Reading time: 8 minutes

Mike Granbois is one of those guys who is sneaky smart. Five minutes talking about annuities and you start to realize you have a lot to learn. Mike’s spent almost 15 years focused on helping clients plan their investments, primarily for retirement. And, annuities—indexed annuities to be specific—have been a big part of his success.

For those of you intrigued by annuities go to the last question of this story and read Mike’s answer. Then come back and read the rest. You may walk away with a different view of the potential of your business.

Redbird: How do you describe annuities to the agent who is considering them?

Granbois: “They provide clients with guarantees in regards to investments and they can be a self-funded pension to give clients a guaranteed lifetime income stream they can never outlive.”

Redbird: That sounds too good to be true.

Granbois: “There are only three ways you can have income that you will never outlive. One is Social Security, and we all know the problems with that. Two is a (employer-sponsored) pension and fewer and fewer companies are offering that to employees because of the cost. And three is an annuity that provides the same benefit but is self-funded.”

Redbird: Then why aren’t agents flocking to annuities?

Granbois: “Annuities have a certain stigma attached to them. They have been improperly sold by some agents just because they can sound too good to be true. Some agents—the bad apples—have been able to take advantage and sell to those clients who don’t necessarily need an annuity or are convinced to put too much of their money into it.”

Redbird: What are clients’ biggest concerns?

Granbois: “The biggest concern retirees have is outliving their nest egg and annuities can address that. Almost all clients will listen to you about it, but you have to make sure it’s the right fit for the client.”

Redbird: Isn’t there a misconception that annuities are only for the wealthy?

Granbois: “The opportunities are not just with people with huge 401(k)s (to roll over). A lot of agents I deal with go after checkbook money that is getting less than quarter of a percent. So, annuities can fit for just about everyone, but again, it’s a personal scenario.”

Redbird: What’s around the corner for annuities?

Granbois: “Our industry has changed drastically from 10, even five years ago. Interest rates then were significantly higher than today. We used be able to sell 7% guaranteed rates on fixed annuities. Today, those fixed annuities are probably 3%. On the positive side, the older products were much more restrictive in benefits to clients. There are many more bells and whistles today that clients can add to annuities. Today the agent can cater the product to specific client needs.

“Also, the evolution of annuities with income riders has been a huge positive. Low interest rates have forced insurance companies to scale back because they are having trouble making profits in a low interest scenario. Hopefully as rates rise they will put more benefits into the products and we’ll see costs decrease.”

Redbird: How important is it for agents to include annuities along with their life products?

Granbois: “It’s better any time you can be a one-stop shop. One, you are bringing more to the table and two you are taking away the propensity for the client to get that service someplace else. Life insurance and annuities tie very strongly with one another. They are different products but they are strongly correlated to overall financial planning. In my financial planning practice, if client has a life agent that doesn’t do investments, tax planning and investment planning like I do in my practice, 95% of the time that client will end up doing life insurance business with me as well.”

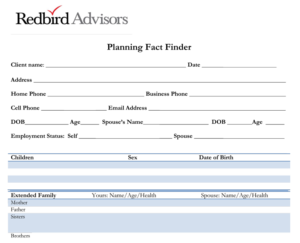

New! Fact Finder available to agents

It never fails: you’re pulling out of the driveway and a really important question comes to mind you wished you would have asked. Help is here.

While the new Redbird Advisors Fact Finder doesn’t claim to be the one source for all knowledge in the universe, it is a resource to guide client discussions to another level (see interview above with Mike Granbois). One minute you’re talking about a small policy to cover a cremation, the next minute you’ve uncovered they have $50,000 in a CD or a checking account and are, not surprisingly, really unhappy with the return. It’s all in how you ask the questions.

It covers all the major subjects, from family planning to retirement planning to funeral planning. And, at the end there is a form you can have the client fill out while you’re there and use it as a key discussion tool.

Another great reason to use this: it provides you a record of your discussion just in case memories get fuzzy months or years down the road. You can never be too careful!

Download a copy from the link below and please let us know how it works and if you have suggestions or additions.

Redbird Chirps

- 5Star training videos help you get over the internal speed bumps. Insurance is a complex and regulated business, so there will always be challenges in getting business through the system. 5Star has put together several great videos to help agents navigate its systems, which they are aggressively upgrading to meet growth. Log into the agent portal and make life easier for yourself. Great effort on their part!

- You make your own luck. No matter the saying – “Power of Positive Thinking” or “Thoughts are Things” – the foundation of luck is all about behavior and attitude. Think good things and good things will happen. Spend a little time with this simple article and begin to believe that “luck” is under your control when so many around you wait for it to happen.