Industry Leader Q&A: John Sachs, 5Star

Reading time… 6 minutes

We are introducing a new feature we will do on a regular basis: Industry Leader Q&A. We want to probe a little into what the industry experts—the guys who spend more time than us looking at the big picture—think about where we are and where we’re going. Our first interview is with John Sachs of 5Star Life Insurance.

John Sachs, VP Business Insurance Markets with 5Star. John has been in insurance for 23 years, almost half of that with AFBA (Armed Forces Benefit Association) and 5Star. For Redbird, John is our go-to guy who gets things done. And, he prides himself and his organization on being accessible at any time, which is exactly what we have found.

Q. What concerns you about the industry today?

A. “One of the biggest challenges is agents finding reliable sources for leads, and it’s only becoming more and more difficult. There are so many agents entering into the senior final expense marketplace due to changes with the Affordable Care Act. It is putting additional pressure on the marketplace.

“I believe that an agent cannot simply rely on leads. You have to look for other ways. You have to knock on doors. You should re-purpose the leads (that you weren’t able to reach). Look at referrals. Quality agents are going to use all the resources available to them and I don’t think enough agents are doing this.”

Q. How is 5Star positioning itself with agents?

A. “The one thing interesting about the final expense is there really hasn’t been lot of product innovation in this segment. Most companies are pretty equal. Some companies have a few bells and whistles, but for most part the product lines are the same with all the carriers.

“We believe we have to differentiate on service. It’s all about making it easy for agents and clients to do business with 5Star. Technology is really driving this business going forward. We know we’ve had some struggles but we are continually trying to innovate.”

Q. What advice would you give an agent getting into the senior market today?

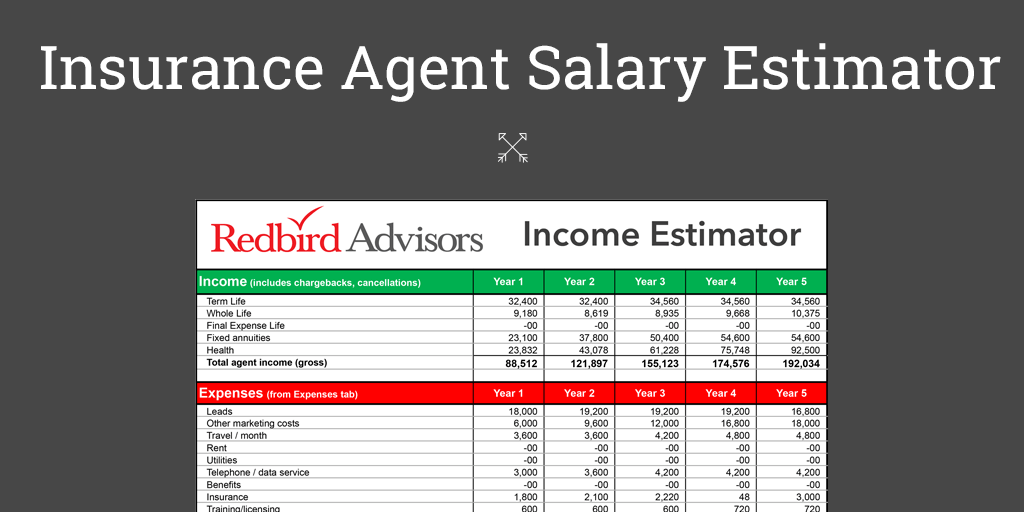

A. “Agents should focus on quality, not quantity and look at the long term. Nobody seems to be concerned anymore about renewals. Agents today are very short-term minded… what can you give me in the next year? Agents need to be educated on their total long-term compensation, not just the first year. We at 5Star want to grow sales but we’re focused on quality sales and persistency, which means we’re looking for a higher quality sales force.”

Q. Unapologetic pitch for your company: what is the 30-second elevator speech for 5Star?

A. “Agents have a unique opportunity with 5Star and AFBA. We’re a small company with a lot of heritage and history through the AFBA and General Eisenhower. For us it’s about principles and integrity and that’s a message that will play well with seniors. We believe in this wholeheartedly and that’s what we want agents to represent when they are in front of clients.

“We have grown 200% each of the last two years. We want agents to grow with us and keep the big picture in mind that we are making improvements while we grow. We take pride in listening to agents. Being small makes us more nimble and, for the most part, I think we’ve been able to deliver. We’re all here working tons of hours and doing our best to serve the agents. The future at 5Star is bright.”

Services Offered turns week 1 into $100,000 opportunity

Jon Burgmann is getting the hang of Services Offered.

Jon, a new Redbird agent from Illinois, is an expert in Medicare Supplements. As those who use it know, Redbird’s Services Offered selling approach is a perfect platform to expand the discussion with clients beyond Medicare Supplements.

This past week Jon closed his first annuity with Redbird and uncovered another opportunity, giving him a total opportunity of more than $100,000… in his first full week in the field with Redbird!

“The first customer had switched to a Medicare Advantage plan because of advice from a friend,” Jon said. “Unfortunately, her friend had about $9,000 in out of pocket expenses in 2013 from her Advantage plan so my customer thought she ought to reconsider a Medicare Supplement.

“After the Med Supp discussion, I used Services Offered and the Thumbprint to move the discussion to other things. During the Thumbprint (ask Drew Gurley about Thumbprint), she mentioned she had a CD and a money market. She didn’t know where it was invested.”

Jon met with her yesterday and closed on his first annuity with Redbird for $25,000. That’s not all.

“I’m getting a referral to her friend that recommended the Advantage plan. She, too, wants to go back to a Med Supp.”

His week continued to get better yesterday.

“I had another Med Supp policy review and her daughter sat in with her,” Jon said. “I was on the phone clearing up an issue with her old company and brought out Services Offered while we were waiting on hold. The information (about their current investments) filtered out during our conversation and I circled back to it at the end. I am putting some options together for them and will be meeting with them in the next two weeks.”

Services Offered… it works!

Want to learn more about Services Offered and Thumbprint.

Redbird Chirps

- Is too much emotion driving the market? We have no dog in the “predicting the economy” fight. However, based on the last recession we’re certainly paying more attention now. This article had a nice combination of both fact and gut-feel. This writer believes emotion is out ahead of fundamentals. You be the judge. Source: MarketWatch.com

- Annuities may be back in good graces. It’s good to see annuities getting good press. For those of you contemplating having annuities in your bag, this article gives a great overview of the good, bad and ugly of annuities. If it fires you up then give Drew a call and let him help you tee up annuity opportunities. Source: LifeHealthPro.com

- 5Star updates Individual Silver Premium application. It allows writing agent commission splits for up to two agents plus has other important improvements. It must be used for all sales starting February 18. Check out the 5Star website for more information.

- Tip of the Week: Get to know your local banker. People needing business loans are often required to get a term life insurance plan to cover the loan in case of the borrower’s death. Bank officers also talk with consumers who fall into high risk categories. Pitch products that are quick issue with no medical exam required. Source: LifeHealthPro.com