For insurance agents selling final expense policies, staying informed about the funeral industry and consumer trends is essential. The more you understand about how people are planning and paying for funerals, the better you can position final expense insurance as a solution for your clients.

This knowledge not only helps you connect with prospects but also establishes you as a trusted expert in their eyes, which can lead to more sales and long-term client relationships.

Why Staying Updated on the Funeral Market Matters

Final expense insurance is directly tied to end-of-life expenses, so understanding how funeral costs and preferences are evolving will make you a more effective agent, especially when you are working small towns where funeral homes are well known.

Consumer behaviors and industry trends shape the size and structure of policies people are purchasing. If you can explain these trends in a simple manner to your prospects, you will stand out from the competition.

For example, one major trend is the declining face amounts of final expense policies. Many families are opting for smaller policies, and the reason behind this shift is rooted in funeral industry statistics.

The Rise of Cremation and Its Impact on Final Expense Sales

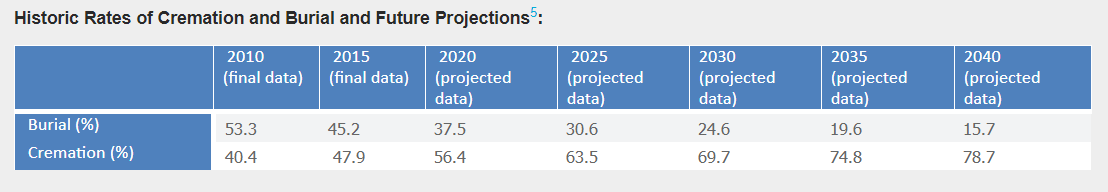

According to the National Funeral Directors Association (NFDA), cremation rates have been rising consistently over the past 10 years and are projected to continue increasing for the next two decades.

This shift is largely due to:

- Lower costs compared to traditional burials

- Changing cultural and religious attitudes toward cremation

- Environmental concerns leading people to seek alternatives to traditional burials

Since cremation is typically less expensive than a traditional burial, many final expense clients are now looking for smaller policy amounts, enough to cover cremation costs rather than a full funeral.

Understanding this trend allows you to:

- Tailor your sales approach to fit consumer needs

- Help clients select the right coverage amount based on current funeral costs

- Build credibility by showing you understand how the market is evolving

Positioning Yourself as an Expert

When you can speak confidently about funeral trends and costs, your prospects will trust your recommendations. Many seniors worry about leaving their family with unpaid funeral expenses, and having up-to-date knowledge about industry changes will help you provide real solutions.

Here’s how you can apply this knowledge in sales conversations:

- Educate your clients about how funeral costs are changing

- Explain how final expense insurance can provide financial protection

- Recommend appropriate policy amounts based on funeral preferences (cremation vs. burial)

- Showcase your expertise by referencing NFDA statistics and other credible sources

Conclusion

If you want to succeed in selling final expense insurance, staying updated on funeral industry trends is just as important as understanding insurance products.

Consumer behaviors are shifting, and knowing what influences policy sizes and buying decisions will help you sell more effectively.