What is the exit strategy to repay the loan?

- What is the client’s net worth?

- What is the client’s current income?

- Has a lender already been identified?

Health and life style summary:

- Health factors in the client’s history that might make placing the case tough

- Any extensive travel plans

- Citizenship details

- Details not provided in application regarding avocations or driving history

- Reasons for any substandard ratings or declinations in the past

Underwriters are information junkies… the more you provide, the easier it is on the underwriter to approve the life application or consider a more competitive offer.

Conclusion:

Consistently implementing the use of an underwriting cover letter will result in three things.

- You will quickly become a better fact finder with your clients and instantly raise consumer confidence during your sales cycle.

- You will build stronger relationships with the insurance companies and underwriting departments which means your quality of business will improve.

- You will increase your referrals because your clients will recognize you actually care about the process. People do business with those they like and trust, and they will see you as a reliable, knowledgeable problem solver.

So, go make underwriters a priority in your sales cycle and start reaping the rewards! 🙂

Other Trending Articles

- Understanding how business owners use life insurance.

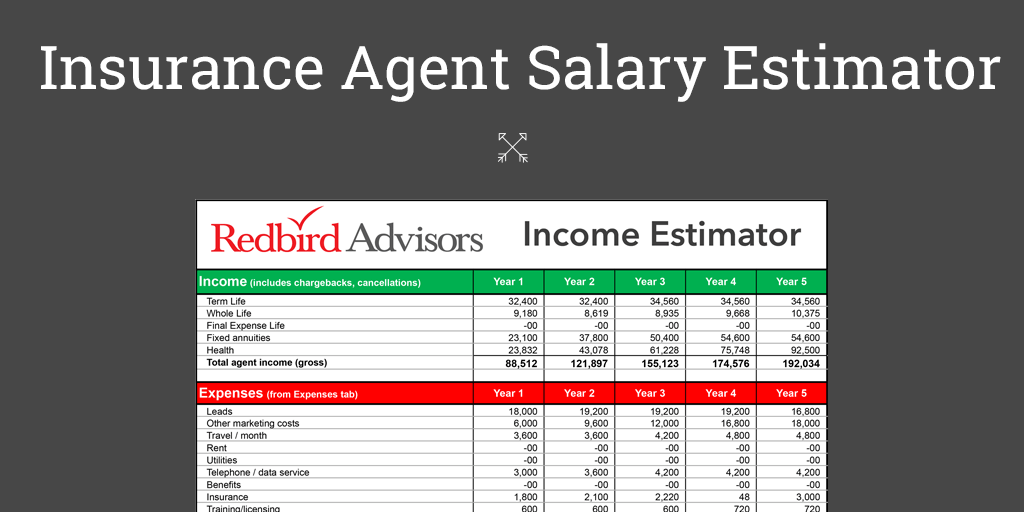

- Building a six-figure income in the Medicare space.

- Guide to understanding how ancillary insurance products work.