Agencies Selling 500+ Medicare Plans Annually Can Earn an Additional $100,000+ this AEP.

Enclosed you are going to find seven critical steps that if you strictly follow, will make you more money than you have ever made, selling insurance.

Is the insurance industry a good career?

The truth about being an insurance agent is that it’s hard work, but the money part gets easy after a while, and it’s a great career!

You need to focus and not skim through this article if you want to learn how to make money selling insurance.

Every year you are flooded with ways to improve your agency, but there is usually one question you’re asking yourself, “What can I do this year to make more money”?

I’m going to SHOW you EXACTLY how to make money selling insurance if you’ll take the time to read this 🙂

You see it all the time on google, “100 Sales Tips to Grow Your Agency.” Or, “100 Best Insurance Marketing Tips.”

And, inevitably, you end up reading through all 100 ideas and can’t seem to sink your teeth into any of them because your brain is fried.

The truth about being an insurance agent is finding a few key strategies you aren’t currently working now and add them to your agency for the upcoming year.

Set attainable and realistic goals for the year ahead and follow through.

You’ve probably heard me say this before, don’t chase shiny objects.

7 Proven Steps to Making More Money Selling Insurance

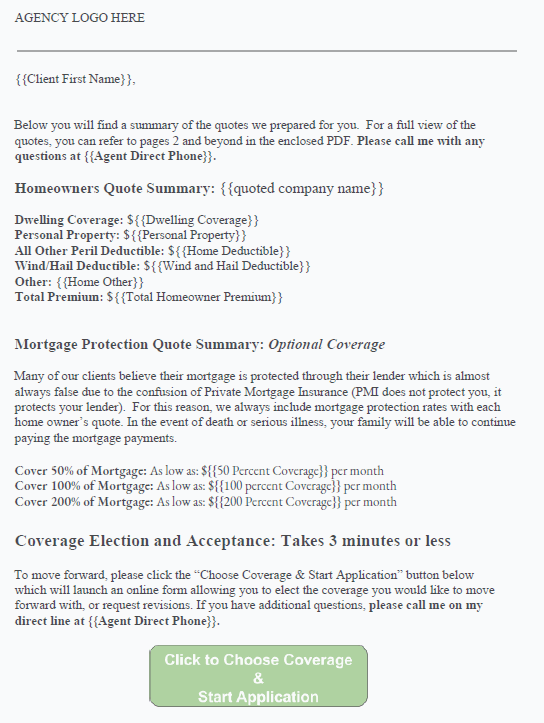

#1 Always Summarize Quotes for Policyholders with Products and Premiums

This step is critical when your sending quotes for insurance products to new prospects via email.

Whether you’re quoting a life insurance policy and sending over a 20 page IUL illustration or selling home and auto and sending over multiple pdf documents, you should summarize the insurance products to improve the experience for your potential new policyholders.

Here is what I mean.

When you send a multi page pdf generated by the various insurance companies you represent, you have to remember most policyholders don’t know a thing about insurance. I call them policyholders and not clients, because they already own some form of insurance products and have a preconceived notion of the sales process.

They are surely going to get confused and have questions about whatever insurance products and premiums you’re proposing. This is your chance to prove to them you are EASY to work with.

This is why insurance products and premiums summary sheets are so effective.

One of my favorite tips for selling life insurance.

Create a summary page that is consistent for every client that lists the insurance products, premiums and over all insurance coverage so you’re future policyholders can make an easy decision.

The key here is consistency. You need a process that you can replicate at scale in your agency.

Step 1) Create a TEMPLATE that has an intro, insurance coverage section, and call to action. I would do a simple word doc that has the content and an easy chart summarizing their coverage and cost options. Below is a quick example of what I’m talking about.

You’ll notice the sample letter is setup so you can connect this to your CRM or other tools to populate information from documents you already have on file. I would personally recommend automating the entire process.

Step 2) Consistency: Use insurance coverage letter template to create a summary form for the new prospective policyholder and save to their client file. This is critical to the consistent habit you want to build.

Step 3) Attach a copy of their insurance coverage summary sheet along with their quotes and instruct them to review the summary page first. This is where your future policyholders will appreciate you took the time to make things easy for them.

By doing this you will create happier prospects and your sales conversions will increase due to the ease of doing business. We have had the most success doing this process with home and auto agents looking to cross sell life insurance. It works great and is consistently one of our most popular tips for selling life insurance.

Do you want to learn how to automate the process of sending life quotes with each home and auto quote?

Yes! I would like to schedule a time to learn how to do this.

#2 How do I become a successful insurance sales person? Strategic Partnerships!

I Love, love, love these!

Sales agents ask me all the time, “how do I become a successful insurance sales person”?

My first answer is to always practice patience, and second is to focus on building strategic partnerships. This is especially important for independent agents and insurance brokers.

If you sell insurance and don’t do this, you’re missing out!

We wouldn’t have survived in the insurance business without strategic partnerships. Having like-minded people with skills that compliment yours and that you can tap at a moment’s notice is an invaluable resource.

Partnerships will also make you look bigger and smarter.

Sometimes they can even be an excellent lead source. Having core people in place who are advocates for your brand will help you continue to grow your agency.

If you’re an insurance agent, get out there and start asking for meetings. Take someone to coffee, lunch or even a simple phone call.

Tell them your objective is to learn more about their business and uncover some synergies.

The result – you will uncover opportunities.

What is my recommended solution to use this to sell insurance?

You first need to identify the areas you want to start selling. Once you know that, the rest is easy. Remember, you asked, “how do I become a successful insurance sales person”? This is it.

For example, if you own a P&C agency and want to cross sell life insurance—but you’re not sure how to start—then start looking for the movers and shakers in your area that are in front of your target prospect.

Or, don’t be confined by geography… search online.

The life agent doesn’t have to live in your area, especially if you are focused on selling more to existing policyholders. You get the appointment because you are a trusted source and then you let your smart “partner” make the sale.

Remember, the most lucrative insurance to sell is the kind your target market needs. Make your decision to start selling based on policyholders needs.

Connect with independent agents or groups of sales agents

Say something like this…

“Hey Joe, this is Drew Gurley. You don’t know me but I’m calling you because of your experience selling life insurance and I’m looking to connect with some independent agents in my area. Do you have a few minutes to chat?”

If this agent doesn’t respond positively, then hit the NEXT button and repeat until you find an agent or group of sales agents interested in growing their business and looking for a kickass partner like yourself.

Now that you have the conversation going, invite them to breakfast or lunch and tell them what you are trying to achieve and see if they are interested in helping you.

It’s that easy.

Do this enough and you will build some very lucrative strategic partnerships over time.

I know this works because it’s exactly what I do ALL THE TIME.

Here is another tip for how independent agents can build centers of influence.

I would partner with estate planning attorneys and offer to do seminars for them on their behalf, and on your dime.

Here’s how it works.

Let’s say you’re an independent broker and an expert in social security planning. You can work with an attorney to conduct social security or Medicare seminars for their clients. This usually works best when it occurs at the attorney’s office as the clients are more likely to show up relaxed.

Here it is in a nutshell:

- Find an attorney who wants to partner up.

- Send direct mail out to the attorney’s book of business that falls into your target age group.

- Conduct a seminar and take 30-35 minutes for your presentation and leave 20-30 minutes for questions (they will all have questions).

- Assuming an average size conference room, limit your audience to 2-4 couples (8 attendees) – Intimate settings are great and generate more questions.

- Provide light snacks and drinks (I usually do deli sandwiches, soda, and water) and spend less than $150. They are there for education, not for the dinner, so don’t try and make it something it’s not.

- Follow up and start selling.

This is a great way to establish yourself as an expert and expand your prospect base. It also allows the attorney to add great value to their existing customers. And, the attorney will begin sending you referrals as they talk to clients, it’s a snowball effect.

You’ll start to notice some consistency after the first few weeks of doing the seminars. People from the first couple of events will begin to follow up with questions and you’ll now have a solid list of follows up to start dripping (drip marketing is key to success here).

Spend an hour a week doing this and by the end of the year you’ll be shocked at the relationships you’ve built and the customers you’ve added to your book of business.

Again, the most lucrative insurance to sell is the type your prospects need. You can’t do this without having a consistent group of prospects to communicate with.

Lastly, the most important part here is that you don’t forget to follow up. If you set this up with out a follow up plan in place, you’ll fall flat on your face and I’ll be forced to tell you “I told you so”. 🙂

Partner with Physicians

Another great strategic partner to help drive sales is by partnering with local primary care physicians. You can find out which plans they offer and become a valued resource.

The key to making these work is by taking the time to build relationships with the office staff so you remain top of mind. If they know who you are and what you do, they will certainly remember to refer you when they get questions they aren’t prepared to answer.

How do you get started partnering with physicians?

- Walk in the office and politely ask to speak with someone in billing.

- Ask them which health plans they are in network with.

- Medicare Advantage

- Commercial plans

- Medicaid

- Let them know you are a local resource and you would like to start helping their patients better understand their benefits.

- Follow up consistently with the office staff and get to know them…this is the most critical part.

Spend the time to develop and nurture strategic partnerships and before you know it, you’ll have new referrals coming to you every single week. More referrals means more money!

#3 How can I increase my insurance sales? Marketing!

We all have our strengths and, for sales agents like us, marketing may not be one of them. This is true for both full time and those selling life insurance part time.

It’s important to have literature and brochures about who you are and the types of insurance services you offer. Compile your core insurance products and services available in your agency and create targeted brochures for each of the types of insurance.

If you are selling home and auto, you need to have a marketing piece specific to home and auto.

If you are selling Buy Sell and Key Man policies, the same applies. Having professional-looking literature makes you look smarter and bigger.

And so on and so forth for the following:

- Long-Term Care Insurance

- Annuities

- Umbrella Coverage

- Final Expense

- General Liability

The point here is you need to be prepared to be the absolute best at what you do. This doesn’t happen unless you are prepared.

I say it all the time, the most lucrative insurance to sell is the kind your prospects need. Arm yourself with information to help build the need.

**Tip – Long-term care insurance is a good target due to the size of the baby boomers. It’s a complex topic and a major need for the growing boomers.

What I would do…

Whether you’re a full time independent broker or just selling life insurance part time, create a marketing library of the services your offer as well as individual selling sheets on each of those products and services.

Many local printing shops have in house designers who can help you.

Or, you can contact a graphic design company to create a consistent look for all your pieces to make you look like a rock star to your clients. My suggestion is to look at Upwork or Fiverr and find a really good marketing freelancer.

The easiest way to do this is piggy back on what we have already done here at Redbird.

Below is a link to download a free services offered template which you can customize with your logo, services and contact information. We also have about 30 other brochures for different types of insurance you can access; you just need to ask.

REQUEST YOUR FREE CUSTOMIZED MARKETING PIECES

Focus on The Right Message

What makes a good insurance agent is knowing how to communicate to your prospective policyholders.

It shouldn’t surprise you that insurance is traditionally very product focused. Agent has an insurance product, sells it to someone, and moves on to find another person to sell.

The problem with that shotgun approach is that it’s too short sighted. Using the right marketing materials will help with this!

Let’s take a life settlement broker for example.

At one point they may have been licensed to sell life insurance, but they have transitioned their focus on life insurance settlement cases which focus on around selling inforce life insurance policies. This agent found their niche and when they are prospecting for new clients, they are using the right message at the right time.

Another example is term life insurance agents.

Even if term life is something we offer to multiple segments, what we say to the young couple will undoubtedly be different than the couple with college just around the corner.

Too often insurance marketers carpet bomb with the same message and then wonder why nobody responds.

Do your homework and don’t make that same mistake. Be very intentional with your messaging and speak directly to the heart of your target customer.

#4 Cross Selling – Start Cross Selling and Round Out Your Accounts

Rounding out accounts is the low hanging fruit of a growth strategy. You already have a book of business that knows and trusts you.

If they aren’t buying from you, they are buying from someone else. This is a fact!

You may have a strong commercial lines book of business, but are you offering Key Man Insurance or Buy Sell funding solutions using life insurance?

Did you know voluntary accident plans often reduce your clients’ workers comp claims?

Did you know that individuals turning 65 not only need Medicare options, but they should also be considering safe money options such as fixed annuities in retirement?

Rounding out your accounts can be simple when the offering makes sense. Plus, it’s easier for you to commit to cross selling when you are connected to the purpose of the new product you are offering.

Here’s my two cents on cross selling.

There are many techniques in selling life insurance and I’ve seen many of the insurance selling strategies to create my own opinions over the years.

Start small and kick off two basic insurance selling strategies that won’t disrupt the day-to-day flow in your agency.

Insurance Selling Strategy 1:

Train your CSR team to consistently ask a few basic questions.

They are speaking with your clients on a daily basis and are the perfect folks to generate discussions which can be pivoted to new sales appointments. Along with asking the right questions, you need to stay in touch with your existing clients consistently.

Insurance Selling Strategy 2:

Start an email marketing campaign using video. Video is one of my favorite techniques in selling life insurance!

My friend, Mike Demko at My Insurance Videos, has an excellent program that easily allows you to stay in front of your clients all year long. The greatest part about this is the ability to put the entire program on autopilot… you can set it and forget it. Using some simple techniques, Mike can have you up and running with an automated video email marketing campaign in literally 15 minutes. He has already created the content for you which is then branded with your logo and information. This will save you time and money and instantly separate you from your competition.

DOWNLOAD YOUR FREE EBOOK TO VIDEO EMAIL MARKETING

The right clients for cross selling

Clearly, you need to speak differently to commercial and personal lines clients. Even if you’re simply announcing your expansion into life insurance, the tone and approach of the message should be different.

However, the real issue—and opportunity—will be to determine what specific groups or segments of clients to target.

Let’s tackle each one:

Cross selling commercial clients life insurance

This is a hot topic and great opportunity!

Small to medium sized business owners are a fertile target audience. For example, LLCs have operating agreements and owners often have buy-sell agreements.

Buy-sell agreements typically require each member to have life insurance (Term, UL or IUL) to protect the business in the event of the death or removal of an officer, often called Key Man/Person insurance.

Other business structures have similar needs. We would recommend one of your first letters focus on life insurance to protect their business.

I can almost guarantee that if they open the envelope and see the subject, they will read it.

**Inside Tip – I work with a lot of commercial P&C agents and the ones with a focused book of business have tremendous success cross selling their commercial clients life insurance. Typically to the tune of an extra $100-$150k per year in income using these strategies.

Cross selling personal lines clients life insurance

The segmentation possibilities are almost infinite.

We would encourage you to filter your client base by age and income to start.

For example, a young client or family with children (less than 30 years old and making less than $75,000) is the perfect candidate for term insurance.

Remember, term life insurance is the most basic protection at the lowest annual premium. An older family, with teenagers headed to college, making $150,000 per year has many more needs for life insurance.

And, don’t forget those older than 55 or the wealthy.

Fixed annuities are an excellent tool to manage risk and provide predictable income in retirement (and most clients are totally unaware of the benefits of annuities).

The cross selling opportunities are endless.

#5 Virtual Assistants Help Independent Insurance Agents Earn More Cash

Virtual assistants are a growing trend with independent insurance agents.

They are an excellent way for you to delegate responsibility and free up time to complete your core sales activities. Plus, they are much more affordable than a traditional assistant. This can be good if you’re new to the business and cash is tight.

The life blood for a life insurance agent is commissions for selling life insurance. You can’t do that when you’re stuck doing service work.

- How much time are you wasting following up with your carriers on commissions or insurance policy requirements?

- Are you calling to get beneficiary change forms for the last insurance policy you wrote?

- How long did it take you track down an insurance policy that the insurance company claimed it never received?

Your virtual assistant could work a few hours each week to track all your commissions and reconcile your reports. They could call and get all your required forms for your upcoming policy delivery.

You can even have them calling existing clients to schedule policy reviews.

They can complete all of these are activities which are burning your precious sales time.

What is my recommended solution for independent insurance agents?

Hire a virtual assistant and start off-loading responsibilities to free up your time to start selling. The costs are minimal compared to what you’re losing by not focusing on what’s most important in your business.

If you’re curious how to best utilize a virtual assistant, here’s a great guide to help you learn more.

#6 Insurance CRM Reduces Challenges in Selling Life Insurance and Other Lines

Don’t get intimidated.

If you don’t have a CRM now, that’s ok, but you really should consider it.

Having a CRM in your insurance agency is going to help you keep track of your clients and maximize your sales efforts.

Let’s say you’re a Medicare agency and have 2,000 clients and want to filter all your clients who will be impacted by network changes in their local HMO plan. You can simply use your CRM to filter based on the information you are looking for and pop out the exact list you need.

Another way to use a CRM is by creating your daily call list, which is one of the common challenges in selling life insurance.

This will help you ensure you are consistently reaching out to all your leads and policy holders throughout the year.

One of my favorite automatically generated call lists are clients I have yet to complete an annual review with. The CRM will auto-generate this list and I can then send it to my Virtual Assistant to start calling and scheduling.

After all, we’re in a relationship business.

Without a CRM, you may not be able to effectively create and execute ongoing marketing and communication plans.

What is my recommended solution?

Start simple.

Find a CRM that keeps your costs down but allows you to manage the core tasks which drive your business.

Don’t get stuck on the bells and whistles, you can worry about that later. And, you no longer have to buy an expensive software program… you can simply pay a small monthly fee and get access to the same high-powered capabilities the big boys use.

Popular CRMs for insurance agencies:

- Zoho (my favorite)

- VanillSoft (super user friendly and incorporates CRM, soft phone, text, and email)

- Agency Bloc (popular but I haven’t personally worked with it)

- Radius Bob (easy to customize)

- SalesForce (Best and most expensive)

#7 Social Media – Become a sensational tweeter 🙂

Social media isn’t just for high school kids.

Living in 2021 as an insurance agent, salary remains one of the toughest parts of the business to manage as more and more consumers are buying online.

Think about it, if more buyers are online, shouldn’t you be there too?

Millions of dollars each year are made through connections on social media.

If you’re scared of it, have someone else do it for you (like your virtual assistant).

Social media allows you to establish yourself as a leader in your space, in this case, insurance. You are the best at what you do and should portray that to your social networks.

Use social media to help people get connected with you when they need someone to solve their problem.

What is my recommended solution?

Find a college intern.

You can have them help you with a social media strategy and then put them to work helping you to execute. By doing this you will be able to focus on creating the content you know your followers need and leave the technology side of things up to your intern.

They will put together your posting schedules, manage your multiple accounts and even help you identify influencers which may share your content and build your following.

You’ll be sharing viral content in no time and your clients will see you as the go to person to help solve their problems. Go check out your local college and find a hungry intern looking for experience in the real world.

**Tip – Start making social videos educating on your core services. People are hungry for detailed value and it doesn’t need to be hard.

- Use your smart phone or tablet to record your video.

- Keep your topics short, concise, and consistent.

- Don’t worry about editing out the ums and pauses, you can improve that later.

- Speak to your target prospect from your heart and focus on education.

- Do it weekly.

- Take your phone out of your pocket, off your deck, out of your cup holder, off your nightstand, and record a video right now. It’s that easy!

The hardest part here is getting started which is why I listed it in such a simple way. Once you start something and it becomes a habit, you’ll instinctively improve along the way. Don’t let trying to find the perfect process keep you from getting started. Just go for it and give your videos to your intern to start posting.

Good luck!!

Conclusion: Work Smarter, Not Harder if You Want to Make Money Selling Insurance

Does selling life insurance pay well?

Heck yes, and so do the other lines of business, but only if you’re selling consistently. Life insurance agents need to have the same business focus as commercial, personal lines, or health agents. I’m partial to using life insurance agents as examples as that is where the bulk of my sales time has been spent since I started an independent agency over a decade ago.

Sales are the life blood of your business and anything that gets in the way better be mission critical.

We covered a lot in this article and hopefully you’re walking away with some actionable ways to sell more insurance.

By considering the 7 tactics listed above, you’ll be growing your insurance agent salary in no time. Knowing how to build strong relationships, increase your personal brand, pivot discussions, delegate responsibility and focus on your customers is a sure fire way to increase your sales year after year.

More sales, more money.

We see this happen all the time and it pumps us up!

Taking steps to implement new strategies and step outside your comfort zone is exactly how the successful insurance agents separate themselves from the unsuccessful ones.

They are taking more risks, getting uncomfortable and learning new ways to improve. And, they do it all the time.

Selling Insurance Pros and Cons

Pros:

- You can improve the lives of every client in your book of business.

- You can work flexible hours.

- Commissions are uncapped.

- You can make a lot of money

- You can be the owner of your independent insurance agency.

- There are multiple areas to focus your sales efforts.

- You have full power to harness your creativity to serve your customers.

Cons:

- Sales is hard to master and it might not be for you.

- Starting out commission only can be tough.

- Working for a captive agency limits what you can sell.

- You have to be accessible outside of work hours to service your clientele.

Strongly consider what we have listed above and see for yourself how you can change the pace of your sales in the coming year.

As always, we would love to hear from you. If you have any questions or comments, please call 866-547-8780 to speak with someone on our team.