I’ve heard more than once the misconception that selling insurance is easy.

If selling insurance was so easy, then why is it that roughly 10 percent of the independent insurance agents generate the vast majority of the sales? Are they better salespeople? Do they know something you don’t know?

Are all independent agents good salespeople? Heck no! The odds of succeeding selling insurance are against you, so listen up and let’s see if we can help you beat the odds.

Why Do Insurance Agents Fail?

It’s a common misconception that becoming an insurance agent is an easy path to success. Get a license, become an agent, join a brokerage and boom, start making money…not quite.

Statistics from the insurance industry reveal a different story. Roughly 10 percent of independent insurance agents generate the vast majority of insurance sales, leaving many to question the viability of this career path.

Many attribute the failure rate to agents being lazy or not intelligent enough—a “muddy bucket of water,” as one insurance agency owner described. However, we see a different picture. Often, the root cause is not a lack of intelligence or effort but a lack of preparation and or being open to dedicate the discipline required to master insurance business.

4 Highly Underestimated Components of selling insurance

- You aren’t following a universal sales process. This is a huge problem you should fix immediately.

- You don’t fully understand how commission based sales jobs work and how to navigate what it takes to survive.

- You’re not prioritizing insurance marketing, i.e. leads and referral partnerships.

- You’ve gotten lazy on studying the different types of insurance which impacts your ability to navigate your client’s needs.

I spoken with thousands of insurance agents, many of whom are venturing out on their own for the first time. They’ve been misled by friends claiming that selling insurance policies as an independent insurance agent is straightforward and profitable. Unfortunately, these new insurance agents are usually unprepared for the realities of both a new job and the challenges of what is takes to stay in front of enough potential clients each week until enough sales have been made that renewal income is sustaining the operation.

Insurance Agent’s Aren’t Prepared to be Business Owners

The notion that you just need to pass a local “Cash is King” course to start selling insurance products is far from the truth.

The insurance industry has built a false sense of security for new agents by subsidizing marketing costs in exchange for hefty commissions. This seems beneficial until the lead generation from these subsidized efforts fails to deliver, leaving insurance agents dependent and vulnerable. Being a business owner is not about getting free handouts from someone with little to no recourse on performance.

The harsh reality hits when agents realize that the support they expected—like paid leads—is not a standard practice across the industry.

This creates a vicious cycle where the bottom 90% of independent insurance agents are at the mercy of another entity’s marketing efforts. They wait passively for the next lead, rather than proactively generating new clients and insurance leads themselves.

Insurance Sales Requires Leads and You Can’t Afford Them

And, this isn’t just reserved for new agents.

I can’t even tell you how many prospective independent agents have abruptly ended a conversation when they learned we didn’t pay for their leads. What our industry has done is create a self-fulfilling prophecy where the “bottom 90% or so” of independent agents are slaves to somebody’s else’s marketing.

They are on their heels waiting for the next lead card to hit their mailbox vs. out hustling and generating new prospects.

When one agency’s leads start fading the agent simply pulls up stakes and moves to the next FMO. And, that often means taking on new product contracts and a lot more boxes of applications and brochures.

They never really take command of their business. And when you’re an independent agent, you need to operate in a capacity where you take command of yourself and the choices you make.

How to Not Suck at Being an Insurance Agent

It doesn’t have to be that way, you don’t have to suck at this business if you make the right choices.

You have a choice to actively participate in the success of your business and dramatically increase the odds of success. We believe there are three critical factors to make this occur:

Control What is in YOUR Control

I like to think this is the golden rule of becoming an insurance agent.

When you first start out you will be absolutely flooded with information which creates an environment of distraction. It’s overwhelming, stressful, and 100% real.

This is your chance to take a step back and look at your environment through a different lens.

There are only so many things you can do in a day, so getting overwhelmed is only going to hurt your results. Below are some tips for how your can stay focused when you’re surrounded by distractions.

- Remember that this is a marathon, not a sprint. You will never learn it all and you’ll constantly experience situations that will catch you off guard. Take things one day at a time and create small victories on a daily basis. For example, you received 15 new leads today and still have 75 that you haven’t connected with from previous orders. Instead of worrying about getting to all your leads today, shift your mindset to setting your target number of appointments. By doing this, you extract some of the stress and focus on what you can control, your ability to make quality calls and set quality appointments.

- Part of being a strong member of a team is being a strong follower. Some of the most effective leaders are the best followers. Allow yourself to learn from others and follow their lead. Doing this will establish a foundation from which you can customize over time. It’s easy to let your mind wonder and think that one approach isn’t right for you. What you need to remember is that establishing a foundation is critical, and being a good follower will get you to the finish line quicker.

- Don’t cast blame on others. Before casting blame on others for your lack of success or results, step back and think about how you choose to respond to directions from your leader. Has your attitude been in the right place and have you mentally accepted taking direction from someone else. Most agents hate hearing this, but frankly it’s the cold hard truth. Sure, sometimes it’s someone else’s fault, but most of the time it’s because you’re letting something other than yourself control your mind, actions, and decisions.

Choose how your respond. Choose how you embrace education. Choose to be positive.

How you choose to to respond will have a immense impact on your ability to succeed.

Learn to Love the Phone

It’s the number one fear for agents yet it’s the number one component that agents have complete control over.

We’ve heard a million reasons why insurance agents hate the phone, but we’re 100% certain that the most successful agents are those that make the phone part of their daily routine. We believe it is the lifeblood of a successful practice.

Remember, you have full control of your focus and effort!

The 10% of agents that absolutely knock it out of the park are glued to their phones on a daily basis, it’s in their blood! If you’re scared of the phoning, then go sell iphones at the Apple Store. If you’re lazy, then go get a salaried job.

This doesn’t mean cold calling, this means working your leads and opportunities.

- Call all of your leads.

- Call all of your follow ups.

- If you have exhausted all of your leads and follow ups for the day, then start calling your existing customers and upsell additional coverage.

- If you have exhausted your existing customers, pick up the phone and start working on calling your target centers of influence to build your referral channels.

- There is always someone to call that can begin generating an ROI…this is a sales 101 fundamental.

Long term, if you don’t make friends with the phone you have little chance of success selling insurance.

Always Ask For Referrals

Why, why, why won’t agents do this?

WHY?

If you only track one metric in your business it should be cost per sale. Take five minutes and do the math where each prospect you see gives you one referral and you close 25% of those leads.

It’s staggering.

Getting consistent referrals will transform your business if you’ll just do the work.

Create a Prospecting Plan

I know everyone says that.

Well, it’s true.

I’ll bet you 100 push ups that 90 percent or more of agents who wash out never spent more than five minutes thinking about the who, what and how of their business. Again, they weren’t prepared to be business owners.

The most successful insurance agents have goals for their business, a target audience, products they are comfortable with and a passion for being their own boss. Agents who try and wing it on a daily or weekly basis are bound for failure. Following a plan not only provides confidence in yourself, but it also provides consistency in your life.

Frequently Asked Questions

What type of insurance should I sell?

You should sell the products that live at the intersection of opportunity backed by data and what interests you. Whether it’s selling Medicare plans, life insurance or annuities, you need to pick your focus and start with what feels right that also shows a path to progress.

What is the hardest part of being an insurance agent?

The hardest part of being an insurance agent often revolves around the constant need for lead generation and sales. Many agents struggle with the cold calling aspect, where rejection is frequent, and maintaining a steady stream of new clients can be challenging. Additionally, balancing the demands of insurance sales with personal time can lead to burnout.

Is it hard to make money as an insurance agent?

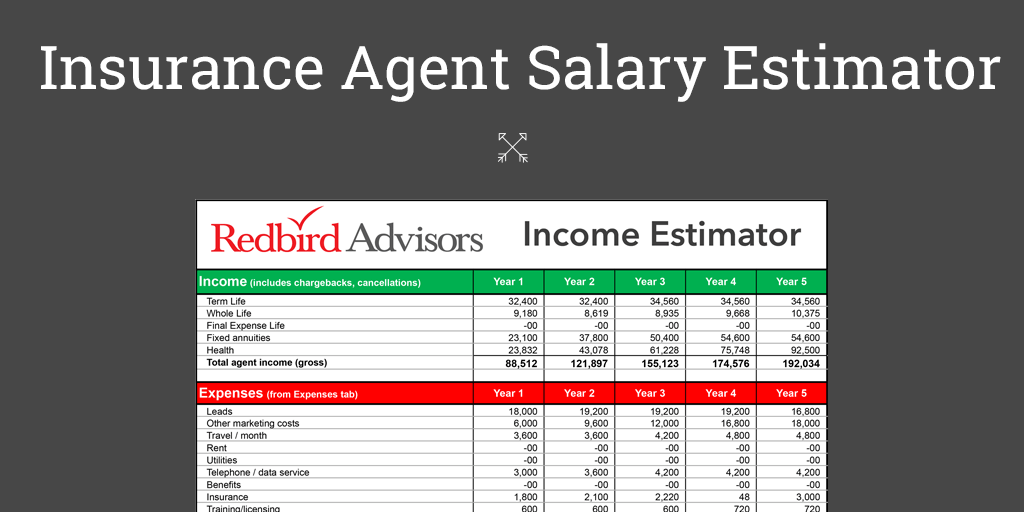

Earning potential as an insurance agent can vary widely. While some agents achieve significant financial success, others find it difficult to make a stable income, especially in their first year. Success typically requires a strong book of business, effective referral networks, and the ability to sell multiple types of insurance products.

How stressful is being an insurance agent?

Being an insurance agent can be quite stressful due to the high-pressure environment of sales jobs and the need to meet quotas. The uncertainty of income and the hard work required to build and maintain client relationships add to the stress levels.

Why do so many insurance agents quit?

A high turnover rate in the insurance industry is often due to unrealistic expectations about the career path, lack of initial support or training, difficulty in building a sufficient client base, and the stress related to income instability.

What type of insurance agent?

Insurance agents can specialize in various fields such as life insurance, health insurance, auto insurance, and homeowners insurance. Each type requires different knowledge bases and sales techniques.

Why is selling life insurance hard?

Selling life insurance is challenging because it involves discussing sensitive topics like death and financial planning, which many potential customers are uncomfortable or reluctant to think about. Additionally, life insurance policies can be complex, requiring agents to have a thorough understanding and ability to explain these details clearly.

How to sell life insurance from home?

Selling life insurance from home is the same as any kind of insurance and follows a similar process once you pass your licensing exam with your respective state insurance department.

- Pick you product: Choose which type of insurance you’re going to focus on. (home insurance, life insurance, healthcare such as Medicare or under 65 health insurance from the ACA marketplace, etc.)

- Get Contracts: Secure contracts with insurance carriers using a brokerage, FMO or directly with the carriers.

- Tech and Equipment: Line up your technology and equipment which at a base level is a computer plus two monitors, a headset, VOIP phone solution, CRM and quoting and enrollment software.

- Marketing: Organize your insurance marketing to attract potential clients.

- Goals: Set goals on building a target income stream and start working your marketing plan based on the activity it takes to hit your income goals. This means don’t stop until you hit your goals.

What is an Insurance Sales Agent?

An Insurance Sales Agent is a professional who sells insurance policies to clients, including life insurance, health insurance, and property and casualty insurance. They work to tailor insurance coverage to the needs of individual customers and may work as captive insurance agents or independent insurance agents.

Is life insurance sales a good career?

Life insurance sales can be a rewarding career choice for those who are good at building relationships and are comfortable with long-term client management. Success in this field often depends on the agent’s earning potential, resilience, and commitment to providing financial security to clients.

What Types of Insurance Can I Sell as an Agent?

As an insurance agent, you can sell various types of insurance:

- Life insurance

- healthcare products such as individual health insurance, Medicare and ancillary insurance such as cancer plans, hospital indemnity plans, accident insurance and more.

- Property and casualty insurance such as auto insurance, home insurance and commercial insurance.

- Some agents also specialize in selling annuities and financial services products.

What Does an Insurance Broker Do?

An insurance broker acts as an intermediary between clients and insurance companies, helping clients find the best insurance coverage based on their needs. Unlike agents, brokers do not represent a single insurance company but work with several to provide options to their clients.

What are the challenges faced by insurance agents?

Challenges include high competition, economic fluctuations affecting clients’ purchasing decisions, and the need for continuous professional development to keep up with industry changes and new insurance products. It’s a mental battle mainly because there are so many details to juggle on top of maintaining strong customer experience.

The mental side impacts maintaining steady income stream, policyholder attrition (they cancel their policy or go to another agent), staying up to speed with emerging technologies and compliance, and balancing your personal life with work!

Challenges are exponentially greater for part time vs. full time.

What skills are necessary to succeed as an insurance agent?

Successful insurance agents need a mix of strong interpersonal skills, salesmanship, resilience, thick skin, and the ability to manage stress. They also need to be adept at using social media and other online platforms for marketing and lead generation, as well as have strong analytical skills to understand and offer the appropriate insurance products.

Conclusion

There’s nothing mysterious about the above. And, the truth is, a lot of insurance agents suck at selling insurance when they don’t have to and actually begin to hate the business which makes me sad for so many high potential individuals that could have changed their lives and created generational wealth.

Maybe they just need to hear it from someone like me?

Take a long weekend and draw out your business road map.

- Where do you see opportunity in the market?

- Who are you comfortable talking with?

- Who do you identify with?

- What are their needs?

Start tracking your activity and results. How many people did you talk with last week? How many calls did you make? Write it all down and keep a log. Work with your mentor, and if you don’t have one, get one ASAP!

Think about it this way: you are unemployed every minute you are not in front of or talking with someone.

Commit yourself to the proven tools and strategies for success and hold yourself relentlessly accountable so you don’t end up sucking and washing out! 🙂

Great Free Resources to Help You

If you’re really pumped up to increase your sales, check out this awesome free resources to help get your business back on track! We’re here to help you!