Welcome to your comprehensive resource for understanding bank owned life insurance. We originally posted this content on bankownedlifeinsurance.org, but felt it was necessary to make the content available to everyone over here at Redbird.

The authors, Drew Gurley and Scott Karstens have more than 30 years of combined experience working with business owners, banks, high net worth clients, and are both current members of the Forbes Finance Council.

Interested in Getting a BOLI Quote?

Enclosed you will find a full review of bank owned life insurance (BOLI) which will help you better understand if it’s a strategy your bank or credit union partners should be utilizing.

What is Bank Owned Life Insurance?

Bank Owned Life Insurance (BOLI) uses tax advantages to create an efficient way to offset employee benefit costs for banks and credit unions.

A bank will purchase and own a life insurance policy on an executive or group of executive’s lives and the bank is listed as the beneficiary of the policy.

Cash surrender values are allowed to grow tax-deferred to provide the bank with monthly bookable income. When the insured executive passes away, the tax-free death benefits are paid to the bank and distributed according to the agreement in place.

These types of policies provide funding for investment to offset the cost of providing benefit packages to employees in a specific organization.

The U.S. Department of the Treasury’s Office of the Comptroller of the Currency (OCC) has ruled that banks are allowed to purchase BOLI policies, “in connection with employee compensation and benefit plans, key person insurance, insurance to recover the cost of providing pre- and post-retirement employee benefits, insurance on borrowers, and insurance taken as security for loans.” OCC may also allow for other uses on a case-by-case basis.

In the past, BOLI plans were bought for companies to protect them against any financial loss that might occur as a result of the death of an important member of their organization. More recently, these policies are now more commonly seen as financial keys to investment money while also sheltering against additional taxes.

The one caveat that must be met is that the policy owner must get informed consent from the employee or employees in question before a bank owned life insurance policy can be taken out.

Common uses for BOLI

- Executive Benefits

- Unexpected Loss of a Key Employee

- Buy / Sell Agreement

BOLI Checklist

There are a number of tasks which need to be completed when implementing a bank owned life insurance policy.

- Insurance companies: Review the various insurance company vendors

- Census: Put together the census which includes the proposed executives to be insured

- Underwriting: Understand the differences between full underwriting and guaranteed issue. You should understand the cost difference and the timing difference of getting the case approved.

- Approve strategy: Review the product and plan design in order to move forward.

- Create BOLI Investment Policy: This occurs between the bank and the plan administrator.

- Insurance Company Approval: Get approval and offer from the insurance companies to move forward with accepting the policy.

- Prepare Employee Communications: Finalized and complete communications to the insured team of executives.

- Complete BOLI Consent Forms: Complete the required forms for each covered executive.

- Final Forms and Outstanding Requirements: Submit final forms to the insurance companies.

- Wire Premium Payment: Complete wiring of premiums to the insurance companies.

- Issue policy: Insurance company will issue the policy and copy will be sent to the bank with evidence of insurance coverage.

- Service and Administration: Begin servicing and managing policy performance.

Which employees can be insured?

There must be an insurable interest clearly defined in order to be insured through a BOLI policy. Typically this means that the employee contributes to the company performance and are likely an officer or equity holder.

Employees participating must give written consent to be listed as an insured on a BOLI policy. This is achieved with a BOLI consent form provided by your administrator.

Below are the general requirements for those participating in bank owned life insurance.

- Employee is in the group of the top 35% highest paid

- 5% of greater equity holder

- Top 5 highest paid company executives

What is the Difference Between BOLI and COLI?

BOLI and COLI are incredibly similar.

BOLI

BOLI is a life insurance policy purchased and owned by a bank on a group of executives.

COLI

Corporate Owned Life Insurance, or COLI, is life insurance on employees’ lives that is owned by any corporate employer, not classified as a bank or credit union.

For both, benefits are either paid to the employer or directly to the employee’s families.

How BOLI and COLI work

The corporation pays non-deductible premiums, receives tax-deferred cash values and when the employee passes away, the corporation receives tax-free death benefit proceeds. When properly configured, this type of life insurance funding mechanism can allow a company to recover all costs associated with the policies put in place, including lost earnings on the premium deposits. Cash value can be borrowed against to aid in future cash flow or future corporate program funding. As long as the loans are repaid through the tax-free death benefit proceeds, no income tax is due on the distributions.

To summarize, the corporation pays non-deductible premiums, receives tax-deferred cash value accumulation, tax-free death benefit proceeds, and can book an asset to offset the account balance liability.

What is Credit Union-Owned Life Insurance (CUOLI)

Similar to BOLI and COLI programs, Credit Union-Owned Life Insurance (CUOLI) is also an efficient method that specifically allows credit unions to offset the costs of employee benefit programs while potentially generating higher yields than more traditional credit union permissible investments.

Many credit unions utilize CUOLI as an investment strategy to fund, or to offset costs of programs designed to reward and retain key employees. However, CUOLI is flexible and is not just limited to executive reward programs. It can also offset other employee benefit programs such as healthcare and other group benefits.

Because credit unions are finding it more difficult to compete for top talent, CUOLI is being used more and more to offset the costs of retention, reward and retirement strategies for key executives of credit unions.

Types of Life Insurance Used for BOLI

There are two common types of permanent life insurance used when designing a bank owned life insurance policy.

Indexed Universal Life Insurance (IUL)

Indexed universal life insurance is a common type of life insurance product used to fund a bank owned life insurance strategy. IULs provide premium flexibility and often have unique indexing options to meet the needs of the customer.

Some of the best IUL companies used for BOLI are Global Atlantic, Allianz, and Midland.

Whole Life Insurance

Whole life insurance is what most people are familiar with and has for a long time been a staple product for BOLI planning.

Banks often choose whole life for the financial stability paired with the strong dividend paying history. Some of the strongest whole life companies used for bank owned life insurance are Mass Mutual, Great West Life, and New York Life.

The Purpose of BOLI

While all banks may have a need for BOLI, it is usually the bank that has one of the following or a combination of the issues that need to be addressed that create the best match for a BOLI program:

- Consistently rising benefit costs

- Retention problems of key executives because of a lack of benefits

- Large deposits and a low loan percentage in relation to those deposits

- Unfunded post retirement obligations for employees

- A deferred compensation program for key employees

The growth of the cash surrender value is tax-deferred in a BOLI policy. When the insured(s) passes away, the death proceeds are received tax-free as a benefit of a life insurance policy. This combination of economic benefits makes BOLI an excellent tool to offset a variety of existing or new benefit costs.

How Does BOLI Work?

BOLI has been around more than 30 years and these life insurance policies are used as alternative methods to fund employee and executive benefits for participating banks. One of the biggest perks to an employee is the ability to access certain types of benefits at a reduced rate.

A BOLI policy is put in place when a bank purchases life insurance on a group of key employees or bank directors. The purchase can be made with a single large premium payment up front or through a series of annual premium payments. The bank sets up contracts, and then makes payments into a fund set aside as the insurance trust. All employee benefits paid to particular employees covered under the plan are paid from this fund.

Who is the Owner and Beneficiary?

The bank is the owner and beneficiary. Many banks share a portion of the insurance proceeds with the participants.

The tax-adjusted cash value growth within a BOLI policy produces a return greater than the payout of other possible alternative investments.

The accounting for BOLI is governed by FASB Technical Bulletin No. 85-4 and should be recorded on a balance sheet as an “other asset”. The increase in cash surrender or contract value during a specific period, as well as the final net insurance proceeds at maturity, should be recorded as “other income”.

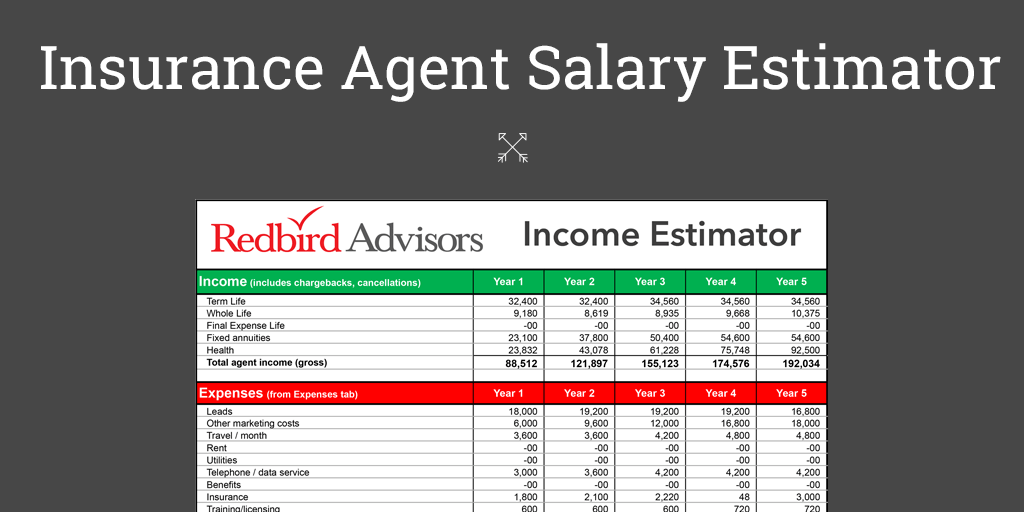

BOLI is a long-term asset when properly implemented and administered. It offers the bank a highly-rated investment option with a significant tax advantage versus other bank permissible investments as evidenced by the following chart:

| Single | Beginning of Year | End of Year | Tax-free | ||

| Age | Premium | Cash Surrender Value | Cash Surrender Value | Yield | Equivalent Yield * |

| 45 | $1,000,000 | $1,000,000 | $1,040,100 | 4.01% | 6.68% |

| 50 | $1,000,000 | $1,000,000 | $1,038,780 | 3.88% | 6.46% |

| 55 | $1,000,000 | $1,000,000 | $1,037,560 | 3.76% | 6.26% |

Banks can often get a stronger yield compared to other traditional investments.

Cash value inside a BOLI policy grows tax-free which means means the deposit gains are actually larger than they appear.

Who pays the Insurance Premiums?

The bank pays the insurance premiums of the BOLI policy out of their tier 1 capital.

Premiums are typically paid one of two ways:

- Annually

- Lump sum

Single premium lump sum is the most common ways banks pay BOLI premiums.

Regardless of how the premiums are paid, a specialized funding vehicle is created for these payments, also referred to as the bank’s insurance trust.

Employees are never required to participate in BOLI, but once the benefits are fully explained it can become an attractive option because there is no cost to the employees. In addition, for larger plans, there typically is no medical underwriting required.

Does the Financial Institution need to Communicate with its Employees About BOLI?

Laws vary by state regarding insurable interest and most states do already require disclosure, but most insurance companies will advocate obtaining positive written consent from every employee that is going to be insured.

This notification is part of the setup checklist.

How does BOLI Make Money for the Banks?

To fund benefit programs, banks will purchase BOLI policies on employees and reap the tax-free rewards. Not only is BOLI is a tax-shelter for the bank and can also offer it a tax-free source of funds.

The bank owns the BOLI policy and is also the beneficiary upon the death of the employee.

Banks save money (and that means they effectively make money) because BOLI policies used in connection with the funding of employee compensation and benefit plans, are set up by the bank.

The bank makes payments into a specialized trust account, and employee benefits are then paid out from the fund’s proceeds. From a compliance standpoint, BOLI is used to offset the costs of providing employee benefit programs.

Gains and payouts from the life insurance policies are both tax-free, so this is a creative tax-free way for the banks to fund their employee benefit programs. It also helps offset the potential loss of a valuable executive’s services.

BOLI is attractive to the banks because it can produce better returns that the banks couldn’t otherwise achieve. Since the growth in the cash value of the insurance policies is tax-free, and returns are further magnified by this benefit.

For example, a BOLI policy might appreciate in value at 3.25% to 3.5% per year. But since this is a tax-free gain, it is actually equivalent to a taxable investment gain of 5% or more.

Different Types of BOLI Plans

There are three types of BOLI products currently offered to banks:

General Account BOLI

A General Account is the oldest type of BOLI policy and still the most common product in the market today. When banks make an investment in a general account product the deposit becomes part of the general account of the insurance carrier.

Most insurance carriers primarily invest in real estate and bonds and with a general account, the carrier does not provide specific detail on where they are investing the BOLI proceeds. Instead, they provide some information on the general account holdings of the carrier.

BOLI policy cash values are backed by assets in the general account of the insurance carrier which emphasizes the importance of selecting a sound carrier

The product has a current crediting rate which can be changed from time to time by the carrier as well as a guaranteed minimum crediting rate that it cannot fall below.

It has a fixed interest rate that is reset annually based on expected return of assets earmarked by the carrier, minus a spread for expenses and capital.

Separate Account BOLI

With a Separate Account, the carrier segregates the holdings from their general account into eligible investments managed by well-known fund managers. The fund managers provide detailed reporting of the assets in the portfolio.

The BOLI cash value from assets are separately held by the carrier. This offers insulation from the claims of creditors and other policyholders in the event of carrier insolvency.

It has a variable yield based on the return of underlying variable policy assets, minus expenses.

The crediting rate is determined by the carrier, but there is no guaranteed minimum crediting rate. A stable value insurance rider can be purchased to smooth out the market performance and provide downside protection.

Hybrid Account BOLI

A Hybrid Account is a combination of the benefits of the above approaches. It provides both a current and guaranteed crediting rate of a general account product with the transparency of a separate account product.

It offers financing solutions for community, regional and large banks combined with a flexible program to meet each bank’s individual risk profile. It also provides the security of a contractually guaranteed minimum interest rate for the life of the policy.

Advantages and Disadvantages of BOLI

BOLI Advantages

- BOLI is a tax favored asset with returns that typically exceed after-tax returns of more traditional bank investments.

- Cash values grow tax-deferred and become tax-free if held until death

- Death benefits are tax-free

- Give banks the ability to efficiently generate gains to offset costs of employee benefits programs

- Risks are well within standard business risks in the bank’s investment portfolio

- Well-defined guidance on permissible usage by regulatory authorities

- No surrender charges

- Diversifies a bank’s investment portfolio

BOLI Disadvantages

- BOLI is considered to be a long-term illiquid asset. Although it can be surrendered at any time without policy charges, any gains in the policy now become taxable as well as a 10% IRS penalty on the gain. The policy must be held to the death of each insured before the gain becomes part of the tax-free death benefit and no tax is incurred.

- With these policies the bank also takes on all of the risks associated with holding the insurance policy. There is a possibility that all of the premiums deposited into the account could be lost.

- The biggest concern for most banks is the credit quality of the BOLI carrier. Most carriers in the market are of the highest quality, but that can change over time.

- The second concern is the competitiveness of the crediting rate in comparison to the market. A bank can either surrender the policies and pay taxes or execute an IRC Section 1035 exchange of the

Bank Owned Life Insurance and Tax Reform

If the tax treatment of Bank Owned Life Insurance (BOLI) changes existing plans may be grandfathered. But if they are not grandfathered, they may be surrendered for their cash surrender values.

It should be noted that BOLI’s current tax benefits have been unsuccessfully challenged over the years. There are strong bank regulatory guidelines for proper use of BOLI and it seems unlikely that tax reform will impact this investment device at any time in the near future.

What are the tax consequences of surrendering Bank Owned Life Insurance?

When a BOLI policy is surrendered, any gain above the premium that the bank paid would be taxed at the normal rate.

Most BOLI policies are also classified as Modified Endowment Contracts. These types of policies allow for the most efficient cash surrender value growth possible, but any gain is subject to an additional 10% penalty tax if the policies’ cash values are accessed.

But even with this penalty tax, the net BOLI returns may compare favorably to other financing alternatives over the same time period.

The greatest value of a BOLI plan is the tax-deferred growth of the cash surrender value.

The bank does receive death proceeds when an employee dies, but it loses the potential tax-deferred growth of that contract.

Many banks also choose to share a portion of the death benefits as an additional benefit to employees’ beneficiaries through a split dollar agreement.

Is Bank Owned Life Insurance Liquid?

Yes. It can be surrendered at any time for its cash surrender value. But if this happens, it could cause adverse tax consequences to the bank. That’s why to receive full economic benefits, BOLI should be considered a long-term asset.

How many Banks use This Strategy?

According to the FDIC, more than 70% of the Top 50 largest banks in the U.S. owned BOLI as of June 2015. As a whole, 55% of all banks have more than 3.5% of their Tier 1 assets in BOLI.

25% of tier 1 capital is the suggested maximum amount used for BOLI.

By the end of 2017, 3,570 banks nationwide reported cash surrender values on their regulatory filings. It was reported that 68% of these banks with assets between $100 million and $1 billion currently owned BOLI. There was $167.8 billion of BOLI cash value on bank’s financials also as of the end of 2017.

How is BOLl Regulated?

The regulations governing BOLI depend on the structure of the financial institution.

For National Banks, The U.S. Department of the Treasury’s Office of the Comptroller of the Currency is the primary authority for BOLI usage. The OCC updates BOLI usage periodically

And documents the ways in which BOLI can be used, as well as the risks that must be addressed prior to plan inception and over the life of the plan.

For State Banks, Part 362 of the FDIC’s regulations provides the authority for state chartered banks’ use of BOLI. These guidelines largely defer to the parameters outlined by the OCC, although exceptions may be permitted. State banks must also make sure that any BOLI transactions fall within specific guidelines that may be issued by their state banking department.

Savings and loans are regulated by the FDIC, they largely follow the parameters of laid out by the OCC.

Banks generally engage a third party administrative firm to provide the ongoing due diligence, administration and BASEL compliance necessary to administer a BOLI program.

Regardless of an institution’s charter, any BOLI program must comply with state insurable interest laws. The COLI Best Practices Bill limits the percentage of people who can be insured in any company, including banks.