When we look at the GUL landscape, we have seen a considerable change in the leverage we are able to provide our clients. The cost per thousand for death benefit has increased and the pressures on this marketplace aren’t going away.

This creates a scenario where you as the licensed insurance agent should be understanding the options available for you to shop for your clients and continue to establish yourself as a life insurance expert.

In our recent GUL article, Guaranteed Universal Life Landscape, we highlight some of these pressures listed below which are part of the driving reason GIUL should be considered as a valuable alternative.

- Low interest rate environment.

- Premium flow reduction (due to COVID currently).

- Regulation on reserving requirements for insurance companies.

Enter GIUL, which might just be the life insurance solution you’ve been looking for to increase your sales closing percentages.

Why Use Hybrid Guaranteed Indexed Universal Life (GIUL)

It’s important to highlight Hybrid Guaranteed Indexed Universal Life (GIUL) due to the pressures we’re seeing on Guaranteed Universal Life.

We are calling these “Hybrid” because these life insurance products are the new generation of death benefit planning in the GUL Landscape.

Hybrid Guaranteed Indexed Universal Life typically provide a life expectancy guarantee with the ability to extend well beyond. This extension of duration is tied to some performance due to indexing performance built in the product. You can read more here.

In short, you can often offer your clients a cash value building life insurance solution at a reduced rate from a traditional IUL or UL product.

GIUL Can Reduce Policy Premiums

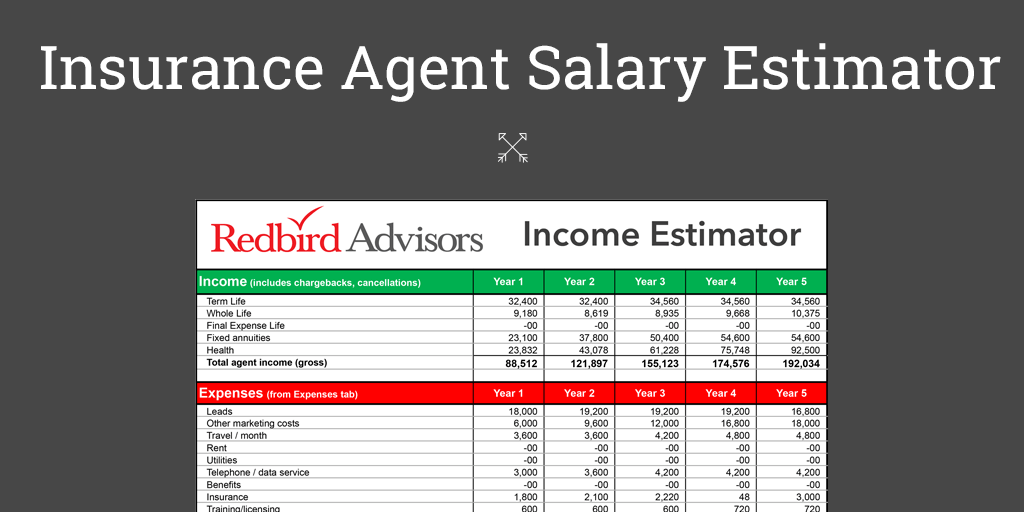

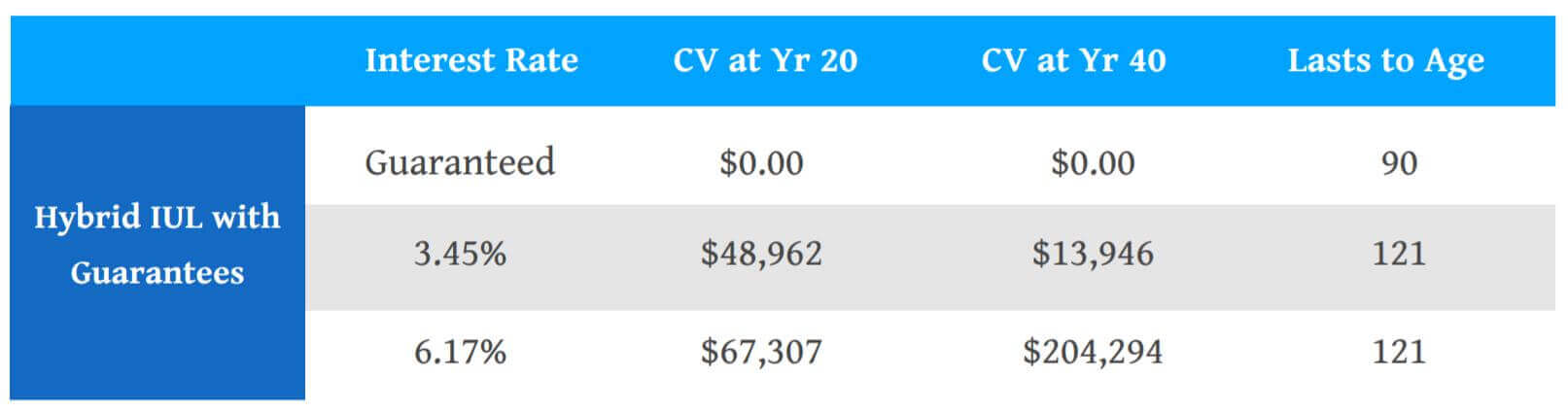

With these new Hybrid GIULs, you may be able to save your clients 20% – 30% on their life insurance premium dollars with a guarantee to age 90. We did a comparison of GIULS to show you the differences in the power of a GIUL vs. a standard GUL. We used the lowest GUL premium to show the minimal return required to carry these products to age 121 to put this in context.

GIUL vs. GUL

You’ll notice the three options below are drastically different and what’s surprising to most is that all three illustration are based off the same $5,062 annual premium. It’s definitely an eye opener and I highly suggest every agent take the time to learn more.

It is important to note that these GIULs also provide premium flexibility unlike a traditional GUL which is a great differentiator from your competition.

If your clients need to skip premiums, pay a reduced premium, or even catchup a premium this new category of product design can be meaningful to help manage change more effectively for your clients.

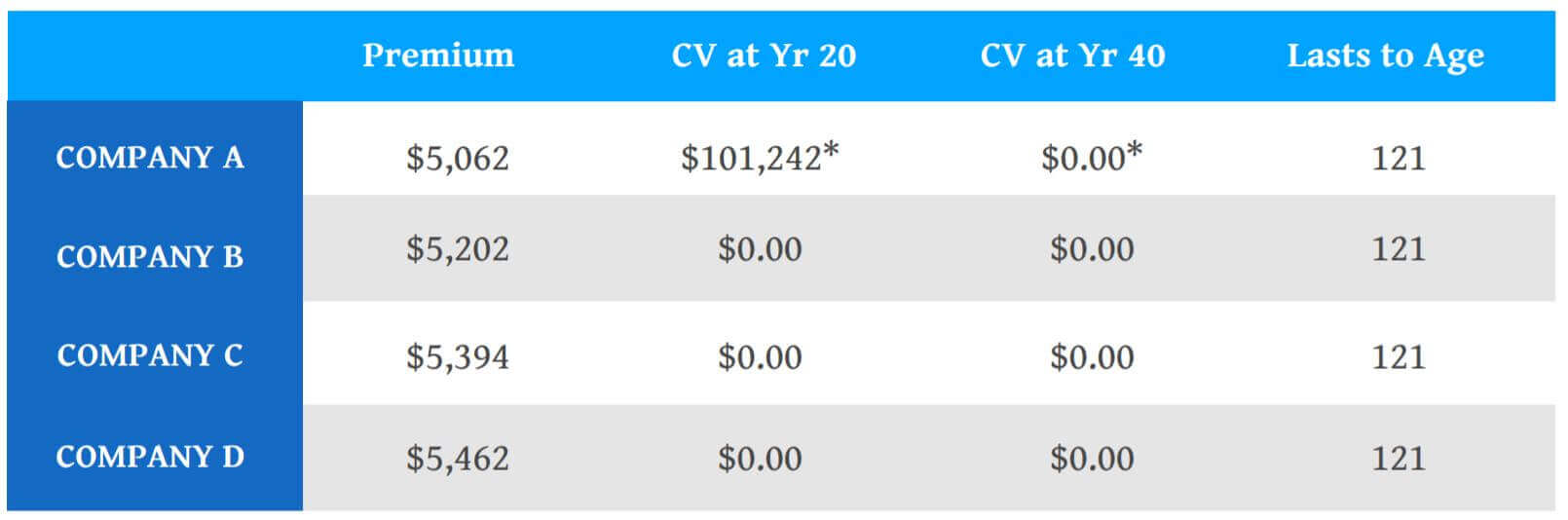

Here is another look at how GUL stacks up against GIUL.

GUL vs. GIUL Premium Comparison

Which option do you think your client would choose if you presented the 4 solutions below? I think most people would agree Company A would be the logical choice! 🙂

Conclusion

Presenting GIUL as an alternative option to IUL and GUL is a great way to gain confidence with your clients when selling life insurance.

I’ve always suggested that agents should present three options with every client which would be GUL, IUL, and GIUL. By using this strategy you can show your clients each end of the spectrum from a premium standpoint and put them in the driver seat which will increase your sales.

Below are five points to remember:

- You can save your client up to 20%-30% on their life insurance premium payments.

- You regain the flexibility you want in Indexed Universal Life at the price point of a GUL.

- Matching GUL funding provides a midpoint lasting to age 121.

- You have cash value you can access.

- GIULs have premium flexibility and GULs do not.