There are a lot of insurance old-timers shaking their heads about today’s emphasis on the customer experience. They don’t quite get why we have to turn operations and procedures upside down to win (or keep) a piece of business.

It’s simple: we are no longer in charge of the experience. The insurance industry and every other industry has been outflanked by rampant new technology in the last 30 years that has given control of the purchasing steering wheel to the customer. Long wait times, unresponsive agents and lethargic insurance agencies are in their rear view mirrors.

What we were told customers wanted—transparency, efficiency and personalization—is now firmly in their grasp and they are not waiting around for us to catch up.

There are many aspects of the customer experience that we all need to improve on, from clear communications that simplifies decision making to personalization that ensures a customer’s unique needs are met. We will give you ideas to help you meet your customers where they are today and drive customer satisfaction and customer loyalty to new levels.

1. Clear Communications Binds a Great Customer Experience for Insurance Companies

Clear communications is to the customer experience what clean floors are to a grocery store. It is a basic requirement in today’s business.

Unlike the old days where customers didn’t believe they had many choices, today’s customers have zero tolerance for lethargic operations and sales processes that waste their time. They will drop you like a hot potato and simply go to a company that pulls out all the stops to provide positive customer experiences.

Clear communication is a mandatory element at every touchpoint of the customer journey. Here are three key elements:

- Shopping. It is shocking how many insurance carriers and agencies today have websites that make it difficult—sometimes impossible—for the customer to make an informed decision. In the old days, a customer might get frustrated and call the agency. No more. They just move on to the next provider. If you want to be a long-term player with this new customer type, you had better present yourself as open for business on their terms.

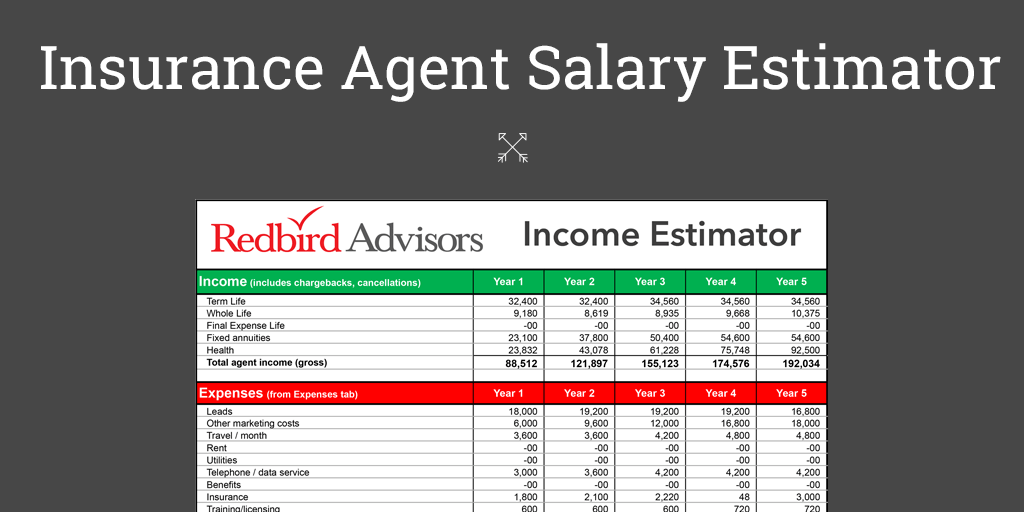

- Plain Talk. Speaking your company’s language is lazy. Find ways to simplify how you communicate all aspects of your business, from who you are to the insurance products you sell. Make features and benefits understandable; focused on customer needs and not your need to sell. Use charts and graphs to turn the complex to simple. And, most important, present you illustrations in a way that summarizes and provides the details. Handing over a pile of illustrations with little to no summary is a recipe for disaster with today’s customer.

- Customer Service. Great customer service is 50% attitude. Be interested. Engaged. Inquisitive. Find ways to say “no” so it doesn’t come across as “never.” Be active listeners because customers aren’t always great communicators. Get them to open up about what is important to them by asking open-ended questions.

Clear communication enhances understanding, builds trust and reduces mistakes and misunderstandings. Always strive to have a customer say “wow” to themselves when the encounter is done.

2. Personalization

Many customers want more personalized experiences. They want nothing to do with the traditional way of selling insurance policies, which typically involves an in-person meeting or two. They are savvy with digital tools and expect their insurance providers to be the same.

McKinsey consulting reports that 71% of consumers expect companies to deliver personalized interactions. Of those, more than three-fourths of them become frustrated when this doesn’t happen.

The magic with personalization is creatively utilizing your data to provide customer-specific sales and service experiences. Here are some ideas for you:

- Creative Customized Recommendations. Use customer data to fit the policy to their unique circumstances. We inserted the word creative because we see too many agents staying close to a one-size-fits-all approach to selling. Use the data your agency has to build a more complete picture of your customers and prospects and give your agents the ability to craft more creative solutions.

- Targeted Communications. This is a big one many agencies miss. Using your customer data, match products and services to their specific situation, e.g., family size, location where they live, etc. While we all get emails that clearly came from a computer program, new software today will allow you to produce emails that appear to have come from your inbox, or those of your insurance agents. Here’s a better idea: Send a hand-written note to your customers on their anniversary thanking them for being loyal customers. Nobody does that anymore. All you need is a stamp!

- Personalized Information and Education. Insurance carriers create tons of information that is suitable for customers, so segment your database and send them articles and videos specific to their needs. And in situations where you have something really important, consider texting a link to the article with an explanation that you don’t typically text but this was something you thought they would appreciate. These kinds of interactions will be a differentiator for your agency.

Personalizing your communications is a sign you think enough of your customers to send them something important for them. They will love it.

3. Ease of Interaction

This one will take a little more heavy lifting than the first two, but the benefits are huge if a superior customer experience is your goal.

Make every interaction with your agency easy and intuitive. Identify all the touchpoints in which a customer might encounter your brand and build a plan to make it easy for them to get to you. Getting to this point will involve designing processes, systems and platforms that are easy to use and are technically integrated to create a seamless channel for your customers.

The list here is a bit longer, but all are important to creating what you will come to believe as a competitive advantage:

- Customer-focused Website Design. Websites have gotten much, much easier to develop and much more intuitive for users thanks to technology. There should be prominent buttons that lead customers to the things most important to them: quotes, customer service, product information, etc. If you site is more than five years old then you should consider updating its capabilities.

- Optimize for Mobile. 97% of Americans own some type of cellular phone (85% own a smartphone). If your website and other accessible platforms are not optimized for mobile then you will stick out like a sore thumb in the worst of ways. Creating your own app is no longer a bridge too far for agencies. Make it EASY for customers to do business with you.

- Self-Service Options. Most carriers have passable portals for their customer service experience. Make sure customers are aware and provide instructions on how to use them. You might be surprised how many customers really want to check out what they purchased from you!

- Multiple Communications Channels. Offer various ways for customers to reach you such as phone, text, email, live chat and social media. There’s one caveat here: If you are not committed to a quick response then don’t do this. Customers expect you will respond quickly.

- Virtual Assistance and Chatbots. Who would have thought this would be on the list two years ago? Automation through artificial intelligence (AI) is rapidly improving the quality of these capabilities. Chatbots can now efficiently handle common inquiries and take customers through basic tasks such as scheduling an appointment for finding basic policy information. Make sure the customer can get to a live representative easily.

Most important, understand you are going to have to tightly manage all these moving parts so what a customer hears from a representative is the same thing they will get from a live chat or through an online search in their portal.

4. Timely Responsiveness

All of these good ideas in the name of the customer have a price: You better be there when they need you. Quick responses—even if it is to tell the customer you will get back with them—are what your policyholders and potential customers want from you.

Every second you don’t respond is a second the customer believes they might not be a priority for you. They will see this experience as anything but customer centric. Here are some of the more important considerations:

- Prompt Email Responses. It seems a 24-hour response time is what our industry believes is good service. We wonder what you think when you get a message that says they will respond within a day. If we’re buying bed linens then it’s probably ok, but what if they have an important question? Whatever response time you choose, don’t miss it. If customers have something important to discuss, make sure the email gives them options, such as phone or text.

- Real-Time Chat. If this is what you name your service, then you have a minute, two at the most to respond before the customer loses interest.

- Phone Call. Many companies in the insurance business are trying to encourage customers to use other methods of contact to save money. Our advice is to find those channels that best fit what your customers want and staff them appropriately. Younger customers may appreciate real-time chat and email while older customers may prefer the phone.

- Social Media Engagement. Most agencies don’t do this very well. You should be monitoring your social media for customer comments, messages and mentions. You should be responding to these as quickly as if someone had called you. When someone tweets about a positive experience, respond quickly to thank them and let them know you are there if they have other needs.

- Web Form Submissions. Someone should be regularly monitoring these. It’s easy to have your system alert you when someone fills out a form on your website. An automated email or text (depending on the information the customer provides) should go out immediately letting them know you are aware of their request.

- Appointment Scheduling. There are excellent scheduling programs you can integrate into your website that will allow customers to set appointments. Be sure to send a confirmation email and reminders before the scheduled time to meet.

Customers expect quick responses to their inquiries, even if it’s just a simple question. It will demonstrate your commitment to them and how much your agency values them as a customer.

The Magic Potion: Consistency, Consistency, Consistency

It is critical you are consistent in what you deliver across all of your insurance customer experience touchpoints whether over the phone, with an agent or with a chatbot. All the hard work you put into breaking down walls to make it easy for the customer to get to you will be thrown aside when the information they receive is inconsistent.

Here are the key takeaways:

- Unify Branding and Messaging. Look and feel the same no matter where a customer finds you.

- Align Information. Insurance is full of details so make sure what customers see is the same across all channels by delivering an omnichannel experience.

- Personalize to Build Relationships. You will build trust faster if customers think you’ve taken the time to get to know them.

- Respond Like Your Hair is on Fire. You will never be criticized or responding too quickly.

- Get Your Data to Talk. Integrating data is a journey, but you will be rewarded through more growth, better customer relationships and improved customer retention.

- Don’t Allow Channels to be Roadblocks. Make sure customers can switch between channels and your teams can see every step of their journey.

- Monitor Feedback and Act. Make sure you are tracking what customers have to say about you.

There is a lot in this article to digest but know this: Customer expectations are very high. They expect a better customer experience.

To you, this is a digital transformation of your business, which is scary.

There’s no time like the present to start the journey. Let us know what you think.