I recently was talking with Redbird Network Partner, Scott Karstens about a very common question we hear, does indexed universal life insurance work?

As I’ve mentioned before, Scott gave up his $300M book of business to grow NFG Brokerage. Scott was also instrumental in helping us put together the Ultimate Guide to Selling Indexed Universal Life Insurance and continues to drive life insurance growth in the Redbird Network. You can catch up on that comprehensive IUL training article, here.

His level of knowledge has had massive impacts on the life insurance agents in our business.

Below you will find Scott’s take on the question of, does indexed universal life work? I have added some commentary below to help you think through the questions that might be running through your head and how to get support on those questions.

Does Indexed Universal Life Work?

I often get asked “Do you believe Indexed Universal Life works?”. It’s an interesting question and certainly many valid arguments on each side of the debate…” Does Indexed Universal Life work?”. One thing I do believe is that math does not lie.

In this article I’m going to go through some basic examples of how IULs complement your client’s insurance plan as well as potentially their overall portfolio.

We will specifically look at this in three market scenarios:

- Seesaw market (continual up and down)

- Bull Market

- Bear Market

Looking at this from the lens of these scenarios should certainly help provide you some perspective on this question as well as how to better present IULs to your clients in the broader picture of their financial plan.

Does Indexed Universal Life Work in a Seesaw Market

What is a seesaw market?

A Seesaw Market is just like the seesaw you may remember being on as a kid.

One friend is lifted up while the other goes down. The market goes up and then it goes down. When finished, the goal is to be in the position you were when you started, level.

We are characterizing this type of market in this section to see how indexing works through this kind of up and down market.

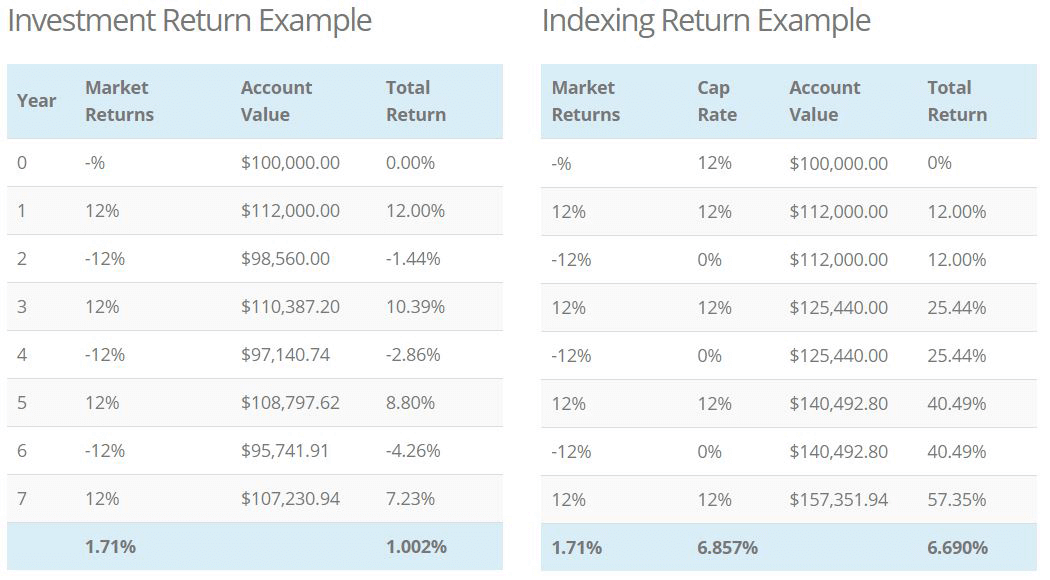

IMPORTANT: Since we do not have investment fees nor insurance costs coming out of these examples, this is just an illustration on how the concept of indexing works. Remember, this is life insurance so fees exist but can be discussed in the illustration.

In the animated example you can see a market going +12% then -12% and repeating. This example has four +12% returns and three -12% returns.

In the animated example you can see a market going +12% then -12% and repeating. This example has four +12% returns and three -12% returns.

Without picking up a calculator answer this question:

What is the average rate of return?

Most people will instinctually say 6%.

This may surprise most of you, but the average rate of return is actually 1.71%. The Real Rate of Return (not including inflation, just account growth) is only 1%.

Would it surprise you to know that in an Indexed Universal Life policy with a 12% CAP Rate, that the Real Rate of Return is 6.69%? The average rate of return in the market remains 1.71% because we are receiving the same market performance.

Would it also surprise you that in this kind of market the IUL CAP Rate would need to be less than 1.76% for the Indexed Universal Life to perform worse than the rate of return of the investment?

Again, this is only the investment merit analysis of indexing because there is insurance in place which has expenses.

You aren’t alone if you are skeptical about this answer.

Below, I prepared some nerdy data for you to fact check me on. 😊

Total Return is the rate of return of your actual account growth over this 7-year period. This shows the compounded interest rate needed each year to arrive at the same final value.

Drew’s Two Cents: This is important to illustrate because agents are bombarded with offers all the time to pick up IULs with the highest compensation and best performance. Using a product with the highest cap is a marketing tactic, you should take the time to understand the other impacts built into the product you are presenting.

Does Indexed Universal Life Work in a Bull Market

What is a bull market?

A Bull Market is a market characterized by growth.

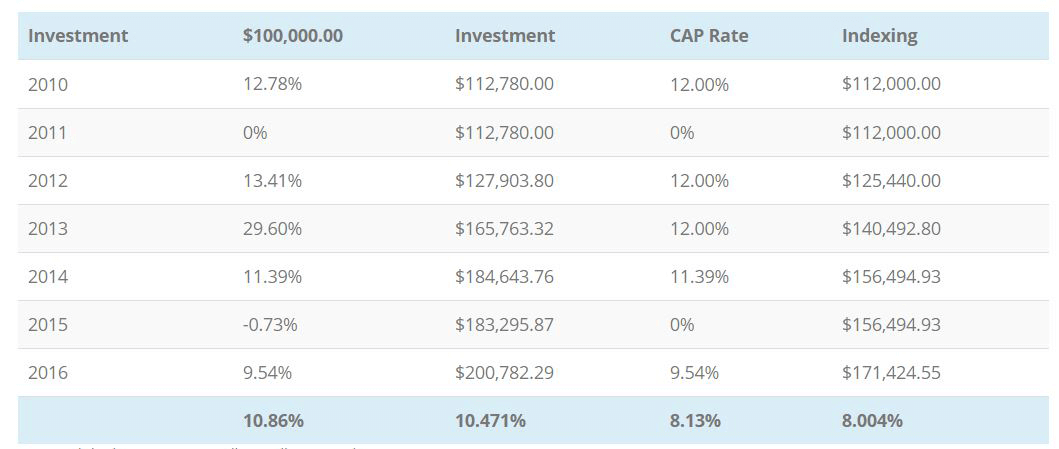

We will often see negative or flat years within a Bull Market run. For the purpose of this example, we are going to take a look at the market¹ returns from 2010 – 2016.

In the animated bull market market example, we see the market steadily rising over a 7yr period. The average rate of return during this market is 10.86%. During a Bull Market it is common to see the Total Rate of Return very close to average.

In the animated bull market market example, we see the market steadily rising over a 7yr period. The average rate of return during this market is 10.86%. During a Bull Market it is common to see the Total Rate of Return very close to average.

You may notice in the chart below that Indexing does not quite match the returns of the investment. In fact, you see 17% over performance in the investment compared to indexing.

It is no surprise that a Bull Market swings the advantage to investment account. The CAP Rate in this example would need to be very near to the max return to be able to compete with the investment in a Bull Market. The chart below does a good job of summarizing this for us.

IMPORTANT: Since we do not have investment fees nor insurance costs coming out of these examples, this is just an illustration on how the concept of indexing works. Remember, this is life insurance so fees exist but can be discussed in the illustration.

Does Indexed Universal Life Work in a Bear Market?

What is a bear market?

A Bear Market is characterized by declining markets.

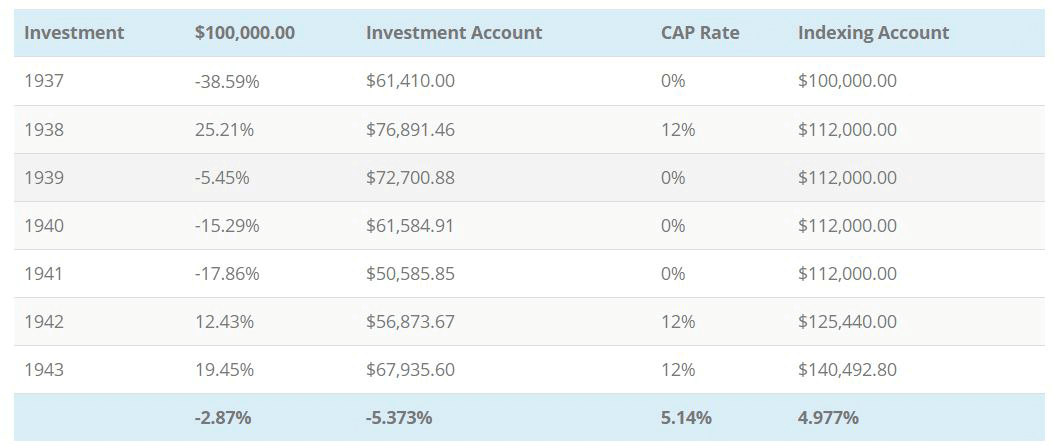

It is common to see positive years within a bear market. For the purpose of this example, we are going to look at the market¹ returns from 1937 – 1943.

IMPORTANT: Since we do not have investment fees nor insurance costs coming out of these examples, this is just an illustration on how the concept of indexing works. Remember, this is life insurance so fees exist but can be discussed in the illustration.

In the animated example we see the bear market steadily declining over a 7 yr period. The average rate of return during this market is -2.87% and the total rate of return is -5.37% (the amount needed annually to return the same final account value.

In the animated example we see the bear market steadily declining over a 7 yr period. The average rate of return during this market is -2.87% and the total rate of return is -5.37% (the amount needed annually to return the same final account value.

It may be surprising to some that the total rate of return for the indexing account is +4.97%. The account value of the indexing method is 206% greater than the investment account.

It should be no surprise from the bear market chart above that with an average return of 5.14% and a total rate of return of 4.97% the indexing method provides far greater growth in a Bear Market.

Conclusion

So, back to the original question where we started.

Do you believe Indexed Universal Life works?

With the examples shown…

- I think it’s clear that in the Seesaw Market there is an advantage to Indexing as well as a high degree of safety in the performance.

- We also saw that in a Bull Market, the investment account clearly was a winner, and to be fair your biggest risk in the Indexing method is missing out on potential upside.

- Lastly, but not least, we see that the Bear Market example significantly favors the Indexing method.

I think these examples clearly show that YES, Indexing can and does work. However, there are a few gotchas that we need to address to fully answer for you.

Don’t forget these Gotchas! 🙂

Tips to make IUL work better for your clients

- The Need. Your client should have an Insurance Need. In the absence of an insurance need how do they apply and what are they buying? The customer experience should be at the top of your list!

- Fees. Indexed Universal Life is an insurance policy and since it’s an insurance policy the fees associated are important to review.

- CAP Rates. Indexing CAP rates can and most likely will change over time. Spend some time working on stressed scenarios, not just the max illustrated rate. What return is needed to make your illustration work for your client’s scenario?

- Age and Underwriting. Both can drastically affect the numbers. Avoid always using the best underwriting class when illustrating as it’s just not a reasonable assumption.

- Funding Matters. If you are looking for cash value accumulation as a big driver of the sale, Max Funding is best (typically this is done with a low face amount with increasing death benefit, but can also be done on a level death benefit). However, if the client cannot max fund, consider coaching them on having excess money set aside to contribute if it becomes necessary over time. Lastly, if max funding isn’t realistic, consider showing them a GIUL illustration instead.

- No Step Benefit Designs. In accumulation solves I have seen many designs where the client increases their payment over time and in order to do this the death benefit sold is much higher than it should be. These are very convenient, but extremely inefficient use of money (this is because this normally causes a minimally funded policy in the early years and the fees compared to the cash value are too high and will not allow for meaningful account value going into the indexing strategies).

- Have someone help you design the case. We are always happy to help you design the most efficient policy for your client and we are available via email, phone, or our broker back office.

If you keep these “gotchas” top of mind when working with your clients on opening IUL accounts, you can more confidently answer that question “does indexed universal life work”? You will also be able to more clearly see how they can complement a retirement plan, life plan, legacy plan, and so many other types of planning strategies you may employ for your clients.